Life Insurance Agencies Near Me

When it comes to protecting your loved ones and ensuring financial security, having a reliable life insurance policy is essential. However, navigating the world of insurance can be daunting, especially when searching for the right agency to meet your specific needs. In this comprehensive guide, we will delve into the world of life insurance agencies, exploring the key considerations, benefits, and factors to keep in mind when searching for the best option near you.

Understanding the Role of Life Insurance Agencies

Life insurance agencies act as intermediaries between insurance companies and policyholders. They play a crucial role in guiding individuals and families through the complex process of selecting the most suitable life insurance plan. These agencies offer expertise, advice, and personalized support to help you make informed decisions about your financial future.

The Importance of Local Agencies

While you may find numerous online resources and comparison websites, there are several advantages to opting for a local life insurance agency. Local agencies have a deep understanding of the unique needs and regulations of your community. They can provide tailored recommendations based on your specific circumstances, ensuring you receive the most appropriate coverage.

Additionally, local agencies often build long-lasting relationships with their clients, offering ongoing support and guidance throughout the policy term. This personal touch can be invaluable, especially during times of need when you require prompt assistance.

Key Factors to Consider When Choosing a Life Insurance Agency

Selecting the right life insurance agency is a critical decision. Here are some essential factors to keep in mind during your search:

Reputation and Experience

Look for an agency with a solid reputation and a proven track record of success. Check online reviews and testimonials from previous clients to gauge their level of satisfaction. An experienced agency will have the knowledge and expertise to navigate the complexities of the insurance industry, ensuring you receive the best possible coverage.

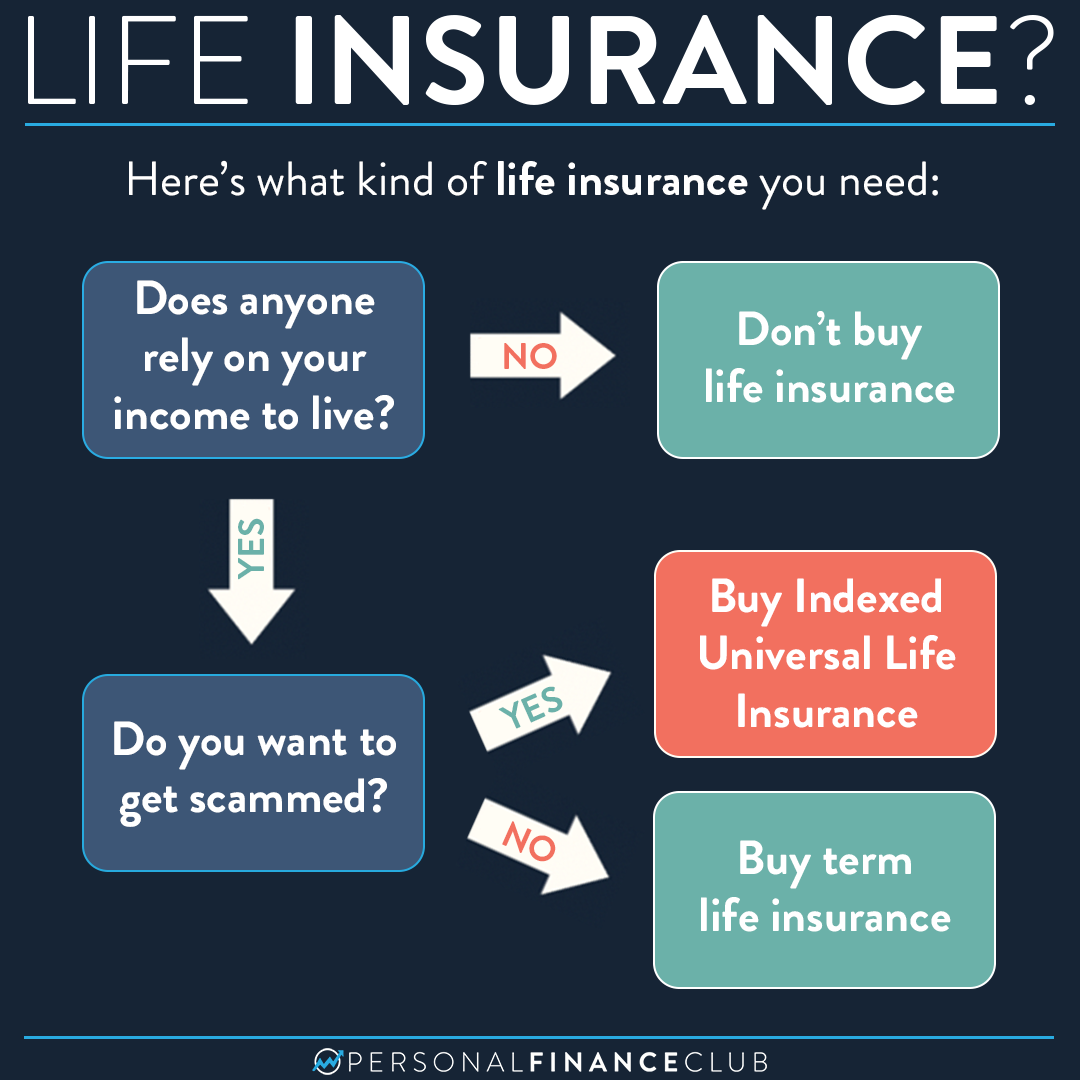

Product Range and Customization

Different life insurance policies cater to various needs. A reputable agency should offer a diverse range of products, including term life insurance, whole life insurance, and riders to customize your policy. The ability to tailor your coverage ensures you can create a plan that aligns perfectly with your financial goals and budget.

Financial Strength and Stability

When choosing an insurance agency, it's crucial to consider the financial stability of the underlying insurance company. Look for agencies that represent well-established and financially secure insurance providers. This ensures that the company will be able to honor its commitments and pay out claims when needed.

Consider checking the financial ratings of the insurance companies associated with the agency. Ratings from reputable agencies like AM Best, Standard & Poor's, or Moody's can provide valuable insights into the financial strength and reliability of the insurance provider.

Customer Service and Support

Excellent customer service is a cornerstone of any reputable life insurance agency. Look for an agency that prioritizes prompt and personalized support. They should be readily available to answer your queries, provide guidance, and assist you throughout the entire process, from policy selection to claim settlement.

Digital Tools and Resources

In today's digital age, many life insurance agencies offer online platforms and tools to enhance the customer experience. Look for an agency that provides convenient online services, such as policy management, claim submission, and premium payment options. These digital resources can simplify the process and provide added flexibility.

The Benefits of Working with a Life Insurance Agency

Engaging the services of a life insurance agency can offer numerous advantages. Here are some key benefits to consider:

Expert Guidance

Insurance agents are highly trained professionals who possess in-depth knowledge of the industry. They can provide expert advice tailored to your specific needs, helping you navigate the complex world of life insurance policies. Their guidance ensures you make informed decisions and select the most suitable coverage for your circumstances.

Personalized Plans

Life insurance agencies work closely with you to understand your unique financial goals and requirements. They can create personalized plans that align with your needs, whether you're seeking coverage for a specific period or lifetime protection. This level of customization ensures you receive the right coverage at the most competitive rates.

Claim Support

One of the most significant advantages of working with a life insurance agency is the support they provide during the claims process. When you need to file a claim, your agent will guide you through the steps, ensuring a smooth and efficient process. They can assist with documentation, answer any questions you may have, and advocate on your behalf to ensure a timely resolution.

Long-Term Relationship

Life insurance policies are long-term commitments, and building a relationship with your insurance agency can be invaluable. Over time, your needs and circumstances may change, and your agent can help you adjust your coverage accordingly. They can also provide ongoing advice and support to ensure your policy remains up-to-date and aligned with your financial goals.

Comparing Life Insurance Agencies: A Step-by-Step Guide

To make an informed decision, it's essential to compare multiple life insurance agencies. Here's a step-by-step guide to help you through the process:

- Identify Your Needs: Begin by assessing your specific requirements. Consider factors such as the level of coverage you need, your budget, and any unique circumstances (e.g., health conditions or dependents). This initial step will help you narrow down your options and focus on agencies that offer the right products.

- Research Agencies: Conduct thorough research to identify reputable life insurance agencies in your area. Look for online reviews, check their websites for product offerings and services, and consider asking for recommendations from trusted friends or family members.

- Evaluate Financial Strength: As mentioned earlier, the financial stability of the insurance company is crucial. Research the financial ratings of the companies represented by the agencies you're considering. Look for agencies that partner with well-established and highly rated insurance providers.

- Compare Product Offerings: Each agency may offer a unique range of products. Compare the types of life insurance policies, riders, and additional benefits available. Ensure that the agencies you're considering can provide the coverage options you desire.

- Assess Customer Service: Customer service is a critical aspect of the agency-client relationship. Evaluate the responsiveness and accessibility of the agencies you're considering. Check their online reviews and reach out to them directly to gauge their level of support.

- Consider Digital Capabilities: In today's digital landscape, online accessibility and convenience are essential. Assess the digital tools and resources offered by the agencies. Look for user-friendly platforms, online policy management, and efficient claim submission processes.

- Request Quotes: Obtain quotes from multiple agencies to compare pricing and coverage options. Ensure that the quotes are tailored to your specific needs and circumstances. This step will help you identify the most competitive and suitable options.

- Evaluate Agent Expertise: Meet or communicate with the insurance agents from each agency. Assess their knowledge, communication skills, and ability to provide personalized advice. A good agent should be able to explain complex insurance concepts in a clear and understandable manner.

- Review Contracts: Before making a final decision, carefully review the policy contracts provided by the agencies. Ensure that the terms and conditions align with your expectations and that there are no hidden fees or exclusions. Pay close attention to the fine print to avoid any surprises down the line.

- Make an Informed Choice: Based on your research, comparisons, and interactions with the agencies, make an informed decision. Choose the agency that best meets your needs, offers competitive pricing, and provides excellent customer service. Remember, this is a long-term commitment, so select an agency you feel comfortable working with.

Frequently Asked Questions (FAQ)

How do I find life insurance agencies near me?

+You can search online using keywords like "life insurance agencies near me" or "local life insurance brokers." Alternatively, you can ask for recommendations from friends, family, or financial advisors. Local business directories and insurance industry websites can also provide a list of agencies in your area.

What questions should I ask when comparing life insurance agencies?

+Some key questions to ask include: What types of life insurance policies do they offer? How long have they been in business? What is their claim settlement process like? Do they provide ongoing support and policy reviews? Are they licensed and insured? Asking these questions will help you assess their expertise, reliability, and customer service.

Can I get a quote from multiple agencies at once?

+Yes, you can request quotes from multiple agencies to compare pricing and coverage options. Many agencies offer online quote tools, making it convenient to obtain multiple quotes in a short time. However, ensure that the quotes are tailored to your specific needs to get an accurate comparison.

What factors should I consider when evaluating the financial strength of an insurance company?

+Look for insurance companies with high financial ratings from reputable agencies like AM Best, Standard & Poor's, or Moody's. These ratings indicate the company's ability to meet its financial obligations and pay claims. Additionally, consider the company's size, length of operation, and any recent financial reports or news.

Finding the right life insurance agency is a crucial step in securing your financial future and protecting your loved ones. By considering the factors outlined in this guide and conducting thorough research, you can make an informed decision and choose an agency that provides the best possible coverage and support. Remember, life insurance is a long-term commitment, so take the time to find the agency that aligns with your needs and offers excellent service.