Life Insurance And How It Works

Life insurance is a crucial financial tool that provides security and peace of mind to individuals and their families. It serves as a protective shield, ensuring that loved ones are financially safeguarded in the event of an unexpected tragedy. With various types of life insurance policies available, understanding how they work is essential for making informed decisions and building a robust financial safety net.

In this comprehensive guide, we will delve into the world of life insurance, exploring its inner workings, the different policy options, and the key considerations to help you navigate this essential aspect of personal finance.

The Fundamentals of Life Insurance

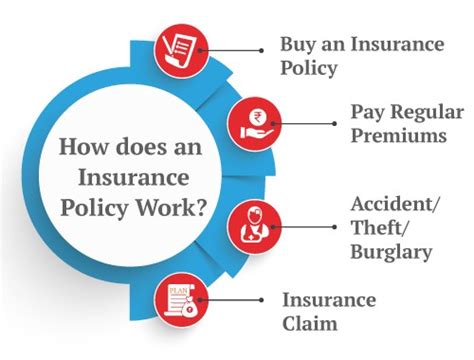

Life insurance is a contract between an individual (the policyholder) and an insurance company. The policyholder pays a premium, typically on a monthly or annual basis, in exchange for financial protection for their beneficiaries in the event of their death. This protection comes in the form of a death benefit, which is a lump-sum payment made to the beneficiaries upon the policyholder’s passing.

The primary purpose of life insurance is to provide a financial safety net that can help cover various expenses and ensure the financial well-being of those left behind. These expenses may include funeral and burial costs, outstanding debts, daily living expenses, education costs for children, and even business continuation expenses in the case of a business owner.

The death benefit paid out by a life insurance policy can vary depending on the type of policy and the amount of coverage chosen. It is designed to be a substantial sum that can significantly alleviate the financial burden on the beneficiaries, allowing them to maintain their standard of living and pursue their future goals.

Types of Life Insurance Policies

Life insurance policies can be broadly categorized into two main types: term life insurance and permanent life insurance. Each type has its own unique features and benefits, catering to different financial needs and circumstances.

Term Life Insurance

Term life insurance is a straightforward and affordable option that provides coverage for a specific period, known as the term. The term can range from 10 to 30 years, and during this period, the policyholder pays a fixed premium. If the policyholder passes away during the term, the beneficiaries receive the death benefit. However, if the term expires and the policyholder is still alive, the coverage ends, and there is no payout.

Term life insurance is ideal for individuals who have temporary financial responsibilities, such as covering mortgage payments or supporting children's education during their dependent years. It is often chosen for its cost-effectiveness, as premiums are generally lower compared to permanent life insurance.

| Term Life Insurance Features | Description |

|---|---|

| Coverage Period | Ranges from 10 to 30 years, depending on the policy. |

| Premium Payment | Fixed monthly or annual payments throughout the term. |

| Death Benefit | Paid out to beneficiaries if the policyholder passes away during the term. |

| Renewal | Option to renew the policy at the end of the term, often with increased premiums. |

| Cost | Affordable, with premiums increasing as the policyholder ages. |

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides coverage for the policyholder’s entire life, as long as premiums are paid. This type of insurance includes whole life, universal life, and variable life policies, each with its own unique features.

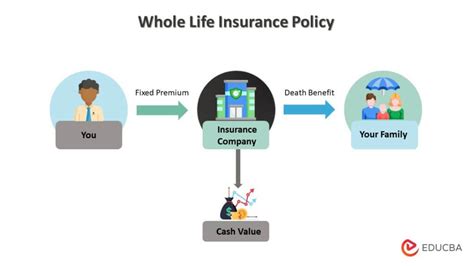

Whole life insurance offers a fixed death benefit and guaranteed premiums for life. It also accumulates cash value over time, which can be borrowed against or withdrawn in certain circumstances. Universal life insurance provides more flexibility in premium payments and death benefit amounts, allowing policyholders to adjust their coverage based on their needs.

Variable life insurance, on the other hand, allows policyholders to invest a portion of their premiums in separate investment accounts, providing the potential for higher returns but also carrying higher risks.

| Permanent Life Insurance Types | Description |

|---|---|

| Whole Life | Fixed death benefit and guaranteed premiums. Accumulates cash value. |

| Universal Life | Flexible premiums and death benefit amounts. Cash value accumulates. |

| Variable Life | Allows investment of premiums in separate accounts. Higher potential returns but also higher risks. |

How Life Insurance Premiums Are Calculated

Life insurance premiums are determined based on several factors, including the policyholder’s age, health, lifestyle, and the type and amount of coverage chosen. Insurance companies use actuarial tables and statistical models to assess the risk associated with insuring an individual and set premiums accordingly.

In general, younger individuals with no health issues or risky habits tend to have lower premiums. As a person ages or develops health conditions, the risk of an earlier death increases, leading to higher premiums. Additionally, the amount of coverage desired and the type of policy chosen will also impact the premium amount.

It's important to note that life insurance companies may require medical examinations or health screenings to assess an individual's health status before issuing a policy. These examinations help the insurance company accurately assess the risk and determine the appropriate premium.

Factors Affecting Premium Calculation

- Age: Younger individuals typically pay lower premiums.

- Health: Pre-existing health conditions or risky behaviors can lead to higher premiums.

- Lifestyle: Smoking, extreme sports participation, and certain occupations may result in higher premiums.

- Coverage Amount: The higher the death benefit, the higher the premium.

- Policy Type: Permanent life insurance often has higher premiums than term life insurance.

The Benefits of Life Insurance

Life insurance offers a range of benefits that extend beyond the financial protection it provides. Here are some key advantages of having a life insurance policy:

Financial Security for Beneficiaries

The primary benefit of life insurance is ensuring financial security for loved ones after the policyholder’s death. The death benefit can cover immediate expenses, such as funeral costs, and provide long-term financial support for daily living, education, and other future goals.

Debt Repayment

Life insurance can be used to repay outstanding debts, such as mortgages, car loans, or credit card balances. This helps prevent financial strain on beneficiaries and ensures that the policyholder’s legacy is not burdened by debt.

Estate Planning

Life insurance can be a valuable tool for estate planning. It can help cover estate taxes, ensuring that heirs receive the full inheritance without significant tax burdens. Additionally, life insurance proceeds are typically paid out quickly, providing immediate liquidity to the estate.

Business Continuity

For business owners, life insurance can be a crucial component of a business continuity plan. It can provide funds to buy out a deceased owner’s share of the business, ensuring smooth transition and continuity. Life insurance can also cover key person risks, where the loss of a key employee could significantly impact the business.

Choosing the Right Life Insurance Policy

Selecting the appropriate life insurance policy depends on various factors, including your financial goals, family circumstances, and personal preferences. Here are some key considerations to guide your decision-making process:

Assess Your Needs

Begin by evaluating your financial responsibilities and the potential impact of your death on your loved ones. Consider factors such as mortgage payments, children’s education costs, daily living expenses, and any outstanding debts. Determine the amount of coverage needed to provide sufficient financial support.

Term vs. Permanent Insurance

Decide whether you need temporary coverage (term life insurance) or lifelong protection (permanent life insurance). Term life insurance is ideal for covering short-term financial obligations, while permanent life insurance offers lifelong coverage and additional benefits like cash value accumulation.

Compare Policies and Providers

Research and compare different life insurance policies and providers to find the best fit for your needs. Consider factors such as coverage amounts, premium costs, policy flexibility, and the financial stability of the insurance company. Seek advice from financial advisors or insurance brokers to make an informed decision.

Consider Additional Benefits

Some life insurance policies offer additional benefits beyond the death benefit. These may include accelerated death benefit riders, which allow for early access to a portion of the death benefit in the event of a terminal illness, or long-term care riders, which provide coverage for nursing home or assisted living expenses.

Life Insurance and Estate Planning

Life insurance plays a crucial role in estate planning, helping individuals ensure the financial well-being of their heirs and minimize tax burdens. By incorporating life insurance into your estate plan, you can achieve several objectives:

Estate Tax Payment

Life insurance proceeds can be used to pay estate taxes, ensuring that your heirs receive the full inheritance without significant tax deductions. This is particularly important for estates that exceed the federal estate tax exemption amount.

Equalizing Inheritances

If you have multiple heirs and want to ensure equal inheritances, life insurance can be used to balance out any disparities in asset distribution. For example, if one heir receives a larger inheritance due to business interests or real estate ownership, life insurance proceeds can be used to provide equal shares to other heirs.

Charitable Giving

Life insurance can be used to make charitable donations, allowing you to support causes that are important to you while also potentially reducing estate taxes. By naming a charity as a beneficiary, you can ensure that a portion of your assets goes towards supporting the organization of your choice.

Frequently Asked Questions

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on your financial responsibilities and goals. As a general rule, experts recommend having enough coverage to replace 10-15 times your annual income. However, your specific needs may vary based on factors such as mortgage payments, children’s education costs, and outstanding debts.

Can I change my life insurance policy once it’s in place?

+Yes, you can typically make changes to your life insurance policy, such as increasing or decreasing coverage amounts or adding optional riders. However, it’s important to review the terms and conditions of your policy to understand any restrictions or fees associated with making changes.

What happens if I miss a premium payment?

+Missing a premium payment can have different consequences depending on the type of policy you have. With term life insurance, missing a payment may result in the policy lapsing, and you may need to apply for a new policy with potentially higher premiums. Permanent life insurance policies often have a grace period, allowing you to make the payment within a certain timeframe without losing coverage.

Can I cancel my life insurance policy?

+Yes, you can cancel your life insurance policy at any time. However, it’s important to consider the financial implications of canceling a policy. If you have a permanent life insurance policy with cash value, you may be able to surrender the policy and receive a portion of the cash value. Term life insurance policies, on the other hand, do not have cash value, and canceling them may leave you without coverage.

Life insurance is an essential financial tool that provides peace of mind and financial security to individuals and their families. By understanding the different types of policies, how premiums are calculated, and the benefits they offer, you can make informed decisions to protect your loved ones and achieve your financial goals. Remember to regularly review and adjust your life insurance coverage as your circumstances and needs evolve.