Least Expensive Homeowners Insurance Companies

When it comes to safeguarding your home and belongings, homeowners insurance is a crucial aspect to consider. The cost of this coverage can vary significantly between insurance companies, and finding the least expensive option without compromising on quality and coverage is a top priority for many homeowners. In this comprehensive guide, we will delve into the world of homeowners insurance, exploring the most affordable companies, their offerings, and the factors that influence pricing.

Unveiling the Top Affordable Homeowners Insurance Companies

Identifying the most budget-friendly homeowners insurance providers requires a thorough analysis of the market. Here are some of the top contenders renowned for their competitive rates:

1. State Farm: A Trusted Choice for Affordable Coverage

State Farm is a well-established name in the insurance industry, known for its extensive network and competitive pricing. The company offers a wide range of homeowners insurance policies tailored to meet diverse needs. With a strong focus on customer satisfaction and a solid financial backing, State Farm provides an attractive combination of affordability and reliability.

Key Features:

- Personalized coverage options

- Discounts for loyalty and safety features

- 24⁄7 customer support

State Farm’s reputation for excellent customer service and its commitment to offering customizable policies make it a top choice for those seeking both value and peace of mind.

2. Progressive: Leading the Way in Innovation and Affordability

Progressive has revolutionized the insurance landscape with its innovative approach and competitive rates. This company offers a comprehensive suite of insurance products, including homeowners insurance, designed to cater to various lifestyles and budgets. Progressive’s online tools and resources further enhance the convenience and accessibility of their services.

Key Features:

- Online policy management and quotes

- Discounts for bundling multiple policies

- Flexible payment options

Progressive’s commitment to digital innovation and customer-centric solutions sets it apart, making it an excellent option for tech-savvy homeowners.

3. Erie Insurance: A Legacy of Affordable Protection

Erie Insurance has a long-standing tradition of providing affordable insurance solutions to homeowners. With a focus on local presence and personalized service, Erie offers competitive rates without compromising on coverage. Their commitment to community involvement and customer satisfaction has earned them a loyal customer base.

Key Features:

- Discounts for homeowners associations

- Claim forgiveness options

- Excellent customer service ratings

Erie Insurance’s dedication to its customers and its strong financial stability make it a trusted partner for homeowners seeking reliable and affordable coverage.

4. Lemonade: Disrupting the Industry with Transparency and Affordability

Lemonade is a modern insurance company that has disrupted the traditional insurance model with its unique, tech-driven approach. This company offers a simple and transparent process for obtaining homeowners insurance, with competitive rates and a focus on giving back to society. Lemonade’s innovative use of technology and its commitment to social impact make it an appealing choice for tech-oriented homeowners.

Key Features:

- Instant online quotes and policy issuance

- Low minimum premiums

- Donations to causes chosen by policyholders

Lemonade’s innovative business model and its emphasis on transparency and social responsibility set it apart in the insurance industry.

5. Amica Mutual: A Legacy of Excellence and Affordability

Amica Mutual is a well-respected insurance provider known for its outstanding customer service and competitive rates. With a focus on building long-term relationships with its customers, Amica offers personalized homeowners insurance policies at affordable prices. Their commitment to financial stability and customer satisfaction has earned them a solid reputation in the industry.

Key Features:

- Discounts for claim-free years

- 24⁄7 claims assistance

- Excellent financial ratings

Amica Mutual’s dedication to its customers and its focus on providing comprehensive coverage make it a reliable choice for homeowners seeking both value and security.

Factors Influencing Homeowners Insurance Rates

Understanding the factors that influence homeowners insurance rates is crucial for making informed decisions. Here are some key elements that impact the cost of your policy:

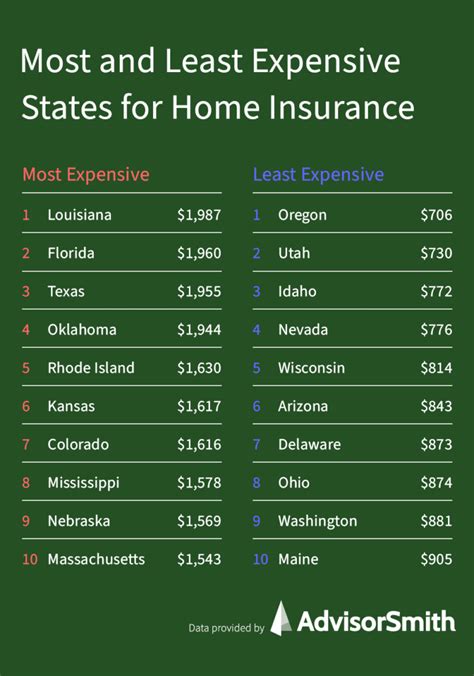

1. Location and Property Value

The location of your home and its property value play a significant role in determining insurance rates. Areas with higher crime rates, natural disaster risks, or dense populations often result in higher premiums. Additionally, the value of your home and its contents can impact the cost of your policy, as insurance companies need to ensure they can cover potential losses.

2. Coverage Options and Deductibles

The coverage options you choose and the associated deductibles can significantly affect your insurance premiums. Opting for higher deductibles typically leads to lower premiums, as you’re taking on a larger share of the financial responsibility. Conversely, selecting comprehensive coverage with lower deductibles may result in higher premiums.

3. Credit Score and Claims History

Your credit score and claims history are crucial factors that insurance companies consider when calculating rates. A higher credit score often correlates with lower premiums, as it indicates a lower risk profile. Similarly, a clean claims history can lead to more favorable rates, as it demonstrates responsible and safe behavior.

4. Age and Condition of Your Home

The age and condition of your home can impact insurance rates. Older homes may require more extensive coverage due to potential aging-related issues, which can result in higher premiums. Additionally, homes in good repair and with modern safety features often qualify for discounts, as they pose a lower risk to insurance providers.

5. Discounts and Bundling Opportunities

Many insurance companies offer discounts to encourage safe behavior and loyalty. These discounts can be for various reasons, such as installing security systems, having multiple policies with the same provider, or being a long-term customer. Bundling your homeowners insurance with other policies, like auto insurance, can also lead to significant savings.

Maximizing Savings: Tips for Finding Affordable Homeowners Insurance

While the companies mentioned above offer competitive rates, there are additional strategies you can employ to further reduce your homeowners insurance costs. Here are some tips to consider:

- Shop Around: Compare quotes from multiple insurance companies to find the best rates. Online comparison tools can simplify this process.

- Review Coverage: Regularly review your coverage options and adjust them based on your changing needs. Ensure you're not overinsured or paying for unnecessary coverage.

- Increase Deductibles: Opting for higher deductibles can significantly reduce your premiums. However, ensure you can afford the deductible amount in the event of a claim.

- Safety Features: Install security systems, fire alarms, and other safety features to qualify for discounts and lower your risk profile.

- Bundle Policies: Bundling your homeowners insurance with other policies, such as auto insurance, can result in substantial savings.

- Improve Credit Score: Maintaining a good credit score can lead to lower insurance rates. Focus on responsible financial practices to improve your creditworthiness.

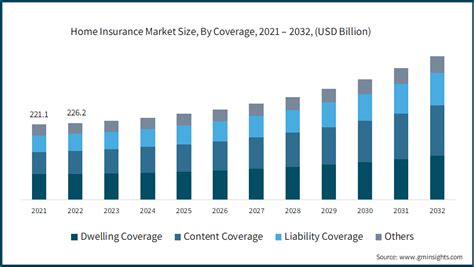

The Future of Affordable Homeowners Insurance

The insurance industry is constantly evolving, and the future holds exciting possibilities for homeowners seeking affordable coverage. Technological advancements, such as the use of artificial intelligence and data analytics, are expected to further enhance the accuracy and efficiency of risk assessment. This could lead to more tailored insurance policies and potentially lower premiums for homeowners.

Additionally, the rise of insurtech companies and their innovative business models is set to disrupt the traditional insurance landscape. These companies, like Lemonade, are leveraging technology to streamline processes, reduce overhead costs, and offer more competitive rates. As the industry continues to embrace digital transformation, homeowners can expect increased accessibility, convenience, and affordability in their insurance options.

FAQ

What is the average cost of homeowners insurance?

+The average cost of homeowners insurance varies based on several factors, including location, property value, and coverage options. On average, homeowners can expect to pay between 1,000 and 2,000 annually for standard coverage.

How can I get a quote for homeowners insurance?

+Obtaining a quote for homeowners insurance is straightforward. You can request quotes directly from insurance companies or use online comparison tools that allow you to compare rates from multiple providers simultaneously.

What factors can I control to lower my homeowners insurance premiums?

+You can influence your homeowners insurance premiums by taking proactive measures such as installing safety features, maintaining a good credit score, increasing your deductibles, and regularly reviewing your coverage options to ensure you’re not overinsured.

Are there any government programs that offer discounted homeowners insurance?

+Some states offer government-backed programs that provide discounted homeowners insurance to eligible residents. These programs often target specific demographics or areas with higher risk factors. It’s worth checking with your state’s insurance department to see if you qualify for any such programs.

Can I negotiate my homeowners insurance rates with the provider?

+While negotiating insurance rates is not as common as with other products or services, it’s worth discussing your options with your insurance provider. They may be able to offer discounts or suggest adjustments to your policy that could result in lower premiums.