Life Insurance Average Cost

Understanding the cost of life insurance is crucial for anyone seeking financial protection for their loved ones. The average cost of life insurance is a topic that often sparks curiosity and concerns among individuals considering this essential form of coverage. In this comprehensive article, we will delve into the factors that influence life insurance premiums, explore the average costs associated with different policy types, and provide valuable insights to help you make informed decisions about your life insurance coverage.

The Factors Shaping Life Insurance Premiums

Life insurance premiums are determined by a multitude of factors, each playing a significant role in the overall cost of your policy. By understanding these factors, you can gain a clearer picture of how your individual circumstances impact the average cost of life insurance.

Age and Health

One of the most influential factors in determining life insurance premiums is your age and overall health. Generally, younger individuals are offered lower premiums due to their lower risk of health issues and mortality. As you age, the cost of life insurance tends to increase, reflecting the higher likelihood of health complications and the need for coverage.

Additionally, your health plays a crucial role. Insurance providers carefully assess your medical history, lifestyle choices, and any existing health conditions to assess your risk profile. Individuals with a history of chronic illnesses or high-risk behaviors may face higher premiums or even be declined coverage altogether.

| Age | Average Annual Premium |

|---|---|

| 25 years | $300 - $500 |

| 35 years | $400 - $700 |

| 45 years | $600 - $1,200 |

| 55 years | $1,000 - $2,500 |

This table provides a rough estimate of average annual premiums based on age. However, it's important to note that individual circumstances can significantly impact these averages.

Policy Type and Coverage Amount

The type of life insurance policy you choose and the coverage amount you require are key factors in determining your premium costs. There are primarily two main types of life insurance: term life insurance and permanent life insurance.

Term Life Insurance: This type of policy provides coverage for a specific period, often ranging from 10 to 30 years. Term life insurance is typically more affordable, as it offers protection for a defined term. The average cost of a term life insurance policy can vary depending on the length of the term and the coverage amount.

| Term Length | Coverage Amount | Average Annual Premium |

|---|---|---|

| 10 years | $250,000 | $200 - $400 |

| 20 years | $500,000 | $400 - $800 |

| 30 years | $1,000,000 | $800 - $1,600 |

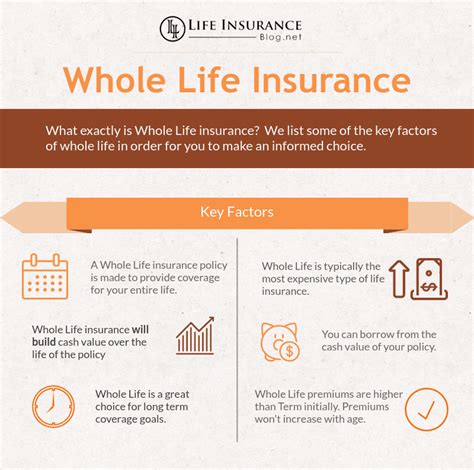

Permanent Life Insurance: Unlike term life insurance, permanent life insurance provides lifelong coverage and accumulates cash value over time. This type of policy tends to be more expensive due to its comprehensive nature and the added investment component. The average cost of permanent life insurance can vary significantly based on the policy type and coverage amount.

| Policy Type | Coverage Amount | Average Annual Premium |

|---|---|---|

| Whole Life | $250,000 | $1,500 - $3,000 |

| Universal Life | $500,000 | $2,000 - $4,000 |

| Variable Life | $1,000,000 | $4,000 - $8,000 |

Lifestyle and Occupation

Your lifestyle choices and occupation can also impact the cost of your life insurance policy. Insurance providers consider factors such as smoking, alcohol consumption, and high-risk hobbies or occupations when assessing your risk profile. Individuals engaged in hazardous occupations or recreational activities may face higher premiums to account for the increased risk.

Exploring Average Costs: A Real-World Perspective

To provide a more tangible understanding of life insurance costs, let’s explore some real-world examples and average premium estimates based on different scenarios.

Family Coverage for Financial Security

John, a 35-year-old father of two, is considering life insurance to protect his family’s financial future. He wants to ensure his wife and children are financially secure in the event of his untimely demise. Here’s a breakdown of the average costs John might expect for different policy types:

- Term Life Insurance (20 years, $500,000 coverage): John could expect to pay an average annual premium of around $450 - $700.

- Whole Life Insurance ($500,000 coverage): The average annual premium for whole life insurance could range from $2,000 to $3,500.

By comparing these averages, John can make an informed decision based on his family's needs and budget.

Single Individual’s Peace of Mind

Sarah, a 28-year-old single professional, is looking to secure her future and ensure her financial obligations are met even in her absence. Here’s a look at the average costs Sarah might encounter:

- Term Life Insurance (10 years, $250,000 coverage): Sarah can expect an average annual premium of approximately $250 - $350.

- Universal Life Insurance ($250,000 coverage): The average annual premium for universal life insurance could range from $1,200 to $2,000.

Maximizing Value: Tips for Affordable Life Insurance

While the average costs of life insurance provide a useful benchmark, it’s essential to explore strategies to secure the most affordable coverage tailored to your needs. Here are some valuable tips to help you maximize the value of your life insurance policy:

Shop Around and Compare

The life insurance market is diverse, with numerous providers offering a wide range of policies. Take the time to compare quotes from multiple insurers. Online comparison tools and insurance brokers can simplify this process, allowing you to find the most competitive rates for your specific circumstances.

Consider Term Length and Coverage Amount

When choosing a term life insurance policy, carefully assess your needs and the duration of coverage required. Opting for a shorter term or a lower coverage amount can significantly reduce your premiums. Conversely, if you require lifelong coverage, permanent life insurance may be more suitable, offering the added benefit of cash value accumulation.

Maintain a Healthy Lifestyle

Leading a healthy lifestyle is not only beneficial for your overall well-being but can also positively impact your life insurance premiums. Insurance providers often offer discounts or lower rates to individuals who maintain a healthy weight, engage in regular exercise, and refrain from high-risk behaviors. Adopting healthy habits can not only reduce your insurance costs but also improve your quality of life.

Bundle Policies for Savings

If you’re in the market for multiple insurance policies, such as life insurance, homeowners insurance, and auto insurance, consider bundling them with the same provider. Many insurance companies offer discounts when you bundle multiple policies, resulting in significant savings on your overall insurance costs.

Seek Professional Guidance

Navigating the complexities of life insurance can be challenging. Consider seeking advice from a qualified insurance broker or financial advisor who can provide personalized recommendations based on your unique circumstances. They can help you understand the nuances of different policies, ensuring you make informed choices that align with your financial goals and budget.

The Future of Life Insurance Costs

The life insurance industry is continually evolving, and technological advancements are shaping the way premiums are determined. Here’s a glimpse into the future of life insurance costs and the potential impact on policyholders:

Data-Driven Underwriting

Insurance providers are increasingly leveraging advanced data analytics and machine learning algorithms to assess risk and determine premiums. This data-driven approach allows for more accurate underwriting, potentially leading to more precise and tailored premiums for policyholders. As a result, individuals with lower risk profiles may benefit from reduced premiums, while those with higher risks may experience more accurate pricing.

Telehealth and Remote Monitoring

The rise of telehealth and remote monitoring technologies is transforming the way insurance providers assess and monitor policyholders’ health. These innovations enable insurers to collect real-time health data, track lifestyle choices, and offer personalized health recommendations. By incentivizing policyholders to adopt healthier lifestyles, insurers can potentially reduce the overall risk pool, leading to more affordable premiums for all.

Artificial Intelligence and Predictive Modeling

Artificial intelligence (AI) and predictive modeling techniques are being employed by insurance companies to forecast health trends and identify potential risks. By analyzing vast amounts of data, including medical records, lifestyle habits, and genetic information, insurers can develop more accurate risk models. This advanced risk assessment can lead to more precise pricing, ensuring that policyholders pay premiums that accurately reflect their individual risk profiles.

The Impact of Regulatory Changes

The life insurance industry is subject to regulatory oversight, and changes in regulations can influence the cost and availability of policies. Governments and regulatory bodies may implement measures to promote transparency, consumer protection, and affordability in the insurance market. These interventions can have both positive and negative effects on policyholders, potentially impacting the average cost of life insurance.

Conclusion: Empowering Your Financial Future

Understanding the average cost of life insurance is a crucial step towards securing your financial future and protecting your loved ones. By exploring the factors that influence premiums and considering real-world examples, you can make informed decisions about the type and amount of coverage you require. Additionally, by adopting strategies to maximize value and staying abreast of industry developments, you can ensure that your life insurance policy remains affordable and aligned with your evolving needs.

Remember, life insurance is a vital component of any comprehensive financial plan. By taking the time to understand the costs and benefits associated with different policy types, you can empower yourself to make the best choices for your unique circumstances. With the right coverage in place, you can rest assured knowing that your loved ones are protected and provided for, even in your absence.

How often should I review my life insurance coverage?

+

It is recommended to review your life insurance coverage every 3-5 years or whenever there is a significant life event, such as marriage, birth of a child, or a change in financial status. Regular reviews ensure your coverage remains adequate and aligned with your evolving needs.

Can I get life insurance if I have pre-existing health conditions?

+

Yes, individuals with pre-existing health conditions can still obtain life insurance. However, the cost and terms may vary based on the nature and severity of the condition. It is advisable to consult with insurance providers who specialize in covering individuals with health challenges.

Are there any tax benefits associated with life insurance?

+

Yes, life insurance policies often offer tax advantages. The death benefit proceeds are typically tax-free, providing a valuable financial benefit to the beneficiaries. Additionally, depending on the policy type, premiums paid may be tax-deductible. It is advisable to consult a tax professional for specific guidance.