Liability In Insurance

In the complex world of insurance, understanding liability is crucial, as it forms the foundation of many insurance policies and legal obligations. This article aims to provide a comprehensive guide to liability in insurance, exploring its definitions, implications, and real-world applications. From personal injury cases to business operations, liability insurance plays a pivotal role in managing risks and protecting individuals and entities from financial losses.

Understanding Liability: Definitions and Key Concepts

Liability, in the context of insurance, refers to the legal responsibility for any harm, loss, or damage caused to another party. This responsibility arises from negligent actions, breaches of contract, or other wrongful conduct. In essence, liability insurance exists to safeguard individuals and businesses from the financial repercussions of such events.

The concept of liability is multifaceted and can be categorized into several types, each with its unique implications. The primary types of liability include:

- Personal Liability: This type of liability arises from everyday actions and incidents, such as accidents on one's property or bodily injuries caused by pets. Personal liability insurance is often included in homeowners' or renters' insurance policies.

- Product Liability: Product manufacturers and distributors can be held liable for any harm caused by their products. Product liability insurance protects businesses from financial losses arising from defective products, inadequate warnings, or misrepresentations.

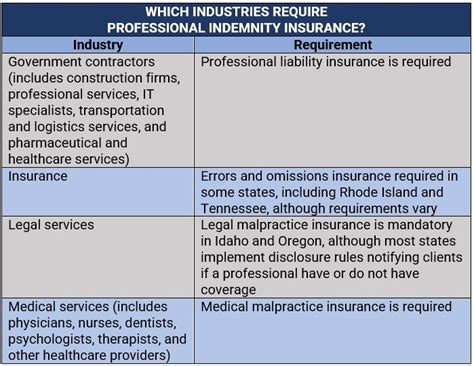

- Professional Liability: Also known as errors and omissions (E&O) insurance, professional liability covers professionals such as lawyers, doctors, and consultants against claims of negligence, errors, or omissions in their work. This insurance is vital for maintaining trust and ensuring client protection.

- General Liability: General liability insurance is a broad category that covers various risks, including bodily injury, property damage, and personal and advertising injury. It is commonly used by businesses to protect against lawsuits and other financial claims.

The Importance of Liability Insurance

Liability insurance serves as a critical risk management tool, providing several key benefits:

- Financial Protection: Liability insurance offers a safety net against substantial financial losses. It can cover legal expenses, medical bills, property repairs, and other costs associated with liability claims.

- Legal Defense: In the event of a lawsuit, liability insurance often includes legal defense coverage, ensuring that the insured party has access to qualified legal representation.

- Peace of Mind: Knowing that one is protected from unforeseen liabilities can provide significant peace of mind, especially for businesses operating in high-risk industries.

- Compliance: Certain types of liability insurance are often mandatory, as they are required by law or contractual agreements. Failure to maintain such insurance can result in severe penalties.

Key Considerations in Liability Insurance

When navigating the world of liability insurance, several critical factors come into play:

Coverage Limits and Deductibles

Insurance policies typically come with coverage limits, which specify the maximum amount the insurer will pay for a covered loss. It’s essential to carefully review and understand these limits to ensure adequate protection. Additionally, deductibles, the portion of the loss the insured must pay out of pocket, are another crucial consideration. Higher deductibles can lead to lower premiums, but it’s important to balance this trade-off with the potential financial impact of a claim.

| Policy Type | Average Coverage Limit | Standard Deductible |

|---|---|---|

| Personal Liability | $1 million | $500 - $1,000 |

| Product Liability | $2 million | $1,000 - $2,500 |

| Professional Liability | $1 million per claim | $5,000 - $10,000 |

| General Liability | $2 million | $1,000 - $2,500 |

Exclusions and Limitations

While liability insurance provides comprehensive protection, it’s crucial to be aware of the exclusions and limitations outlined in the policy. These may include specific types of claims, intentional acts, or situations where the insured is not legally liable. Understanding these exclusions is vital to avoid any surprises in the event of a claim.

Risk Management and Mitigation

Liability insurance is not a standalone solution for risk management. Insured parties should actively work to mitigate risks and prevent potential liabilities. This can include implementing safety measures, regular maintenance, employee training, and adherence to industry standards and regulations.

Real-World Applications of Liability Insurance

Liability insurance finds its application in various scenarios, protecting individuals and businesses from a wide range of risks. Here are a few real-world examples:

Personal Injury Claims

Imagine a scenario where a visitor slips and falls on a wet floor in your home, sustaining serious injuries. Personal liability insurance would come into play, covering the medical expenses and any potential legal costs associated with the claim.

Product Recall and Damages

A manufacturing company discovers a defect in one of its products, leading to a recall. Product liability insurance steps in to cover the costs of the recall, including any legal fees and compensation for affected consumers.

Professional Malpractice

A lawyer provides erroneous legal advice to a client, resulting in significant financial loss for the client. Professional liability insurance protects the lawyer from the client’s claim, covering the legal expenses and any potential settlements.

Business Operations and Public Liability

A restaurant owner, concerned about potential liability claims, purchases general liability insurance. This coverage protects the business from claims of bodily injury, property damage, or personal injury, such as a customer slipping on a wet floor or being served spoiled food.

The Future of Liability Insurance

As society and industries evolve, so too does the landscape of liability insurance. Here are some key trends and considerations for the future:

Emerging Risks and Technological Advancements

With the rapid advancement of technology, new risks are emerging, such as cyber liability and data breach concerns. Insurers are adapting their policies to address these evolving risks, offering specialized coverage to protect businesses and individuals.

Increased Regulatory Compliance

As industries become more regulated, liability insurance is expected to play a more prominent role in compliance. Insurers will need to stay abreast of changing regulations to ensure their policies meet the necessary standards.

Data-Driven Risk Assessment

The insurance industry is increasingly leveraging data analytics to assess and manage risks. This shift towards data-driven decision-making allows for more accurate pricing and coverage, benefiting both insurers and policyholders.

Conclusion

Liability insurance is an indispensable tool for managing risks and protecting individuals and businesses from financial ruin. By understanding the various types of liability, coverage options, and real-world applications, one can make informed decisions to safeguard their interests. As the insurance landscape continues to evolve, staying informed and adaptable is key to effective risk management.

How does liability insurance differ from other types of insurance?

+Liability insurance is distinct from other types of insurance, such as property or health insurance, as it primarily focuses on legal responsibilities and potential financial losses arising from harm or damage caused to others. It provides coverage for legal defense and compensation, rather than specific assets or medical expenses.

What are the consequences of not having liability insurance?

+Failing to have adequate liability insurance can result in significant financial consequences. If a liability claim arises, the insured party may be responsible for paying all legal expenses and compensation out of pocket, which can lead to severe financial strain or even bankruptcy.

How can I determine the right level of liability coverage for my needs?

+Determining the right level of liability coverage involves assessing your specific risks and potential liabilities. Consider factors such as your industry, the nature of your business operations, and any unique circumstances. Consulting with an insurance professional can help tailor coverage to your specific needs.