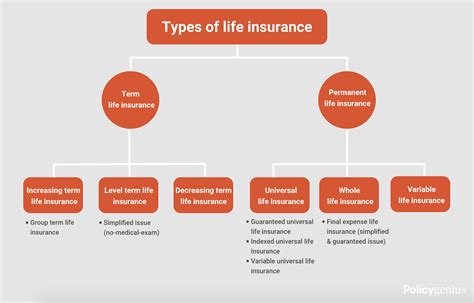

Kinds Of Life Insurance

Life insurance is an essential financial tool that provides security and peace of mind to individuals and their loved ones. It offers a safety net during uncertain times, ensuring that beneficiaries receive a predetermined sum upon the policyholder's demise. The world of life insurance is diverse, catering to various needs and preferences. In this comprehensive guide, we will delve into the different types of life insurance, exploring their unique features, benefits, and suitability for different life stages and financial goals.

Term Life Insurance

Term life insurance is a popular and straightforward form of coverage. It offers protection for a specified term, typically ranging from 10 to 30 years. During this period, the policyholder pays regular premiums, and in the event of their death, the beneficiaries receive a tax-free lump sum payment known as the death benefit. Term life insurance is ideal for individuals seeking temporary coverage to protect their family during specific life stages, such as raising children or paying off a mortgage.

Key Features and Benefits

- Affordability: Term life insurance is often the most cost-effective option, making it accessible to a wide range of individuals.

- Flexibility: Policyholders can choose the term length that aligns with their needs, ensuring coverage during critical life stages.

- Convertibility: Many term policies allow conversion to permanent life insurance, providing an option to transition to long-term coverage.

- Renewability: Some term policies offer the option to renew the coverage at the end of the term, albeit at a potentially higher premium.

| Term Length | Common Terms (in years) |

|---|---|

| Short-Term | 5, 10 |

| Medium-Term | 15, 20 |

| Long-Term | 25, 30 |

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, offers coverage for the policyholder’s entire life, providing a guaranteed death benefit. This type of insurance is designed to provide long-term financial protection and accumulate cash value over time. Whole life insurance policies typically have higher premiums compared to term life insurance, as they combine protection with a savings component.

Key Features and Benefits

- Lifetime Coverage: Whole life insurance guarantees coverage until the policyholder’s death, ensuring peace of mind.

- Cash Value Accumulation: A portion of the premiums goes into a cash value account, which grows tax-deferred and can be accessed through loans or withdrawals.

- Guaranteed Premiums: The premiums remain level throughout the policy, providing stability and predictability.

- Flexible Premium Payments: Policyholders can adjust premium payments within certain limits, offering flexibility in managing finances.

| Policy Type | Description |

|---|---|

| Traditional Whole Life | Basic form with fixed premiums and a guaranteed death benefit. |

| Universal Life | Offers flexibility in premium payments and death benefit amounts, with a cash value account. |

| Variable Life | Allows investment of cash value in separate accounts, providing potential for higher returns but also carries more risk. |

Universal Life Insurance

Universal life insurance is a flexible form of permanent life insurance that offers policyholders more control over their coverage and premiums. It combines a death benefit with a cash value component, similar to whole life insurance, but with added flexibility. Universal life insurance policies allow policyholders to adjust their premium payments and death benefit amounts within certain limits, making it a versatile option for those with changing financial needs.

Key Features and Benefits

- Flexibility: Policyholders can increase or decrease premiums and death benefits to align with their financial situation and goals.

- Cash Value Accumulation: The cash value account grows tax-deferred, providing a potential source of funds for retirement or emergencies.

- Adjustable Premiums: Premiums can be adjusted to suit the policyholder’s financial circumstances, offering control over their insurance costs.

- Guaranteed Death Benefit: Despite the flexibility, the death benefit is still guaranteed, providing long-term financial protection.

| Universal Life Policy Type | Key Characteristics |

|---|---|

| Guaranteed Universal Life | Offers a fixed death benefit and guaranteed cash value growth, providing stability. |

| Variable Universal Life | Allows investment of cash value in separate accounts, providing potential for higher returns but with added risk. |

| Indexed Universal Life | Combines elements of fixed and variable universal life, offering participation in stock market growth with a guaranteed minimum return. |

Group Life Insurance

Group life insurance is often provided through employers as an employee benefit. It offers coverage to a group of individuals, typically employees and their families. Group life insurance policies are usually less expensive than individual policies and provide a basic level of protection. The coverage amount is often based on the employee’s salary, and the policy may have certain limitations and exclusions.

Key Features and Benefits

- Affordability: Group life insurance is often more cost-effective than individual policies, making it accessible to a larger portion of the workforce.

- Convenience: Employees can easily enroll in the group policy, and the coverage is often automatic, simplifying the process.

- Coverage for Dependents: Many group policies extend coverage to spouses and children, providing additional protection for families.

- No Medical Underwriting: In some cases, group policies may not require extensive medical underwriting, making it quicker to obtain coverage.

| Group Life Insurance Types | Description |

|---|---|

| Employer-Sponsored | Provided by employers as a benefit, often with coverage amounts based on salary. |

| Association Group Policies | Offered to members of specific associations or organizations, providing group rates. |

| Credit Union Group Policies | Available to members of credit unions, providing affordable life insurance options. |

Final Thoughts

The world of life insurance is diverse, offering a range of options to suit different financial needs and life stages. From the affordability and flexibility of term life insurance to the long-term protection and savings potential of whole life insurance, each type has its unique advantages. Understanding these different kinds of life insurance is crucial for individuals to make informed decisions and secure their loved ones’ financial future.

When choosing a life insurance policy, it's essential to consider your specific needs, financial goals, and the stage of life you're in. Whether it's providing for your family during a specific term or building a long-term financial legacy, there's a life insurance policy tailored to your circumstances.

FAQ

What is the main difference between term and whole life insurance?

+

Term life insurance offers coverage for a specified term, providing a death benefit if the policyholder dies during that period. It is cost-effective but provides temporary coverage. Whole life insurance, on the other hand, offers permanent coverage with a guaranteed death benefit and accumulates cash value over time, making it a long-term financial investment.

Can I convert my term life insurance to a permanent policy?

+

Yes, many term life insurance policies allow conversion to permanent life insurance, typically without the need for additional medical underwriting. This provides an option to transition from temporary to long-term coverage.

What is the advantage of universal life insurance over whole life insurance?

+

Universal life insurance offers more flexibility than whole life insurance. Policyholders can adjust their premiums and death benefits to suit their changing financial circumstances, making it a versatile choice for those with evolving needs.

Is group life insurance sufficient for my family’s needs?

+

Group life insurance can provide a basic level of protection, but it may not be sufficient for all families. It’s essential to assess your specific needs and consider supplementing with individual life insurance policies to ensure comprehensive coverage.