Life Insurance Benefit

Life insurance is a financial safeguard that protects individuals and their loved ones by providing a monetary benefit in the event of the policyholder's death. This essential form of insurance offers a critical safety net for families, ensuring financial stability and peace of mind during difficult times. The benefits of life insurance are far-reaching and extend beyond immediate financial support, encompassing various aspects of long-term financial planning and estate management.

Understanding the Life Insurance Benefit

The life insurance benefit, often referred to as the death benefit, is a key component of a life insurance policy. It represents the sum of money that is paid out to the designated beneficiaries upon the death of the insured individual. This benefit serves as a crucial financial cushion, helping beneficiaries cover immediate expenses, such as funeral costs and outstanding debts, and providing long-term financial security for their future needs.

The life insurance benefit is tailored to the policyholder's specific needs and circumstances. It can be customized to cover a range of expenses, including daily living costs, children's education, mortgage payments, and even business continuity for entrepreneurs. The flexibility of life insurance allows individuals to adapt their coverage to their evolving financial goals and responsibilities.

Key Features of the Life Insurance Benefit

- Death Benefit Payout: The primary feature of life insurance is the death benefit, which is typically a lump-sum payment made to the beneficiaries. This payout can be used to replace the deceased individual’s income, ensuring their family’s financial well-being.

- Income Replacement: Life insurance is often utilized as a means to replace the income of the primary earner in a household. This income replacement provides financial stability and prevents beneficiaries from facing immediate financial strain.

- Tax-Free Proceeds: In many jurisdictions, the death benefit from a life insurance policy is received tax-free by the beneficiaries, making it a valuable asset for estate planning and wealth transfer.

- Financial Flexibility: Beneficiaries have the freedom to use the death benefit as they see fit. This flexibility allows for personalized financial planning, whether it’s paying off debts, investing, or covering daily expenses.

- Estate Planning: Life insurance can be a crucial component of estate planning, ensuring that assets are distributed according to the policyholder’s wishes and providing liquidity for estate settlement.

Types of Life Insurance Benefits

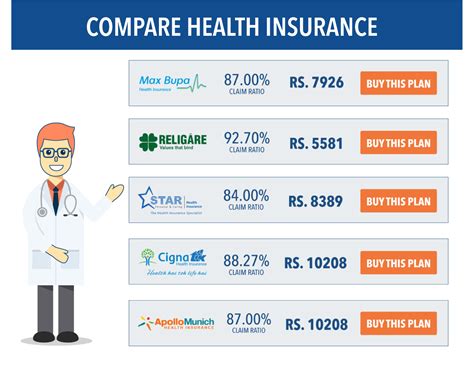

Life insurance benefits come in various forms, each designed to cater to different financial needs and goals. Understanding the different types of life insurance benefits is essential for individuals to choose the most suitable coverage for their circumstances.

Term Life Insurance

Term life insurance offers coverage for a specified period, often ranging from 10 to 30 years. During this term, the policyholder pays premiums, and in the event of their death, the beneficiaries receive the death benefit. Term life insurance is typically more affordable than permanent life insurance and is ideal for covering short-term financial obligations, such as mortgage payments or children’s education expenses.

| Key Features | Details |

|---|---|

| Coverage Period | 10-30 years |

| Premium Structure | Fixed premiums for the term |

| Renewability | Policies can be renewed, but premiums may increase |

| Benefit Payout | Lump-sum payment to beneficiaries upon death |

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides coverage for the policyholder’s entire life, as long as premiums are paid. This type of insurance includes whole life, universal life, and variable life policies. Permanent life insurance not only offers a death benefit but also accumulates cash value over time, making it a dual-purpose financial tool.

| Key Features | Details |

|---|---|

| Coverage | Lifetime coverage |

| Premium Structure | Level premiums for life |

| Cash Value Accumulation | Policyholders can borrow against or withdraw cash value |

| Benefit Payout | Lump-sum payment to beneficiaries upon death |

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides consistent coverage and guaranteed cash value accumulation. Premiums remain level throughout the policyholder’s life, and the death benefit is fixed.

Universal Life Insurance

Universal life insurance offers more flexibility than whole life insurance. Policyholders can adjust their premiums and death benefit amounts, within certain limits, to meet their changing financial needs. Universal life policies also accumulate cash value, which can be used for various financial purposes.

Variable Life Insurance

Variable life insurance allows policyholders to invest a portion of their premiums in different investment options, such as stocks or bonds. The death benefit and cash value of the policy are tied to the performance of these investments, providing the potential for higher returns but also carrying higher risk.

Maximizing the Life Insurance Benefit

To make the most of your life insurance benefit, it’s crucial to understand how to optimize your policy and ensure it aligns with your financial objectives. Here are some strategies to maximize the benefits of your life insurance:

Regularly Review and Update Your Policy

Life insurance policies should be reviewed periodically to ensure they still meet your needs. As your financial situation and responsibilities change, your life insurance coverage should adapt accordingly. Consider updating your policy when you experience significant life events, such as marriage, the birth of a child, or a career change.

Utilize the Cash Value of Permanent Policies

If you have a permanent life insurance policy, understand the cash value accumulation aspect. This accumulated cash value can be used for various financial purposes, such as supplementing retirement income, covering emergency expenses, or funding a child’s education.

Estate Planning Integration

Life insurance can be a vital component of your estate plan. Work with a financial advisor or estate planning professional to ensure your life insurance benefit is integrated effectively into your overall financial strategy. This can help minimize tax liabilities and ensure your assets are distributed according to your wishes.

Consider Riders and Additional Coverage

Life insurance policies often offer riders or additional coverage options that can enhance your benefits. These riders can provide coverage for specific needs, such as long-term care, disability, or critical illness. By adding these riders, you can customize your policy to address a broader range of financial risks.

Case Studies: Real-World Impact of Life Insurance Benefits

To illustrate the significance of life insurance benefits, let’s explore a few real-world case studies:

Case Study 1: Financial Stability for a Young Family

John, a 35-year-old father of two, passed away unexpectedly, leaving his wife and children without their primary source of income. Fortunately, John had a substantial term life insurance policy. The death benefit provided by the policy allowed his family to pay off their mortgage, cover funeral expenses, and ensure the children’s education was fully funded. This financial stability helped the family navigate the emotional challenges of their loss with the knowledge that their future was secure.

Case Study 2: Business Continuity for Entrepreneurs

Sarah, a successful business owner, understood the importance of life insurance for business continuity. She secured a substantial permanent life insurance policy with a rider for business expenses. When Sarah passed away, her life insurance benefit covered the costs of maintaining her business operations, ensuring her employees’ jobs were protected, and allowing her business to continue thriving under new ownership.

Case Study 3: Estate Planning and Wealth Transfer

Michael, a retired professional with a well-established estate, utilized life insurance as a key component of his estate plan. By strategically structuring his life insurance policies, he was able to minimize estate taxes and ensure that his assets were distributed efficiently to his heirs. The tax-free death benefit from his life insurance policies provided liquidity for estate settlement, making the process smoother for his beneficiaries.

Frequently Asked Questions (FAQ)

How much life insurance coverage do I need?

+

The amount of life insurance coverage you need depends on various factors, including your income, financial obligations, and future goals. As a general rule, experts recommend having coverage that is 10 to 15 times your annual income. However, your specific needs may vary, so it’s essential to consult with a financial advisor to determine the right amount of coverage for your circumstances.

Can I change the beneficiaries on my life insurance policy?

+

Yes, you can typically change the beneficiaries on your life insurance policy at any time. This is a straightforward process that can be done by contacting your insurance provider and completing the necessary paperwork. It’s important to keep your beneficiary information up-to-date to ensure your wishes are honored.

What happens if I stop paying premiums on my life insurance policy?

+

If you stop paying premiums on your life insurance policy, your coverage will typically lapse, and you will no longer have insurance protection. However, some policies offer a grace period, during which you can still make payments without losing coverage. It’s crucial to understand the terms of your policy and maintain timely premium payments to avoid lapses.

Can I borrow against the cash value of my permanent life insurance policy?

+

Yes, if you have a permanent life insurance policy with accumulated cash value, you may be able to borrow against that cash value. This allows you to access funds for various financial needs without canceling your policy. However, it’s important to understand the implications of such a move, as it can affect your policy’s future cash value and death benefit.

How does life insurance impact my estate taxes?

+

The life insurance death benefit is typically included in your taxable estate, which can increase your overall estate tax liability. However, with proper estate planning and the use of irrevocable life insurance trusts, you may be able to minimize or even eliminate the impact of life insurance on your estate taxes. It’s advisable to consult with an estate planning professional for personalized guidance.