Insurance What Is It

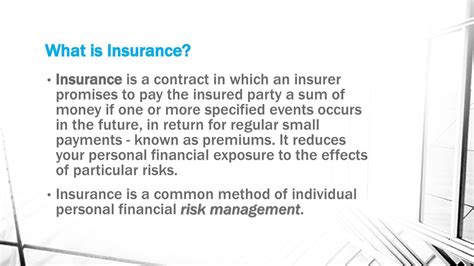

Insurance is a fundamental pillar of the modern financial landscape, offering individuals and businesses a crucial safety net against unforeseen circumstances and risks. At its core, insurance is a contractual agreement between an insurer (insurance company) and an insured party (individual or entity), wherein the insurer promises to compensate the insured for specific losses or damages in exchange for regular premium payments. This practice of risk management and financial protection has become an integral part of our daily lives, impacting everything from personal finances to global economic stability.

The Basics of Insurance

Insurance operates on the principle of risk pooling, where a large number of policyholders contribute premiums to a collective fund. This fund is then used to compensate those who suffer losses or damages covered by their insurance policies. By spreading the financial risk across a broad spectrum of policyholders, insurance companies can offer protection against a wide range of potential risks, from health issues and property damage to business disruptions and legal liabilities.

Key Components of an Insurance Policy

An insurance policy typically includes the following essential elements:

- Premium: The amount paid by the insured to the insurer, usually on a regular basis (monthly, quarterly, or annually). This is the price of the insurance coverage.

- Coverage: The specific risks or perils that the policy covers. This can range from health conditions and natural disasters to professional errors and legal actions.

- Deductible: The amount the insured must pay out of pocket before the insurance coverage kicks in. Higher deductibles often result in lower premiums.

- Policy Limits: The maximum amount the insurer will pay for a covered loss or claim. Exceeding these limits means the insured is responsible for the remaining costs.

- Exclusions: Specific events, damages, or circumstances that are not covered by the policy. It’s important to understand these exclusions to ensure adequate protection.

Types of Insurance

The insurance landscape is diverse, offering specialized coverage for various needs. Here’s an overview of some common types of insurance:

- Life Insurance: Provides a monetary benefit to the beneficiaries upon the death of the insured. It can help cover funeral expenses, pay off debts, and provide financial support for loved ones.

- Health Insurance: Covers the cost of medical and surgical expenses. It’s a crucial safeguard against the financial burden of unexpected illnesses or injuries.

- Auto Insurance: Protects against financial loss from vehicle accidents, theft, or damage. Most states require drivers to have at least liability insurance.

- Homeowners’ Insurance: Covers the structure of a home and its contents against damage or loss. It can also include liability coverage for accidents that occur on the insured property.

- Business Insurance: A range of policies designed to protect businesses against various risks, including property damage, liability, and business interruption.

- Travel Insurance: Provides coverage for unexpected events while traveling, such as trip cancellations, medical emergencies, or lost luggage.

- Pet Insurance: Helps cover veterinary costs for unexpected illnesses or injuries in pets.

- Umbrella Insurance: Provides additional liability coverage beyond the limits of other policies, offering an extra layer of protection for high-value assets.

How Insurance Works

The process of insurance involves several key steps, from the initial application to the claims process. Understanding these steps can help individuals and businesses make informed decisions about their insurance needs.

The Application Process

When applying for insurance, the insurer assesses the risk associated with the applicant. This risk assessment involves evaluating factors like age, health, driving record, or the value of assets being insured. Based on this assessment, the insurer determines the premium and coverage limits for the policy.

Premiums and Coverage

Premiums are calculated based on the risk assessment and the type of coverage desired. Higher-risk applicants or those seeking more comprehensive coverage will typically pay higher premiums. The coverage limits outline the maximum amount the insurer will pay for a covered loss.

Filing a Claim

When an insured event occurs, policyholders must file a claim with their insurer. This involves providing details of the loss or damage and any supporting documentation. The insurer then assesses the claim to determine if it’s covered under the policy and authorizes payment up to the policy limits.

Renewal and Updates

Insurance policies typically have a set term, after which they must be renewed. This provides an opportunity to review and update coverage to ensure it remains adequate for changing needs and circumstances. It’s important to keep insurance policies current to maintain continuous protection.

The Benefits of Insurance

Insurance offers a multitude of advantages, making it an essential component of financial planning. Here are some key benefits:

- Financial Protection: Insurance provides a safety net against unexpected financial losses, helping individuals and businesses manage the costs of accidents, illnesses, or other covered events.

- Peace of Mind: Knowing that you’re protected against potential risks can provide significant peace of mind, allowing you to focus on your daily life or business operations without constant worry.

- Risk Management: Insurance enables effective risk management by transferring the financial burden of specific risks to the insurer. This allows individuals and businesses to focus on their core activities without being burdened by the worry of potential losses.

- Asset Protection: Insurance can help protect valuable assets like homes, vehicles, and businesses from damage or loss. This ensures that even in the face of unexpected events, your assets remain secure.

- Legal Compliance: Certain types of insurance, such as auto and workers’ compensation insurance, are often legally required. Having the necessary insurance coverage helps ensure compliance with the law and avoids potential legal penalties.

The Future of Insurance

The insurance industry is continually evolving to meet the changing needs and risks of a modern world. Technological advancements are playing a significant role in shaping the future of insurance, offering enhanced efficiency, personalization, and accessibility.

Digital Transformation

The digital age has brought about significant changes in the insurance industry. Online platforms and mobile apps now offer policyholders the convenience of managing their policies, filing claims, and receiving updates in real-time. This digital transformation has not only improved customer experience but also enhanced operational efficiency for insurers.

Data Analytics and AI

Advanced data analytics and artificial intelligence (AI) are transforming the way insurers assess risk and develop policies. By analyzing vast amounts of data, insurers can more accurately predict and manage risks, leading to more tailored and efficient coverage. AI-powered chatbots and virtual assistants are also becoming common, offering 24⁄7 customer support and streamlining the claims process.

InsurTech Innovations

The rise of InsurTech (insurance technology) startups is driving innovation in the industry. These companies are leveraging technology to offer more flexible, affordable, and customer-centric insurance solutions. From peer-to-peer insurance models to usage-based insurance policies, InsurTech is reshaping the insurance landscape.

Sustainability and Social Responsibility

Insurance companies are increasingly recognizing the importance of sustainability and social responsibility. Many insurers are now offering policies that support environmentally friendly practices and initiatives. Additionally, social impact insurance is gaining traction, providing coverage for initiatives aimed at improving social conditions and reducing inequality.

Conclusion

Insurance is a vital component of financial planning, offering protection against a wide range of risks and uncertainties. From personal life insurance policies to business liability coverage, the insurance industry provides a safety net that allows individuals and businesses to thrive with peace of mind. As the industry continues to evolve with technological advancements and a focus on sustainability, the future of insurance looks promising, offering enhanced protection and accessibility to all.

How do I choose the right insurance policy for my needs?

+Choosing the right insurance policy involves assessing your specific needs and risks. Consider factors like your financial situation, assets, and potential liabilities. It’s often beneficial to consult with an insurance professional who can guide you through the process and help you select policies that offer adequate coverage at a reasonable cost.

What happens if I need to make a claim but my insurance policy has an exclusion for that specific event or loss?

+If your insurance policy has an exclusion for a specific event or loss, it means that the insurer will not cover that particular incident. It’s important to thoroughly review your policy’s exclusions to ensure you understand what risks are not covered. If you have concerns about specific exclusions, you can discuss them with your insurance provider or consider purchasing additional coverage to fill those gaps.

How can I reduce my insurance premiums?

+There are several strategies to potentially reduce your insurance premiums. Some common methods include increasing your deductible (the amount you pay out of pocket before insurance coverage kicks in), bundling multiple policies with the same insurer, maintaining a good credit score, and exploring discounts for safety features or low-mileage usage. However, it’s important to balance premium savings with adequate coverage to ensure you’re not underinsured.