Insurance Standard Life

In today's complex financial landscape, understanding the nuances of different insurance products is crucial. Standard Life, a prominent player in the insurance industry, offers a comprehensive range of services, particularly in the realm of life insurance. This article aims to provide an in-depth analysis of Standard Life's insurance offerings, exploring its unique features, benefits, and how it stands out in the competitive market.

The Evolution of Standard Life: A Historical Perspective

Standard Life has a rich history that spans over two centuries, solidifying its position as one of the oldest and most trusted insurance providers. Founded in 1825 in Edinburgh, Scotland, the company initially focused on providing life insurance policies to the Scottish populace. Over the years, it expanded its operations, branching out into various financial services, including pensions and investment management.

A key turning point in Standard Life's history was its merger with Aberdeen Asset Management in 2017. This strategic move created a powerful entity, Aberdeen Standard Investments, which now manages assets worth billions and offers a diverse range of investment opportunities.

Standard Life’s Insurance Products: A Comprehensive Overview

Standard Life’s insurance arm offers a plethora of products tailored to meet diverse customer needs. Here’s a breakdown of their key offerings:

Life Insurance Policies

At the core of Standard Life’s portfolio are its life insurance policies, designed to provide financial protection to individuals and their families. These policies come in various forms, catering to different life stages and goals:

- Term Life Insurance: Offering coverage for a specified term, this policy provides a lump-sum payment to beneficiaries upon the insured's death during the policy period. Standard Life's term plans are highly customizable, allowing customers to choose the coverage amount and term length that suits their needs.

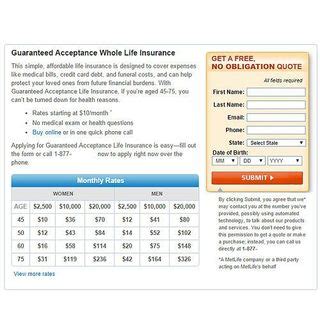

- Whole Life Insurance: As the name suggests, this policy provides lifelong coverage, ensuring financial security for beneficiaries regardless of when the insured passes away. It accumulates cash value over time, making it a popular choice for long-term financial planning.

- Universal Life Insurance: A flexible option, universal life insurance combines death benefit coverage with an investment component. Policyholders can adjust their premiums and death benefit amounts, providing greater control over their financial strategy.

Standard Life's life insurance policies are renowned for their affordability and customizability, making them accessible to a wide range of individuals. The company's innovative underwriting processes also ensure that applicants receive fair and accurate quotes, based on their unique health and lifestyle factors.

Income Protection and Critical Illness Cover

In addition to traditional life insurance, Standard Life offers specialized policies to address specific financial risks. These include:

- Income Protection Insurance: This policy provides a regular income if the insured is unable to work due to illness or injury. It's particularly beneficial for individuals whose income is their primary source of financial stability.

- Critical Illness Cover: Designed to provide a lump-sum payment upon diagnosis of a specified critical illness, this policy offers financial support during a time of great need. Standard Life's critical illness cover is known for its comprehensive list of covered illnesses, ensuring policyholders are protected against a wide range of health conditions.

By offering these specialized policies, Standard Life demonstrates its commitment to providing holistic financial protection, addressing not just the risk of death but also the potential impacts of illness and injury.

Pension and Retirement Planning

Standard Life’s expertise in pension and retirement planning is a key differentiator in the market. The company offers a range of pension products, including:

- Personal Pensions: These are individual retirement savings plans, allowing customers to save for their future while benefiting from tax advantages. Standard Life's personal pension plans are highly flexible, offering a range of investment options to suit different risk appetites.

- Workplace Pensions: For employers, Standard Life provides workplace pension schemes, helping businesses meet their legal obligations and offer valuable benefits to employees. These schemes often include employer contributions, enhancing the retirement savings of employees.

Standard Life's pension expertise extends beyond just the products themselves. The company provides comprehensive guidance and support to help individuals and businesses navigate the complex world of retirement planning, ensuring they make informed decisions about their financial future.

Why Choose Standard Life: Unique Features and Benefits

Standard Life’s insurance offerings stand out in a crowded market for several reasons. Here are some key features and benefits that set them apart:

Innovative Underwriting

Standard Life’s underwriting process is renowned for its accuracy and fairness. The company utilizes advanced technology and data analytics to assess risk factors, ensuring that customers receive tailored quotes based on their individual circumstances. This approach not only provides a more accurate assessment of risk but also helps to keep premiums competitive.

Digital Innovation

Standard Life has embraced digital transformation, investing heavily in technology to enhance the customer experience. Their online platforms offer a seamless and efficient way to manage policies, providing customers with real-time access to their insurance and investment portfolios. This digital focus also extends to the application process, making it quicker and easier for customers to secure the coverage they need.

Expertise and Experience

With over 190 years of experience, Standard Life’s expertise in the insurance and financial sectors is unparalleled. The company’s deep understanding of market trends, coupled with its extensive product portfolio, positions it as a trusted advisor to customers seeking financial protection and planning solutions.

Customer-Centric Approach

Standard Life’s commitment to its customers is evident in its dedication to providing personalized service and support. The company offers a range of resources and tools to help individuals understand their insurance and investment options, ensuring they make informed decisions. Additionally, Standard Life’s customer service teams are highly trained and responsive, providing prompt assistance when needed.

Performance Analysis and Customer Satisfaction

Standard Life’s performance in the insurance market is a testament to its reliability and customer satisfaction. The company consistently achieves high customer satisfaction ratings, with independent reviews praising its efficient claims process and responsive customer service.

In terms of financial performance, Standard Life has demonstrated steady growth over the years. Its merger with Aberdeen Asset Management has further strengthened its financial position, allowing it to invest in product innovation and customer experience enhancements. This financial stability is a key factor in maintaining customer trust and ensuring the long-term viability of its insurance offerings.

Future Outlook and Market Positioning

Looking ahead, Standard Life is well-positioned to continue its success in the insurance market. The company’s focus on innovation and customer-centricity aligns with the evolving needs of consumers. As the financial landscape continues to digitize, Standard Life’s digital prowess will likely enhance its market share and customer engagement.

Furthermore, Standard Life's commitment to sustainability and ethical practices is gaining increasing importance among consumers. The company's recent initiatives in responsible investing and environmental, social, and governance (ESG) integration demonstrate its alignment with modern values, setting it apart from competitors.

Expanding Horizons

While Standard Life has a strong presence in the UK market, its global reach is expanding. The company is actively exploring opportunities in international markets, particularly in Asia and the Middle East, where there is a growing demand for comprehensive financial protection and planning solutions. This strategic expansion will further enhance Standard Life’s reputation as a global leader in insurance and financial services.

In conclusion, Standard Life's insurance offerings provide a comprehensive suite of products and services, catering to the diverse needs of individuals and businesses. With its rich history, innovative approach, and commitment to customer satisfaction, Standard Life is well-positioned to remain a trusted provider in the insurance market for years to come.

How does Standard Life’s underwriting process work, and how does it benefit customers?

+Standard Life’s underwriting process utilizes advanced technology and data analytics to assess an individual’s risk factors accurately. This ensures that customers receive tailored quotes based on their unique circumstances, leading to more competitive premiums and a fairer assessment of their insurance needs.

What sets Standard Life’s life insurance policies apart from competitors?

+Standard Life’s life insurance policies are known for their affordability, customizability, and innovative underwriting. The company offers a range of policy types, including term, whole life, and universal life insurance, allowing customers to choose the coverage that best suits their needs and budget.

How does Standard Life support customers in their retirement planning journey?

+Standard Life offers a comprehensive range of pension products, including personal pensions and workplace pensions. The company provides expert guidance and resources to help individuals and businesses navigate retirement planning, ensuring they make informed decisions about their financial future.