Life Insurance Cost Per Month

Life insurance is a vital financial tool that provides peace of mind and security to individuals and their loved ones. The cost of life insurance is often a key consideration when evaluating insurance plans. Understanding the factors that influence the monthly premiums can empower individuals to make informed decisions about their coverage. In this comprehensive guide, we will delve into the intricacies of life insurance cost per month, exploring the variables that impact premiums and offering insights to help you navigate this essential aspect of financial planning.

Understanding Life Insurance Cost per Month

Life insurance cost per month, also known as the premium, is the amount an individual pays regularly to maintain their coverage. This premium is determined by a range of factors, each contributing to the overall cost of the policy. By breaking down these factors, we can gain a clearer understanding of how life insurance premiums are calculated and how they can vary from person to person.

Key Factors Influencing Monthly Premiums

The cost of life insurance per month is influenced by several critical factors. These include:

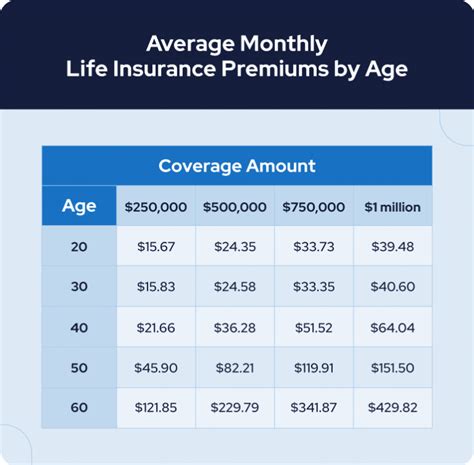

- Age and Health: One of the most significant factors is the age and health of the policyholder. Generally, younger individuals in good health can expect lower premiums compared to older individuals or those with health complications. Life insurance companies assess the risk associated with insuring an individual based on their health status and age.

- Coverage Amount: The amount of coverage desired plays a crucial role in determining the premium. Higher coverage amounts typically result in higher monthly costs. It’s essential to strike a balance between the coverage needed and what one can afford.

- Term Length: The length of the policy, known as the term, also impacts premiums. Shorter terms often have lower monthly costs, while longer terms may result in higher premiums over time. The choice of term length depends on individual needs and financial goals.

- Tobacco Use: Tobacco users, including smokers and those who use chewing tobacco, often face higher premiums due to the increased health risks associated with tobacco consumption.

- Occupation and Lifestyle: Certain occupations and lifestyles can affect premiums. High-risk jobs or adventurous hobbies may result in higher costs as they increase the likelihood of potential health issues or accidents.

- Medical History: Pre-existing medical conditions or a history of serious illnesses can impact premiums. Insurance companies carefully evaluate an individual’s medical history to assess their risk profile.

- Family Health History: The health history of an individual’s immediate family members can also influence premiums. Certain hereditary conditions or a family history of specific illnesses may be considered in the underwriting process.

Example: Age and Health Impact on Premiums

Let’s consider an example to illustrate the impact of age and health on life insurance premiums. Suppose we have two individuals: John, a 30-year-old non-smoker in excellent health, and Sarah, a 50-year-old smoker with a history of high blood pressure.

| Individual | Age | Health Status | Estimated Monthly Premium |

|---|---|---|---|

| John | 30 | Excellent Health | 25 - 35 |

| Sarah | 50 | Smoker with Health Issues | 75 - 100 |

In this example, John’s younger age and good health result in a lower estimated monthly premium compared to Sarah, who faces higher premiums due to her age, smoking status, and health issues.

Calculating Life Insurance Premiums

Life insurance companies use a combination of actuarial science and underwriting to calculate premiums. Actuarial science involves analyzing statistical data to assess risk and determine the likelihood of a claim being made. Underwriting is the process of evaluating an individual’s risk profile and determining the appropriate premium based on that assessment.

Actuarial Science and Risk Assessment

Actuaries play a crucial role in life insurance by collecting and analyzing vast amounts of data to understand the likelihood of specific events, such as death, occurring within a given population. They consider factors like age, gender, health, and lifestyle to develop statistical models that predict the probability of a claim. These models help insurance companies set premiums that accurately reflect the risk associated with insuring an individual.

Underwriting Process

The underwriting process involves a thorough evaluation of an individual’s application for life insurance. Underwriters review the application, including medical history, lifestyle factors, and any available medical records. They may also request a medical exam or additional tests to gather more information about the applicant’s health. Based on this assessment, underwriters assign a risk classification, which determines the premium rate for the policy.

Group vs. Individual Life Insurance

It’s important to note the distinction between group life insurance and individual life insurance when discussing premiums. Group life insurance, often offered through employers, typically has lower premiums due to the spread of risk across a large group of individuals. In contrast, individual life insurance policies are tailored to an individual’s specific needs and risk profile, resulting in premiums that reflect their unique circumstances.

Strategies to Manage Life Insurance Costs

While life insurance premiums are primarily based on individual risk factors, there are strategies individuals can employ to manage and potentially reduce their costs. Here are some approaches to consider:

- Review Coverage Needs Regularly: Life circumstances change, and it’s essential to review your coverage needs periodically. Assessing your financial situation and goals can help you determine if you have adequate coverage or if you need to adjust your policy.

- Compare Policies and Providers: Shopping around and comparing different life insurance policies and providers can reveal variations in premiums. Different companies may offer different rates for similar coverage, so it’s worth exploring multiple options.

- Consider Term Length: The length of your life insurance term can impact premiums. Shorter terms may be more affordable in the short term, but longer terms provide coverage for a more extended period. Evaluate your financial goals and stability to determine the appropriate term length.

- Improve Health and Lifestyle: Adopting a healthier lifestyle can positively impact your premiums. Quitting smoking, maintaining a healthy weight, and managing any health conditions can reduce the risk associated with your policy and potentially lead to lower premiums.

- Bundle Policies: Some insurance companies offer discounts when you bundle multiple policies, such as life insurance and home insurance. This can be a cost-effective strategy to manage your overall insurance costs.

- Consider Riders and Add-Ons: Riders and add-ons can enhance your life insurance policy, but they may also increase your premiums. Carefully evaluate the benefits and costs of these additions to ensure they align with your needs and budget.

Future Trends in Life Insurance Costs

The life insurance industry is evolving, and several trends may impact the cost of premiums in the future. Here are some potential developments to consider:

- Advancements in Technology: The increasing use of technology in the insurance industry, such as digital applications and health tracking devices, may allow for more precise risk assessment. This could lead to more accurate premiums based on an individual’s unique health and lifestyle data.

- Changing Demographics: Shifts in population demographics, such as an aging population or changes in health trends, can influence the overall risk pool. These demographic changes may impact the pricing structure for life insurance policies.

- Regulatory Changes: Government regulations and industry standards can affect the cost of life insurance. Any changes in these regulations, such as those related to underwriting practices or premium calculation methods, could have a direct impact on premiums.

- Innovation in Insurance Products: Insurance companies are continuously developing new products and services. The introduction of innovative life insurance policies with unique features may offer alternative pricing structures, potentially impacting the overall cost landscape.

Conclusion

Understanding the cost of life insurance per month is crucial for individuals seeking to protect their loved ones financially. By recognizing the factors that influence premiums and adopting strategies to manage costs, individuals can make informed decisions about their life insurance coverage. The dynamic nature of the insurance industry means that staying informed about trends and advancements can further empower individuals to navigate the ever-changing landscape of life insurance costs.

How often should I review my life insurance coverage and premiums?

+It’s recommended to review your life insurance coverage and premiums at least once a year or whenever there are significant changes in your life, such as marriage, the birth of a child, or a major career shift. Regular reviews ensure your coverage remains adequate and aligned with your financial goals.

Can life insurance premiums change over time?

+Yes, life insurance premiums can change over time. Factors like age, health, and lifestyle changes can impact your risk profile, leading to adjustments in premiums. It’s essential to keep your insurance provider informed of any significant changes to ensure accurate coverage and premiums.

What are some common mistakes to avoid when selecting life insurance coverage?

+Common mistakes include choosing inadequate coverage amounts, neglecting to review and update policies regularly, and failing to understand the differences between term and permanent life insurance. It’s crucial to thoroughly research and understand your options to make informed decisions.