Inventory Ratio Formula

The Inventory Ratio is a financial metric that assesses a company's inventory management efficiency. It is a crucial tool for understanding how effectively a business manages its inventory, which directly impacts its cash flow, profitability, and overall financial health. This ratio provides insights into the relationship between a company's inventory and its sales, offering a snapshot of its inventory turnover rate and potential excess inventory levels.

Understanding the Inventory Ratio

The Inventory Ratio, also known as the Inventory Turnover Ratio, measures how many times a company’s inventory is sold and replaced over a specific period, typically a year. It is a vital indicator of a company’s ability to manage its inventory, strike a balance between having enough stock to meet demand and minimizing the risk of excess inventory that ties up cash and reduces profitability.

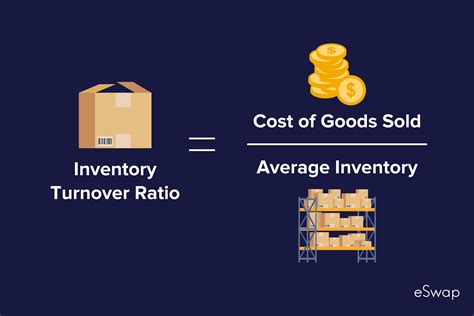

The formula for calculating the Inventory Ratio is as follows:

Inventory Ratio = Cost of Goods Sold (COGS) / Average Inventory

Here's a breakdown of the components:

- Cost of Goods Sold (COGS): This represents the direct costs associated with producing the goods sold by a company. It includes the cost of materials, labor, and other expenses directly tied to the production process.

- Average Inventory: This is the average value of a company's inventory over a specified period. It is calculated by adding the value of the inventory at the beginning and end of the period and dividing by 2. The average inventory takes into account any fluctuations in inventory levels throughout the period.

By dividing the COGS by the average inventory, the Inventory Ratio provides a measure of how quickly a company's inventory is turning over. A higher ratio indicates faster inventory turnover, suggesting that the company is effectively managing its inventory and efficiently converting it into sales. Conversely, a lower ratio may indicate excess inventory or slow-moving stock, which can tie up cash and impact profitability.

Interpreting the Inventory Ratio

The interpretation of the Inventory Ratio can vary depending on the industry and the specific nature of the business. Here are some key insights:

- Industry Benchmarks: Different industries have different typical inventory turnover rates. For example, a grocery store may have a much higher turnover rate than a furniture retailer due to the nature of the products and customer demand.

- Comparison with Competitors: Comparing a company's Inventory Ratio with its competitors can provide valuable insights. If a company has a higher ratio than its peers, it may indicate more efficient inventory management practices.

- Historical Analysis: Tracking a company's Inventory Ratio over time can reveal trends and potential areas of improvement. Significant changes in the ratio may warrant further investigation into the causes, such as shifts in demand, supply chain issues, or changes in inventory management strategies.

- Financial Health Indicator: A healthy Inventory Ratio can reflect a company's overall financial stability. Efficient inventory management can lead to better cash flow, reduced carrying costs, and improved profitability.

It's important to note that while the Inventory Ratio is a valuable tool, it should be used in conjunction with other financial metrics and analyses for a comprehensive understanding of a company's financial health and performance.

Practical Application of the Inventory Ratio

The Inventory Ratio finds practical application in various aspects of business management and decision-making. Here are some key ways it is utilized:

Inventory Management Strategies

The Inventory Ratio is a crucial tool for developing effective inventory management strategies. Companies can use this ratio to assess the efficiency of their current inventory practices and make informed decisions about stocking levels, reordering points, and inventory control methods. By optimizing inventory turnover, businesses can reduce carrying costs, minimize the risk of excess inventory, and improve cash flow.

| Company | Inventory Ratio | Carrying Costs |

|---|---|---|

| ABC Retail | 8 | $150,000 |

| DEF Electronics | 6 | $220,000 |

| GHI Groceries | 12 | $85,000 |

In the table above, you can see how different companies have varying inventory ratios and carrying costs. ABC Retail, with a higher inventory ratio, is more efficient in managing its inventory, resulting in lower carrying costs. On the other hand, DEF Electronics, with a lower ratio, may need to reevaluate its inventory management practices to reduce costs.

Financial Analysis and Planning

Financial analysts and planners use the Inventory Ratio to assess a company’s financial health and make predictions about its future performance. A consistent and healthy Inventory Ratio can indicate a company’s ability to manage its assets effectively and maintain a strong cash flow position. It is often used in conjunction with other financial ratios to paint a comprehensive picture of a company’s financial stability.

Supply Chain Optimization

The Inventory Ratio plays a vital role in supply chain management. By understanding their inventory turnover rates, companies can optimize their supply chain processes. This includes negotiating better terms with suppliers, improving order lead times, and implementing just-in-time inventory strategies to reduce storage costs and minimize the risk of stockouts.

Performance Evaluation

The Inventory Ratio is a key performance indicator (KPI) for businesses, especially those in retail and manufacturing. It helps management evaluate the effectiveness of their inventory management practices and make strategic decisions. Regular monitoring of this ratio allows for early detection of potential issues and the implementation of corrective actions.

Factors Influencing the Inventory Ratio

Several factors can influence the Inventory Ratio, impacting a company’s inventory management efficiency. Understanding these factors is crucial for interpreting the ratio accurately and making informed business decisions.

Demand Fluctuations

One of the primary factors affecting the Inventory Ratio is the fluctuation in customer demand. Unexpected surges or declines in demand can significantly impact inventory levels and turnover rates. For instance, a sudden increase in demand may lead to higher sales, increasing the Inventory Ratio, while a decrease in demand may result in excess inventory and a lower ratio.

Supply Chain Issues

Challenges in the supply chain, such as delays in delivery, production bottlenecks, or quality control issues, can disrupt inventory management. Delays in receiving inventory can lead to stockouts and impact sales, while production issues may result in excess inventory. These supply chain problems can directly affect the Inventory Ratio and highlight the need for effective supply chain management.

Seasonal Variations

Many businesses experience seasonal variations in demand, which can significantly impact their Inventory Ratio. For example, a retailer selling winter clothing may have a higher Inventory Ratio during the winter months when sales are high, but a lower ratio during the off-season when sales are slow and inventory levels are higher.

Inventory Management Policies

The inventory management policies and strategies implemented by a company can greatly influence its Inventory Ratio. These policies include setting appropriate reordering points, determining safety stock levels, and adopting efficient inventory control systems. Effective inventory management policies can help optimize the Inventory Ratio and improve overall operational efficiency.

Economic Conditions

Economic factors, such as recession or economic growth, can impact consumer spending patterns and, consequently, a company’s Inventory Ratio. During economic downturns, consumers may reduce their spending, leading to lower sales and a potential increase in excess inventory. Conversely, during economic booms, increased consumer spending can drive up sales and improve the Inventory Ratio.

Limitations and Considerations

While the Inventory Ratio is a valuable metric, it’s important to acknowledge its limitations and consider it within the broader context of a company’s financial health.

Industry-Specific Variations

The Inventory Ratio can vary significantly across industries. Some industries, such as fashion retail, may have inherently higher inventory turnover rates due to the nature of their products and customer preferences. Therefore, when comparing Inventory Ratios, it’s crucial to consider industry benchmarks to ensure an accurate interpretation.

Dynamic Nature of Business

Businesses are dynamic entities, and their financial performance, including inventory management, can be influenced by various internal and external factors. It’s important to regularly monitor and analyze the Inventory Ratio to detect any significant changes that may warrant further investigation or strategic adjustments.

Inventory Valuation Methods

The method used to value inventory can impact the Inventory Ratio calculation. Different companies may use different inventory valuation methods, such as FIFO (First In, First Out) or LIFO (Last In, First Out). These methods can affect the cost of goods sold and, consequently, the Inventory Ratio. Therefore, it’s essential to understand the inventory valuation method used when interpreting the ratio.

Financial Statement Accuracy

The accuracy of financial statements, particularly the cost of goods sold and inventory valuation, is critical for an accurate Inventory Ratio calculation. Errors or inconsistencies in financial reporting can lead to misleading interpretations of the ratio. Therefore, it’s essential to ensure the reliability and accuracy of financial data.

Future Implications and Strategic Insights

The Inventory Ratio provides valuable insights for strategic decision-making and future planning. By understanding their Inventory Ratios, businesses can identify areas for improvement and develop more effective inventory management strategies.

Optimizing Inventory Levels

A key strategic insight derived from the Inventory Ratio is the optimization of inventory levels. Companies can use this ratio to determine the ideal balance between carrying too much inventory, which ties up capital, and carrying too little, which can lead to stockouts and lost sales. By striking this balance, businesses can improve their cash flow and overall financial performance.

Strategic Procurement and Supply Chain Management

The Inventory Ratio highlights the importance of strategic procurement and supply chain management. Companies can use this metric to evaluate their suppliers and negotiate better terms, such as just-in-time delivery or improved lead times. By optimizing the supply chain, businesses can reduce inventory carrying costs and improve overall operational efficiency.

Risk Management and Planning

The Inventory Ratio is a critical tool for risk management and strategic planning. By monitoring this ratio, companies can identify potential risks, such as excess inventory or supply chain disruptions, and develop contingency plans. This proactive approach can help businesses mitigate risks and ensure a more stable financial position.

Industry Benchmarking and Competitive Analysis

Comparing a company’s Inventory Ratio with industry benchmarks and competitors can provide valuable insights for strategic planning. If a company’s Inventory Ratio is significantly lower than the industry average, it may indicate an opportunity for improvement. By analyzing successful competitors’ strategies, businesses can identify best practices and make informed decisions to enhance their inventory management.

Conclusion

The Inventory Ratio is a powerful financial metric that provides valuable insights into a company’s inventory management efficiency. By understanding this ratio and its implications, businesses can optimize their inventory levels, improve cash flow, and make strategic decisions to enhance their overall financial health. While it is a critical tool, it should be used in conjunction with other financial analyses to gain a comprehensive understanding of a company’s performance and potential.

How does the Inventory Ratio differ from the Inventory Turnover Ratio?

+The Inventory Ratio and the Inventory Turnover Ratio are essentially the same metric. Both measure the efficiency of a company’s inventory management by calculating the number of times inventory is sold and replaced over a specific period. The terms are often used interchangeably, but the Inventory Turnover Ratio is sometimes expressed as a frequency (e.g., “inventory turns over 8 times a year”), while the Inventory Ratio is typically presented as a rate (e.g., “8”).

Can a high Inventory Ratio always be considered positive?

+A high Inventory Ratio generally indicates efficient inventory management and a strong sales performance. However, it’s important to consider the context. A very high ratio may suggest that a company is not carrying enough inventory to meet demand, leading to potential stockouts. Therefore, while a high ratio is often positive, it should be interpreted in conjunction with other metrics and industry benchmarks.

What are some common challenges in calculating the Inventory Ratio accurately?

+Accurate calculation of the Inventory Ratio can be challenging due to factors like varying inventory valuation methods, inconsistent financial reporting, and the dynamic nature of business operations. Companies must ensure the reliability of their financial data and consider the specific characteristics of their industry when interpreting the ratio. Additionally, tracking inventory levels and sales data accurately is crucial for precise ratio calculation.