Insurance Quotes State Farm Auto

Welcome to an in-depth exploration of State Farm's auto insurance offerings and the process of obtaining quotes for your vehicle. In today's fast-paced world, having reliable and affordable car insurance is essential for every driver. State Farm, a well-established insurance provider, offers a range of auto insurance policies designed to meet diverse needs and preferences. This article will guide you through the key aspects of State Farm's auto insurance, including its coverage options, the quote process, and the factors that influence your premium.

Understanding State Farm’s Auto Insurance Coverage

State Farm’s auto insurance is renowned for its comprehensive coverage options, ensuring that you can tailor your policy to your specific requirements. Here’s an overview of the main coverage types offered by State Farm:

Liability Coverage

Liability coverage is a fundamental aspect of any auto insurance policy. State Farm provides bodily injury liability and property damage liability coverage, protecting you financially if you’re at fault in an accident. Bodily injury liability covers medical expenses and lost wages for the injured party, while property damage liability covers the cost of repairing or replacing damaged property, including other vehicles.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical bills and lost income of injured individuals. |

| Property Damage Liability | Repairs or replaces damaged property due to an accident. |

Collision and Comprehensive Coverage

State Farm offers optional collision and comprehensive coverage to provide additional protection for your vehicle. Collision coverage covers the cost of repairing or replacing your vehicle if you’re involved in an accident, regardless of fault. Comprehensive coverage, on the other hand, protects against damages caused by non-collision events such as theft, vandalism, natural disasters, or collisions with animals.

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, is designed to cover medical expenses for you and your passengers in the event of an accident, regardless of fault. This coverage can help alleviate the financial burden of medical bills and ensure you receive the necessary treatment without delay.

Uninsured/Underinsured Motorist Coverage

In the unfortunate event of an accident involving an uninsured or underinsured driver, State Farm’s uninsured/underinsured motorist coverage steps in to protect you. This coverage pays for your medical expenses, lost wages, and other damages when the at-fault driver lacks sufficient insurance to cover your costs.

Other Coverage Options

State Farm offers a range of additional coverage options to enhance your policy, including rental car coverage, roadside assistance, and glass coverage. These add-ons can provide extra peace of mind and ensure you’re prepared for various scenarios.

The Process of Obtaining an Insurance Quote from State Farm

State Farm has streamlined the process of obtaining an auto insurance quote to be quick and convenient for potential customers. Here’s a step-by-step guide to help you navigate the quote process:

Step 1: Visit the State Farm Website

Begin by visiting the official State Farm website. The homepage provides a clear and user-friendly interface, making it easy to navigate to the auto insurance quote section.

Step 2: Enter Your Basic Information

You’ll be prompted to enter some basic personal details, including your name, address, and contact information. This information is essential for State Farm to provide an accurate quote tailored to your situation.

Step 3: Provide Vehicle Details

Next, you’ll need to input information about your vehicle, such as the make, model, year, and VIN (Vehicle Identification Number). State Farm uses this data to assess the risk associated with your vehicle and determine an appropriate premium.

Step 4: Select Coverage Options

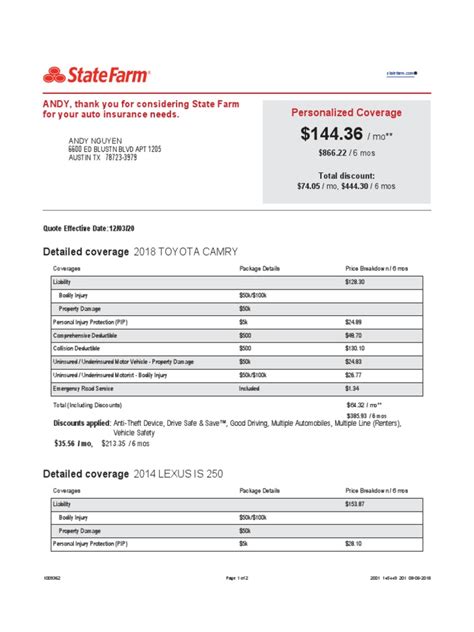

At this stage, you’ll have the opportunity to choose the coverage options that best suit your needs. State Farm’s quote tool provides a clear breakdown of the available coverages and their associated costs, allowing you to customize your policy.

Step 5: Review and Submit

Before finalizing your quote, carefully review the coverage details, premium amount, and any additional fees or discounts. If you’re satisfied, submit your quote request, and State Farm will provide you with a personalized quote based on the information you’ve provided.

Factors Influencing Your State Farm Auto Insurance Premium

Your State Farm auto insurance premium is calculated based on a variety of factors, each playing a role in determining the cost of your policy. Understanding these factors can help you make informed decisions when selecting coverage and managing your insurance expenses.

Vehicle Type and Usage

The make, model, and year of your vehicle significantly impact your insurance premium. State Farm considers the vehicle’s safety features, repair costs, and overall value when calculating your rate. Additionally, the primary use of your vehicle, whether for commuting, business, or pleasure, can influence the premium.

Driver’s Profile

Your driving record and personal details are crucial factors in determining your insurance premium. State Farm takes into account your age, gender, marital status, and driving history, including any previous accidents or violations. Younger drivers, for example, may face higher premiums due to their relative lack of driving experience.

Coverage Selection

The coverage options you choose play a significant role in your premium. Higher levels of coverage, such as comprehensive and collision coverage, will increase your premium, while opting for lower coverage limits can reduce your costs. It’s important to strike a balance between the coverage you need and the premium you can afford.

Location and Usage

Your geographical location and the area where your vehicle is primarily garaged can affect your premium. Areas with higher rates of accidents, theft, or vandalism may result in higher insurance costs. Additionally, the annual mileage you drive can influence your premium, with higher mileage typically leading to increased rates.

Discounts and Bundling

State Farm offers a range of discounts to help reduce your insurance premium. These may include discounts for safe driving, multiple vehicles insured with State Farm, or bundling your auto insurance with other policies, such as homeowners or renters insurance. Taking advantage of these discounts can significantly lower your overall insurance costs.

Making the Most of Your State Farm Auto Insurance

Once you’ve obtained your State Farm auto insurance policy, there are several strategies you can employ to maximize the benefits and ensure you’re getting the most value for your money.

Understanding Your Policy

Take the time to thoroughly read and understand your policy documents. Familiarize yourself with the coverage limits, deductibles, and any exclusions or limitations. This knowledge will empower you to make informed decisions when filing claims or making policy adjustments.

Review and Adjust Coverage Regularly

Life circumstances and financial situations can change over time, and it’s essential to review your auto insurance coverage regularly. Assess your needs annually and adjust your coverage accordingly. You may find that you can save money by reducing unnecessary coverage or increasing your deductibles if your financial situation allows.

Take Advantage of Discounts

State Farm offers a variety of discounts to reward safe driving and loyalty. Be sure to inquire about any applicable discounts when purchasing or renewing your policy. These discounts can include safe driver discounts, good student discounts, and loyalty rewards for long-term customers.

Utilize Digital Tools and Resources

State Farm provides a range of digital tools and resources to enhance your insurance experience. Their mobile app, for example, allows you to manage your policy, file claims, and access your insurance cards conveniently from your smartphone. Additionally, their website offers educational resources and tools to help you understand your coverage and make informed decisions.

State Farm’s Commitment to Customer Service

State Farm prides itself on its commitment to providing exceptional customer service. Their dedicated team of agents and representatives is readily available to assist you with any questions, concerns, or claims you may have. Whether you prefer to communicate via phone, email, or in-person, State Farm ensures a responsive and personalized experience.

Claims Process and Support

In the event of an accident or other insured event, State Farm’s claims process is designed to be efficient and hassle-free. You can report a claim online, over the phone, or through their mobile app. State Farm’s claims adjusters work diligently to assess your claim and provide a fair and timely resolution. They offer guidance and support throughout the claims process, ensuring you receive the compensation you’re entitled to.

Agent Support and Local Presence

State Farm’s network of local agents is a key differentiator. These agents are knowledgeable about your specific needs and can provide personalized advice and support. They can help you understand your coverage, answer questions, and assist with policy adjustments. Having a local agent ensures a more tailored and responsive insurance experience.

The Future of Auto Insurance with State Farm

State Farm is committed to staying at the forefront of the insurance industry, continuously innovating and adapting to meet the evolving needs of its customers. As technology advances, State Farm is exploring new ways to enhance the customer experience and streamline the insurance process.

Digital Transformation and Innovation

State Farm is investing in digital transformation to improve customer engagement and streamline operations. Their mobile app and online platforms are constantly updated with new features, making it easier for customers to manage their policies, pay bills, and access important documents. Additionally, State Farm is exploring the use of telematics and data analytics to offer more personalized and accurate insurance quotes.

Sustainable Practices and Social Responsibility

State Farm is committed to sustainability and social responsibility. They actively promote eco-friendly practices and support initiatives that reduce their environmental impact. By embracing sustainable business practices, State Farm aims to create a positive impact on the communities they serve.

Conclusion

State Farm’s auto insurance offerings provide a comprehensive and customizable solution for drivers seeking reliable coverage. With a range of coverage options, a user-friendly quote process, and a commitment to exceptional customer service, State Farm stands out as a trusted partner in the insurance industry. By understanding the factors that influence your premium and making the most of the available resources, you can navigate the world of auto insurance with confidence and ensure you’re protected on the road ahead.

Can I customize my State Farm auto insurance policy to fit my specific needs?

+Absolutely! State Farm offers a wide range of coverage options, allowing you to tailor your policy to your unique circumstances. Whether you require extensive liability coverage, collision and comprehensive protection, or specific add-ons like rental car coverage, State Farm provides the flexibility to create a policy that meets your needs.

How can I reduce my State Farm auto insurance premium?

+There are several strategies to consider when aiming to lower your insurance premium. Firstly, review your coverage options and consider reducing unnecessary coverage or increasing your deductibles. Additionally, take advantage of any applicable discounts, such as safe driver discounts or bundling discounts. Maintaining a clean driving record and shopping around for the best rates can also help reduce your premium.

What should I do if I’m involved in an accident and have State Farm auto insurance?

+If you’re involved in an accident, it’s important to remain calm and prioritize the safety of all involved parties. Exchange contact and insurance information with the other driver(s) and, if possible, take photos of the accident scene. Contact State Farm as soon as possible to report the accident and initiate the claims process. Their dedicated claims team will guide you through the steps to ensure a smooth and efficient resolution.

How can I get in touch with my State Farm agent or representative?

+State Farm provides multiple channels for you to connect with your agent or representative. You can reach out via phone, email, or by visiting their local office. State Farm’s website also offers a convenient agent locator tool, allowing you to find the contact details of your assigned agent or locate a nearby office for in-person assistance.