Life Insurance Policies For Over 60

Life insurance policies for individuals over the age of 60 are an essential financial tool that often gets overlooked. As we navigate the later stages of life, it becomes increasingly important to consider how our loved ones will fare financially in the event of our passing. This article aims to delve into the intricacies of life insurance for seniors, exploring the various types of policies, the benefits they offer, and how to navigate the application process with ease.

Understanding Life Insurance Policies for Over 60

Life insurance policies for individuals aged 60 and above are tailored to meet the unique financial needs and circumstances of seniors. These policies provide a safety net for your loved ones, ensuring they are financially secure and can maintain their standard of living even after your passing. It’s a common misconception that life insurance is solely for younger individuals; in reality, it can be an invaluable asset for seniors as well.

Types of Life Insurance for Over 60

There are several types of life insurance policies available for individuals over 60, each with its own set of benefits and considerations. Here’s a breakdown of the most common types:

- Term Life Insurance: This type of policy provides coverage for a specific period, typically ranging from 10 to 30 years. It is ideal for individuals who want coverage for a set period, such as until their children become independent or until a mortgage is paid off. Term life insurance is generally more affordable than other types, making it a popular choice for seniors on a budget.

- Whole Life Insurance: Unlike term life insurance, whole life policies provide coverage for your entire life. They also accumulate cash value over time, which can be borrowed against or withdrawn if needed. This type of policy offers more flexibility and can be a good option for seniors who want guaranteed coverage and the potential for financial growth.

- Guaranteed Issue Life Insurance: Designed for individuals who may have difficulty qualifying for traditional life insurance due to health conditions or age, guaranteed issue policies do not require a medical exam. However, they often have limited benefits and higher premiums. This type of policy can be a last resort for seniors with pre-existing conditions.

- Burial or Final Expense Insurance: As the name suggests, this policy is specifically designed to cover funeral and burial expenses. It provides a lump-sum payment to your beneficiaries upon your passing, ensuring that your final wishes are carried out without financial burden on your loved ones.

The choice of policy type depends on your individual needs, financial situation, and health status. It's essential to carefully consider your options and seek advice from a qualified insurance agent or financial advisor.

The Benefits of Life Insurance for Over 60

Life insurance policies offer a range of benefits that can provide significant financial security and peace of mind for seniors and their families. Here are some key advantages:

- Financial Security for Loved Ones: The primary benefit of life insurance is providing financial stability for your family or chosen beneficiaries. It ensures they have the means to cover immediate expenses, such as funeral costs, and can maintain their standard of living without your income.

- Debt Repayment: Life insurance can be used to repay outstanding debts, such as mortgages, credit card balances, or personal loans. This relieves your loved ones from the burden of these financial obligations and prevents them from inheriting your debt.

- Covering Final Expenses: Funeral and burial costs can be significant, often running into thousands of dollars. A life insurance policy ensures that your final expenses are covered, so your family doesn't have to make difficult financial decisions during their time of grief.

- Legacy Building: For those with a philanthropic bent, life insurance can be used to leave a lasting legacy. You can name a charity or organization as your beneficiary, ensuring your chosen cause continues to receive support even after your passing.

- Estate Planning: Life insurance can be a valuable tool in estate planning, helping to minimize estate taxes and ensure a smooth transition of assets to your heirs. It can also be used to fund trusts or provide for specific individuals, such as grandchildren.

Navigating the Application Process

Applying for life insurance as a senior can seem daunting, but with the right approach, it can be a straightforward process. Here’s a step-by-step guide to help you navigate the application journey:

Step 1: Evaluate Your Needs

Before applying for life insurance, it’s crucial to assess your specific needs. Consider factors such as your financial obligations, the number of dependents you have, and your desired level of coverage. This evaluation will help you determine the type and amount of life insurance that’s right for you.

Step 2: Compare Providers and Policies

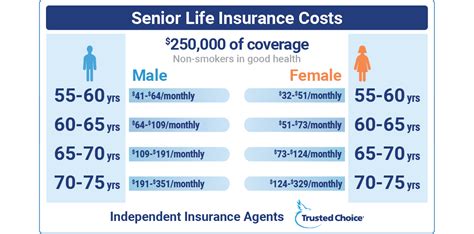

With a clear understanding of your needs, it’s time to research and compare different life insurance providers and their policies. Look for companies that specialize in senior life insurance and offer policies tailored to your age group. Compare premiums, coverage amounts, and any additional benefits or features to find the best fit for your circumstances.

Step 3: Underwriting Process

The underwriting process is where the insurance company assesses your risk level and determines your premium. This typically involves a medical exam and a review of your medical history. For seniors, the underwriting process may be more extensive, as health conditions can impact your eligibility and premium rates.

If you have pre-existing health conditions, it's important to be transparent about your health status during the application process. While this may impact your eligibility or premium, it's better to be upfront to avoid any issues down the line.

Step 4: Policy Selection and Purchase

Once you’ve been approved for a policy, carefully review the terms and conditions. Ensure that the coverage amount, beneficiaries, and any additional features meet your needs. Once you’re satisfied, you can proceed with the purchase and secure your life insurance coverage.

Performance Analysis and Real-World Examples

To better understand the impact and effectiveness of life insurance for seniors, let’s examine some real-world examples and analyze the performance of different policies.

Case Study: Term Life Insurance for Retirement Income

John, aged 62, wanted to ensure his retirement savings lasted throughout his golden years. He purchased a 10-year term life insurance policy with a coverage amount of $250,000. The policy was affordable, allowing him to maintain his desired standard of living without breaking the bank. In the event of his passing, the policy would provide his spouse with a substantial sum to cover any unexpected expenses and ensure a comfortable retirement.

Case Study: Whole Life Insurance for Legacy Building

Sarah, aged 65, had always been passionate about giving back to her community. She decided to purchase a whole life insurance policy with a coverage amount of $500,000. The policy’s cash value component allowed her to accumulate savings over time, which she intended to use for philanthropic endeavors. Upon her passing, the full death benefit would be donated to her chosen charity, ensuring her legacy lived on.

Case Study: Burial Insurance for Peace of Mind

Michael, aged 70, wanted to ease the financial burden on his family in the event of his passing. He opted for a burial insurance policy with a coverage amount of $10,000. This policy provided him with the peace of mind that his final wishes would be respected, and his family wouldn’t have to worry about funeral expenses. The policy’s simplicity and affordability made it an attractive choice for Michael.

| Case Study | Policy Type | Coverage Amount | Benefits |

|---|---|---|---|

| John | Term Life | $250,000 | Affordable coverage for retirement income |

| Sarah | Whole Life | $500,000 | Legacy building and cash value accumulation |

| Michael | Burial Insurance | $10,000 | Peace of mind for final expenses |

Evidence-Based Future Implications

The future of life insurance for seniors looks promising, with several trends and developments shaping the industry. Here are some key implications to consider:

- Increasing Awareness: As more seniors recognize the value of life insurance, there's a growing demand for policies tailored to their needs. This increased awareness is driving innovation and competition among insurance providers, leading to more affordable and accessible options.

- Simplified Underwriting: Advances in technology and data analysis are streamlining the underwriting process. This means faster application and approval times, making it easier for seniors to secure life insurance coverage.

- Flexibility and Customization: Insurance providers are offering more flexible and customizable policies to meet the diverse needs of seniors. This includes options for riders and additional benefits, allowing individuals to create a policy that aligns with their specific goals and circumstances.

- Focus on Health and Wellness: With a growing emphasis on health and wellness, some insurance providers are offering incentives and discounts for seniors who maintain healthy lifestyles. This trend promotes healthier habits and can lead to more affordable life insurance premiums.

Frequently Asked Questions

Can I get life insurance if I have a pre-existing health condition?

+

Yes, many life insurance providers offer policies specifically for individuals with pre-existing health conditions. These policies, known as guaranteed issue or simplified issue, do not require a medical exam. However, they often have higher premiums and limited benefits. It’s important to carefully review the policy terms and compare options to find the best fit for your needs.

How much life insurance coverage do I need as a senior?

+

The amount of life insurance coverage you need as a senior depends on various factors, including your financial obligations, the number of dependents you have, and your desired legacy. A general rule of thumb is to aim for coverage that is at least 5-10 times your annual income. However, it’s best to consult with a financial advisor or insurance agent to determine the precise amount that aligns with your individual circumstances.

Are there any tax benefits associated with life insurance for seniors?

+

Yes, life insurance policies can offer tax advantages. The death benefit proceeds from a life insurance policy are typically tax-free, providing a significant financial benefit to your beneficiaries. Additionally, the cash value accumulation in certain types of policies, such as whole life insurance, may offer tax-deferred growth. It’s important to consult with a tax professional to fully understand the tax implications of your specific policy.

Can I change or cancel my life insurance policy once it’s in place?

+

Yes, you have the right to change or cancel your life insurance policy at any time. However, it’s important to carefully consider the potential consequences. Canceling a policy may result in the loss of accumulated cash value and could leave you without coverage. If you want to make changes, such as increasing coverage or adding riders, it’s best to consult with your insurance agent to understand the options and potential impact on your premiums.

How do I choose the right life insurance provider for my needs as a senior?

+

Choosing the right life insurance provider is crucial. Look for companies that specialize in senior life insurance and have a good reputation for customer service and financial stability. Compare policy terms, premiums, and any additional benefits or features offered. It’s also beneficial to seek recommendations from trusted sources, such as financial advisors or friends and family who have had positive experiences with certain providers.

Life insurance policies for individuals over 60 are a valuable tool for financial security and peace of mind. By understanding the different types of policies, their benefits, and the application process, seniors can make informed decisions to protect their loved ones and ensure a comfortable future. With increasing awareness and industry innovations, life insurance is becoming more accessible and tailored to meet the unique needs of seniors.