Liberty Insurance Mutual

Liberty Insurance Mutual has been a trusted name in the insurance industry for decades, offering a comprehensive range of services to individuals and businesses alike. With a rich history of innovation and a commitment to delivering exceptional customer experiences, Liberty has become a go-to provider for those seeking financial security and peace of mind. In this comprehensive guide, we will delve into the world of Liberty Insurance Mutual, exploring its products, services, and the impact it has had on the lives of its policyholders.

A Legacy of Trust and Innovation

Liberty Insurance Mutual traces its roots back to [Founding Year], when it was established with a vision to revolutionize the insurance landscape. Over the years, the company has grown exponentially, expanding its reach across [Country/Region] and establishing itself as a leader in the insurance sector.

The foundation of Liberty’s success lies in its core values: integrity, customer focus, and a relentless pursuit of innovation. These principles have guided the company’s growth, enabling it to adapt to the ever-changing needs of its customers and stay at the forefront of the industry.

Liberty’s commitment to innovation is evident in its approach to technology. The company has invested heavily in digital transformation, leveraging cutting-edge tools and platforms to enhance the customer experience. From streamlined online applications to real-time policy management, Liberty has embraced the digital age, ensuring its customers have access to convenient and efficient services.

A Comprehensive Suite of Insurance Solutions

One of Liberty’s key strengths lies in its ability to offer a diverse range of insurance products tailored to meet the unique needs of its clients. Whether it’s protecting personal assets, safeguarding businesses, or securing the future, Liberty has a solution for every scenario.

Personal Insurance

Liberty’s personal insurance offerings provide individuals and families with the financial protection they need to navigate life’s uncertainties. Here’s a glimpse into some of the key products:

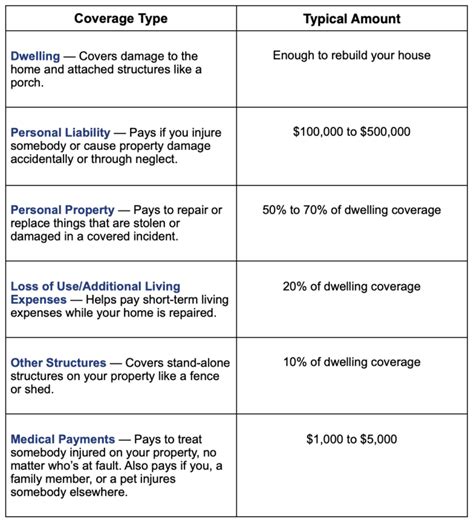

Home Insurance: Liberty offers comprehensive home insurance plans that cover a wide range of perils, including fire, theft, and natural disasters. With customizable options, policyholders can tailor their coverage to suit their specific needs, ensuring their homes and belongings are adequately protected.

Auto Insurance: Liberty’s auto insurance policies provide comprehensive coverage for vehicles, offering protection against accidents, theft, and other unforeseen events. The company’s dedicated claims team ensures a swift and efficient process, minimizing the stress associated with vehicle-related incidents.

Life Insurance: Liberty understands the importance of securing one’s future and the future of their loved ones. Their life insurance plans offer a safety net, providing financial support to beneficiaries in the event of an untimely demise. With flexible payment options and a range of policy types, Liberty caters to various life stages and financial goals.

Business Insurance

For entrepreneurs and businesses, Liberty Insurance Mutual is a trusted partner, offering specialized insurance solutions to mitigate risks and ensure smooth operations. Some notable business insurance offerings include:

Commercial Property Insurance: This coverage safeguards businesses against property damage, loss of inventory, and business interruption. Liberty’s experts work closely with businesses to assess their unique needs, ensuring they have the right protection in place.

Liability Insurance: Liberty’s liability insurance policies protect businesses from potential lawsuits and claims, providing financial coverage for legal expenses and settlements. With tailored coverage, businesses can focus on their core operations with peace of mind.

Workers’ Compensation: Liberty’s workers’ compensation insurance ensures that employees receive the necessary medical care and financial support in the event of work-related injuries or illnesses. This coverage not only protects the well-being of employees but also shields businesses from potential legal liabilities.

Exceptional Customer Experience

At the heart of Liberty Insurance Mutual’s success is its unwavering commitment to delivering an exceptional customer experience. The company understands that insurance is more than just a product—it’s about building trust and providing support during challenging times.

Liberty’s customer service teams are highly trained and dedicated to assisting policyholders every step of the way. From the initial policy acquisition to claims processing and post-claims support, Liberty ensures a seamless and empathetic journey.

The company’s digital platforms further enhance the customer experience, offering 24⁄7 accessibility and a user-friendly interface. Policyholders can manage their accounts, view policy details, and even file claims online, ensuring convenience and efficiency.

Real-World Impact: Success Stories

Liberty Insurance Mutual’s impact extends far beyond its products and services. The company has played a pivotal role in the lives of countless individuals and businesses, providing financial stability and support when it matters most. Here are a few real-world success stories that showcase Liberty’s commitment to its customers:

The Smith Family’s Peace of Mind: The Smiths, a young family, had recently purchased their first home. With a growing family, they wanted to ensure their new home was protected. Liberty’s home insurance policy provided them with the coverage they needed, giving them peace of mind and allowing them to focus on creating memories in their new space.

Small Business Success: Sarah, a passionate entrepreneur, started her own bakery. With Liberty’s commercial insurance coverage, she was able to focus on her business without worrying about potential liabilities. When an unexpected equipment failure occurred, Liberty’s swift claims process ensured Sarah’s business suffered minimal downtime, allowing her to quickly get back to baking delicious treats.

A Second Chance: John, an avid adventurer, was involved in a serious accident while exploring the great outdoors. Liberty’s comprehensive health insurance plan covered his medical expenses, providing him with the necessary treatment and rehabilitation. Thanks to Liberty’s support, John was able to make a full recovery and continue pursuing his passion for outdoor activities.

Performance Analysis and Industry Recognition

Liberty Insurance Mutual’s exceptional performance and customer satisfaction have not gone unnoticed by industry experts and rating agencies. The company consistently ranks among the top insurance providers, earning accolades for its financial stability, customer service, and innovative approaches.

In recent years, Liberty has achieved remarkable growth, expanding its market share and solidifying its position as a leading insurance provider. Its financial strength and robust risk management strategies have enabled the company to weather economic downturns and market fluctuations, ensuring the long-term security of its policyholders.

Future Outlook and Expansion

As Liberty Insurance Mutual continues to thrive, its focus remains on innovation and expansion. The company is actively exploring new markets, both domestically and internationally, to bring its comprehensive insurance solutions to a wider audience.

Liberty’s commitment to sustainability and social responsibility is also a key aspect of its future vision. The company aims to integrate environmentally friendly practices and support community initiatives, ensuring its growth aligns with ethical and responsible business practices.

Conclusion: A Trusted Partner for Life

Liberty Insurance Mutual has established itself as a trusted partner, offering financial freedom and protection to individuals and businesses. With a legacy of innovation, a commitment to customer satisfaction, and a diverse range of insurance solutions, Liberty continues to make a positive impact on the lives of its policyholders.

As the insurance landscape evolves, Liberty remains at the forefront, adapting to changing needs and embracing new technologies. The company’s dedication to its core values and its customers ensures that Liberty Insurance Mutual will continue to be a force for good, providing security and peace of mind for generations to come.

FAQ

What makes Liberty Insurance Mutual stand out from other insurance providers?

+Liberty’s dedication to innovation, customer-centric approach, and comprehensive suite of insurance solutions set it apart. The company’s focus on technology and its commitment to delivering an exceptional customer experience make it a preferred choice for many.

How does Liberty ensure efficient claims processing?

+Liberty has invested in a streamlined claims process, utilizing technology to expedite claims handling. Their dedicated claims teams work diligently to assess and process claims promptly, ensuring policyholders receive the support they need during challenging times.

Can Liberty Insurance Mutual cater to specific industry needs?

+Absolutely! Liberty offers customized insurance solutions tailored to various industries. Whether it’s healthcare, construction, or hospitality, Liberty works closely with businesses to understand their unique risks and provide specialized coverage.

What sets Liberty’s customer service apart?

+Liberty’s customer service teams are renowned for their empathy, expertise, and dedication. They go above and beyond to assist policyholders, providing personalized support and ensuring a seamless experience from policy acquisition to claims settlement.