Liability Car Insurance California

Understanding Liability Car Insurance in California: A Comprehensive Guide

When it comes to navigating the complex world of car insurance, liability coverage stands out as a critical component. In the state of California, understanding liability insurance is essential for every driver. This comprehensive guide aims to unravel the intricacies of liability car insurance, ensuring you make informed decisions about your coverage.

The Essence of Liability Car Insurance

Liability car insurance is a cornerstone of automotive insurance policies. It provides financial protection to policyholders in the event they are found legally responsible for causing bodily injury or property damage to others in an automobile accident. This coverage ensures that the policyholder's assets are safeguarded from claims and lawsuits arising from such incidents.

In California, the Department of Motor Vehicles (DMV) mandates that all drivers maintain a minimum level of liability insurance to operate a vehicle legally. This mandatory coverage is designed to protect other drivers, passengers, and pedestrians, ensuring they receive compensation for injuries or damages sustained in an accident caused by the insured driver.

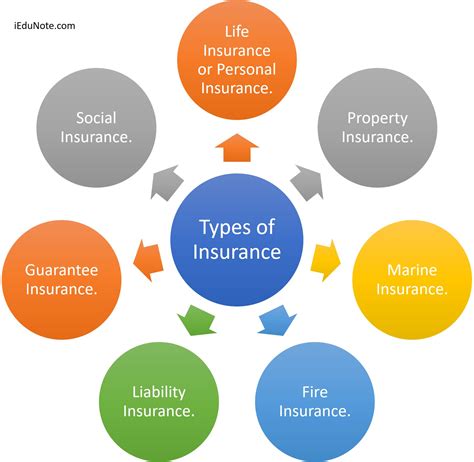

Understanding the Components of Liability Insurance

Liability car insurance in California is typically divided into three main components: bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

Bodily Injury Liability

Bodily injury liability coverage is a critical aspect of any car insurance policy. It provides financial protection in the event the insured driver causes an accident resulting in bodily harm to others. This coverage pays for medical expenses, lost wages, and pain and suffering of those injured. In California, the minimum required limit for bodily injury liability is $15,000 per person and $30,000 per accident.

However, it's essential to note that these limits may not be sufficient to cover the full extent of damages, especially in severe accidents. Many experts recommend increasing these limits to ensure adequate protection. For instance, raising the limits to $100,000 per person and $300,000 per accident provides a more comprehensive safety net.

Property Damage Liability

Property damage liability coverage is another crucial component of liability car insurance. This coverage steps in when the insured driver causes damage to another person's property, such as their vehicle, home, or personal belongings. It covers the cost of repairs or replacements up to the policy limits.

In California, the minimum required limit for property damage liability is $5,000. While this limit might suffice for minor accidents, it may fall short in cases involving extensive property damage. Increasing the limit to $100,000 or more provides a more robust layer of protection, ensuring that the insured driver isn't left financially vulnerable in the event of significant property damage.

Uninsured/Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage is an optional but highly recommended addition to liability car insurance in California. This coverage provides financial protection to the insured driver when involved in an accident with a driver who has insufficient or no insurance coverage.

Given that California is a state with a significant number of uninsured drivers, this coverage can be a lifesaver. It ensures that the insured driver receives compensation for their injuries and property damage, even if the at-fault driver is unable to provide adequate financial coverage.

The Importance of Adequate Coverage Limits

When it comes to liability car insurance, selecting appropriate coverage limits is crucial. The minimum required limits in California might not provide sufficient protection in the event of a severe accident. It's essential to assess your specific needs and financial situation to determine the appropriate limits.

Consider your assets and liabilities. If you have significant assets, higher liability limits can provide an extra layer of protection. Similarly, if you have a family or dependants, higher limits ensure that you're not left financially vulnerable in the event of an accident.

The Role of Deductibles in Liability Insurance

Deductibles are an essential consideration when choosing liability car insurance. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can reduce your premium, but it also means you'll have to pay more out of pocket in the event of a claim.

In California, it's common to see deductibles ranging from $250 to $1,000. Choosing a higher deductible, such as $1,000, can result in significant savings on your premium. However, it's crucial to ensure that you have the financial capacity to cover this amount if the need arises.

The Impact of Driving Record and Claims History

Your driving record and claims history play a significant role in determining your liability car insurance rates. Insurance companies consider these factors when assessing your risk profile and setting your premiums.

A clean driving record, free from accidents and violations, can lead to lower premiums. Conversely, a history of accidents or moving violations can result in higher rates. It's essential to maintain a safe driving record to keep your liability insurance costs as low as possible.

Comparing Insurance Providers and Rates

With numerous insurance providers offering liability car insurance in California, it's crucial to compare rates and coverage options. Each provider has its own methodology for calculating premiums, and rates can vary significantly.

Use online comparison tools or seek the assistance of an insurance broker to obtain quotes from multiple providers. Compare not only the premiums but also the coverage limits and deductibles to ensure you're getting the best value for your money. Don't forget to consider the provider's reputation and customer service record when making your decision.

The Future of Liability Car Insurance in California

The landscape of liability car insurance is constantly evolving, and California is at the forefront of many innovative changes. With the rise of autonomous vehicles and advanced driver-assistance systems, the traditional concept of liability is undergoing a transformation.

In the coming years, we can expect to see more focus on technology-driven insurance solutions. Telematics devices, which track driving behavior and habits, are already being used to offer personalized insurance rates. Additionally, the development of autonomous vehicles may lead to a shift in liability, with manufacturers and software developers taking on more responsibility for accidents.

Frequently Asked Questions (FAQ)

What happens if I'm involved in an accident with an uninsured driver in California?

+If you're involved in an accident with an uninsured driver, your uninsured motorist coverage (if you have it) will step in to provide compensation for your injuries and property damage. This coverage ensures that you're not left financially burdened due to the other driver's lack of insurance.

How do I know if my liability insurance limits are sufficient?

+Determining adequate liability limits depends on your specific circumstances. Consider your assets, liabilities, and the potential severity of accidents you might be involved in. Consulting with an insurance professional can help you assess and choose appropriate limits.

Can I negotiate my liability car insurance rates in California?

+While insurance rates are largely determined by standardized formulas, you can still negotiate with insurance providers. Highlighting your safe driving record, loyalty to the provider, or installing safety features in your vehicle can sometimes lead to rate reductions. It's always worth discussing your options with your insurer.

What are some tips for reducing my liability car insurance premiums in California?

+To reduce your premiums, consider increasing your deductible, maintaining a clean driving record, and exploring multi-policy discounts. Additionally, certain safety features in your vehicle, such as anti-theft devices or advanced driver-assistance systems, can qualify you for discounts. Regularly reviewing and adjusting your coverage to match your needs can also help keep costs down.

Understanding liability car insurance in California is a critical step towards ensuring your financial protection and compliance with state laws. By comprehending the components of liability coverage, selecting appropriate limits, and staying informed about the evolving insurance landscape, you can make confident decisions about your car insurance.