Life Insurance Define

Life insurance is a vital financial tool that provides individuals and their families with a sense of security and peace of mind. In a world filled with uncertainties, it serves as a safeguard, offering financial protection and support during life's unexpected twists and turns. Understanding life insurance is crucial, as it empowers individuals to make informed decisions about their financial future and ensures a safety net for their loved ones.

The Essence of Life Insurance

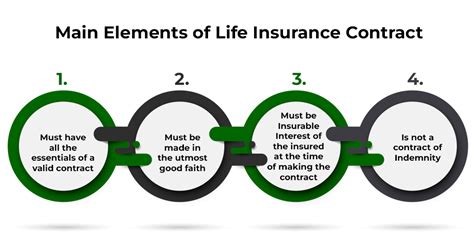

Life insurance, at its core, is a contract between an individual (the policyholder) and an insurance company. This contract promises a monetary benefit, known as the death benefit, to the designated beneficiaries upon the policyholder’s death. The primary purpose is to provide financial stability and support to those left behind, ensuring they can maintain their standard of living and fulfill their financial obligations even in the absence of the policyholder.

Key Components and Types

Life insurance policies come in various forms, each designed to cater to different needs and circumstances. Here’s an overview of the main types:

Term Life Insurance

Term life insurance is a straightforward and cost-effective option. It provides coverage for a specified period, known as the term, typically ranging from 10 to 30 years. During this term, the policyholder pays regular premiums, and in the event of their death, the beneficiaries receive the death benefit. This type is ideal for individuals seeking coverage for a specific period, such as while their children are dependent or during their working years.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, offers coverage for the policyholder’s entire life. It combines a death benefit with a savings or investment component, known as the cash value. The policyholder pays premiums throughout their life, and the cash value grows over time, providing a financial benefit even if the policy is not claimed. Whole life insurance is a long-term investment and is suitable for those seeking lifetime coverage and a potential source of retirement income.

Universal Life Insurance

Universal life insurance offers flexibility in premium payments and coverage amounts. Policyholders can adjust their premiums and death benefit based on their needs and financial situation. The policy accumulates a cash value, similar to whole life insurance, but with the added benefit of allowing policyholders to access this cash value through loans or withdrawals. This type is attractive to individuals seeking customizable coverage and the ability to respond to changing financial circumstances.

Variable Life Insurance

Variable life insurance combines life insurance coverage with the potential for investment growth. The policyholder’s premiums are invested in a variety of funds, allowing for the potential of higher returns. The death benefit and cash value are directly tied to the performance of these investments. While it offers the possibility of significant growth, it also carries higher risk compared to traditional life insurance policies.

Group Life Insurance

Group life insurance is often provided through employers as part of a benefits package. It offers coverage to a group of individuals, such as employees, at a lower cost compared to individual policies. The coverage typically ends when the individual leaves the company, making it a temporary solution. Group life insurance is a convenient and affordable way for employees to obtain basic life insurance coverage.

How Life Insurance Works

The process of obtaining and utilizing life insurance involves several key steps:

Application and Underwriting

To apply for life insurance, individuals typically complete an application providing personal and health-related information. The insurance company then assesses the applicant’s risk through a process called underwriting. This involves evaluating the individual’s health, lifestyle, and other factors to determine the premium and coverage amount. The underwriting process may require medical exams and the disclosure of relevant medical history.

Premium Payments

Once the policy is approved, the policyholder pays regular premiums to maintain the coverage. The premium amount is based on the individual’s age, health, and the type of policy chosen. Premiums can be paid monthly, quarterly, or annually, depending on the policy and the policyholder’s preference.

Benefit Payout

In the event of the policyholder’s death, the beneficiaries named in the policy receive the death benefit. The beneficiaries can be spouses, children, parents, or any other designated individuals. The death benefit is paid as a lump sum, providing immediate financial relief to cover funeral expenses, outstanding debts, and ongoing living expenses.

Cash Value and Loans

For policies with a cash value component, such as whole life and universal life insurance, policyholders can access this cash value through loans or withdrawals. This feature provides a source of funds for various purposes, such as funding a child’s education, covering emergency expenses, or supplementing retirement income. However, it’s important to note that borrowing against the cash value reduces the policy’s death benefit and may have tax implications.

Benefits and Considerations

Life insurance offers a range of benefits and considerations that individuals should carefully evaluate when choosing a policy:

Financial Security

The primary benefit of life insurance is the financial security it provides. In the event of the policyholder’s death, the death benefit ensures that their loved ones can maintain their financial stability and continue to meet their obligations. It covers expenses such as mortgages, education costs, and daily living expenses, providing a safety net during a difficult time.

Peace of Mind

Knowing that their family’s financial future is secured brings peace of mind to policyholders. Life insurance allows individuals to focus on their goals and aspirations without worrying about the financial burden their passing might impose on their loved ones. It provides a sense of control and assurance, enabling individuals to live their lives to the fullest.

Tax Benefits

Life insurance policies offer certain tax advantages. The death benefit is typically tax-free, providing beneficiaries with a substantial financial benefit without the burden of taxation. Additionally, the cash value growth in permanent life insurance policies may have tax-deferred benefits, allowing policyholders to accumulate wealth more efficiently.

Long-Term Planning

Life insurance is an essential component of long-term financial planning. It ensures that an individual’s financial goals, such as retirement planning or estate preservation, are not derailed by untimely death. Life insurance can be used to fund retirement, pay off debts, or leave a legacy for future generations.

Considerations

While life insurance is beneficial, there are a few considerations to keep in mind. The cost of premiums can vary significantly based on the policy type, the policyholder’s age and health, and the coverage amount. Additionally, some policies may have strict requirements for maintaining coverage, and failing to meet these requirements can result in policy cancellation. It’s crucial to carefully review the policy terms and understand the obligations and limitations.

Conclusion: Navigating Life’s Journey

Life insurance is a vital tool for navigating life’s journey with financial security and peace of mind. It empowers individuals to protect their loved ones and ensure their financial well-being, even in the face of unexpected events. By understanding the different types of life insurance and their features, individuals can make informed decisions and choose a policy that aligns with their unique needs and circumstances.

How much life insurance coverage do I need?

+

The amount of life insurance coverage you need depends on your personal circumstances and financial goals. Factors such as your income, debts, dependents, and future financial obligations should be considered. A general rule of thumb is to have coverage that is 10-15 times your annual income, but it’s best to consult with a financial advisor to determine the appropriate amount for your specific situation.

Can I change my life insurance policy after purchasing it?

+

Yes, you can often make changes to your life insurance policy, such as increasing or decreasing the coverage amount, adding or removing beneficiaries, or switching policy types. However, changes may impact your premiums and the overall terms of your policy. It’s important to review your policy regularly and consult with your insurance provider to make any necessary adjustments.

What happens if I miss a premium payment?

+

Missing a premium payment can have consequences. Depending on your policy’s terms, you may have a grace period during which you can make the payment without any penalties. If you fail to pay within the grace period, your policy may lapse, and you may need to reapply for coverage, which could result in higher premiums or a denial of coverage due to changes in your health or age.

Can I have multiple life insurance policies?

+

Yes, you can have multiple life insurance policies. Some individuals choose to have a combination of term and permanent life insurance policies to meet different needs. For example, you might have a term policy to cover short-term financial obligations and a permanent policy for long-term goals. However, it’s essential to manage your policies and premiums carefully to avoid unnecessary expenses.