Liability Insurance For A Business Cost

Understanding the Cost of Liability Insurance for Your Business

In the realm of business, one of the most critical decisions you'll make is choosing the right insurance coverage. Liability insurance, in particular, is an essential safeguard for your business, protecting it from various risks and potential lawsuits. The cost of this coverage can vary significantly based on numerous factors, and understanding these costs is key to making informed decisions about your business's financial health and security.

Let's delve into the world of liability insurance costs, exploring the factors that influence them, real-world examples, and strategies to manage these expenses effectively.

The Factors Shaping Liability Insurance Costs

The cost of liability insurance is not a one-size-fits-all proposition. It's influenced by a myriad of factors unique to your business and its operations. Here's a breakdown of the key elements that come into play:

Industry and Business Type

The industry your business operates in plays a pivotal role in determining insurance costs. High-risk industries like construction or manufacturing typically face higher insurance premiums due to the increased likelihood of accidents and lawsuits. In contrast, low-risk industries like consulting or software development might enjoy more affordable coverage.

| Industry | Average Annual Premium |

|---|---|

| Construction | $3,500 - $10,000 |

| Manufacturing | $2,000 - $8,000 |

| Consulting | $1,000 - $3,000 |

| Software Development | $800 - $2,500 |

Business Size and Revenue

The size and revenue of your business are significant factors. Larger businesses with higher revenues often face higher insurance premiums, as they present a bigger risk profile. This is particularly true if your business has a larger customer base or a more extensive reach, as the potential for claims and lawsuits increases.

| Business Size | Average Annual Premium |

|---|---|

| Small (Annual Revenue < $1M) | $1,200 - $3,000 |

| Medium (Annual Revenue $1M - $5M) | $3,000 - $8,000 |

| Large (Annual Revenue > $5M) | $8,000 - $20,000 |

Claim History and Risk Profile

Your business's claim history and overall risk profile are major considerations for insurance providers. If your business has a history of frequent claims or high-value settlements, insurance companies will view you as a higher risk, leading to increased premiums. Conversely, a clean claim history can result in more favorable rates.

Coverage Limits and Deductibles

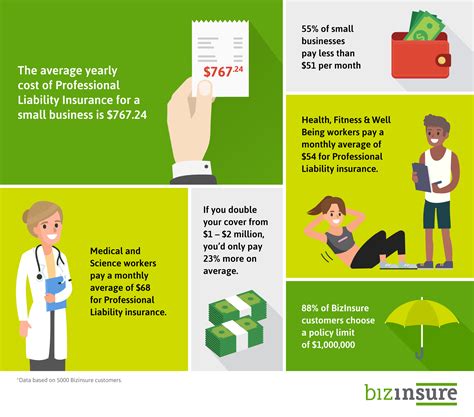

The coverage limits you choose directly impact your insurance costs. Higher limits typically result in higher premiums, as they offer more protection in the event of a claim. Similarly, the deductible you select can influence costs. Opting for a higher deductible can lower your premium, but it means you'll pay more out of pocket if a claim is filed.

Location and Regulatory Environment

The location of your business and the regulatory environment it operates in can also affect insurance costs. Areas with higher litigation rates or stricter regulations might see increased insurance premiums. Additionally, regional factors like weather patterns (e.g., hurricane-prone areas) can influence the cost of liability insurance.

Real-World Examples of Liability Insurance Costs

To bring these concepts to life, let's look at some real-world examples of liability insurance costs across different industries and business types.

Example 1: A Small Construction Firm

Let's consider a small construction firm based in a suburban area. This firm primarily handles residential renovations and has an annual revenue of around $800,000. With a clean claim history and a focus on safety, they've been able to secure liability insurance with a $2 million coverage limit and a $1,000 deductible. Their annual premium comes out to approximately $4,500.

Example 2: A Medium-Sized Manufacturing Company

Now, imagine a medium-sized manufacturing company located in an industrial zone. They produce consumer electronics and have an annual revenue of $3.5 million. Due to the nature of their industry and the potential for product liability claims, they've opted for a higher coverage limit of $5 million and a $2,500 deductible. Their annual premium for liability insurance is around $12,000.

Example 3: A Large Consulting Firm

A large consulting firm with a diverse client base and an annual revenue of $10 million might face different insurance challenges. They work with high-profile clients and, as a result, face the potential for significant reputational damage and legal action. To protect themselves, they've chosen a very high coverage limit of $10 million and a $5,000 deductible. Their annual liability insurance premium comes to approximately $25,000.

Strategies to Manage Liability Insurance Costs

Understanding the factors that influence liability insurance costs is the first step. The next step is implementing strategies to manage and potentially reduce these costs while still ensuring adequate coverage.

Assess Your Risk Profile

A thorough assessment of your business's risk profile is essential. Identify areas where your business might face higher risks and take steps to mitigate these risks. For example, implementing stricter safety protocols in a construction firm or investing in product testing and quality control in a manufacturing business can reduce the likelihood of accidents and claims.

Optimize Coverage Limits and Deductibles

Carefully consider your coverage limits and deductibles. While higher limits offer more protection, they also come at a cost. Assess your business's financial health and risk tolerance to determine the right balance. A higher deductible can reduce your premium, but ensure that it's an amount you're comfortable paying out of pocket if needed.

Shop Around and Negotiate

Don't settle for the first insurance quote you receive. Shop around and compare rates from multiple providers. Insurance companies often offer different rates for similar coverage, so it's worth exploring your options. Additionally, don't be afraid to negotiate. Many providers are willing to work with you to find a premium that fits your budget while still providing adequate coverage.

Explore Bundling and Discounts

Consider bundling your insurance policies. Many providers offer discounts when you purchase multiple types of insurance from them. For instance, combining liability insurance with property insurance or workers' compensation can result in cost savings.

Implement Loss Control Measures

Implementing loss control measures can not only reduce the likelihood of claims but also demonstrate to insurance providers that you're proactive in managing risks. This can lead to more favorable rates. Examples of loss control measures include regular safety training for employees, implementing robust quality control processes, and using advanced technology to minimize risks.

The Importance of Adequate Coverage

While managing costs is important, it's equally crucial to ensure that your business has adequate liability insurance coverage. Inadequate coverage can leave your business vulnerable to financial ruin in the event of a significant claim or lawsuit. Always prioritize finding the right balance between cost and coverage to protect your business effectively.

Future Trends and Considerations

The world of liability insurance is constantly evolving, and staying informed about emerging trends and considerations is vital. As businesses navigate an increasingly complex risk landscape, here are some key factors to keep an eye on:

Changing Regulatory Landscape

Regulatory changes can significantly impact liability insurance costs. Keep abreast of any changes in laws and regulations that might affect your industry. For instance, new product safety standards or environmental regulations could lead to increased insurance premiums.

Emerging Risks and Coverage Innovations

As technology advances and business operations evolve, new risks emerge. Keep an eye out for emerging risks in your industry and ensure your insurance coverage is up-to-date. For example, with the rise of artificial intelligence and automation, businesses might face new liability risks related to these technologies.

Data-Driven Insurance

The insurance industry is increasingly leveraging data analytics to assess risks and set premiums. As a business owner, you can benefit from this trend by ensuring your business practices are transparent and data-driven. This can help you negotiate more favorable rates based on accurate risk assessments.

Collaborative Risk Management

Collaborating with industry peers and insurance providers can lead to more effective risk management strategies. By sharing best practices and learning from others' experiences, you can enhance your own risk mitigation efforts and potentially influence insurance costs.

Conclusion

Understanding and managing the cost of liability insurance is a complex but crucial aspect of running a successful business. By recognizing the factors that influence these costs and implementing strategic approaches to coverage and risk management, you can protect your business effectively while also controlling expenses. Stay informed, adapt to changing risk landscapes, and collaborate with industry experts to ensure your business remains resilient and well-protected.

How often should I review my liability insurance coverage and costs?

+It’s a good practice to review your liability insurance coverage and costs annually, or whenever there are significant changes to your business operations, size, or revenue. Regular reviews ensure that your coverage remains adequate and that you’re not overpaying for unnecessary coverage.

Can I reduce my liability insurance costs by increasing my deductible?

+Yes, increasing your deductible can lead to lower premiums. However, it’s important to carefully consider your financial capabilities and risk tolerance. A higher deductible means you’ll pay more out of pocket if a claim is filed, so ensure you have the means to cover this expense.

What are some common exclusions in liability insurance policies that I should be aware of?

+Common exclusions in liability insurance policies can include intentional acts, contractual liabilities, pollution or environmental damage, and intellectual property claims. It’s crucial to thoroughly review your policy’s exclusions to understand what’s covered and what’s not.