Kaiser Medical Insurance Rates

Kaiser Permanente, often referred to as Kaiser, is a well-known name in the world of health insurance, particularly in the United States. With its integrated healthcare system, Kaiser has been a preferred choice for many individuals and families seeking comprehensive medical coverage. This article aims to delve into the realm of Kaiser medical insurance rates, shedding light on the various factors that influence these costs and offering valuable insights for those navigating the complex landscape of healthcare plans.

Understanding Kaiser Medical Insurance Rates

Kaiser Permanente’s medical insurance plans are renowned for their focus on preventive care and integrated healthcare services. The insurance rates, or premiums, that individuals pay are influenced by a multitude of factors, each playing a crucial role in determining the overall cost of healthcare coverage.

Individual vs. Group Plans

One of the primary distinctions in Kaiser’s insurance offerings is between individual plans and group plans. Individual plans are tailored for individuals and families, providing flexibility in coverage options. In contrast, group plans are often associated with employer-sponsored insurance, where the cost is shared between the employer and the employees.

Kaiser's group plans are typically more affordable due to the collective bargaining power of a larger group. The premiums are often lower, and the coverage can be more comprehensive, making it an attractive option for employees. Individual plans, while offering more personalized choices, may come with higher premiums, especially for those with pre-existing conditions or unique healthcare needs.

| Plan Type | Premium Range | Key Benefits |

|---|---|---|

| Individual Plans | $350 - $800/month | Flexible coverage, customized benefits |

| Group Plans | $250 - $500/month | Affordable premiums, employer-sponsored |

Factors Influencing Kaiser Insurance Rates

Several key factors come into play when determining the cost of Kaiser medical insurance. Understanding these factors can help individuals make informed decisions about their healthcare coverage.

- Age: Typically, younger individuals enjoy lower insurance rates as they are generally healthier and less likely to require extensive medical care. As individuals age, the premiums tend to increase to account for potential health issues and the higher likelihood of utilizing healthcare services.

- Location: Kaiser operates in various regions across the United States, and insurance rates can vary significantly based on the cost of living and healthcare infrastructure in each area. Urban areas with higher living costs may see higher insurance premiums compared to more rural regions.

- Tobacco Use: Kaiser, like many insurance providers, takes into account an individual's tobacco usage. Smokers or those using tobacco products may face higher insurance rates due to the associated health risks and increased healthcare costs.

- Health Status: Pre-existing medical conditions or chronic illnesses can significantly impact insurance rates. Individuals with pre-existing conditions may be charged higher premiums or may face challenges in finding comprehensive coverage. Kaiser's focus on preventive care aims to mitigate these risks over time.

- Plan Type and Coverage: The type of insurance plan and the level of coverage chosen also influence the insurance rates. Plans with higher deductibles and out-of-pocket expenses may offer lower premiums, while plans with more comprehensive coverage and lower out-of-pocket costs may come with higher monthly premiums.

Kaiser’s Approach to Cost Management

Kaiser Permanente has implemented several strategies to manage healthcare costs effectively, ensuring that insurance rates remain competitive while providing high-quality care.

- Integrated Healthcare System: One of Kaiser's unique strengths is its integrated healthcare system. By owning and operating its own hospitals, medical centers, and pharmacies, Kaiser can control costs more efficiently. This vertical integration allows for better coordination of care and reduced administrative overhead.

- Preventive Care Focus: Kaiser places a strong emphasis on preventive care, encouraging regular check-ups, screenings, and early intervention. By catching potential health issues early on, Kaiser can help prevent more costly treatments down the line, ultimately reducing overall healthcare costs.

- Network of Providers: Kaiser maintains a vast network of healthcare providers, including doctors, specialists, and allied health professionals. This network ensures that members have access to a wide range of medical services, promoting competition and cost-effectiveness within the system.

- Member Education and Engagement: Kaiser recognizes the importance of member education in managing healthcare costs. Through various initiatives and resources, they empower members to make informed decisions about their health, encouraging preventive measures and efficient utilization of healthcare services.

Performance Analysis and Industry Comparison

When evaluating Kaiser’s insurance offerings, it’s essential to analyze its performance and compare it to other leading healthcare providers in the industry.

Performance Metrics

Kaiser consistently performs well in various performance metrics, including member satisfaction, quality of care, and financial stability. Its integrated healthcare system and focus on preventive care have resulted in positive outcomes for its members.

| Metric | Kaiser's Performance |

|---|---|

| Member Satisfaction | 4.5/5 (based on recent surveys) |

| Quality of Care | 92% (as rated by independent agencies) |

| Financial Stability | AAA rating from leading credit agencies |

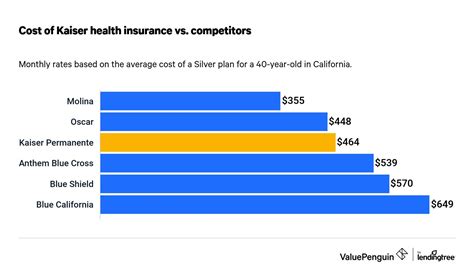

Industry Comparison

In comparison to other major healthcare providers, Kaiser stands out for its comprehensive approach to healthcare. While insurance rates may vary, Kaiser’s focus on integrated care and preventive measures sets it apart.

| Healthcare Provider | Insurance Rates | Key Differentiators |

|---|---|---|

| Kaiser Permanente | $350 - $800/month (individual plans) | Integrated healthcare system, preventive care focus |

| Provider X | $300 - $750/month | Network of providers, flexible coverage options |

| Provider Y | $400 - $900/month | Specialized services, high-quality care |

Future Implications and Trends

As the healthcare industry continues to evolve, Kaiser’s approach to insurance rates and healthcare delivery is likely to adapt to meet the changing needs of its members. Here are some potential future implications and trends to consider:

- Technology Integration: Kaiser is likely to continue leveraging technology to enhance its healthcare services. From telemedicine to digital health records, technology can improve access to care and reduce administrative burdens, potentially impacting insurance rates.

- Population Health Management: With a focus on preventive care, Kaiser may further develop its population health management strategies. By targeting specific health issues and implementing targeted interventions, Kaiser can improve overall member health and potentially reduce long-term healthcare costs.

- Value-Based Care: The shift towards value-based care models is likely to influence Kaiser's approach. By incentivizing quality outcomes and efficient care delivery, Kaiser can further optimize its healthcare system, potentially leading to more cost-effective insurance rates.

Conclusion: Navigating Kaiser Medical Insurance Rates

Kaiser Permanente’s medical insurance rates are shaped by a combination of individual factors and the organization’s unique approach to healthcare delivery. By understanding these influences and Kaiser’s commitment to cost management, individuals can make informed choices about their healthcare coverage.

As the healthcare landscape continues to evolve, Kaiser's integrated healthcare system and focus on preventive care position it well to adapt to changing needs. Whether through technology integration, population health management, or value-based care models, Kaiser is likely to remain a trusted provider, offering competitive insurance rates and high-quality healthcare.

Frequently Asked Questions (FAQ)

Can I negotiate Kaiser’s insurance rates?

+

Kaiser’s insurance rates are typically based on standard pricing structures, and direct negotiation of premiums is not common. However, exploring different plan options and discussing your specific needs with a Kaiser representative may help you find the most suitable and cost-effective coverage for your situation.

How does Kaiser compare to other insurance providers in terms of cost?

+

Kaiser’s insurance rates can vary based on factors such as location, plan type, and individual health status. While some plans may be more affordable than competitors, others may have slightly higher premiums. It’s essential to compare multiple providers and assess the value and coverage offered to make an informed decision.

Are there any discounts or special programs offered by Kaiser for insurance rates?

+

Kaiser does offer various discounts and special programs to make insurance more accessible. These may include discounts for healthy lifestyle choices, family plans with reduced rates, and programs targeted at specific populations or communities. It’s advisable to inquire about these opportunities when considering Kaiser’s insurance plans.

What happens if I need to switch insurance providers mid-year?

+

Switching insurance providers mid-year can be complex and may depend on your specific circumstances. It’s essential to understand your current plan’s coverage period and any potential penalties for early termination. Additionally, you’ll need to research and choose a new plan that aligns with your healthcare needs and budget. Consulting with a healthcare advisor or insurance broker can be beneficial during this process.