Life Insurance Login

In today's fast-paced world, safeguarding your financial well-being and that of your loved ones is paramount. Life insurance serves as a crucial tool to provide peace of mind and ensure financial stability during uncertain times. However, navigating the digital realm of life insurance can be a daunting task, especially when it comes to logging in securely and accessing your policy information. In this comprehensive guide, we will explore the ins and outs of life insurance login, offering expert insights and practical tips to make the process seamless and secure.

As the digital landscape evolves, life insurance companies have embraced online platforms to enhance customer experience and accessibility. From policy management to claims processing, the ability to log in securely to your life insurance account is essential. Whether you are a policyholder seeking to review your coverage or an agent aiming to efficiently manage client portfolios, understanding the nuances of life insurance login is key to unlocking a range of valuable benefits.

The Importance of a Secure Login

In the digital age, where sensitive financial information is often exchanged online, ensuring the security of your life insurance login is of utmost importance. A secure login process protects your personal and financial data from unauthorized access, safeguarding your privacy and the integrity of your insurance portfolio. Here's why a robust login system is crucial:

- Data Protection: Your life insurance policy contains valuable personal and financial details. A secure login ensures that this information remains confidential and inaccessible to malicious actors.

- Fraud Prevention: By implementing strong security measures, life insurance companies can mitigate the risk of fraud and identity theft, protecting both policyholders and the company's reputation.

- Peace of Mind: Knowing that your login process is secure provides a sense of reassurance, allowing you to focus on the benefits of your life insurance policy without worrying about potential security breaches.

Understanding the Login Process

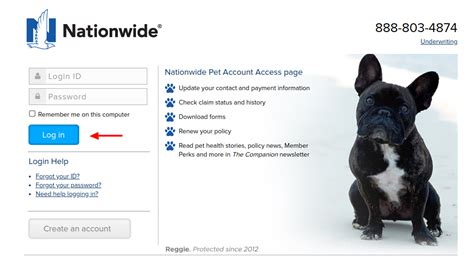

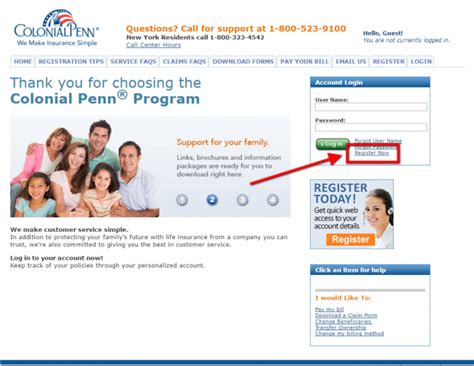

The life insurance login process typically involves a series of steps designed to verify your identity and grant secure access to your policy information. While the exact procedure may vary slightly between insurance providers, the core elements remain consistent. Here's a breakdown of what you can expect:

- Username and Password: Most life insurance companies require you to create a unique username and a strong password during the account setup process. This combination serves as the first line of defense, ensuring that only authorized individuals can access your account.

- Two-Factor Authentication (2FA): An increasingly common security measure, 2FA adds an extra layer of protection by requiring a second form of verification, such as a code sent to your mobile device or an authentication app.

- Biometric Authentication: Some insurance providers offer biometric authentication options, allowing you to use your fingerprint or facial recognition for a faster and more secure login experience.

- Security Questions: In addition to traditional login credentials, many companies implement security questions to further verify your identity. These questions should be personal and known only to you.

- Login Activity Monitoring: Advanced life insurance platforms may utilize login activity monitoring to detect suspicious behavior, such as multiple failed login attempts or access from unusual locations. This feature adds an extra layer of protection by alerting both the company and the policyholder of potential security threats.

By understanding the various security measures in place, you can feel confident that your life insurance login process is robust and secure.

Navigating the Life Insurance Login Platform

Once you've successfully logged in to your life insurance account, you'll gain access to a wealth of information and tools designed to enhance your insurance experience. Here's an overview of what you can expect from a well-designed life insurance login platform:

Policy Overview

The policy overview section provides a comprehensive snapshot of your life insurance coverage. Here, you can review key details such as:

- Policy Number: A unique identifier for your policy, allowing you to easily reference and manage your coverage.

- Coverage Amount: The financial protection provided by your life insurance policy, including any additional riders or benefits.

- Beneficiaries: A list of individuals designated to receive the policy payout upon your passing. You can review and update beneficiary information as needed.

- Premium Payments: An overview of your premium payment history, including due dates and payment methods.

Account Management

The account management section offers a range of tools to help you efficiently manage your life insurance policy. Here are some key features you may find:

- Premium Payment Options: Explore different payment methods and schedules to find the most convenient option for you. Many platforms offer automatic payments or one-time payment options.

- Policy Updates: Easily make changes to your policy, such as updating your personal information, adding or removing beneficiaries, or adjusting coverage amounts.

- Rider Management: Review and manage any additional riders or benefits attached to your policy. Riders can provide enhanced coverage for specific needs, such as accidental death or critical illness.

- Claim Status: If you've filed a claim, this section will provide real-time updates on the progress of your claim, allowing you to track the process and stay informed.

Resource Center

A well-designed life insurance login platform often includes a resource center, offering valuable educational materials and tools to help you make informed decisions. Here's what you might find:

- Insurance Glossary: A comprehensive glossary of insurance terms, helping you understand the language of life insurance and navigate complex policies with ease.

- Educational Articles: Informative articles covering a range of topics, from the basics of life insurance to advanced planning strategies, can help you stay informed and make confident choices.

- Calculator Tools: Interactive calculators can assist you in estimating your insurance needs, determining the right coverage amount, and planning for the future.

- Contact Information: Quick access to customer support channels, including phone numbers, email addresses, and live chat options, ensures you can get assistance whenever needed.

Maximizing the Benefits of Life Insurance Login

Logging in to your life insurance account offers more than just access to policy details. It provides a gateway to a range of valuable benefits and services that can enhance your overall financial planning. Here's how you can make the most of your life insurance login:

Policy Optimization

Regularly reviewing your life insurance policy and making necessary adjustments is crucial to ensuring it aligns with your changing needs and circumstances. The account management features within your login platform can simplify this process, allowing you to:

- Update Personal Information: Life events such as marriage, divorce, or the birth of a child can impact your insurance needs. Stay up-to-date by reviewing and updating your personal information to ensure your policy remains relevant.

- Adjust Coverage: As your financial situation evolves, you may need to increase or decrease your coverage amount. The login platform often provides tools to make these adjustments seamlessly.

- Explore Riders: Life insurance riders can provide additional protection for specific needs. Review the available riders and consider adding them to your policy to enhance your coverage.

Efficient Claims Process

In the unfortunate event of a claim, a secure and user-friendly life insurance login platform can streamline the claims process, ensuring a smoother and less stressful experience. Here's how:

- File Claims Online: Many insurance providers offer the option to file claims directly through your login platform, eliminating the need for paper forms and manual submissions.

- Real-Time Updates: Stay informed about the status of your claim by accessing real-time updates within your login account. This transparency helps you understand the progress and expected timeline.

- Document Upload: Securely upload and submit the necessary documents for your claim, such as medical records or proof of death, directly through your login platform.

- Communication Channel: The login platform often serves as a dedicated communication channel between you and the insurance company, allowing for efficient and secure discussions regarding your claim.

Financial Planning Tools

Beyond policy management, life insurance login platforms often provide valuable financial planning tools to help you make informed decisions. These tools can include:

- Retirement Planning: Interactive calculators and resources can assist you in estimating your retirement needs and determining how life insurance can fit into your overall financial plan.

- Education Funding: Explore options for funding your children's education, including how life insurance proceeds can be utilized to cover educational expenses.

- Estate Planning: Understand the role of life insurance in your estate plan and how it can help provide financial security for your loved ones after your passing.

- Tax Benefits: Learn about the tax advantages associated with life insurance policies and how they can impact your overall financial strategy.

Staying Informed and Secure

As with any online platform, it's essential to stay vigilant and informed about potential security threats and best practices. Here are some key considerations to keep in mind:

Security Awareness

- Phishing Attempts: Be cautious of suspicious emails or messages claiming to be from your insurance provider. Never click on links or provide sensitive information unless you are certain of the sender's legitimacy.

- Password Management: Create strong, unique passwords for your life insurance login and consider using a password manager to securely store and manage your credentials.

- Regular Updates: Keep your login platform up-to-date by installing any available security patches or updates. This ensures you have the latest protection against potential vulnerabilities.

Privacy and Data Protection

- Data Sharing: Review the insurance provider's privacy policy to understand how your data is collected, stored, and shared. Ensure that your personal information is protected and used responsibly.

- Device Security: Protect your devices with antivirus software and keep them updated to prevent unauthorized access to your life insurance login information.

- Public Wi-Fi: Avoid logging in to your life insurance account on public or unsecured Wi-Fi networks, as these can increase the risk of data interception.

Regular Reviews

Schedule regular reviews of your life insurance policy and login platform to ensure everything is up-to-date and aligned with your current needs. Here's what to consider:

- Policy Review: Assess whether your current coverage meets your evolving financial goals and circumstances. Adjust your policy as necessary to maintain adequate protection.

- Beneficiary Review: Regularly review and update your beneficiary designations to ensure the payout goes to the right individuals upon your passing.

- Premium Payments: Stay on top of your premium payment schedule to avoid lapses in coverage. Consider setting up automatic payments for convenience and peace of mind.

The Future of Life Insurance Login

As technology continues to advance, the future of life insurance login holds exciting possibilities. Here's a glimpse into what we can expect:

Enhanced Security Measures

Life insurance providers are continually investing in cutting-edge security technologies to protect policyholders' data. Expect to see advancements such as:

- Biometric Authentication: The use of fingerprint, facial, or voice recognition for a more secure and convenient login experience.

- Blockchain Technology: Blockchain's decentralized nature can enhance data security and provide an immutable record of policy transactions.

- Artificial Intelligence (AI): AI-powered systems can detect and prevent fraudulent activities, further strengthening the security of your login process.

Seamless Integration

The future of life insurance login will likely involve seamless integration with other financial platforms and services. Policyholders can expect:

- Open Banking: Secure data sharing between life insurance providers and other financial institutions, enabling a more holistic view of your financial portfolio.

- Digital Wallet Integration: The ability to store and manage your life insurance policy information within digital wallets, providing quick and secure access to your policy details.

- Mobile App Enhancements: Mobile apps will continue to evolve, offering a more user-friendly and feature-rich experience for managing your life insurance policies on the go.

AI-Driven Personalization

Artificial intelligence will play a significant role in personalizing the life insurance login experience. AI-powered platforms can:

- Offer Tailored Recommendations: Analyze your policy and financial situation to provide personalized recommendations for optimizing your coverage.

- Automate Routine Tasks: Streamline repetitive tasks, such as premium payments or policy updates, through automated processes.

- Predictive Analytics: Utilize predictive models to anticipate your insurance needs, ensuring your policy remains aligned with your future financial goals.

FAQs

How often should I log in to my life insurance account?

+It's recommended to log in to your life insurance account at least once a year to review your policy and make any necessary updates. However, if you experience significant life changes or have concerns about your coverage, logging in more frequently can be beneficial.

Can I change my login credentials easily?

+Yes, most life insurance providers allow you to easily change your login credentials, including your username and password. This is an important security measure to ensure your account remains protected.

What should I do if I forget my login credentials?

+If you forget your login credentials, contact your life insurance provider's customer support team. They can guide you through the password reset process or provide other methods to regain access to your account securely.

Is it safe to use public Wi-Fi for life insurance login?

+Using public Wi-Fi for life insurance login is not recommended due to the increased risk of data interception. It's best to log in to your account from a secure, private network to protect your sensitive information.

Can I access my life insurance account on my mobile device?

+Absolutely! Most life insurance providers offer mobile-optimized websites or dedicated mobile apps, allowing you to access your account securely from your smartphone or tablet.

Logging in to your life insurance account is a critical step in managing your financial future. By understanding the security measures, navigating the platform effectively, and maximizing the benefits, you can ensure that your life insurance policy remains a powerful tool for protecting your loved ones and achieving your financial goals. Stay informed, stay secure, and make the most of your life insurance login experience.