Insurance W/C

The world of workers' compensation insurance is a critical aspect of the modern employment landscape, ensuring the well-being and financial security of employees across various industries. With a complex interplay of legal frameworks, risk assessment, and insurance policies, understanding this domain is essential for businesses, employees, and insurance professionals alike. This article aims to delve into the intricacies of workers' compensation, exploring its history, key components, and its evolving role in the modern workplace.

Unraveling Workers' Compensation Insurance: A Comprehensive Overview

Workers' compensation insurance, often referred to as W/C or simply "comp," is a legal mechanism designed to provide financial and medical benefits to employees who suffer work-related injuries or illnesses. It serves as a safety net, offering a range of protections that include medical treatment, disability compensation, and even death benefits for the dependents of workers who lose their lives due to occupational hazards. The concept has evolved significantly over the years, shaping the way employers and employees navigate the complex terrain of workplace safety and compensation.

A Historical Perspective: The Birth of Workers' Compensation

The roots of workers' compensation can be traced back to ancient civilizations, where various forms of compensation were provided to workers who sustained injuries on the job. However, the modern concept of workers' compensation as we know it today emerged in the late 19th and early 20th centuries. This period saw a rapid industrialization, which led to an increase in workplace accidents and injuries. As a response to the growing concerns over employee welfare, several countries, including Germany and the United Kingdom, began implementing the first workers' compensation laws.

In the United States, the journey towards comprehensive workers' compensation began with individual states passing their own laws. The first state to enact such legislation was Maryland in 1902, followed by Massachusetts in 1908. These early laws, often known as "Workmen's Compensation Acts," provided a foundation for the development of a more uniform system across the nation. Over time, the concept gained momentum, and by the 1940s, all states in the U.S. had adopted some form of workers' compensation legislation.

| Country | Year of First Workers' Compensation Law |

|---|---|

| Germany | 1884 |

| United Kingdom | 1897 |

| United States (Maryland) | 1902 |

| United States (Massachusetts) | 1908 |

The evolution of workers' compensation laws reflected a growing awareness of the need to protect workers' rights and ensure their well-being. It also served as a crucial step towards establishing a more equitable balance between employers and employees, especially in the context of rapidly changing industrial landscapes.

Key Components of a Workers' Compensation Policy

A workers' compensation policy is a comprehensive contract between an employer and an insurance provider. It outlines the specific benefits, coverage, and procedures in the event of a work-related injury or illness. Here are some of the crucial components typically found in such policies:

- Medical Benefits: This is perhaps the most critical aspect, as it covers the cost of medical treatment for work-related injuries or illnesses. It includes doctor visits, hospital stays, medications, and even rehabilitation services. In some cases, it may also cover travel expenses to and from medical appointments.

- Income Benefits: Employees who are unable to work due to their injuries may receive a portion of their regular income as compensation. These benefits are typically paid out on a weekly or bi-weekly basis and are calculated based on the employee's average weekly wage.

- Vocational Rehabilitation: In cases where an employee's injury results in permanent disability, the policy may cover the costs of vocational training to help the employee learn a new trade or skill that accommodates their disability.

- Death Benefits: If an employee passes away due to a work-related incident, their dependents may receive financial benefits to help cover funeral expenses and ongoing living costs. These benefits can be a one-time payment or ongoing weekly or monthly payments.

- Legal Liability Protection: A critical aspect of workers' compensation is that it provides a "no-fault" system. This means that even if the employee is partially at fault for their injury, they are still entitled to benefits. In turn, this protects employers from costly lawsuits and provides a more efficient and predictable system for handling workplace injuries.

The specific coverage and benefits provided by a workers' compensation policy can vary widely based on the state, industry, and the insurance provider. It's essential for employers to carefully review and understand the policy to ensure it aligns with their business needs and adequately protects their employees.

The Role of Risk Assessment and Premium Calculations

Workers' compensation insurance is not a one-size-fits-all solution. Insurance providers use sophisticated risk assessment models to determine the potential risks associated with different industries and businesses. This assessment process is crucial as it helps determine the premium an employer will pay for their workers' compensation insurance.

Risk assessment involves evaluating various factors, including the nature of the work, the safety record of the employer, the size of the workforce, and the industry's overall injury and illness rates. For instance, industries with inherently higher risks, such as construction or manufacturing, will typically have higher premiums compared to offices or retail settings. This ensures that the insurance premium reflects the actual risks associated with the business.

Additionally, some insurance providers offer incentives for employers who take proactive steps to improve workplace safety. These can include discounts for implementing safety programs, providing regular safety training, or investing in ergonomic improvements. By encouraging employers to prioritize workplace safety, insurance providers can help reduce the number of work-related injuries and illnesses, which ultimately benefits both employers and employees.

Navigating the Claims Process: A Step-by-Step Guide

When an employee suffers a work-related injury or illness, understanding the claims process is crucial. Here's a simplified guide to help navigate this often complex procedure:

- Report the Incident: As soon as possible after the injury or illness occurs, the employee should report it to their supervisor or the designated person within the company. Most states have strict time limits for reporting, so prompt action is essential.

- Seek Medical Attention: The employee should receive immediate medical attention for their injury or illness. This is not only crucial for their well-being but also for documenting the injury and its severity, which is essential for the claims process.

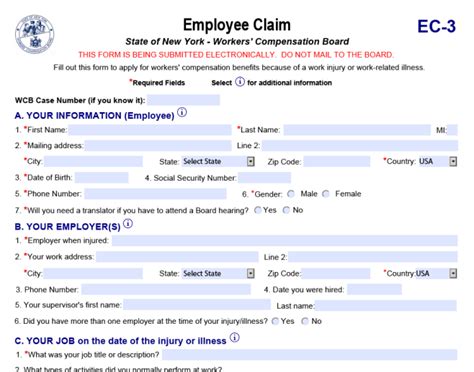

- Complete the Necessary Forms: Both the employee and the employer will need to complete specific forms to initiate the claims process. These forms typically include details about the incident, the nature of the injury or illness, and the employee's medical treatment.

- Submit the Claim: Once all the necessary forms are completed, they should be submitted to the insurance provider. It's important to ensure that all information is accurate and complete to avoid any delays in processing the claim.

- Review and Decision: The insurance provider will review the claim and make a decision on whether to approve or deny it. If approved, the employee will receive the benefits outlined in their employer's workers' compensation policy.

- Appeals Process: In cases where a claim is denied, the employee has the right to appeal the decision. This process typically involves submitting additional evidence or information to support their claim.

It's essential for both employees and employers to understand their rights and responsibilities throughout the claims process. Employers should ensure they have clear procedures in place for reporting incidents and provide employees with the necessary forms and guidance. Employees, on the other hand, should be aware of their rights to prompt medical attention and fair compensation, and know how to navigate the claims process effectively.

The Future of Workers' Compensation: Trends and Innovations

As with many aspects of the modern world, workers' compensation is evolving to meet the changing needs of the workplace. Here are some key trends and innovations that are shaping the future of this critical insurance sector:

- Emphasis on Prevention: There is a growing recognition that preventing workplace injuries and illnesses is more cost-effective and beneficial for all parties involved. As a result, there's a shift towards proactive measures, such as implementing comprehensive safety programs, providing regular safety training, and investing in ergonomic improvements.

- Data-Driven Approaches: With advancements in technology, insurance providers are leveraging data analytics to improve risk assessment and premium calculations. This allows for more accurate predictions of potential risks and more tailored insurance solutions for specific industries and businesses.

- Telemedicine and Virtual Care: The rise of telemedicine and virtual care is revolutionizing the delivery of medical services. In the context of workers' compensation, this means that employees can receive medical treatment and follow-up care remotely, improving access to care and reducing the burden on both employees and employers.

- Return-to-Work Programs: Many insurance providers and employers are implementing return-to-work programs to help employees transition back into the workforce after an injury. These programs often involve modified duties, gradual increases in work hours, and ongoing support to ensure a smooth and safe return.

- AI and Automation: Artificial intelligence (AI) and automation are being utilized to streamline various aspects of the workers' compensation process, from initial claims processing to ongoing case management. This technology can help reduce administrative burdens, improve efficiency, and enhance the overall experience for both employers and employees.

As the workplace continues to evolve, so too will the strategies and tools used to protect the well-being of employees. By staying abreast of these trends and innovations, employers and insurance providers can ensure they are providing the best possible protections for their workforce.

Frequently Asked Questions (FAQ)

What happens if an employee sustains a work-related injury but doesn’t report it right away?

+In most cases, there are strict time limits for reporting work-related injuries. If an employee fails to report an injury within this timeframe, it could result in a denial of their claim. It’s crucial for employees to understand these time limits and report incidents promptly.

Can an employee receive workers’ compensation benefits if they are partially at fault for their injury?

+Yes, one of the key benefits of workers’ compensation is its “no-fault” nature. This means that even if the employee is partially at fault for their injury, they are still entitled to benefits. However, the specific rules and regulations can vary by state, so it’s important to understand the laws in your jurisdiction.

How long does it typically take for a workers’ compensation claim to be processed and approved?

+The timeline for processing and approving a workers’ compensation claim can vary widely. While some claims may be processed and approved within a few weeks, others can take several months. The complexity of the claim, the severity of the injury, and the specific regulations in your state can all impact the timeline.

Are there any circumstances where an employer can deny workers’ compensation coverage to an employee?

+In general, employers are required by law to provide workers’ compensation coverage to their employees. However, there may be certain circumstances where an employer can deny coverage. For example, if an employee is injured while engaging in illegal activities or is under the influence of drugs or alcohol, the employer may have grounds to deny coverage. It’s important to consult with an attorney or insurance professional to understand the specific circumstances and laws in your jurisdiction.

What steps can employers take to reduce their workers’ compensation premiums?

+There are several strategies employers can employ to reduce their workers’ compensation premiums. These include implementing robust safety programs, providing regular safety training to employees, investing in ergonomic improvements, and maintaining a strong safety record. Additionally, some insurance providers offer discounts or incentives for employers who take proactive steps to improve workplace safety.