Life Insurance 10 Year Term

When it comes to financial planning and securing the future of your loved ones, life insurance plays a pivotal role. Among the various types of life insurance policies available, the 10-year term life insurance policy stands out as a popular choice for many individuals and families. This comprehensive guide aims to delve into the intricacies of this policy, providing an expert analysis of its features, benefits, and implications.

Understanding 10-Year Term Life Insurance

A 10-year term life insurance policy is a temporary form of coverage that provides financial protection for a specified period, in this case, a decade. It is designed to offer a cost-effective solution for individuals seeking life insurance coverage for a defined term, often to cover specific financial responsibilities or to bridge a gap in their long-term financial plans.

Key Features of 10-Year Term Policies

These policies are characterized by their simplicity and flexibility. They offer a straightforward coverage structure with a set premium amount that remains consistent throughout the policy term. Here are some of the key features:

- Fixed Premium: Policyholders enjoy the stability of a fixed premium rate, ensuring predictable costs for the duration of the policy.

- Renewability: At the end of the initial 10-year term, policyholders often have the option to renew their coverage for another term, usually with an increased premium to account for age and health changes.

- Level Coverage: The death benefit amount remains constant throughout the policy term, providing consistent financial protection.

- Affordability: Term life insurance is generally more affordable than permanent life insurance policies, making it accessible to a wider range of individuals.

The 10-year term option is particularly attractive to those who have specific, time-bound financial goals or responsibilities, such as covering mortgage payments, funding their children's education, or providing financial support during a career transition period.

Benefits and Considerations

Opting for a 10-year term life insurance policy offers several advantages, but it’s essential to consider these benefits within the context of your unique financial situation and long-term goals.

Advantages of 10-Year Term

One of the primary benefits is the cost-effectiveness. With a shorter term, the premiums are often significantly lower compared to longer-term policies or permanent life insurance. This makes it an attractive option for those with limited financial resources or for covering specific, short-term financial obligations.

Furthermore, the fixed premium and level coverage ensure that policyholders can budget effectively for the duration of the policy. This stability is particularly valuable for individuals who prefer a predictable financial plan.

Potential Drawbacks and Limitations

While 10-year term policies are advantageous for many, there are considerations to keep in mind. Firstly, the coverage duration is relatively short, which means the policy may not align with long-term financial needs. If your financial responsibilities extend beyond the 10-year mark, you may need to consider a longer-term policy or a different type of life insurance.

Additionally, the renewability feature is not guaranteed. While most insurers offer this option, the premium for the renewed term may be significantly higher, especially if your health or age has changed during the initial term. This can make the policy less affordable in the long run.

Another factor to consider is the potential for policy lapses. If you forget to renew your policy or are unable to afford the increased premium, you may find yourself without coverage, leaving your loved ones vulnerable.

Performance Analysis and Real-World Examples

To provide a comprehensive understanding of 10-year term life insurance, let’s examine some real-world scenarios and performance data.

Case Study: Financial Stability for Young Families

Consider the case of Mr. and Mrs. Johnson, a young couple with two children. They recently purchased a new home and are looking to secure their family’s financial future. With a 10-year term life insurance policy, they can ensure that their mortgage is covered in the event of an untimely death, providing their family with the stability to remain in their home.

By choosing a 10-year term, they benefit from lower premiums, allowing them to allocate more of their income towards other financial goals, such as education funds for their children or retirement savings. As their financial situation evolves, they can reassess their needs and consider longer-term or permanent life insurance options.

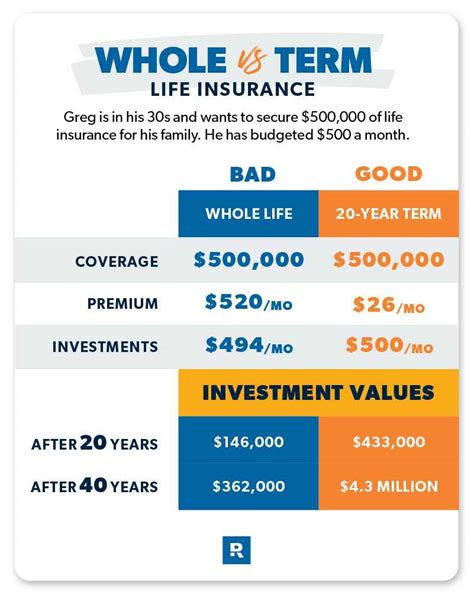

Comparative Analysis: Term vs. Permanent Life Insurance

When comparing 10-year term life insurance to permanent life insurance, such as whole life or universal life policies, the key differences lie in coverage duration, cost, and flexibility.

| Feature | 10-Year Term | Permanent Life Insurance |

|---|---|---|

| Coverage Duration | 10 years | Lifetime coverage |

| Cost | Lower initial premiums | Higher initial premiums |

| Flexibility | Renewable, but may require medical underwriting | Flexible, with cash value accumulation |

While permanent life insurance offers lifetime coverage and the potential for cash value growth, the 10-year term policy provides a more budget-friendly option for those with specific, short-term financial goals.

Expert Insights and Future Implications

From an expert perspective, the 10-year term life insurance policy is a valuable tool in financial planning. It offers a straightforward solution for those seeking temporary coverage without the commitment of a lifelong policy.

💡 Expert Tip: Consider your financial goals and the duration of your responsibilities. If you have long-term financial commitments, a longer-term policy or permanent life insurance may be more suitable. However, for short-term coverage needs, the 10-year term can provide excellent value.

Industry Trends and Predictions

Looking ahead, the life insurance industry is expected to continue evolving to meet the diverse needs of policyholders. We anticipate an increasing focus on customizable and flexible policies, allowing individuals to tailor their coverage to their unique financial situations.

With advancements in technology, insurers are likely to offer more sophisticated online tools and resources to help policyholders make informed decisions. This could include interactive calculators and personalized recommendations based on an individual's financial profile.

Conclusion

In conclusion, the 10-year term life insurance policy is a strategic choice for those seeking temporary coverage to protect their loved ones and financial responsibilities. Its affordability, simplicity, and flexibility make it an attractive option for many. However, as with any financial decision, it’s crucial to assess your unique needs and consult with a financial advisor to ensure you make the right choice.

As you navigate the world of life insurance, remember that your policy should align with your personal and financial goals. By understanding the features, benefits, and limitations of different policies, you can make an informed decision that provides the peace of mind and financial security you deserve.

What happens if I need coverage beyond the 10-year term?

+If you find that your financial responsibilities extend beyond the initial 10-year term, you have the option to renew your policy for another term. However, it’s important to note that the premium may increase based on your age and health status at the time of renewal.

Are there any alternative term lengths available?

+Yes, term life insurance policies are available in various lengths, including 5, 15, 20, and even 30-year terms. The choice of term length depends on your individual needs and financial goals.

How do I determine the right coverage amount for my 10-year term policy?

+Determining the appropriate coverage amount involves assessing your financial responsibilities, such as mortgage payments, outstanding debts, and future expenses like your children’s education. Consulting with a financial advisor can help you calculate the ideal coverage amount to meet your specific needs.