Levels Of Car Insurance

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers worldwide. With a wide range of coverage options available, it's crucial to understand the different levels of car insurance to make an informed decision that suits your specific needs and circumstances. This comprehensive guide will delve into the various levels of car insurance, exploring the coverage options, benefits, and considerations associated with each.

Understanding the Basics: Types of Car Insurance Coverage

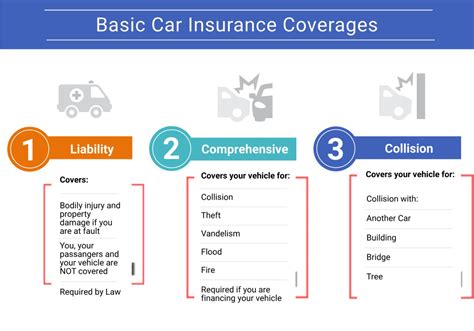

Car insurance can be broadly categorized into several types, each offering a different level of coverage and protection. The primary types of car insurance include:

- Liability Coverage: This is the most basic level of car insurance and is typically required by law in most regions. Liability coverage protects you financially if you are found at fault in an accident, covering the costs of injuries and damages caused to others.

- Collision Coverage: As the name suggests, collision coverage provides protection for your vehicle in the event of a collision. It covers the costs of repairing or replacing your car if it's damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: Comprehensive insurance offers protection against a wide range of non-collision incidents. This includes damage caused by natural disasters, theft, vandalism, or even incidents like hitting an animal. Comprehensive coverage provides a more comprehensive level of protection for your vehicle.

- Personal Injury Protection (PIP): PIP coverage, also known as no-fault insurance, focuses on providing medical coverage for you and your passengers regardless of who is at fault in an accident. It covers medical expenses, lost wages, and other related costs.

- Uninsured/Underinsured Motorist Coverage: This type of insurance protects you in the event of an accident with a driver who has no insurance or insufficient insurance coverage. It ensures you are financially protected even when the other driver is at fault but lacks adequate insurance.

The Spectrum of Car Insurance: From Basic to Comprehensive

Now that we have a basic understanding of the different types of car insurance coverage, let’s explore the levels of insurance in more detail, starting from the most fundamental level and progressing to the most comprehensive.

Level 1: State-Required Minimum Coverage

The first level of car insurance is the state-mandated minimum coverage. Each state has its own specific requirements for the minimum level of insurance coverage that drivers must carry. This level of insurance typically includes liability coverage to protect others in the event of an accident you cause.

| State | Minimum Liability Coverage |

|---|---|

| California | 15/30/5 |

| Texas | 30/60/25 |

| New York | 25/50/10 |

| ... | ... |

While this level of insurance is the legal minimum, it may not provide sufficient protection for your own vehicle or personal expenses in the event of an accident. It is important to carefully review your state's requirements and consider whether additional coverage is necessary.

Level 2: Basic Protection - Liability and Collision

Stepping up from the state-required minimum, Level 2 car insurance typically includes both liability coverage and collision coverage. This level provides a more comprehensive level of protection, as it covers damages to other vehicles and property in an accident you cause, as well as repairs or replacement for your own vehicle if it’s damaged in a collision.

Additionally, Level 2 insurance often includes rental car reimbursement, which can be beneficial if you need a rental vehicle while your car is being repaired. However, it's important to note that this level of insurance may still have limitations and exclusions, and you may need to consider adding further coverage for more comprehensive protection.

Level 3: Enhanced Protection - Comprehensive Coverage

Level 3 car insurance takes protection a step further by adding comprehensive coverage to the mix. With comprehensive coverage, you gain protection against a wide range of incidents, including vandalism, theft, natural disasters, and more. This level of insurance provides a higher level of financial security, as it covers a broader range of potential risks and losses.

Additionally, Level 3 insurance often includes glass coverage, which can be a significant benefit as it covers the cost of repairing or replacing damaged windshields or windows. This can be particularly useful in regions where extreme weather or debris can cause unexpected damage to your vehicle's glass.

Level 4: Maximum Protection - Full Coverage

Full coverage car insurance, often referred to as Level 4, is the pinnacle of car insurance protection. This level of insurance combines all the coverages discussed above, including liability, collision, comprehensive, and additional benefits such as rental car reimbursement and glass coverage.

Full coverage insurance provides the most comprehensive protection for your vehicle and your financial well-being. It ensures that you are covered for a wide range of incidents, from accidents caused by you to damages caused by others or external factors. With full coverage, you can drive with confidence, knowing that you have the highest level of protection available.

Considerations and Factors Affecting Car Insurance Levels

When choosing the level of car insurance that suits your needs, there are several important considerations to keep in mind. These factors can influence the type and level of coverage you opt for and can help you make an informed decision.

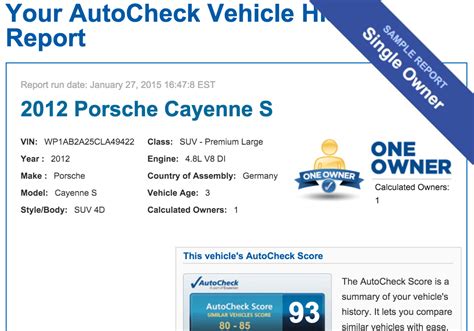

- Vehicle Value: The value of your vehicle plays a significant role in determining the level of insurance you require. If you own a newer or more expensive vehicle, you may want to consider higher levels of coverage to ensure you are adequately protected in the event of an accident or other incidents.

- Personal Financial Risk: Your personal financial situation and risk tolerance are crucial factors. If you have the means to absorb potential costs without significant financial strain, you may opt for a lower level of coverage. However, if you are more risk-averse or have limited financial resources, a higher level of insurance can provide greater peace of mind.

- Driving History and Habits: Your driving record and habits can impact the level of insurance you need. If you have a clean driving record and are a cautious driver, you may be comfortable with a lower level of coverage. On the other hand, if you have a history of accidents or tend to drive in high-risk areas, a higher level of insurance can provide added protection.

- Regional Factors: The region where you live and drive can influence the level of insurance you require. Areas with higher crime rates, extreme weather conditions, or a higher incidence of accidents may warrant a higher level of coverage to mitigate potential risks.

- Personal Preferences: Ultimately, your personal preferences and comfort level play a role in deciding the level of car insurance. Some individuals may prioritize comprehensive protection and peace of mind, while others may prefer a more cost-effective approach with basic coverage.

The Impact of Deductibles on Car Insurance Levels

Another crucial aspect to consider when choosing the level of car insurance is the deductible. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. The choice of deductible can significantly impact the level of insurance you select and your overall insurance costs.

Opting for a higher deductible can reduce your insurance premiums, as you are assuming a larger portion of the financial risk. This can be a cost-effective approach for individuals who are comfortable with the financial responsibility and have sufficient savings to cover potential expenses. However, it's important to carefully consider your financial situation and ensure that you can afford the higher deductible in the event of a claim.

On the other hand, selecting a lower deductible provides greater financial protection, as you pay a smaller amount out of pocket in the event of a claim. While this can result in higher insurance premiums, it offers a more comprehensive level of protection and can be beneficial for those who prefer a lower financial risk.

Tailoring Your Car Insurance to Your Needs

When it comes to choosing the right level of car insurance, it’s important to remember that there is no one-size-fits-all solution. Your unique circumstances, vehicle, and personal preferences will influence the level of coverage that is ideal for you.

By carefully assessing your needs, considering the factors discussed above, and consulting with insurance professionals, you can make an informed decision about the level of car insurance that provides the protection and peace of mind you desire. Remember, the goal is to find a balance between adequate coverage and financial feasibility, ensuring you are well-prepared for any unexpected events on the road.

What is the average cost of car insurance per month in the United States?

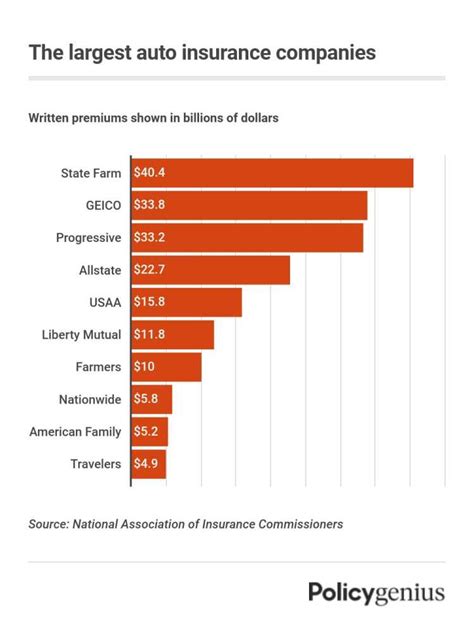

+The average cost of car insurance in the U.S. varies depending on factors such as location, driving record, and the level of coverage chosen. As of 2023, the national average for car insurance premiums is approximately 1,674 per year, or around 139 per month. However, it’s important to note that these averages can vary significantly based on individual circumstances.

How does my driving record affect the level of car insurance I need?

+Your driving record is a crucial factor in determining the level of car insurance you require. A clean driving record with no accidents or violations may allow you to opt for a lower level of coverage, as you pose a lower risk to insurers. However, if you have a history of accidents or traffic violations, insurers may consider you a higher risk, and you may need to choose a higher level of coverage to ensure adequate protection.

Are there any discounts available for different levels of car insurance coverage?

+Yes, many insurance providers offer discounts for different levels of coverage. For example, you may be eligible for a multi-policy discount if you bundle your car insurance with other types of insurance, such as home or life insurance. Additionally, some insurers offer discounts for safe driving, accident-free records, or completing defensive driving courses. It’s worth exploring these discounts to potentially reduce your insurance costs.