Liability Insurance Costs For Small Business

Running a small business comes with its fair share of risks and uncertainties. One of the most crucial aspects of safeguarding your venture is understanding and managing potential liabilities. Liability insurance is a vital tool in your risk management strategy, and its cost is an essential consideration for any small business owner. In this comprehensive guide, we'll delve into the world of liability insurance costs for small businesses, exploring the factors that influence these expenses and providing valuable insights to help you make informed decisions.

Understanding Liability Insurance

Liability insurance is a cornerstone of risk management for small businesses. It provides financial protection in the event that your business is held legally responsible for causing harm or injury to others. This harm could be physical, emotional, or even financial. Here’s a closer look at the key aspects of liability insurance:

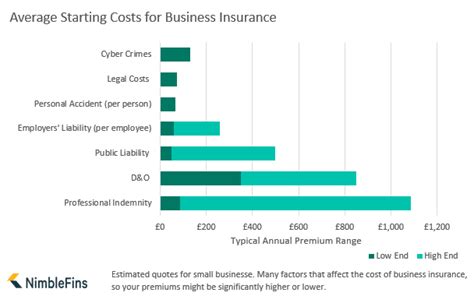

Types of Liability Insurance

- General Liability Insurance: This is the most common type, covering a wide range of claims, including bodily injury, property damage, and advertising injuries.

- Product Liability Insurance: Essential for businesses selling goods, this coverage protects against claims arising from faulty products.

- Professional Liability Insurance: Also known as errors and omissions insurance, it safeguards businesses offering professional services against negligence claims.

- Employers Liability Insurance: Crucial for businesses with employees, it covers workplace injuries and illnesses not covered by workers’ compensation.

The Importance of Liability Insurance

Liability insurance is a vital safety net for small businesses. It not only protects your business’s assets but also your personal finances, especially if you’re a sole proprietor. A single lawsuit or claim can be devastating, potentially leading to financial ruin. Here are some key reasons why liability insurance is indispensable:

- Financial Protection: It provides a financial buffer, covering legal fees, settlements, and damages.

- Peace of Mind: Knowing you're insured allows you to focus on growing your business without constant worry.

- Credibility: Liability insurance demonstrates your commitment to ethical business practices, boosting your reputation.

- Compliance: In some industries and locations, liability insurance is a legal requirement.

Factors Influencing Liability Insurance Costs

The cost of liability insurance for small businesses can vary significantly, and several factors come into play. Understanding these factors is key to making cost-effective choices. Here’s a detailed breakdown:

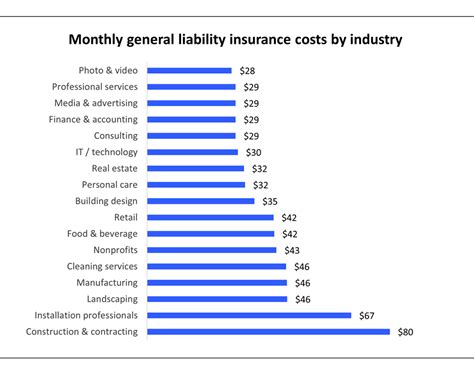

Industry and Business Activities

The nature of your business and the industry you operate in are major cost determinants. High-risk industries like construction or manufacturing typically face higher premiums due to the increased likelihood of accidents and claims.

| Industry | Average Premium |

|---|---|

| Construction | $2,500 - $5,000 |

| Retail | $1,000 - $2,000 |

| Professional Services | $500 - $1,500 |

Business Size and Revenue

The size of your business, often measured by revenue or number of employees, influences insurance costs. Larger businesses with more employees or higher revenue are generally considered higher risk, leading to higher premiums.

| Business Size | Average Premium |

|---|---|

| Small (1-10 employees) | $500 - $1,200 |

| Medium (11-50 employees) | $1,500 - $3,000 |

| Large (50+ employees) | $3,000+ per year |

Location and Local Regulations

The geographical location of your business can impact insurance costs. Areas with higher crime rates or natural disaster risks might result in higher premiums. Additionally, local regulations and laws can mandate certain types of liability insurance, adding to the overall cost.

Claims History and Risk Assessment

Your business’s claims history is a critical factor. A history of frequent claims or high-value claims can lead to higher premiums or even non-renewal of your policy. Insurance companies use risk assessment tools to evaluate your business’s potential risk profile.

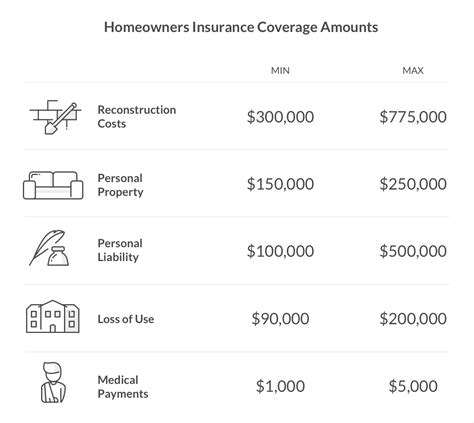

Coverage Limits and Deductibles

The level of coverage you choose directly impacts your insurance costs. Higher coverage limits provide more protection but cost more. Deductibles, the amount you pay out-of-pocket before insurance kicks in, can also affect premiums. Opting for a higher deductible can lower your premium, but it means you’ll pay more in the event of a claim.

Strategies to Lower Liability Insurance Costs

While liability insurance is essential, there are strategies to manage these costs effectively. Here are some expert tips to consider:

Bundle Policies

Combining multiple insurance policies, such as liability, property, and business interruption insurance, can often lead to discounts and cost savings.

Improve Risk Management

Implementing robust risk management practices can reduce the likelihood of claims. This includes regular safety training for employees, thorough background checks, and maintaining a safe workplace environment.

Shop Around and Compare

Don’t settle for the first insurance quote you receive. Compare quotes from multiple insurers to find the best coverage at the most competitive price. Online insurance marketplaces can be a great resource for this.

Consider Higher Deductibles

Opting for a higher deductible can lower your premium. However, ensure you have the financial capacity to cover the deductible in the event of a claim.

Stay Informed and Educated

Stay up-to-date with industry trends and best practices related to liability insurance. Attend workshops, webinars, or industry events to learn about new risk management strategies and insurance products.

Case Studies: Real-World Examples

To illustrate the impact of these factors, let’s explore a few real-world case studies of small businesses and their liability insurance costs:

Case Study 1: Construction Business

A small construction business with 5 employees in a high-risk urban area pays approximately $4,000 annually for general liability insurance. The premium is high due to the nature of the business and the location’s risk factors.

Case Study 2: Online Retail Store

An online retail store with 3 employees, based in a suburban area, pays around $1,200 per year for general liability insurance. The lower premium is due to the reduced risk associated with online retail and the business’s location.

Case Study 3: Consulting Firm

A consulting firm with 10 employees, providing professional services, pays approximately $1,800 annually for professional liability insurance. The premium is influenced by the nature of the business and the potential for errors and omissions claims.

Future Trends and Considerations

The landscape of liability insurance for small businesses is constantly evolving. Here are some future trends and considerations to keep in mind:

Increasing Cyber Risks

With the rise of remote work and online business operations, cyber risks are becoming more prominent. Small businesses should consider adding cyber liability insurance to their risk management portfolio.

Environmental Concerns

As environmental awareness grows, businesses are increasingly being held accountable for their environmental impact. Environmental liability insurance is becoming more relevant for businesses operating in environmentally sensitive sectors.

Changing Regulatory Landscape

Keep up-to-date with changes in local, state, and federal regulations that may impact your liability insurance requirements. Non-compliance can lead to penalties and increased insurance costs.

Emerging Insurance Technologies

The insurance industry is embracing technology, with the rise of insurtech companies offering innovative products and services. Stay informed about these developments to access new, cost-effective insurance options.

How often should I review my liability insurance policy?

+It’s recommended to review your policy annually or whenever your business undergoes significant changes, such as expansion, new products, or increased revenue.

Can I get liability insurance as a sole proprietor?

+Yes, sole proprietors can and should obtain liability insurance to protect their personal assets. General liability insurance is often a good starting point.

What happens if I don’t have enough liability insurance coverage?

+If you’re sued for an amount exceeding your coverage limits, you’ll be personally responsible for paying the excess. This can lead to financial hardship or even bankruptcy.

Are there any tax benefits associated with liability insurance premiums?

+Yes, liability insurance premiums are generally tax-deductible business expenses. Consult with a tax professional to understand the specific deductions applicable to your business.