Insurance Rates For New Drivers

Understanding Insurance Rates for New Drivers: A Comprehensive Guide

Navigating the world of insurance as a new driver can be daunting, with many factors influencing the cost of coverage. This guide aims to shed light on the key aspects that impact insurance rates for newcomers to the road, providing an in-depth analysis of the challenges and strategies to manage costs effectively.

The Challenge of High Insurance Rates for New Drivers

When you're new to driving, insurance companies view you as a higher risk due to your lack of experience on the road. This perception often translates to significantly higher insurance premiums, which can be a financial burden for many young drivers and their families. The challenge is not just about finding affordable coverage, but also about understanding the factors that influence these rates and learning strategies to mitigate their impact.

Factors Influencing Insurance Rates for New Drivers

Several key factors contribute to the high insurance rates often seen for new drivers. These include:

- Age and Driving Experience: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This is a significant factor in insurance pricing, as companies consider age and experience when assessing risk.

- Vehicle Type and Usage: The make, model, and age of your vehicle can impact insurance rates. Additionally, how you use your vehicle - whether for daily commutes, occasional pleasure driving, or even for work - can influence the premium.

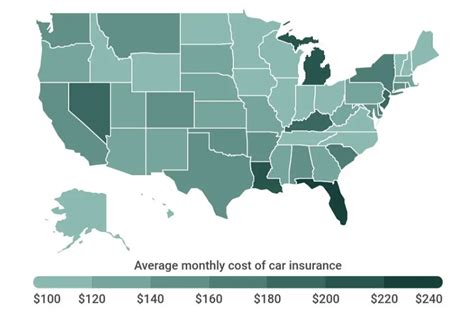

- Location and Mileage: Where you live and how many miles you drive annually can also affect your insurance rates. High-density urban areas often have higher rates due to increased accident and theft risks.

- Driving Record: A clean driving record is crucial for keeping insurance rates down. Even a single speeding ticket or minor accident can lead to increased premiums, especially for new drivers.

- Credit Score: Believe it or not, your credit score can also play a role in insurance pricing. Many insurers use credit-based insurance scores to assess risk, so maintaining a good credit history is beneficial.

Strategies for Managing Insurance Costs as a New Driver

While the factors mentioned above can make insurance rates challenging for new drivers, there are strategies to help manage these costs effectively. Here are some practical tips:

- Choose a Safe and Economical Vehicle: Opt for a vehicle with good safety ratings and lower insurance costs. Some insurers offer discounts for hybrid or electric vehicles, so this could be an option to consider.

- Enroll in a Defensive Driving Course: Many insurance companies offer discounts for completing a defensive driving course. These courses can improve your driving skills and potentially lower your insurance rates.

- Bundle Policies: If you or your family already have insurance policies with a particular company, consider bundling your auto insurance with them. This can often lead to significant savings.

- Maintain a Good Driving Record: Strive to maintain a clean driving record. Even a single violation can lead to increased rates, so it's crucial to drive safely and responsibly.

- Explore Discounts: Many insurance companies offer discounts for various reasons, such as good grades (for students), safety features in your vehicle, or even for belonging to certain professional organizations.

Analyzing Real-World Insurance Scenarios for New Drivers

To better understand the practical implications of insurance rates for new drivers, let's analyze some real-world scenarios. These examples will provide a clearer picture of how the factors mentioned above come into play and impact insurance costs.

Scenario 1: Urban vs. Rural Driving

Imagine two new drivers, both aged 18, with similar vehicles and driving records. The only difference is that one lives in a busy urban area, while the other resides in a rural community. Despite their similarities, the urban driver faces higher insurance rates due to the increased risk of accidents and theft in the city.

Scenario 2: Vehicle Choice

Consider a new driver who chooses a sports car as their first vehicle. While this choice might be exciting, it also comes with higher insurance costs due to the vehicle's performance and the higher risk profile associated with sports cars.

Scenario 3: Driving Record

A new driver with a perfect driving record may be rewarded with lower insurance rates. However, if this driver gets a speeding ticket or is involved in an accident, their rates could increase significantly. This highlights the importance of maintaining a clean driving record.

The Future of Insurance for New Drivers: Emerging Trends

As the insurance industry evolves, several emerging trends offer hope for more affordable and accessible coverage for new drivers. Here's a look at some of these trends:

- Usage-Based Insurance (UBI): With UBI, insurance rates are determined by how and when you drive. This means that safe drivers can potentially pay lower rates, as their driving behavior is tracked and assessed.

- Telematics: Telematics devices installed in vehicles provide real-time data on driving behavior. This data can be used to offer personalized insurance rates based on an individual's actual driving habits.

- Data-Driven Risk Assessment: Advanced analytics and machine learning are being used to assess risk more accurately. This could lead to a fairer pricing system for new drivers, as it considers more than just age and experience.

- Peer-to-Peer Insurance: This innovative model allows drivers to pool their resources and share risks. It offers an alternative to traditional insurance, potentially providing more affordable coverage for new drivers.

Conclusion: Navigating the Complex World of Insurance as a New Driver

Understanding the factors that influence insurance rates for new drivers is the first step towards managing these costs effectively. While challenges exist, with the right strategies and an awareness of emerging trends, new drivers can navigate the insurance landscape more confidently and find coverage that suits their needs and budget.

How can I find the best insurance rates as a new driver?

+The key is to shop around and compare quotes from multiple insurers. Also, consider factors like the vehicle you drive, your driving record, and any potential discounts you may be eligible for.

Are there any specific discounts for new drivers?

+Yes, many insurers offer discounts for new drivers who complete defensive driving courses or maintain good grades in school. Additionally, some insurers provide multi-policy discounts if you bundle your auto insurance with other types of coverage.

What impact does my credit score have on insurance rates?

+Your credit score can have a significant impact on your insurance rates. Insurers often use credit-based insurance scores to assess risk, so maintaining a good credit history can help keep your rates lower.