Liability Insurance Uk

Liability insurance is an essential aspect of business and personal risk management in the United Kingdom. It provides crucial protection against a range of potential liabilities, ensuring individuals and businesses can operate with peace of mind. This comprehensive guide aims to delve into the intricacies of liability insurance in the UK, exploring its various types, coverage, and key considerations.

The Importance of Liability Insurance

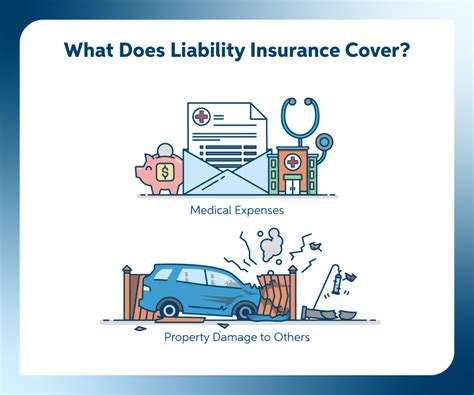

In the UK, liability insurance serves as a vital safety net for individuals and businesses, offering protection against legal claims and financial liabilities that may arise from a wide range of circumstances. These can include personal injury, property damage, or professional negligence, among others.

For businesses, liability insurance is particularly crucial as it safeguards against the financial fallout that can result from a single legal claim. Whether it's a slip and fall accident on business premises, product defects causing harm, or professional errors leading to client losses, liability insurance provides the financial resources to address these issues and protect the business's stability.

Types of Liability Insurance

Public Liability Insurance

Public liability insurance is a cornerstone of business insurance in the UK. It provides coverage for legal claims and compensation arising from bodily injury, property damage, or personal injury caused to members of the public as a result of business operations. This includes accidents occurring on business premises, during delivery, or as a result of a product sold by the business.

Public liability insurance is particularly important for businesses that interact regularly with the public, such as retailers, service providers, and manufacturers. It offers protection against claims that can be costly and time-consuming to resolve, potentially saving businesses from significant financial loss.

Employers’ Liability Insurance

Employers' liability insurance is a legal requirement for all UK businesses with employees. It provides coverage for claims made by employees who suffer work-related injuries or illnesses, including those resulting from negligence, faulty equipment, or unsafe working conditions.

This type of insurance is crucial in protecting businesses from the financial implications of employee claims, which can be substantial. It demonstrates a commitment to employee welfare and ensures that businesses can continue to operate smoothly even in the face of such claims.

Professional Indemnity Insurance

Professional indemnity insurance is designed for professionals and businesses offering advice or services to clients. It provides coverage for legal claims and compensation arising from alleged or actual errors, omissions, or negligence in the provision of professional services.

Professional indemnity insurance is essential for professionals such as accountants, lawyers, consultants, and IT specialists, among others. It protects against claims that can arise from the complex and often highly specialized nature of their work, ensuring that professionals can continue to operate with confidence and peace of mind.

Product Liability Insurance

Product liability insurance is a critical coverage for manufacturers, distributors, and retailers of physical goods. It provides protection against legal claims and compensation arising from injuries or damage caused by defective products.

This type of insurance is particularly important given the stringent product safety regulations in the UK. It safeguards businesses from the financial implications of product recalls, lawsuits, and other legal actions, ensuring that they can continue to operate and maintain their reputation in the market.

Key Considerations in Liability Insurance

Policy Limits and Deductibles

When choosing liability insurance, understanding the policy limits and deductibles is crucial. Policy limits refer to the maximum amount the insurance provider will pay out for a covered claim, while deductibles are the portion of the claim that the insured party must pay before the insurance coverage kicks in.

It's essential to select policy limits that adequately cover potential liabilities, taking into account the nature and scale of the business or individual's operations. Similarly, deductibles should be chosen carefully, balancing the desire for cost savings with the need for sufficient coverage.

Policy Exclusions

All liability insurance policies contain exclusions, which are specific situations or claims that are not covered by the policy. Understanding these exclusions is vital to ensure that the chosen policy provides the desired level of protection.

Common exclusions in liability insurance policies may include intentional acts, contract disputes, certain types of professional services, and war or terrorism-related events. It's important to carefully review the policy exclusions to ensure that they align with the business or individual's specific needs and circumstances.

Additional Coverages and Endorsements

In addition to the standard liability coverages, many insurance providers offer optional additional coverages or endorsements that can be added to the policy to provide more comprehensive protection.

These may include coverage for cyber liability, business interruption, or specific professional services. By adding these endorsements, businesses and individuals can tailor their liability insurance to their unique needs, ensuring that they have the necessary protection in place.

Choosing the Right Liability Insurance Provider

When selecting a liability insurance provider, it's important to consider factors such as the provider's financial stability, reputation, and the range of products and services they offer. A reputable provider with a strong financial standing will ensure that claims are paid out promptly and fairly.

Additionally, it's beneficial to choose a provider that offers a dedicated claims service, providing support and guidance throughout the claims process. This can make a significant difference in ensuring that claims are handled efficiently and effectively, minimizing disruption to the business or individual's operations.

The Future of Liability Insurance in the UK

The liability insurance landscape in the UK is continually evolving, driven by changing regulations, emerging risks, and advancements in technology. As businesses and individuals face new challenges, the insurance industry is adapting to provide innovative solutions and comprehensive coverage.

One notable trend is the increasing focus on cyber liability insurance, as businesses become more vulnerable to cyber attacks and data breaches. Additionally, the rise of remote work and the gig economy has led to a greater need for flexible and tailored liability insurance solutions.

As the UK continues to adapt to a post-pandemic world, liability insurance will play a crucial role in supporting businesses and individuals as they navigate new risks and challenges. By staying informed and proactive, businesses and individuals can ensure they have the necessary protection in place to thrive in an ever-changing environment.

FAQ

What is the minimum level of employers’ liability insurance required in the UK?

+In the UK, the minimum level of employers’ liability insurance is set at £5 million (approximately 6.5 million USD). This is a legal requirement for all businesses with employees, and failure to comply can result in significant penalties.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>Are there any industries or professions that have specific liability insurance requirements in the UK?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Yes, certain industries and professions in the UK have specific liability insurance requirements. For example, construction companies are required to have public liability insurance with a minimum limit of £10 million (approximately 13 million USD). Similarly, medical professionals may need specific professional indemnity insurance to cover their unique risks.

How can businesses in the UK ensure they have adequate liability insurance coverage?

+Businesses in the UK can ensure adequate liability insurance coverage by conducting a thorough risk assessment, identifying potential liabilities, and working with an insurance broker or provider to tailor a policy that meets their specific needs. Regularly reviewing and updating insurance policies is also essential to keep pace with changing risks and business operations.