Large Insurance Companies

The insurance industry, a vital pillar of the global financial system, has undergone significant transformations over the years. Among its ranks, large insurance companies play a pivotal role in shaping the landscape of risk management and financial protection. These giants, with their vast resources and influence, have not only withstood the test of time but also adapted to the ever-evolving nature of risk and uncertainty.

This article delves deep into the world of large insurance companies, exploring their historical significance, modern-day operations, and the pivotal role they play in safeguarding the interests of individuals, businesses, and societies at large. By understanding the intricacies of this industry, we gain insights into the mechanisms that underpin our financial security and the strategies that drive the world's largest insurance providers.

The Evolution of Large Insurance Companies: A Historical Perspective

The history of large insurance companies is a narrative of innovation, resilience, and adaptability. It traces back to the early days of maritime trade, where the concept of sharing risks through insurance contracts first emerged. Over centuries, these practices evolved, giving rise to modern insurance giants that we know today.

One of the earliest recorded instances of insurance can be traced to the Code of Hammurabi, a Babylonian law code dating back to around 1750 BCE. This code included provisions for the bottomry contract, which allowed lenders to charge high interest rates in exchange for forgiving the loan if the borrower's ship was lost at sea. This early form of insurance laid the foundation for risk-sharing practices that would evolve over millennia.

Fast forward to the 17th century, and we see the emergence of the first true insurance companies. In 1688, Nicholas Barbon, an English economist and entrepreneur, founded The Fire Office, the first fire insurance company in London. This marked a significant milestone in the history of insurance, as it demonstrated the potential for insurance to protect against specific risks, in this case, the threat of fire.

The 18th century saw the birth of life insurance, with the establishment of The Amicable Society for a Perpetual Assurance Office in London in 1706. This society, often regarded as the world's first life insurance company, offered insurance on the lives of members, providing a financial safety net for families in the event of the breadwinner's death.

The Industrial Revolution of the 19th century further fueled the growth of insurance companies. As industries expanded and the world became more interconnected, the need for insurance grew exponentially. This era saw the emergence of giants like Lloyd's of London, which, despite its unique structure as a market rather than a traditional company, played a pivotal role in shaping the insurance industry. Lloyd's introduced innovative insurance products and services, solidifying its position as a leading player in the industry.

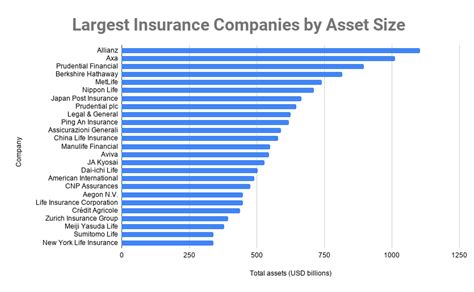

The 20th century brought with it a host of challenges and opportunities for insurance companies. Two world wars, economic depressions, and a growing awareness of health and environmental risks presented new avenues for insurance to step in and provide protection. This century witnessed the rise of large multinational insurance companies, with entities like Allianz, AIG, and AXA establishing themselves as global leaders.

Modern Operations: Navigating Complex Risks

In today’s world, large insurance companies are multifaceted entities, offering a comprehensive range of products and services. From traditional life and health insurance to property and casualty coverage, these companies have evolved to cater to a diverse set of needs.

Product Diversification

Large insurance companies have recognized the importance of diversifying their product offerings to remain competitive and relevant. For instance, Allianz, one of the world’s largest insurers, offers a wide array of products including life insurance, health insurance, auto insurance, home insurance, and even specialized coverage for high-net-worth individuals and businesses.

This diversification strategy not only allows insurance companies to cater to a broader customer base but also helps in mitigating risks. By spreading their portfolio across various lines of business, they reduce their exposure to any single type of risk, thereby enhancing their overall stability.

Technology Integration

The digital age has brought about a revolution in the insurance industry, and large insurance companies have been at the forefront of this transformation. They have embraced technology to enhance operational efficiency, improve customer experience, and streamline risk assessment and management processes.

One notable example is AIG, which has leveraged technology to develop innovative digital platforms. Their AIG Digital initiative aims to transform the customer experience by offering digital-first solutions, from quoting and purchasing insurance to filing and managing claims. This shift towards a digital ecosystem not only enhances customer convenience but also enables AIG to gather valuable data, which can be used for more accurate risk assessment and personalized product offerings.

Risk Management Strategies

Effective risk management is at the core of any successful insurance company. Large insurers employ sophisticated strategies to identify, assess, and mitigate risks. This involves a combination of data analytics, actuarial science, and strategic planning.

Take AXA as an example. They have developed a comprehensive Enterprise Risk Management (ERM) framework that identifies and manages risks across the entire organization. This framework includes processes for identifying and assessing risks, setting risk tolerances, and developing strategies to mitigate or transfer risks. AXA's ERM approach ensures that the company is not only aware of potential risks but also has robust plans in place to manage them effectively.

| Insurance Company | Risk Management Strategy |

|---|---|

| Allianz | Allianz Risk Pulse: A digital platform that provides real-time risk analytics and insights, helping the company stay ahead of emerging risks. |

| AIG | Risk Assessment Tools: AIG utilizes advanced analytics and machine learning to identify and assess risks, particularly in the areas of cyber security and climate change. |

| AXA | AXA Research Fund: A dedicated fund supporting research in risk management, climate change, and emerging technologies to enhance AXA's risk assessment capabilities. |

Impact and Influence: Shaping Industries and Societies

Large insurance companies are not just financial intermediaries; they are powerful drivers of economic growth and social development. Their influence extends across various sectors, shaping industries and contributing to the overall stability and resilience of societies.

Economic Growth and Stability

Insurance companies play a crucial role in promoting economic growth and stability. By providing financial protection, they encourage businesses to take risks and innovate, knowing that they have a safety net in case of failure. This fosters a culture of entrepreneurship and drives economic development.

For instance, Munich Re, one of the world's largest reinsurance companies, provides risk solutions to primary insurers, allowing them to underwrite larger and more complex risks. This, in turn, enables businesses to access the insurance coverage they need to operate and grow, contributing to overall economic prosperity.

Social Welfare and Safety Nets

Insurance companies also play a vital role in providing social welfare and safety nets. Life insurance policies, for example, offer financial security to families in the event of a breadwinner’s death. Health insurance provides access to medical care, ensuring that individuals can receive the treatment they need without incurring catastrophic financial burdens.

Consider Prudential, a leading insurer in the Asia-Pacific region. They have developed a range of microinsurance products specifically designed for low-income individuals and communities. These products provide affordable access to insurance coverage, offering a crucial safety net for those who might otherwise be unable to afford traditional insurance policies.

Environmental and Social Responsibility

In recent years, there has been a growing awareness among insurance companies of their role in addressing environmental and social issues. Many large insurers have made commitments to sustainability and social responsibility, integrating these principles into their business strategies.

Aviva, a UK-based insurer, is a notable example. They have pledged to achieve net-zero emissions across their investment portfolio by 2040 and have divested from coal and tar sands. Aviva has also launched initiatives to support sustainable development, such as their Aviva Climate Transition Fund, which invests in companies committed to reducing their carbon footprint.

Future Prospects: Navigating an Uncertain World

As we look towards the future, the insurance industry faces both challenges and opportunities. The ongoing global pandemic, climate change, and technological advancements are reshaping the risk landscape, presenting new challenges for insurance companies to navigate.

Pandemic and Health Risks

The COVID-19 pandemic has highlighted the critical role of insurance in managing health risks. It has also brought to the forefront the need for insurers to adapt their products and services to address emerging health threats.

Large insurers are investing in research and development to create new insurance products that address pandemic-related risks. They are also exploring ways to enhance their existing health insurance offerings to better protect policyholders against such risks.

Climate Change and Environmental Risks

Climate change poses significant risks to the insurance industry, from increased frequency and severity of natural disasters to the long-term impacts of climate change on various industries. Insurers are recognizing the need to address these risks and are taking steps to mitigate them.

Many large insurers, such as Swiss Re and Munich Re, are actively involved in initiatives to promote climate resilience and sustainability. They are developing new insurance products and services to help businesses and individuals adapt to a changing climate, and they are also advocating for policies and regulations that support a transition to a low-carbon economy.

Technological Innovations

Technology is transforming the insurance industry, offering both challenges and opportunities. Artificial intelligence, machine learning, and data analytics are enhancing insurers’ ability to assess and manage risks, but they also present ethical and regulatory challenges.

Large insurers are investing in technological innovations to improve their operations and customer experience. They are leveraging technology to offer more personalized insurance products, streamline the claims process, and enhance fraud detection. However, they must also navigate the complex ethical and regulatory issues that arise with the use of advanced technologies.

Sustainable Business Models

As societal expectations evolve, insurance companies are increasingly expected to demonstrate their commitment to sustainability and social responsibility. This involves not only addressing environmental and social risks but also integrating sustainability into their core business strategies.

Many large insurers are embracing sustainable business models, integrating environmental, social, and governance (ESG) factors into their investment and business decisions. They are also working to reduce their own environmental footprint and promote sustainable practices across their value chains.

Conclusion: A Pillar of Financial Security

Large insurance companies are more than just financial institutions; they are guardians of financial security, social welfare, and economic stability. Their historical evolution, modern operations, and impact on industries and societies underscore their critical role in our world.

As we navigate an uncertain future, characterized by evolving risks and rapid technological advancements, the resilience and adaptability of large insurance companies will be tested. Their ability to innovate, integrate technology, and address emerging risks will be crucial in maintaining their relevance and ensuring the financial security of individuals, businesses, and societies at large.

What are some of the key challenges faced by large insurance companies today?

+Large insurance companies face a myriad of challenges, including regulatory compliance, increasing competition, and the need to keep pace with technological advancements. They must also address emerging risks such as those posed by climate change and pandemics, while maintaining financial stability and meeting the evolving needs of their customers.

How do large insurance companies use data analytics to improve their operations?

+Data analytics plays a crucial role in helping large insurance companies make informed decisions. By analyzing vast amounts of data, they can identify trends, assess risks more accurately, develop more targeted products, and enhance their overall operational efficiency. Advanced analytics also enables them to personalize their offerings and improve customer experience.

What role do large insurance companies play in promoting sustainability and social responsibility?

+Large insurance companies are increasingly recognizing their role in promoting sustainability and social responsibility. They are integrating these principles into their business strategies, investing in sustainable initiatives, and advocating for policies that support a more sustainable and equitable world. By doing so, they not only contribute to a better society but also future-proof their own operations.