Insurance What

Insurance, a cornerstone of modern society, is an intricate system designed to protect individuals, businesses, and communities from financial risks and uncertainties. It is a vital component of financial planning and risk management, offering peace of mind and a safety net in an unpredictable world. This comprehensive guide delves into the world of insurance, exploring its history, diverse types, key principles, and its evolving role in our lives.

The Evolution of Insurance: A Historical Perspective

The concept of insurance can be traced back to ancient civilizations, where early forms of risk-sharing were practiced. The Babylonians, for instance, developed a system where merchants could borrow money and repay the loan with interest, but if their cargo was lost or stolen, the interest was waived. This rudimentary form of insurance laid the foundation for more complex systems to come.

In the medieval era, European guilds and trade organizations provided rudimentary insurance services to their members, offering financial support in times of need. These early insurance practices evolved into marine insurance, which became crucial for the thriving maritime trade of the time. The 17th century saw the establishment of the first insurance company, The Royal Exchange Assurance, in London, marking a significant milestone in the history of insurance.

Over the centuries, insurance has evolved to cover a vast array of risks, from life and health to property and liability. The principles of insurance have been refined, ensuring fair and equitable practices. Today, insurance is a global industry, with a myriad of products tailored to meet the diverse needs of individuals and businesses.

Understanding the Basics: Key Insurance Concepts

At its core, insurance is a form of risk management primarily designed to protect against potential financial losses. It operates on the principle of risk pooling, where a group of individuals or entities contribute funds (premiums) to a central pool, which is then used to compensate those who suffer a covered loss.

A critical concept in insurance is risk assessment, which involves evaluating the likelihood and potential impact of a specific risk. Insurance companies use actuarial science and statistical models to assess risks accurately and set premiums accordingly. This process ensures that the premiums collected are sufficient to cover potential claims.

Another fundamental principle is indemnification, which refers to the process of compensating the insured for their losses. Insurance policies typically outline the specific circumstances under which the insured is entitled to compensation, ensuring fair and transparent practices.

Types of Insurance: A Comprehensive Overview

The insurance industry offers a wide array of products to cater to various needs. Here’s a breakdown of some common types of insurance:

- Life Insurance: This type of insurance provides financial protection to the policyholder's beneficiaries upon their death. It can offer a range of benefits, including income replacement, debt repayment, and funding for education or retirement.

- Health Insurance: Health insurance covers the cost of medical care, including hospitalization, doctor visits, and prescription drugs. It plays a crucial role in ensuring access to quality healthcare and protecting individuals from catastrophic medical expenses.

- Property Insurance: Property insurance safeguards against losses related to one's home, belongings, or business property. It can cover damages caused by natural disasters, theft, or accidents, providing financial stability in the face of such events.

- Auto Insurance: Mandatory in many jurisdictions, auto insurance provides coverage for damages or injuries resulting from vehicle accidents. It typically includes liability coverage, collision coverage, and comprehensive coverage.

- Liability Insurance: This type of insurance protects individuals and businesses from legal liabilities arising from their actions or products. It can cover legal defense costs and damages awarded in lawsuits, offering crucial protection against financial ruin.

- Travel Insurance: Travel insurance provides coverage for unexpected events while traveling, such as trip cancellations, medical emergencies, or lost luggage. It offers peace of mind and financial protection for those embarking on journeys.

- Business Insurance: Essential for entrepreneurs, business insurance covers a wide range of risks, including property damage, liability claims, and business interruption. It helps protect the financial viability of a business and its owners.

Each type of insurance has its own unique features, benefits, and considerations. Choosing the right insurance involves careful evaluation of one's needs, risks, and budget.

The Insurance Process: From Policy to Claim

The insurance process involves several key stages, from policy acquisition to claim settlement. Understanding this process is essential for both policyholders and those considering insurance.

Policy Acquisition

Policy acquisition begins with an individual or business identifying their insurance needs and researching suitable providers. This process often involves comparing quotes, reviewing policy terms and conditions, and understanding the coverage offered. Once a suitable policy is identified, the policyholder pays a premium, typically on a monthly or annual basis, to obtain coverage.

Risk Management and Mitigation

Insurance companies employ various strategies to manage and mitigate risks. This includes rigorous underwriting processes to assess the risk profile of applicants and set appropriate premiums. Policyholders, too, have a role in risk management by taking steps to reduce their exposure to risks, such as installing security systems or practicing safe driving habits.

Claims Process

When an insured event occurs, policyholders initiate the claims process. This involves providing evidence of the loss, such as medical bills, repair estimates, or police reports, to the insurance company. The insurer then evaluates the claim, assessing its validity and the extent of coverage under the policy. If the claim is approved, the insurer compensates the policyholder as per the terms of the policy.

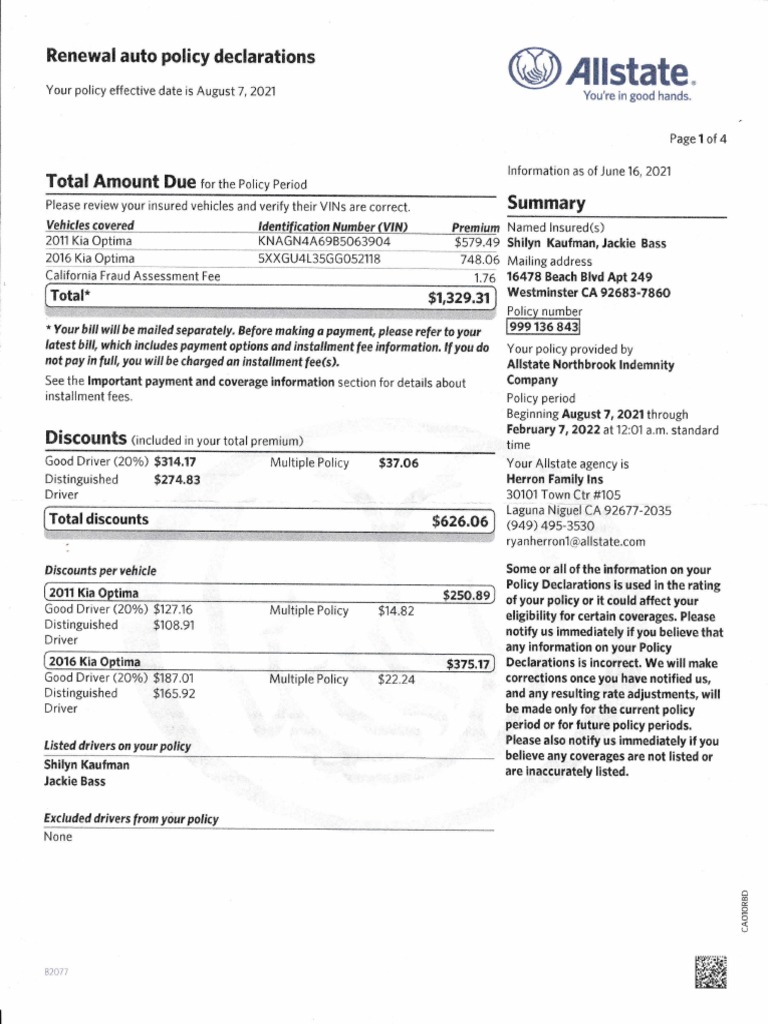

Renewal and Review

Insurance policies typically have a set term, after which they must be renewed. Policyholders should review their coverage periodically to ensure it aligns with their current needs and circumstances. This process allows for adjustments to be made, such as increasing or decreasing coverage limits or adding new endorsements to the policy.

| Policy Type | Renewal Frequency |

|---|---|

| Life Insurance | Typically annual, but can be longer-term |

| Health Insurance | Often tied to employment or annually |

| Property Insurance | Annually or biennially |

| Auto Insurance | Typically 6 or 12 months |

| Liability Insurance | Varies based on industry and coverage needs |

The Future of Insurance: Innovation and Adaptation

The insurance industry is undergoing significant transformation, driven by technological advancements and changing consumer expectations. Here’s a glimpse into the future of insurance:

Digital Transformation

The digital age has brought about a shift in how insurance is accessed and managed. Insurers are embracing digital technologies to enhance the customer experience, streamline processes, and improve operational efficiency. From online policy management to mobile apps for claims submission, digital innovation is revolutionizing the industry.

Data Analytics and AI

Advanced data analytics and artificial intelligence (AI) are transforming risk assessment and underwriting processes. Insurers can now analyze vast amounts of data to identify patterns and trends, enabling more accurate risk profiling. AI-powered chatbots and virtual assistants are also enhancing customer service and claim handling.

Parametric Insurance

Parametric insurance is an innovative approach that provides coverage based on predefined parameters, such as weather events or natural disasters. This type of insurance pays out based on the occurrence of a specific event, regardless of the actual loss suffered. It offers a faster, more efficient claims process, particularly in regions prone to natural disasters.

InsureTech and Collaboration

The rise of InsureTech startups is disrupting the traditional insurance model. These companies are leveraging technology to offer innovative insurance products and services, often targeting niche markets. Established insurers are recognizing the value of collaboration, partnering with InsureTech firms to enhance their digital capabilities and customer offerings.

Sustainable and Ethical Insurance

With growing environmental concerns, the insurance industry is adapting to offer sustainable and ethical insurance products. This includes initiatives like green insurance, which incentivizes environmentally friendly practices, and ethical investing, where insurance companies align their investments with sustainable and responsible practices.

FAQ: Common Questions About Insurance

What is the main purpose of insurance?

+The primary purpose of insurance is to provide financial protection and peace of mind by helping individuals and businesses manage and mitigate risks. It offers a safety net against potential losses, ensuring that policyholders can recover and maintain financial stability in the face of unforeseen events.

How do insurance companies determine premiums?

+Insurance companies use actuarial science and statistical models to assess risks and determine premiums. Factors such as the likelihood of a claim, the potential cost of a claim, and the insured’s risk profile (age, health, location, etc.) are considered. Premiums are set to ensure the insurer can cover potential claims while remaining profitable.

What happens if I need to make a claim but don’t have insurance coverage for that specific event?

+If you don’t have insurance coverage for a specific event, you may be responsible for covering the costs yourself. This can lead to significant financial strain, especially for unexpected or catastrophic events. It’s essential to carefully review your insurance policies to ensure you have adequate coverage for your needs.

How can I choose the right insurance policy for my needs?

+Choosing the right insurance policy involves assessing your specific needs and risks. Consider factors like your financial situation, the value of your assets, and the potential risks you face. Research and compare different insurance providers and policies, ensuring you understand the coverage, exclusions, and premiums involved. Seek advice from insurance professionals if needed.

What is the difference between indemnity and replacement cost coverage in property insurance?

+Indemnity coverage in property insurance pays the insured for their actual loss, up to the policy limit. It considers depreciation and may not fully cover the cost of replacing damaged items. On the other hand, replacement cost coverage pays the full cost of replacing damaged property, without deducting for depreciation. This provides more comprehensive coverage but may result in higher premiums.

In conclusion, insurance is a vital tool for managing risk and ensuring financial security. With its rich history, diverse product offerings, and evolving nature, insurance continues to play a crucial role in our lives. As the industry embraces innovation and adapts to changing times, the future of insurance looks promising, offering enhanced protection and peace of mind for individuals and businesses alike.