Kinds Of Life Insurance Policy

Life insurance is a vital financial tool that provides individuals and their families with protection and peace of mind. It serves as a safety net, offering financial support during unforeseen events such as the death of the policyholder. With a wide range of life insurance policies available, understanding the different types and their unique features is essential to make informed decisions. This comprehensive guide explores the various kinds of life insurance policies, their benefits, and how they can cater to diverse needs.

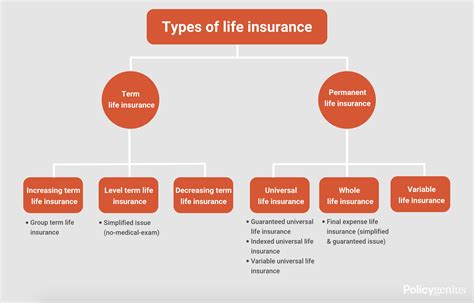

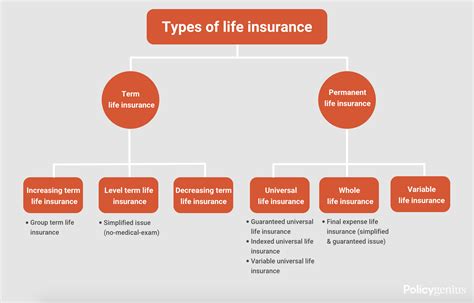

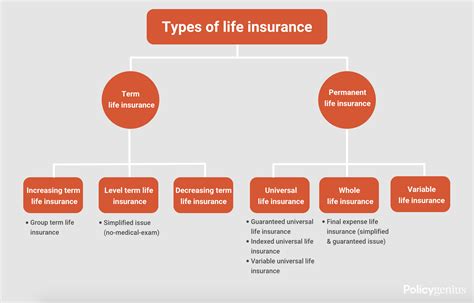

Term Life Insurance

Term life insurance is the most basic and common form of life insurance. It provides coverage for a specified period, known as the term, typically ranging from 10 to 30 years. During this term, the policyholder pays regular premiums, and in the event of their death, the beneficiaries receive a tax-free lump sum payment. The key advantage of term life insurance is its affordability, making it an accessible option for many individuals and families.

Features and Benefits of Term Life Insurance

Term life insurance offers several key features and benefits:

- Affordability: With relatively low premiums, term life insurance is an economical choice for those seeking basic coverage.

- Flexibility: Policyholders can choose the term length based on their needs and life stage. For example, a young couple might opt for a 20-year term to cover their children’s education and mortgage.

- Renewability: Most term policies can be renewed, although premiums may increase with age.

- Convertibility: Some term policies allow conversion to permanent life insurance, providing an option to switch if financial circumstances change.

Who Should Consider Term Life Insurance

Term life insurance is ideal for individuals and families with temporary financial needs. For instance, it can provide financial security for a family with young children or help cover a mortgage until it’s paid off. It’s a practical choice for those seeking short-term protection at an affordable cost.

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides lifelong coverage. It offers more than just a death benefit; it also includes a cash value component that grows over time. This type of policy is often more expensive than term life insurance, but it provides long-term financial protection and can be a valuable asset.

Types of Permanent Life Insurance

- Whole Life Insurance: Whole life insurance is a popular form of permanent life insurance. It offers a fixed premium and a guaranteed death benefit. The cash value component grows steadily, providing a savings element alongside the insurance coverage.

- Universal Life Insurance: Universal life insurance offers more flexibility than whole life. Policyholders can adjust their premiums and death benefit amounts within certain limits. The cash value component can also be accessed for various financial needs.

- Variable Life Insurance: Variable life insurance allows policyholders to invest their premiums in different investment options, such as stocks or bonds. While it offers potential for higher returns, it also carries more risk.

Advantages of Permanent Life Insurance

Permanent life insurance provides several benefits:

- Lifetime Coverage: As the name suggests, permanent life insurance ensures financial protection throughout the policyholder’s life.

- Cash Value: The policy’s cash value can be used for various financial needs, such as retirement planning or emergency funds.

- Tax Advantages: The cash value growth and death benefit are generally tax-free, offering significant tax benefits.

Who Should Choose Permanent Life Insurance

Permanent life insurance is ideal for individuals seeking long-term financial protection and those who value the cash value component. It’s a suitable choice for business owners, high-net-worth individuals, and those with specific financial goals, such as estate planning or leaving a legacy.

Universal Life Insurance

Universal life insurance is a flexible type of permanent life insurance. It combines the death benefit coverage with an investment component, allowing policyholders to customize their premiums and death benefit amounts. The cash value within the policy can be used for various financial needs, making it a versatile option.

Key Features of Universal Life Insurance

- Flexibility: Policyholders can adjust their premiums and death benefit amounts, providing control over their coverage and financial strategy.

- Cash Value Growth: The cash value within the policy grows tax-deferred, offering potential for long-term savings and investment.

- Death Benefit: The death benefit is guaranteed, providing financial protection for beneficiaries.

Who Should Opt for Universal Life Insurance

Universal life insurance is an excellent choice for individuals seeking a balance between financial protection and investment opportunities. It’s suitable for those who want control over their premiums and death benefit amounts and can be a valuable tool for estate planning and wealth accumulation.

Whole Life Insurance

Whole life insurance is a traditional form of permanent life insurance. It offers a fixed premium and a guaranteed death benefit, ensuring financial protection for the policyholder’s entire life. The policy’s cash value grows steadily over time, providing a reliable savings component.

Benefits of Whole Life Insurance

- Guaranteed Coverage: Whole life insurance provides lifelong coverage, ensuring financial protection for the policyholder and their beneficiaries.

- Stable Premiums: The premiums remain fixed throughout the policy, offering stability and predictability.

- Cash Value Growth: The cash value component grows steadily, providing a savings element that can be used for various financial needs.

Ideal Candidates for Whole Life Insurance

Whole life insurance is ideal for individuals seeking long-term financial security and those who prefer a stable, predictable insurance product. It’s a suitable choice for families with specific financial goals, such as covering funeral expenses or providing a financial legacy.

Variable Life Insurance

Variable life insurance is a type of permanent life insurance that offers investment opportunities. Policyholders can choose to invest their premiums in different investment options, such as stocks, bonds, or mutual funds. While it provides potential for higher returns, it also carries more risk compared to other life insurance types.

Key Characteristics of Variable Life Insurance

- Investment Opportunities: Policyholders can choose from a range of investment options, allowing for potential higher returns.

- Risk and Reward: The investment component carries market risk, so policyholders should be comfortable with potential fluctuations.

- Death Benefit: The death benefit is guaranteed, providing financial protection for beneficiaries.

Who Should Consider Variable Life Insurance

Variable life insurance is suitable for individuals seeking investment opportunities within their life insurance policy. It’s ideal for those who are comfortable with market risk and want the potential for higher returns. However, it’s essential to carefully assess one’s risk tolerance and financial goals before opting for this type of policy.

Comparative Analysis

When choosing a life insurance policy, it’s essential to compare the different types based on your specific needs and financial goals. Here’s a brief comparison to help you make an informed decision:

| Policy Type | Coverage | Premiums | Cash Value | Flexibility |

|---|---|---|---|---|

| Term Life | Short-term protection | Affordable | None | Limited |

| Permanent Life | Lifelong coverage | Higher | Yes | Limited |

| Universal Life | Flexible coverage | Customizable | Yes | High |

| Whole Life | Stable coverage | Fixed | Yes | Limited |

| Variable Life | Investment-focused | Varies | Yes | High |

Remember, the best life insurance policy for you depends on your unique circumstances and financial goals. It's always advisable to consult with a financial advisor or insurance professional to make an informed decision.

Can I switch from term life insurance to permanent life insurance later in life?

+Yes, many term life insurance policies offer a conversion option, allowing you to switch to permanent life insurance without a medical exam. However, the cost may increase with age, so it’s best to explore this option early on.

How does the cash value component of permanent life insurance work?

+The cash value within permanent life insurance policies grows over time, typically at a guaranteed minimum rate. This value can be used for various financial needs, such as retirement planning or covering premiums during difficult times.

What happens if I miss a premium payment for my life insurance policy?

+Missing a premium payment can have different consequences depending on the policy. Some policies may lapse, while others may have a grace period or offer a reduced paid-up insurance option. It’s crucial to understand the terms of your specific policy.

Can I add riders or additional benefits to my life insurance policy?

+Yes, many life insurance policies allow you to add riders, which are additional benefits or coverage options. Common riders include accelerated death benefits, waiver of premium, and long-term care coverage. Consult your insurer to explore available options.

How often should I review my life insurance policy?

+It’s recommended to review your life insurance policy periodically, especially when your financial situation or family circumstances change. Regular reviews ensure your coverage remains adequate and aligned with your needs.