Liability Insurance California

Liability insurance is a vital aspect of personal and business protection in California, a state known for its diverse landscapes and thriving industries. This comprehensive guide delves into the world of liability insurance, providing expert insights and practical information tailored to the unique needs of Californians. From understanding the different types of liability coverage to exploring the nuances of state-specific regulations, we aim to equip you with the knowledge to make informed decisions about your insurance coverage.

Unraveling Liability Insurance in California

In the Golden State, liability insurance serves as a crucial safety net, shielding individuals and businesses from financial ruin in the event of unforeseen circumstances. Whether it's a slip-and-fall accident on your property or a lawsuit arising from your professional services, having adequate liability coverage can mean the difference between a manageable setback and a devastating financial crisis.

Types of Liability Insurance: A Comprehensive Overview

Liability insurance in California encompasses a range of policies, each designed to address specific types of claims. Here's a breakdown of the key types of liability insurance and their unique applications:

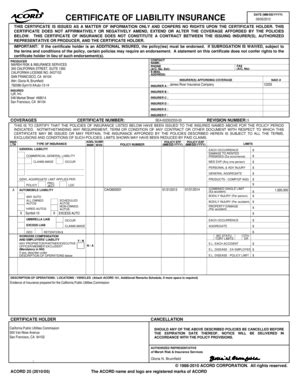

- General Liability Insurance: This is the bedrock of liability coverage for businesses. It provides protection against bodily injury, property damage, and personal and advertising injury claims. General liability insurance is essential for businesses operating in California, offering a broad range of coverage for common risks.

- Professional Liability Insurance (Errors and Omissions): Also known as E&O insurance, this policy is tailored for professionals such as consultants, accountants, and lawyers. It safeguards against claims of negligence, errors, or omissions in the course of providing professional services. In a state like California, where professional services are diverse and highly specialized, E&O insurance is a crucial safeguard.

- Product Liability Insurance: For businesses involved in manufacturing, distributing, or selling products, product liability insurance is a must-have. It protects against claims arising from product defects, injuries caused by products, or even false advertising claims. With California's vibrant consumer market, product liability insurance is a critical component of risk management.

- Cyber Liability Insurance: In today's digital age, cyber liability insurance has become increasingly important. This policy covers losses and damages resulting from cyber attacks, data breaches, and other online security threats. As California is home to numerous tech companies and a growing number of cyber threats, having cyber liability insurance is a prudent measure.

- Umbrella Insurance: An umbrella policy provides an additional layer of liability coverage, extending beyond the limits of other insurance policies. It offers protection for both personal and business liabilities, ensuring that you are covered for catastrophic losses that exceed the limits of your primary policies. In a state as diverse as California, umbrella insurance provides peace of mind.

| Liability Insurance Type | Coverage Highlights |

|---|---|

| General Liability | Bodily injury, property damage, and personal/advertising injury claims |

| Professional Liability (E&O) | Negligence, errors, and omissions in professional services |

| Product Liability | Product defects, injuries caused by products, and false advertising claims |

| Cyber Liability | Cyber attacks, data breaches, and online security threats |

| Umbrella Insurance | Additional liability coverage for both personal and business risks |

California-Specific Liability Insurance Considerations

California, with its diverse economy and population, presents unique challenges and opportunities when it comes to liability insurance. Understanding the state-specific regulations and risk factors is essential for making informed insurance decisions.

Understanding California's Insurance Landscape

California has a robust insurance market, with a wide range of insurance carriers offering various liability insurance products. The state's Department of Insurance oversees the insurance industry, ensuring compliance with regulations and protecting consumers' rights. Understanding the regulatory environment and the availability of different insurance options is crucial for Californians.

Navigating California's Liability Risks

California's diverse population and thriving economy create a dynamic risk landscape. From natural disasters like earthquakes and wildfires to the complexities of a bustling tech industry, the state presents a unique set of liability challenges. Here are some key considerations when navigating liability risks in California:

- Natural Disasters: California is prone to earthquakes and wildfires, which can lead to significant property damage and bodily injury. Having adequate liability coverage to address these risks is crucial. Consider purchasing earthquake and wildfire insurance endorsements to enhance your protection.

- Tech Industry Risks: With Silicon Valley at its heart, California is a global hub for technology and innovation. The tech industry presents unique liability risks, including data breaches, intellectual property disputes, and product defects. Cyber liability insurance and E&O insurance are essential for businesses operating in this sector.

- Professional Services: California is home to a vast array of professional services, from healthcare to legal and financial services. Professional liability insurance is a must-have for these industries, providing protection against claims of negligence or errors.

- Consumer Protection Laws: California has some of the most stringent consumer protection laws in the nation. Businesses must be aware of these laws and ensure compliance to avoid potential liability claims. Understanding the state's privacy laws, product safety regulations, and consumer rights is essential for risk mitigation.

Tailoring Liability Insurance to California's Unique Needs

Given the diverse risk landscape in California, tailoring your liability insurance coverage to your specific needs is essential. Here are some strategies to consider:

- Risk Assessment: Conduct a thorough risk assessment to identify the unique hazards and liabilities associated with your business or personal situation. This assessment should consider factors such as industry, location, and specific operations.

- Customized Coverage: Work with an insurance professional to tailor your liability insurance coverage to your specific needs. This may involve selecting the right combination of policies, such as general liability, professional liability, and cyber liability insurance, to address your unique risks.

- Risk Management Strategies: Implement risk management practices to reduce the likelihood of liability claims. This can include safety training for employees, implementing robust cybersecurity measures, and staying informed about industry-specific regulations and best practices.

- Review and Update Regularly: Liability insurance needs can change over time. Regularly review your coverage to ensure it remains adequate and aligned with your evolving risks. Stay updated on changes in California's insurance regulations and emerging liability trends.

The Importance of Expert Guidance

Navigating the complex world of liability insurance, especially in a state as diverse as California, can be challenging. Seeking guidance from insurance professionals who understand the unique needs and regulations of the state is crucial. These experts can provide personalized advice, help you select the right policies, and ensure you have the protection you need to thrive in California's dynamic business and personal environments.

Frequently Asked Questions

What is the average cost of liability insurance in California?

+The cost of liability insurance in California can vary significantly based on factors such as the type of business, industry, location, and coverage limits. On average, small businesses in California can expect to pay anywhere from $500 to $2,000 per year for general liability insurance. However, specific costs can be much higher or lower depending on individual circumstances.

Are there any state-specific requirements for liability insurance in California?

+Yes, California has specific regulations regarding liability insurance. For example, certain industries like construction may have mandatory liability insurance requirements. Additionally, California's Department of Insurance sets minimum coverage limits for auto liability insurance. It's important to consult with an insurance professional to ensure compliance with state regulations.

How can I determine the right amount of liability insurance coverage for my business or personal needs in California?

+Determining the right amount of liability insurance coverage involves assessing your specific risks and potential liabilities. Consider factors such as the size and nature of your business, the value of your assets, and the potential severity of claims. Working with an insurance professional can help you identify appropriate coverage limits and tailor your policy to your unique needs.

In conclusion, liability insurance is a vital aspect of financial protection in California. By understanding the different types of liability coverage, navigating California’s unique liability landscape, and seeking expert guidance, you can ensure you have the right insurance in place to safeguard your personal and business interests. Remember, the key to effective liability insurance is to tailor your coverage to your specific needs and stay informed about evolving risks and regulations.