Insurance Statement

In today's complex and ever-changing world, the importance of having robust insurance coverage cannot be overstated. From unexpected accidents to natural disasters, life is full of uncertainties, and insurance serves as a financial safety net, providing peace of mind and protection against potential risks. This article delves into the intricacies of insurance, exploring its various facets, benefits, and the critical role it plays in our lives.

The Essence of Insurance: A Financial Security Blanket

Insurance is an agreement between an individual or entity and an insurance company, where the latter agrees to provide financial protection or reimbursement in the event of specified losses, damages, or accidents. It is a mechanism designed to mitigate the financial impact of unforeseen circumstances, ensuring that individuals and businesses can recover and rebuild after facing adversity.

The principle of insurance is based on the concept of risk pooling. By collecting premiums from a large group of policyholders, insurance companies create a fund that can be used to pay out claims. This sharing of risks ensures that the financial burden of a few is distributed across a larger community, making it more manageable for all involved.

Types of Insurance: A Comprehensive Overview

The insurance industry offers a vast array of policies tailored to meet diverse needs. Here’s a glimpse into some of the most common types of insurance:

- Life Insurance: This type of insurance provides financial protection to beneficiaries in the event of the policyholder's death. It can offer a lump-sum payment or regular income, ensuring the policyholder's dependents are financially secure.

- Health Insurance: A vital aspect of modern life, health insurance covers medical expenses, hospitalization costs, and sometimes even preventive care. It ensures individuals have access to quality healthcare without incurring excessive financial burdens.

- Auto Insurance: With a vehicle being a significant investment, auto insurance is crucial. It covers a range of risks, including accidents, theft, and damage to the insured vehicle, as well as providing liability coverage for injuries caused to others.

- Homeowners' Insurance: A policy designed to protect homeowners against a variety of risks, including damage to the property, theft, and liability claims. It provides coverage for the structure of the home and its contents, offering peace of mind to homeowners.

- Travel Insurance: This insurance is tailored for travelers, covering a range of risks associated with trips, including medical emergencies, trip cancellations, lost luggage, and personal liability.

- Business Insurance: Essential for entrepreneurs and businesses, this insurance covers a wide range of risks, from property damage and liability claims to business interruption and cyber risks.

Each type of insurance offers unique benefits and covers specific risks, allowing individuals and businesses to tailor their coverage to their unique needs.

The Benefits of Insurance: Beyond Financial Protection

Insurance provides more than just financial security; it offers a multitude of benefits that extend beyond the monetary value of a policy.

- Peace of Mind: Knowing that you have insurance coverage can provide immense mental relief. It allows individuals and businesses to focus on their daily lives and pursuits without constant worry about potential risks.

- Risk Management: Insurance serves as a proactive risk management tool. By identifying and assessing potential risks, individuals and businesses can take appropriate measures to mitigate them, ensuring a more secure future.

- Financial Stability: In the event of a loss or accident, insurance provides the necessary financial support to cover the costs, ensuring that individuals and businesses can maintain their financial stability and avoid debt.

- Legal Protection: Many insurance policies offer liability coverage, which can protect policyholders from legal action and financial penalties resulting from accidents or injuries caused to others.

- Access to Quality Services: Insurance often provides access to a network of approved service providers, ensuring that policyholders receive high-quality services when they need them most.

The Process of Insurance: From Policy to Payout

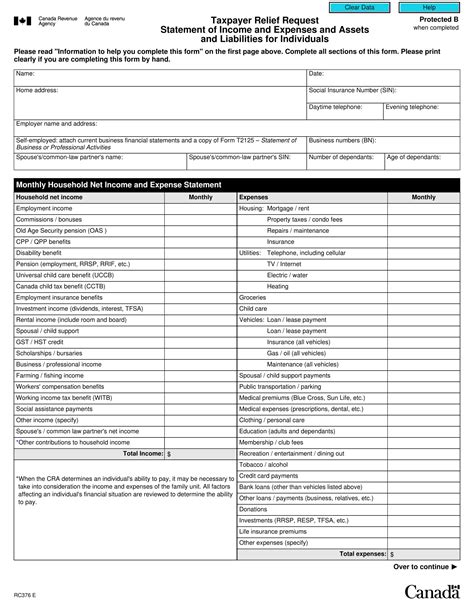

The insurance process involves several key stages, each crucial to ensuring a smooth and efficient experience for policyholders.

Policy Acquisition

The first step in the insurance process is acquiring a policy. This involves assessing one’s needs, comparing different insurance options, and selecting a policy that best suits those needs. Factors such as coverage limits, deductibles, and premium costs play a significant role in this decision-making process.

During policy acquisition, it is essential to provide accurate and truthful information to the insurance company. Misrepresentations or omissions can lead to policy voidance or claim denials in the future.

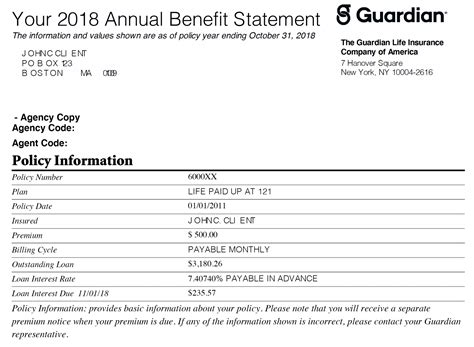

Premium Payments

Once a policy is acquired, policyholders are required to make regular premium payments to maintain their coverage. These payments are typically made on a monthly, quarterly, or annual basis, depending on the policy and the insurance company.

Premiums are calculated based on a variety of factors, including the type of insurance, the level of coverage, the policyholder's age, health, and occupation, and the risk profile of the insured.

Filing a Claim

In the event of a covered loss or accident, policyholders can file a claim with their insurance company. This process involves providing documentation and evidence of the loss, such as police reports, medical records, or repair estimates.

Insurance companies have a responsibility to investigate claims thoroughly to ensure they are valid and accurate. This process may involve inspections, interviews, and a review of the policy and applicable laws.

Claim Settlement

Once a claim is approved, the insurance company will settle the claim, providing the policyholder with the agreed-upon compensation. This can be in the form of a lump-sum payment, regular installments, or reimbursement for specific expenses.

The claim settlement process can vary depending on the type of insurance and the nature of the claim. Some claims may be settled quickly, while others may require more extensive investigation and negotiation.

| Type of Insurance | Average Time to Settle a Claim |

|---|---|

| Life Insurance | Varies based on the type of policy and the cause of death, but typically ranges from a few weeks to several months. |

| Health Insurance | Usually processed within a few days for routine claims, but more complex claims can take several weeks. |

| Auto Insurance | Varies depending on the severity of the accident and the complexity of the claim, ranging from a few days to several weeks. |

| Homeowners' Insurance | Claims can take anywhere from a few days to several months, depending on the extent of the damage and the complexity of the claim. |

| Travel Insurance | Most claims are settled within a few days, but more complex cases can take up to several weeks. |

The Future of Insurance: Embracing Innovation

The insurance industry is constantly evolving, adapting to new technologies and changing consumer needs. Here’s a glimpse into the future of insurance:

Digital Transformation

The digital revolution has had a significant impact on the insurance industry. Insurance companies are increasingly leveraging technology to enhance their operations, from policy acquisition to claim settlement. Online platforms and mobile apps are making it easier for policyholders to manage their policies, file claims, and receive updates.

Additionally, the use of big data and analytics is transforming the way insurance companies assess risks and price policies. By analyzing vast amounts of data, insurance companies can make more accurate predictions and offer more tailored coverage options.

Personalized Insurance

The future of insurance is moving towards personalized coverage. With the help of advanced analytics and customer data, insurance companies can offer policies that are tailored to the unique needs and risks of individual policyholders.

For instance, usage-based insurance policies for auto insurance consider the actual driving behavior of policyholders, offering discounts to safe drivers and providing more accurate pricing.

Insurtech Innovations

Insurtech, or insurance technology, is a rapidly growing field that is disrupting traditional insurance models. Insurtech startups are leveraging technology to offer innovative insurance products and services, often with a focus on convenience, speed, and affordability.

These innovations include peer-to-peer insurance platforms, parametric insurance policies triggered by specific events, and blockchain-based insurance solutions that enhance transparency and security.

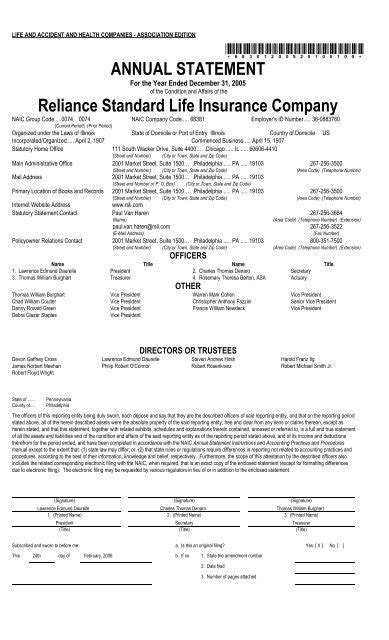

Conclusion: A Secure Future with Insurance

Insurance is an essential aspect of modern life, providing financial security and peace of mind in an uncertain world. By understanding the various types of insurance, their benefits, and the process involved, individuals and businesses can make informed decisions to protect their assets and future.

As the insurance industry continues to evolve, embracing digital transformation and innovative technologies, the future looks bright for those who prioritize their insurance coverage. With personalized policies and cutting-edge solutions, insurance is poised to become even more accessible and effective in mitigating risks and ensuring a secure future for all.

What is the difference between term life insurance and whole life insurance?

+Term life insurance provides coverage for a specific period, typically 10 to 30 years, and is designed to offer financial protection during key life stages, such as raising a family or paying off a mortgage. It is often more affordable than whole life insurance. Whole life insurance, on the other hand, provides coverage for the entire life of the policyholder and also includes a cash value component that grows over time. This cash value can be borrowed against or used to pay premiums, making it a more comprehensive and long-term investment.

How does health insurance work in different countries?

+Health insurance systems vary greatly across countries. Some countries, like the United States, have a predominantly private health insurance system, where individuals purchase policies from private insurance companies. Other countries, such as the United Kingdom, have a national healthcare system, where healthcare is provided and funded by the government, and insurance is often not necessary for basic medical care. In many countries, a combination of public and private insurance systems exists, offering a mix of government-funded and privately purchased insurance options.

What is the process for filing an auto insurance claim after an accident?

+After an accident, it is important to first ensure the safety of all involved and call the police to file a report. Next, you should contact your insurance company to notify them of the accident and provide them with the necessary details, including the date, time, location, and any relevant information about the other party involved. Your insurance company will guide you through the claim process, which may involve providing documentation, such as photos of the damage, repair estimates, and any relevant medical records if injuries were sustained. It is important to cooperate with your insurance company and provide accurate and timely information to ensure a smooth claim process.