Liability Motor Insurance

Motor insurance, a cornerstone of modern transportation systems, is a critical safeguard for individuals and businesses alike. In the fast-paced world of automotive mobility, understanding the nuances of liability insurance is essential. This article delves into the intricacies of liability motor insurance, exploring its importance, coverage, and real-world implications.

Understanding Liability Motor Insurance

Liability motor insurance is a specific type of coverage that protects policyholders from financial loss in the event they are found legally responsible for causing harm or damage to others while operating a motor vehicle. This coverage is a vital component of responsible driving and is often mandated by law in many jurisdictions.

The primary purpose of liability insurance is to provide a financial safety net for the policyholder in the face of unexpected and potentially devastating legal liabilities. It ensures that the policyholder can meet their legal obligations without facing financial ruin.

Key Components of Liability Insurance

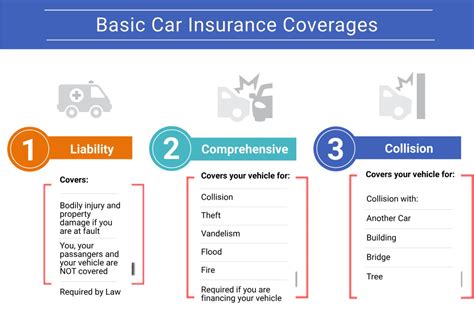

Liability insurance typically covers two main areas: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses, lost wages, and pain and suffering claims resulting from an accident caused by the policyholder. Property damage liability, on the other hand, covers the cost of repairing or replacing damaged property, including vehicles, structures, and personal belongings.

Additionally, liability insurance may also include coverage for legal defense costs, providing financial support for the policyholder if they are sued as a result of an accident. This aspect of liability insurance is particularly important, as legal fees can quickly escalate and become a significant financial burden.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical costs, lost wages, and pain and suffering for injured parties. |

| Property Damage Liability | Repairs or replaces damaged property caused by the policyholder. |

| Legal Defense Costs | Provides financial support for legal fees arising from covered accidents. |

Real-World Implications

The importance of liability motor insurance becomes evident when considering real-life scenarios. For instance, imagine a scenario where a driver, due to their negligence, causes a severe accident resulting in multiple injuries and significant property damage. Without adequate liability insurance, the driver could face overwhelming financial obligations, including medical bills, property repairs, and potential lawsuits.

In such cases, liability insurance steps in to provide the necessary financial coverage, allowing the policyholder to fulfill their legal responsibilities without facing financial devastation. It ensures that victims receive the compensation they are entitled to, while also protecting the policyholder's financial stability.

Choosing the Right Liability Coverage

Selecting the appropriate liability coverage involves careful consideration of various factors. Policyholders must assess their unique circumstances, including the type of vehicle they drive, the area they live in, and their personal financial situation.

Factors to Consider

- Vehicle Type: Different vehicles may attract different liability risks. For instance, sports cars or high-performance vehicles might face higher liability risks due to their speed and handling capabilities.

- Location: The region or state in which the policyholder resides can impact liability coverage needs. Some areas may have higher accident rates or unique legal requirements.

- Financial Situation: Policyholders should consider their ability to absorb financial losses. Higher liability limits provide greater protection but may also result in higher premiums.

It is essential to strike a balance between adequate coverage and affordability. While higher liability limits offer more protection, they can also lead to increased insurance costs. Policyholders should work closely with their insurance providers to tailor their coverage to their specific needs and budget.

Customizing Your Liability Insurance

Liability insurance can be customized to suit individual needs. Policyholders can opt for additional coverage, such as uninsured/underinsured motorist coverage, which provides protection in the event of an accident with a driver who has insufficient or no insurance. This coverage is particularly valuable, as it ensures that the policyholder is not left financially vulnerable in the face of an accident caused by an uninsured driver.

Additionally, liability insurance can be enhanced with personal injury protection (PIP) or medical payments coverage, which provides medical expense coverage for the policyholder and their passengers, regardless of fault. This coverage ensures that the policyholder and their passengers receive prompt medical attention without having to wait for liability determinations.

The Impact of Liability Insurance on Claims

Liability insurance plays a pivotal role in the claims process, particularly in determining fault and resolving disputes. In the event of an accident, liability insurance provides a clear framework for assessing responsibility and allocating compensation.

Determining Fault

When an accident occurs, liability insurance carriers conduct thorough investigations to determine fault. This process involves analyzing evidence, witness statements, and police reports to establish who was at fault. The findings of these investigations are crucial in determining liability and, consequently, the allocation of compensation.

In some cases, fault may be shared between multiple parties. In such instances, liability insurance carriers work to allocate responsibility proportionately, ensuring that each party is held accountable for their contribution to the accident.

Resolving Disputes

Liability insurance also plays a critical role in resolving disputes that may arise during the claims process. In cases where there is disagreement over fault or the extent of damages, insurance carriers may engage in mediation or arbitration to reach a fair resolution. This process ensures that all parties involved have a voice and that the outcome is just and equitable.

Furthermore, liability insurance carriers often provide legal support and guidance to policyholders, helping them navigate the complex legal landscape and protecting their rights in the event of a dispute.

Future Trends and Innovations in Liability Insurance

The world of liability motor insurance is constantly evolving, driven by technological advancements and changing consumer needs. As the automotive industry moves towards autonomous vehicles and connected technologies, the landscape of liability insurance is likely to undergo significant transformations.

The Rise of Autonomous Vehicles

The advent of autonomous vehicles presents both opportunities and challenges for liability insurance. On the one hand, autonomous vehicles have the potential to significantly reduce the number of accidents caused by human error. This could lead to a decrease in liability claims and, consequently, lower insurance premiums.

However, the introduction of autonomous vehicles also raises complex liability questions. In the event of an accident involving an autonomous vehicle, determining fault becomes more intricate. Is the responsibility borne by the vehicle owner, the manufacturer, or the software developer? These questions will shape the future of liability insurance, necessitating innovative solutions and clear legal frameworks.

Connected Technologies and Data Analytics

The integration of connected technologies and data analytics into the automotive industry is revolutionizing liability insurance. Insurance carriers are now able to collect real-time data on driving behavior, vehicle performance, and accident patterns, enabling them to offer more accurate and personalized insurance coverage.

By leveraging data analytics, insurance carriers can identify high-risk driving behaviors, such as aggressive acceleration or frequent hard braking, and offer tailored insurance solutions. This approach not only encourages safer driving practices but also allows for more precise risk assessment and pricing.

Telematics and Usage-Based Insurance

Telematics, the technology that enables the collection and transmission of vehicle data, is paving the way for usage-based insurance (UBI). UBI policies offer customized premiums based on an individual’s actual driving behavior and mileage. This approach rewards safe drivers with lower premiums, while also providing a more accurate reflection of the policyholder’s risk profile.

UBI policies have the potential to revolutionize the insurance industry, as they offer a more equitable and personalized approach to pricing. Policyholders have an incentive to drive safely, knowing that their premiums will reflect their actual risk level.

Conclusion

Liability motor insurance is a critical component of responsible driving and a vital safeguard for all road users. It provides financial protection, legal support, and peace of mind in the face of unforeseen accidents and liabilities. As the automotive industry evolves, liability insurance will continue to adapt, incorporating new technologies and innovative solutions to meet the changing needs of policyholders.

By understanding the intricacies of liability insurance and staying informed about industry trends, policyholders can make informed decisions to protect themselves and their loved ones on the road. Liability insurance is not just a legal requirement; it is a commitment to safety and financial responsibility in the complex world of automotive mobility.

What is the minimum liability coverage required by law?

+The minimum liability coverage required by law varies depending on the jurisdiction. It is essential to check with your local insurance regulations or consult with an insurance provider to understand the specific requirements in your area.

How does liability insurance differ from comprehensive insurance?

+Liability insurance covers damages caused to others, while comprehensive insurance provides coverage for damages to your own vehicle, regardless of fault. Comprehensive insurance typically includes coverage for theft, vandalism, and natural disasters, offering broader protection than liability insurance.

Can liability insurance cover legal defense costs for criminal charges?

+No, liability insurance typically covers legal defense costs for civil lawsuits resulting from accidents. Criminal charges, such as DUI or reckless driving, are generally not covered by liability insurance. Policyholders facing criminal charges should seek legal advice and consider additional insurance options to protect their interests.

How does liability insurance affect my insurance premiums?

+The level of liability coverage you choose can impact your insurance premiums. Higher liability limits generally result in higher premiums, as they provide more extensive protection. However, the specific impact on premiums can vary depending on factors such as your driving record, the insurance company, and the jurisdiction in which you reside.