Insurance Whole Life Vs Term Life

Insurance: Whole Life vs Term Life – A Comprehensive Comparison

When it comes to financial planning and securing your future, one of the most important decisions you'll make is choosing the right life insurance policy. Two prevalent options are whole life and term life insurance, each with its own set of advantages and considerations. In this comprehensive guide, we'll delve into the nuances of these policies, providing you with the knowledge to make an informed decision tailored to your unique circumstances.

Understanding Whole Life Insurance

Whole life insurance, also known as permanent life insurance, is a long-term financial commitment designed to provide coverage for the entirety of your life. It's a comprehensive policy that offers not only death benefits but also accumulates cash value over time. This cash value acts as a savings component, allowing policyholders to access funds through loans or withdrawals, though these actions may impact the death benefit and tax implications.

Key Features of Whole Life Insurance

- Lifetime Coverage: As the name suggests, whole life insurance guarantees coverage for your entire life, provided premiums are paid. This provides peace of mind, knowing your loved ones are protected regardless of age or health changes.

- Cash Value Accumulation: A distinctive feature of whole life insurance is its cash value component. A portion of your premium goes towards building this cash value, which grows tax-deferred over time. This can be used for various financial goals, such as retirement planning or emergency funds.

- Fixed Premiums: Whole life insurance typically offers fixed premiums, meaning the cost remains the same throughout the policy. This predictability is appealing for those seeking long-term financial planning.

- Dividends: Some whole life policies offer dividends, which are essentially a share of the insurance company's profits. These dividends can be used to reduce premiums, purchase additional coverage, or be added to the cash value.

Real-World Example: John's Story

John, a 35-year-old professional, opted for whole life insurance to secure his family's future. He chose a policy with a $500,000 death benefit and a fixed premium of $500 per month. Over the years, John's policy accumulated cash value, which he used to pay for his daughter's college education. As his financial needs evolved, he also took advantage of the policy's flexibility, borrowing against the cash value to fund a home renovation.

| Whole Life Insurance Features | Description |

|---|---|

| Coverage | Lifetime protection, ensuring financial security for beneficiaries. |

| Cash Value | Tax-deferred savings component that grows over time. |

| Fixed Premiums | Stable and predictable premium costs throughout the policy. |

| Dividends | Potential profit-sharing benefits, offering flexibility in premium management. |

Exploring Term Life Insurance

Term life insurance, on the other hand, provides coverage for a specified period, often ranging from 10 to 30 years. It is a more straightforward and cost-effective option compared to whole life insurance, making it a popular choice for those seeking temporary protection or coverage during specific life stages.

Key Characteristics of Term Life Insurance

- Temporary Coverage: Term life insurance offers coverage for a defined term, such as 10, 20, or 30 years. This makes it ideal for covering specific financial obligations or life stages, like paying off a mortgage or supporting children's education.

- Affordability: One of the most appealing aspects of term life insurance is its cost-effectiveness. Premiums are generally lower compared to whole life insurance, making it accessible to a wider range of individuals.

- No Cash Value: Unlike whole life insurance, term life policies do not accumulate cash value. This means the entire premium goes towards providing coverage, making it a straightforward and focused option.

- Renewability and Convertibility: Many term life policies offer the option to renew the coverage at the end of the term, although premiums may increase with age. Some policies also allow conversion to a permanent life insurance policy without a medical exam, providing flexibility.

Real-World Example: Sarah's Term Life Journey

Sarah, a young professional in her early 30s, opted for a 20-year term life insurance policy with a $250,000 death benefit. With affordable premiums of $200 per month, Sarah secured coverage during a critical period of her life, when her mortgage and childcare expenses were at their peak. As her children grew older and her financial obligations decreased, Sarah chose not to renew the policy, opting for a more cost-effective approach to insurance.

| Term Life Insurance Features | Description |

|---|---|

| Coverage Period | Specified term, often ranging from 10 to 30 years, providing temporary protection. |

| Affordability | Lower premiums compared to whole life, making it budget-friendly. |

| No Cash Value | Premiums solely fund the coverage, without a savings component. |

| Renewal and Conversion | Options to renew or convert to permanent life insurance, offering flexibility. |

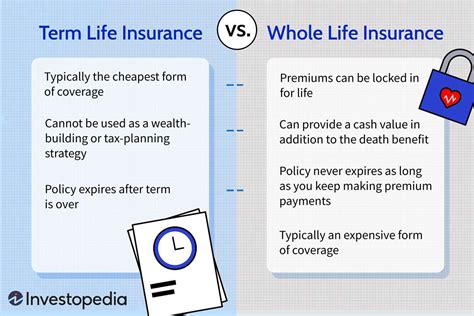

Comparative Analysis: Whole Life vs Term Life

When deciding between whole life and term life insurance, it's essential to consider your unique financial situation, goals, and the specific protection needs of your loved ones. Here's a comparative analysis to help you make an informed decision.

Cost and Premium Structure

One of the most significant differences between whole life and term life insurance is the cost. Whole life insurance typically comes with higher premiums due to its lifetime coverage and cash value component. On the other hand, term life insurance offers more budget-friendly options, making it accessible to a broader range of individuals.

Consider your financial situation and whether you can commit to the long-term premiums of whole life insurance. Term life insurance, with its lower costs, might be a more suitable option if you're on a tighter budget or seeking coverage for a specific period.

Coverage and Flexibility

Whole life insurance provides comprehensive coverage for your entire life, offering peace of mind and ensuring your beneficiaries are protected regardless of age or health changes. The cash value component also adds flexibility, allowing you to access funds for various financial needs.

In contrast, term life insurance provides coverage for a defined term, making it ideal for temporary financial obligations or specific life stages. While it doesn't offer the same long-term protection, it excels in affordability and simplicity, making it a popular choice for those seeking a focused solution.

Cash Value vs. Pure Coverage

Whole life insurance's cash value component is a significant advantage, as it allows policyholders to build savings over time. This can be particularly beneficial for retirement planning or accessing funds during emergencies. However, it's essential to note that accessing the cash value may impact the death benefit and have tax implications.

Term life insurance, on the other hand, focuses solely on providing coverage without a savings component. This straightforward approach ensures that the entirety of the premium goes towards protecting your loved ones, without the complexities of managing cash value.

Renewal and Conversion

Term life insurance policies often come with the option to renew the coverage at the end of the term. While this provides continued protection, it's important to note that premiums may increase with age. Some term policies also allow conversion to permanent life insurance, offering flexibility to adapt to changing financial needs.

Whole life insurance, being a permanent policy, doesn't require renewal. However, it's worth considering that the fixed premiums of whole life insurance may not always accommodate changing financial circumstances.

Real-World Example: David's Whole Life vs Term Life Dilemma

David, a 40-year-old entrepreneur, was faced with the decision between whole life and term life insurance. After careful consideration, he opted for a whole life policy with a $750,000 death benefit and a fixed premium of $800 per month. The policy's cash value component aligned with his long-term financial goals, providing him with a tax-efficient savings vehicle. Additionally, the lifetime coverage offered peace of mind, knowing his family's future was secured.

However, David's situation changed a few years later when his business expanded and he faced increased financial obligations. He decided to supplement his whole life policy with a 10-year term life insurance policy, providing additional coverage during this critical growth phase. This combination allowed him to balance long-term security with short-term protection needs.

Making the Right Choice for Your Needs

Choosing between whole life and term life insurance is a highly personal decision that depends on your unique circumstances and financial goals. Here are some key considerations to guide you:

- Financial Stability: Assess your financial situation and determine if you can commit to the long-term premiums of whole life insurance. If you're seeking a more flexible and cost-effective option, term life insurance might be a better fit.

- Coverage Needs: Consider your current and future financial obligations. If you require lifetime coverage or have specific long-term goals, whole life insurance could be the right choice. For temporary obligations or specific life stages, term life insurance is often the preferred option.

- Cash Value vs. Pure Coverage: Evaluate whether you prioritize building savings through the cash value component of whole life insurance or if you prefer the simplicity and affordability of term life insurance, which focuses solely on coverage.

- Flexibility: Think about the potential changes in your financial situation over time. Whole life insurance offers fixed premiums and lifetime coverage, while term life insurance provides renewal and conversion options, allowing you to adapt to changing needs.

It's crucial to consult with a financial advisor or insurance professional who can provide personalized guidance based on your unique circumstances. They can help you navigate the complexities of life insurance policies and ensure you make a decision that aligns with your financial goals and provides the protection your loved ones deserve.

FAQs

Can I switch from whole life to term life insurance if my needs change?

+

Yes, it’s possible to switch from whole life to term life insurance if your financial needs or circumstances change. However, it’s important to consult with an insurance professional to understand the implications and ensure a smooth transition.

Are term life insurance policies renewable indefinitely?

+

Most term life insurance policies offer renewal options, but the renewability period varies. Some policies may allow indefinite renewals, while others have a maximum renewal age. It’s best to review your policy terms and conditions or consult with your insurer for specific details.

Can I have both whole life and term life insurance policies simultaneously?

+

Yes, it’s possible to have both whole life and term life insurance policies. Many individuals choose to combine the two to balance long-term financial security with temporary coverage needs. This approach allows for flexibility and customization based on changing circumstances.