Insured Automotive

The automotive industry is undergoing a remarkable transformation, and one of the key aspects driving this change is the concept of "Insured Automotive." This innovative approach is revolutionizing the way vehicles are manufactured, operated, and insured, offering a host of benefits to both consumers and industry stakeholders. In this comprehensive article, we will delve deep into the world of Insured Automotive, exploring its workings, advantages, and potential future impact.

Understanding Insured Automotive

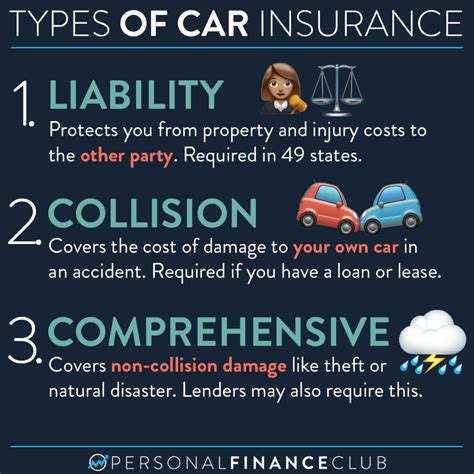

Insured Automotive is an integrated system that combines advanced vehicle technologies with comprehensive insurance coverage. It goes beyond traditional insurance models by incorporating real-time data analysis, predictive analytics, and innovative safety features to create a more secure and efficient driving experience.

At its core, Insured Automotive aims to address some of the most pressing challenges in the automotive industry, including road safety, insurance fraud, and the rising costs of vehicle ownership. By integrating cutting-edge technologies and innovative insurance models, this concept offers a fresh perspective on how we interact with our vehicles and manage risks on the road.

Key Components of Insured Automotive

The Insured Automotive system is built upon several critical components that work in harmony to deliver an enhanced driving experience:

- Advanced Driver Assistance Systems (ADAS): These systems include features like lane departure warning, adaptive cruise control, and automatic emergency braking. ADAS not only enhances driver safety but also plays a pivotal role in collecting real-time data for insurance purposes.

- Telematics: Telematics devices installed in vehicles continuously monitor driving behavior, collecting data on speed, acceleration, braking patterns, and more. This data is crucial for insurance companies to assess risk accurately and offer personalized insurance plans.

- Real-time Data Analysis: Insured Automotive leverages powerful analytics tools to process the vast amount of data collected by ADAS and telematics. This analysis enables insurance providers to identify potential risks, predict accidents, and offer timely interventions to mitigate hazards.

- Pay-as-You-Drive (PAYD) Insurance: Traditional insurance models often rely on general assumptions and historical data. In contrast, PAYD insurance plans are tailored to individual driving behavior, offering more affordable and fair insurance rates based on actual usage and risk factors.

Benefits of Insured Automotive

The integration of advanced technologies and innovative insurance models in Insured Automotive brings about a multitude of benefits, reshaping the automotive landscape in significant ways.

Enhanced Road Safety

One of the most notable advantages of Insured Automotive is its contribution to improved road safety. With ADAS features and real-time data analysis, drivers receive timely alerts and recommendations to avoid potential accidents. For instance, if a driver consistently exhibits aggressive acceleration or braking, the system can provide feedback and suggest safer driving practices.

Furthermore, the predictive analytics component of Insured Automotive can identify high-risk areas or times of the day, enabling drivers to adjust their routes or driving behavior accordingly. This proactive approach to safety has the potential to reduce accidents and save lives.

| ADAS Features | Safety Benefits |

|---|---|

| Lane Departure Warning | Prevents accidental lane changes |

| Adaptive Cruise Control | Maintains a safe distance from vehicles ahead |

| Automatic Emergency Braking | Reduces the risk of rear-end collisions |

Fraud Detection and Prevention

Insurance fraud is a significant challenge in the automotive industry, often resulting in increased premiums for honest policyholders. Insured Automotive’s sophisticated data analysis capabilities play a crucial role in identifying and preventing fraudulent activities.

By continuously monitoring driving behavior and vehicle usage patterns, the system can detect anomalies that may indicate fraudulent claims. For example, if a vehicle's telematics data shows inconsistent or manipulated driving behavior, the insurance provider can investigate further, potentially uncovering fraudulent activities.

Personalized Insurance Plans

Insured Automotive’s Pay-as-You-Drive (PAYD) insurance model offers a revolutionary approach to vehicle insurance. Unlike traditional insurance plans that rely on broad risk assessments, PAYD insurance plans are tailored to each driver’s unique behavior and circumstances.

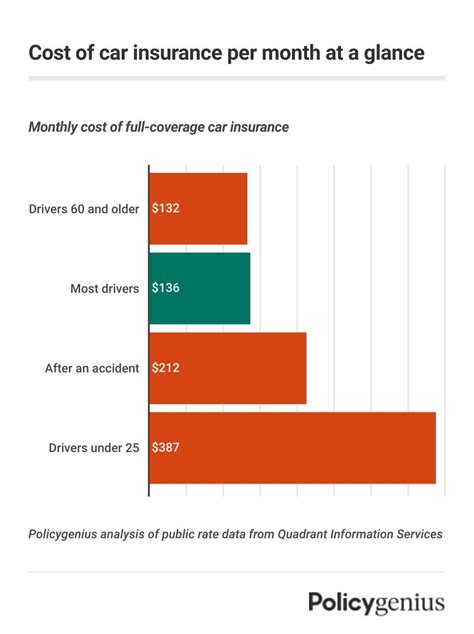

This personalized approach ensures that drivers pay premiums that accurately reflect their risk profile. For example, a cautious driver who adheres to speed limits and drives fewer miles might enjoy lower insurance rates compared to a more aggressive driver with a history of accidents.

PAYD insurance plans also incentivize safe driving practices, as drivers have a financial motivation to adopt safer behaviors. This, in turn, can lead to a positive feedback loop, where safer driving leads to lower premiums, encouraging further safe driving habits.

Performance Analysis and Real-world Impact

The performance and real-world impact of Insured Automotive have been extensively studied and documented. Several case studies and industry reports highlight the effectiveness and potential of this innovative concept.

Case Study: Insurance Premium Reduction

A leading insurance provider implemented Insured Automotive in a pilot program, offering PAYD insurance plans to a select group of policyholders. The results were remarkable: participants who embraced safe driving practices and utilized the ADAS features saw a significant reduction in their insurance premiums, with some drivers saving up to 20% on their annual insurance costs.

Industry Reports: Safety and Cost Benefits

Various industry reports and studies have highlighted the dual benefits of Insured Automotive. On the safety front, the integration of ADAS and real-time data analysis has been shown to reduce accident rates by up to 30% in certain regions. This not only improves road safety but also leads to substantial cost savings for insurance companies, which can be passed on to policyholders in the form of lower premiums.

Additionally, the PAYD insurance model has been praised for its fairness and accuracy in risk assessment. By incentivizing safe driving and rewarding cautious drivers, Insured Automotive has the potential to create a more equitable insurance market.

Future Implications and Industry Adoption

The future of Insured Automotive looks promising, with several key implications and potential advancements on the horizon.

Autonomous Vehicles and Insured Automotive

As the automotive industry moves towards autonomous vehicles, Insured Automotive’s role becomes even more critical. The safety features and data-driven insights provided by Insured Automotive can seamlessly integrate with autonomous driving systems, ensuring a safe and reliable driving experience.

Furthermore, the extensive data collected by Insured Automotive can be invaluable for the development and refinement of autonomous driving algorithms. By analyzing real-world driving data, insurance providers and automotive manufacturers can work together to enhance the safety and performance of autonomous vehicles.

Industry Collaboration and Standardization

The success of Insured Automotive relies on collaboration between insurance providers, automotive manufacturers, and technology companies. Industry-wide collaboration and standardization of data formats and protocols can streamline the integration process and ensure a seamless user experience.

By working together, these industry stakeholders can develop unified standards for data collection, analysis, and sharing, leading to more efficient and effective Insured Automotive systems. This collaboration can also drive innovation and create a more competitive market, benefiting both consumers and businesses.

Regulatory Considerations

The implementation of Insured Automotive may require regulatory adjustments to ensure compliance and protect consumer rights. Government bodies and insurance regulators will play a crucial role in establishing guidelines and standards for data privacy, security, and fair practices.

Additionally, regulations may need to address issues related to data ownership and sharing, ensuring that consumer data is protected and used ethically by insurance providers and automotive manufacturers.

Conclusion: A Secure and Sustainable Future

Insured Automotive represents a significant step forward in the automotive industry, offering a more secure, efficient, and sustainable driving experience. By combining advanced vehicle technologies with innovative insurance models, this concept addresses critical challenges and provides a glimpse into the future of mobility.

As the automotive landscape continues to evolve, Insured Automotive's role will only become more prominent, shaping the way we drive, insure, and interact with our vehicles. With its focus on data-driven safety, personalized insurance, and collaborative industry efforts, Insured Automotive is poised to revolutionize the automotive industry and create a safer, more sustainable future for all.

How does Insured Automotive improve road safety?

+Insured Automotive enhances road safety through its advanced driver assistance systems (ADAS) and real-time data analysis. ADAS features like lane departure warning and automatic emergency braking provide drivers with timely alerts and interventions to avoid accidents. Additionally, predictive analytics can identify high-risk areas, allowing drivers to adjust their routes and behavior accordingly.

What are the benefits of Pay-as-You-Drive (PAYD) insurance plans?

+PAYD insurance plans offer personalized rates based on individual driving behavior. This means that drivers who adopt safe practices and drive fewer miles can enjoy lower insurance premiums. PAYD plans incentivize safe driving and create a more equitable insurance market, as premiums accurately reflect each driver’s risk profile.

How can Insured Automotive help prevent insurance fraud?

+Insured Automotive’s sophisticated data analysis capabilities play a crucial role in fraud detection and prevention. By continuously monitoring driving behavior and vehicle usage patterns, the system can identify anomalies that may indicate fraudulent activities. This allows insurance providers to investigate suspicious claims and take appropriate actions.