Liability Insurance Small Business

For small business owners, navigating the complex world of insurance is crucial, especially when it comes to liability coverage. Liability insurance is a vital aspect of any business's risk management strategy, protecting against potential financial losses resulting from claims and lawsuits. This comprehensive guide aims to shed light on the intricacies of liability insurance for small businesses, offering an in-depth analysis of its importance, coverage options, and the steps to secure the right protection.

Understanding Liability Insurance for Small Businesses

Liability insurance serves as a safeguard for businesses against a range of claims, including bodily injury, property damage, and personal and advertising injury. It provides coverage for legal defense costs and any damages awarded in a lawsuit, ensuring that the financial impact of such events doesn’t cripple the business.

The significance of liability insurance becomes evident when considering the various risks small businesses face daily. From slip-and-fall accidents on premises to product defects causing harm, the potential for liability claims is ever-present. Without adequate insurance, a single lawsuit could lead to devastating financial consequences, including bankruptcy.

Types of Liability Claims

Liability claims can stem from a variety of situations, and understanding these scenarios is crucial for effective risk management. Here are some common types of liability claims small businesses may encounter:

- Bodily Injury Claims: These involve physical harm to customers, employees, or visitors on business premises. Examples include slips and falls, workplace accidents, or injuries caused by defective products.

- Property Damage Claims: Claims resulting from damage to property owned by others, such as customers' belongings or leased equipment. This could include scenarios like a fire caused by faulty electrical wiring.

- Personal and Advertising Injury Claims: These claims arise from non-physical injuries, such as libel, slander, copyright infringement, or invasion of privacy. For instance, a competitor suing for defamation due to false advertising.

Coverage Options and Considerations

Small businesses have various liability insurance options, each tailored to specific needs. Here’s a breakdown of some common coverage types:

- General Liability Insurance: A fundamental coverage for most small businesses, providing protection against bodily injury, property damage, and personal injury claims. It covers a broad range of common risks and is often the first line of defense.

- Product Liability Insurance: Essential for businesses manufacturing, distributing, or selling products. It safeguards against claims resulting from product defects or malfunctions, ensuring financial protection even if the business is found not at fault.

- Professional Liability Insurance (E&O): Also known as Errors and Omissions insurance, this coverage is vital for businesses offering professional services. It protects against claims of negligence, errors, or omissions in the provision of professional services, a common risk for consultants, IT professionals, and other service-based businesses.

- Cyber Liability Insurance: With the increasing reliance on digital technologies, cyber liability insurance is becoming a necessity. It covers losses from data breaches, cyber attacks, and other online risks, providing financial support for investigations, legal fees, and potential settlements.

Assessing Your Business’s Liability Risks

Understanding the specific liability risks your business faces is crucial for effective insurance coverage. Every business is unique, and so are its potential risks. Here’s a step-by-step guide to help you assess and manage your liability risks:

Conduct a Risk Assessment

Begin by identifying the types of liability claims your business is most likely to encounter. Consider factors like your industry, the nature of your business operations, and the level of interaction with customers, employees, and the public. A thorough risk assessment will help you prioritize coverage needs.

Evaluate Past Claims

Review any past liability claims or incidents your business has faced. Analyze the causes, outcomes, and financial implications. This historical data can provide valuable insights into the types of risks you’ve already encountered and help you predict potential future claims.

Identify Unique Risks

Every business has its own set of unique risks. For instance, a restaurant faces food safety risks, while a construction company faces risks related to heavy machinery and worker safety. Identify these unique risks and assess their potential impact on your business.

Consult Industry Experts

Reach out to industry associations, insurance brokers, or legal professionals for guidance. They can provide valuable insights based on their experience with similar businesses, helping you understand common liability issues and best practices for risk management.

Securing the Right Liability Insurance Coverage

With a clear understanding of your business’s liability risks, you can now take steps to secure the right insurance coverage. Here’s a comprehensive guide to help you navigate the process:

Work with a Reputable Insurance Broker

Insurance brokers are professionals who work on your behalf to find the best insurance policies and coverage options. They can guide you through the process, explain complex terms, and help you tailor a policy to your specific needs. A good broker will have access to multiple insurance companies, ensuring you get competitive rates and comprehensive coverage.

Understand Your Policy

Take the time to thoroughly understand your insurance policy. Read through the fine print, and don’t hesitate to ask questions if something is unclear. Know what is covered, the limits of your coverage, and any exclusions or conditions that might apply. This knowledge is essential to ensure you’re fully protected.

Tailor Your Coverage

Don’t settle for a one-size-fits-all insurance policy. Work with your broker to customize your coverage based on your specific needs. This might involve adding endorsements or riders to your policy to address unique risks or increasing coverage limits to provide adequate protection.

Regularly Review and Update Your Coverage

Your business is dynamic, and so are your insurance needs. Regularly review your policy to ensure it aligns with your current business operations and risks. Update your coverage as your business grows, changes, or takes on new ventures. This ensures that you always have the right level of protection.

| Coverage Type | Key Considerations |

|---|---|

| General Liability | Broad coverage for common risks; consider higher limits for increased protection. |

| Product Liability | Essential for product-based businesses; covers defects and recalls. |

| Professional Liability (E&O) | Critical for service-based businesses; protects against negligence claims. |

| Cyber Liability | Increasingly important; covers data breaches and cyber attacks. |

The Impact of Liability Insurance on Small Businesses

Liability insurance plays a pivotal role in the success and longevity of small businesses. By providing a safety net against financial losses from lawsuits and claims, it allows businesses to focus on their core operations without the constant worry of catastrophic risks.

Financial Protection and Peace of Mind

One of the most significant benefits of liability insurance is the financial protection it offers. In the event of a lawsuit or claim, the insurance policy steps in to cover legal defense costs and any damages awarded. This financial support can be crucial for small businesses, often operating on tight budgets, as it prevents a single claim from devastating their financial stability.

Building Trust and Credibility

Having adequate liability insurance is not just a legal requirement; it’s a sign of professionalism and responsibility. Customers, clients, and partners are more likely to trust and do business with companies that demonstrate a commitment to managing risks. This trust can lead to stronger relationships and a more positive reputation in the market.

Aiding Business Growth

Liability insurance is often a prerequisite for business expansion and collaboration. Many clients, especially in industries with high liability risks, will only work with businesses that can demonstrate adequate insurance coverage. Having the right insurance in place can open doors to new opportunities, allowing small businesses to take on larger projects and grow their operations.

The Future of Liability Insurance for Small Businesses

As the business landscape continues to evolve, so too will the world of liability insurance. Small businesses must stay informed about emerging risks and insurance trends to ensure they remain adequately protected.

Emerging Risks and Insurance Innovations

With technological advancements and changing business models, new risks are constantly emerging. For instance, the rise of e-commerce and online businesses has led to an increased focus on cyber liability risks. Similarly, the gig economy and remote work arrangements have introduced new liability considerations.

Insurance companies are responding to these changes by offering innovative coverage options. For example, some insurers now provide coverage for data breaches and cyber attacks, addressing the specific needs of online businesses. Others are developing policies tailored to the unique risks faced by gig economy workers.

The Role of Technology in Insurance

Technology is playing an increasingly significant role in the insurance industry. Insurers are leveraging data analytics and artificial intelligence to better understand risks and tailor policies to individual businesses. This level of customization ensures that small businesses can access coverage that aligns precisely with their needs.

Preparing for the Future

To stay ahead of the curve, small business owners should stay informed about industry trends and changes in their specific sector. Regularly review and update your insurance coverage to ensure it continues to meet your needs. Additionally, consider seeking advice from insurance professionals who can provide insights into emerging risks and coverage options.

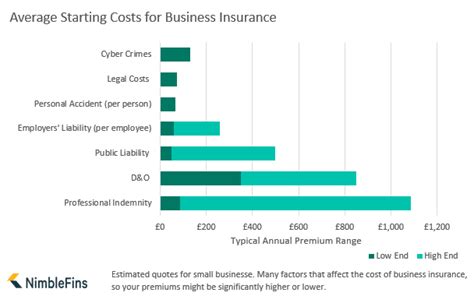

What is the average cost of liability insurance for small businesses?

+The cost of liability insurance varies based on factors like the type of business, its size, and the level of coverage needed. On average, small businesses can expect to pay anywhere from a few hundred to a few thousand dollars annually for general liability insurance. However, this can increase significantly depending on the specific risks and coverage limits required.

Can liability insurance cover claims of negligence or errors made by my business?

+Yes, liability insurance often includes coverage for claims of negligence or errors made by the business. This is particularly important for service-based businesses, as it provides protection against lawsuits stemming from mistakes or omissions in the provision of professional services.

How often should I review and update my liability insurance coverage?

+It’s recommended to review your liability insurance coverage annually or whenever there are significant changes to your business operations. This ensures that your coverage remains aligned with your current needs and any new risks that may have emerged.