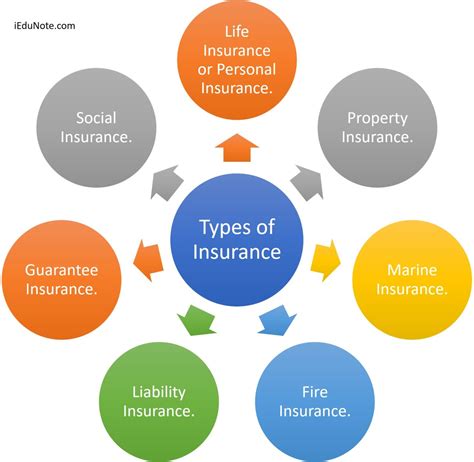

Insurance Type

In the world of financial protection and risk management, insurance stands as a crucial pillar, offering individuals and businesses a safety net against unforeseen events and financial losses. The diverse landscape of insurance types is a testament to the myriad risks that can be insured, each with its unique characteristics and coverage parameters. This article aims to delve into the intricacies of different insurance types, exploring their purposes, benefits, and real-world applications. By understanding these nuances, individuals can make informed decisions about their financial security, ensuring they have the right coverage for their specific needs.

Understanding the Basics: A Spectrum of Insurance Types

The insurance industry is an intricate web of various policies, each designed to address specific risks and provide tailored protection. From the moment you acquire your first vehicle to the day you start a family or launch a business, insurance becomes an indispensable part of your financial journey.

Life Insurance: Securing Your Legacy

Life insurance is a cornerstone of financial planning, providing a safety net for your loved ones in the event of your untimely demise. With a wide range of options, from term life insurance that offers coverage for a specific period to permanent life insurance policies that offer lifelong coverage, individuals can choose a plan that aligns with their financial goals and circumstances.

One of the key benefits of life insurance is its ability to provide a substantial sum of money to your beneficiaries, helping them maintain their standard of living and cover expenses like mortgage payments, education costs, and daily living expenses. Additionally, certain life insurance policies offer cash value accumulation, providing a savings component that can be accessed during your lifetime for various financial needs.

Consider the story of John, a young professional who recently tied the knot. He understood the importance of life insurance and opted for a term life policy, ensuring that his wife would be financially secure if something were to happen to him. This simple act of financial responsibility provided peace of mind for both John and his spouse, knowing they were protected against the unforeseen.

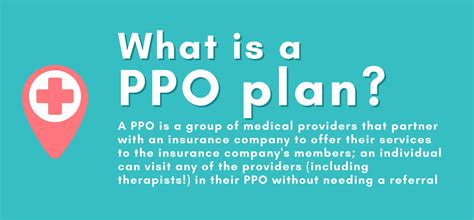

Health Insurance: Navigating the Healthcare Landscape

In today’s healthcare environment, where medical expenses can be exorbitant, health insurance is a vital tool for managing healthcare costs. Health insurance policies provide coverage for a wide range of medical services, including doctor visits, hospital stays, prescription medications, and often, preventive care.

The benefits of health insurance are twofold. Firstly, it offers financial protection by covering a significant portion of healthcare costs, preventing individuals from being burdened with unaffordable medical bills. Secondly, health insurance encourages regular check-ups and preventive care, promoting better overall health and early detection of potential health issues.

For instance, consider the case of Sarah, a freelance writer who works remotely. With the rise of COVID-19, she recognized the importance of having comprehensive health insurance. Her policy not only covered her regular check-ups and prescription medications but also provided essential coverage during the pandemic, giving her peace of mind and access to necessary medical care.

Auto Insurance: Protecting Your Ride

Auto insurance is a legal requirement in most regions and a crucial aspect of vehicle ownership. It provides financial protection in the event of accidents, theft, or other damages to your vehicle. Auto insurance policies typically cover liability, which protects you if you’re at fault in an accident, as well as collision and comprehensive coverage, which provide protection for your vehicle’s repair or replacement costs.

The significance of auto insurance extends beyond legal compliance. It offers peace of mind by ensuring that you’re not financially devastated in the event of an accident or vehicle-related incident. Additionally, certain auto insurance policies offer additional benefits like roadside assistance, rental car coverage, and gap insurance, further enhancing your protection.

Take the example of David, a young driver who recently purchased his first car. Understanding the importance of auto insurance, he opted for a comprehensive policy that covered not only liability but also collision and comprehensive coverage. This decision proved wise when he was involved in a minor fender bender, as his insurance company covered the costs of repairing his vehicle, providing him with a stress-free experience.

Homeowners Insurance: Safeguarding Your Haven

Homeowners insurance is an essential component of homeownership, offering protection against a variety of risks, including damage to your home and its contents, as well as liability coverage in case someone is injured on your property.

The benefits of homeowners insurance are far-reaching. It provides financial protection against a wide range of potential disasters, from fires and storms to vandalism and theft. Additionally, homeowners insurance often includes liability coverage, safeguarding you against lawsuits if someone is injured on your property.

Imagine the scenario of a family who recently purchased their dream home. Knowing the importance of homeowners insurance, they secured a policy that covered not only the structure of their home but also their personal belongings. This peace of mind allowed them to enjoy their new home without the worry of financial ruin in the face of unexpected disasters.

Business Insurance: Shielding Your Enterprise

For business owners, insurance is not just a financial safety net but a crucial component of risk management. Business insurance policies can cover a wide range of risks, from property damage and liability to business interruption and workers’ compensation.

The benefits of business insurance are multifaceted. It provides financial protection against potential losses, ensures continuity in the face of unexpected events, and helps maintain a positive public image by demonstrating a commitment to safety and responsibility.

Consider the story of Jane, a successful entrepreneur who owns a small bakery. She understood the importance of business insurance and secured a comprehensive policy that covered not only her physical bakery but also her equipment, inventory, and liability risks. This decision proved invaluable when a fire broke out in her bakery, as her insurance company covered the costs of repairs and helped her get back on her feet quickly.

The Impact of Insurance: A Real-World Perspective

Insurance is more than just a financial product; it’s a tool for peace of mind and financial security. By understanding the different types of insurance and their benefits, individuals and businesses can make informed decisions to protect their assets, secure their futures, and navigate the complexities of life’s uncertainties.

Whether it’s life insurance that provides a safety net for loved ones, health insurance that ensures access to quality healthcare, auto insurance that safeguards your vehicle, homeowners insurance that protects your dream home, or business insurance that shields your enterprise, the right insurance coverage can make all the difference in managing life’s risks.

| Insurance Type | Key Benefits |

|---|---|

| Life Insurance | Financial protection for beneficiaries, cash value accumulation |

| Health Insurance | Cost coverage for medical services, encouragement of preventive care |

| Auto Insurance | Financial protection in case of accidents or vehicle damage, additional benefits like roadside assistance |

| Homeowners Insurance | Protection against various risks like damage, theft, and liability, safeguarding personal belongings |

| Business Insurance | Financial protection, business continuity, and public image enhancement |

What is the main purpose of insurance?

+Insurance serves as a financial safety net, providing protection against various risks and unforeseen events. It offers peace of mind and financial security, ensuring individuals and businesses can manage potential losses and continue their normal operations despite challenges.

How do I choose the right insurance for my needs?

+The choice of insurance depends on your specific circumstances and financial goals. Consider factors like your age, family status, health, assets, and business needs. Consulting with insurance professionals can help you tailor your coverage to your unique situation.

What are some common exclusions in insurance policies?

+Common exclusions vary by insurance type but can include pre-existing conditions, intentional acts, war or civil unrest, and natural disasters like floods or earthquakes. It’s important to carefully review your policy to understand what’s covered and what’s not.

How do insurance premiums work?

+Insurance premiums are the cost of your insurance policy, typically paid monthly, quarterly, or annually. The premium amount is determined by various factors, including the type of insurance, your risk profile, and the level of coverage you choose. Higher coverage often comes with higher premiums.