Life Insurance Policy New York

Understanding the intricacies of life insurance policies in the diverse and complex landscape of New York is crucial for anyone seeking financial protection and peace of mind. This comprehensive guide aims to demystify the process, offering an in-depth analysis of the key aspects of life insurance in the Empire State.

The Importance of Life Insurance in New York

New York, known for its bustling cities and diverse population, presents a unique set of financial considerations. Life insurance policies play a pivotal role in safeguarding the financial well-being of individuals and their families in this dynamic environment. With a high cost of living and a wide range of economic activities, from Wall Street finance to creative industries, having adequate life insurance coverage is essential.

Consider the following statistics: according to a 2022 survey by the Insurance Information Institute, over 61% of New York residents own some form of life insurance. This highlights the state's awareness of the importance of financial planning. However, with such a large market, choosing the right policy can be daunting. This guide aims to provide clarity and ensure New Yorkers make informed decisions.

Types of Life Insurance Policies in New York

Life insurance policies in New York come in various forms, each tailored to meet specific needs. Here's an overview of the main types:

Term Life Insurance

Term life insurance is a popular choice for New Yorkers seeking affordable coverage for a defined period, typically ranging from 10 to 30 years. It offers a death benefit to beneficiaries if the policyholder passes away during the term. For instance, a 30-year-old New York resident can secure a $500,000 term life policy for approximately $25 per month, according to Policygenius (as of January 2023). This makes it an attractive option for those on a budget or with short-term financial goals.

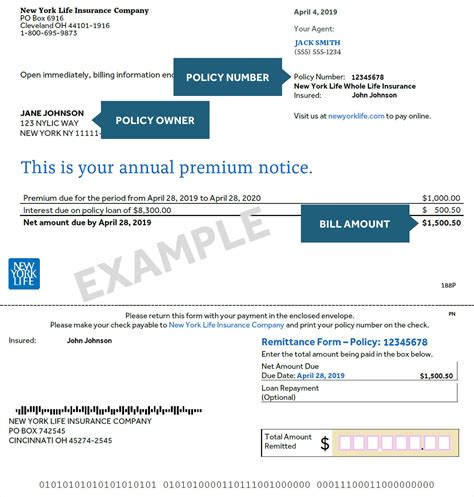

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, provides coverage for the policyholder's entire life. It includes a cash value component that grows over time, offering a savings element. The cost of whole life insurance is typically higher than term life, but it provides long-term financial protection and stability. For example, a 40-year-old New Yorker might pay around $200 per month for a $250,000 whole life policy, again based on Policygenius data.

Universal Life Insurance

Universal life insurance is a flexible option that allows policyholders to adjust their coverage and premiums over time. It combines the death benefit of term life with the cash value growth of whole life, offering a customizable approach. This type of policy is ideal for those who want control over their coverage and the ability to adapt to changing financial circumstances. According to ValuePenguin, a 35-year-old New York resident could expect to pay around $130 per month for a $500,000 universal life policy (as of January 2023).

Variable Life Insurance

Variable life insurance policies offer a unique investment component, allowing policyholders to allocate their cash value among different investment options. This provides the potential for higher returns but also carries more risk. It's a suitable choice for those comfortable with market fluctuations and seeking investment opportunities within their life insurance policy.

Group Life Insurance

Many New Yorkers gain access to life insurance through their employers, which often offer group life insurance policies as part of their benefits package. These policies are typically more affordable and convenient, as they are managed through the employer. However, coverage may be limited, and the policy may not be portable if the employee leaves the job.

| Life Insurance Type | Key Features |

|---|---|

| Term Life | Affordable, temporary coverage with fixed premiums and death benefit. |

| Whole Life | Lifetime coverage with cash value accumulation and higher premiums. |

| Universal Life | Flexible, customizable coverage with adjustable premiums and death benefit. |

| Variable Life | Investment-linked policy with potential for higher returns but increased risk. |

| Group Life | Affordable coverage through employers, often with limited portability. |

Key Considerations for New Yorkers

When navigating the life insurance landscape in New York, there are several key factors to keep in mind:

Cost of Living

New York's high cost of living can significantly impact insurance needs. Residents often require higher coverage amounts to ensure their loved ones' financial security in the event of their passing. For instance, a 2022 report by the New York State Department of Financial Services noted that the average life insurance policy in the state was for $220,000, reflecting the higher financial demands of living in the region.

Financial Goals and Needs

Understanding personal financial goals is crucial. Whether it's covering funeral expenses, paying off debts, or providing long-term financial support for dependents, the type and amount of life insurance coverage should align with these goals. For example, a 35-year-old New York couple with two children might opt for a 20-year term life policy to ensure their children's education and other financial needs are met in the event of their untimely demise.

Health and Lifestyle Factors

Insurance providers assess policy applications based on health and lifestyle. Pre-existing medical conditions or high-risk hobbies can impact eligibility and premiums. It's important to be honest and transparent during the application process to avoid issues with coverage later on. For instance, a smoker in New York might pay double or more for a life insurance policy compared to a non-smoker, according to Healthline (as of January 2023).

Policy Riders and Add-ons

Life insurance policies often come with optional riders or add-ons that can enhance coverage. These may include provisions for long-term care, accelerated benefits in case of critical illness, or waivers for premium payments during certain circumstances. While these add-ons can increase policy value, they also raise the cost. It's essential to carefully consider which riders are necessary and which are optional.

Choosing the Right Provider

With a plethora of life insurance providers operating in New York, selecting the right one can be a challenge. Here are some key considerations:

Reputation and Financial Stability

Look for providers with a strong track record and financial stability. Check ratings from independent agencies like AM Best or Standard & Poor's to ensure the company is reliable and can meet its obligations over the long term. A company's reputation for customer service and claim handling is also crucial, as it can impact the overall experience with the policy.

Policy Options and Flexibility

Consider the range of policies offered and the flexibility they provide. Some providers specialize in certain types of policies, while others offer a more comprehensive suite of options. Choose a provider that offers policies aligned with your specific needs and goals, whether it's term life, whole life, or a combination of both.

Premium Costs and Payment Options

Compare premiums and payment options to find the most affordable and convenient plan. Some providers offer discounts for multiple policies or loyalty programs, while others may have flexible payment plans. Ensure the premium costs fit within your budget and consider any potential future adjustments to your financial situation.

Claim Process and Customer Service

Research the provider's claim process and customer service reputation. A smooth claim process is essential, especially in times of need. Look for providers with a straightforward and transparent process, and consider customer reviews and ratings to gauge their level of service.

The Application Process

Applying for a life insurance policy in New York typically involves the following steps:

- Research and Comparison: Use online tools and resources to compare policies and providers, ensuring you understand the coverage and terms.

- Choose a Provider: Select a provider based on your research and specific needs.

- Complete an Application: Provide personal and health information, typically online or with the assistance of an agent.

- Medical Exam (if required): Depending on the policy and provider, you may need to undergo a medical exam to assess your health status.

- Underwriting: The provider will review your application and medical exam (if applicable) to determine your eligibility and premiums.

- Policy Issuance: Once approved, you'll receive your policy documents, outlining the coverage, premiums, and other important details.

- Review and Acceptance: Carefully review the policy and ensure it meets your expectations. You have the right to accept or decline the policy.

Frequently Asked Questions

What is the average cost of life insurance in New York?

+

The cost of life insurance in New York can vary widely based on factors such as age, health, and the type of policy. On average, a 30-year-old healthy individual might pay around 20 to 30 per month for a term life policy, while a whole life policy could cost upwards of $100 per month. It’s important to get quotes from multiple providers to find the best rate for your specific situation.

Can I get life insurance if I have a pre-existing medical condition?

+

Yes, individuals with pre-existing medical conditions can still obtain life insurance. However, the coverage may be more expensive, and you may need to undergo additional medical exams or provide detailed health information. It’s best to work with an agent who specializes in high-risk policies to find the most suitable option.

What happens if I move out of New York after purchasing a policy?

+

If you move out of New York, your life insurance policy will generally remain in force, as long as you continue to pay the premiums. However, it’s important to review your policy to understand any potential changes or adjustments that may occur due to your new location. Some policies may have specific provisions for out-of-state residents.

Can I cancel my life insurance policy if I no longer need it?

+

Yes, you can cancel your life insurance policy at any time. However, it’s important to note that you may not receive a refund for any premiums paid, especially if the policy has a surrender charge period. It’s best to discuss your options with your insurance provider to understand the potential financial implications of canceling your policy.

Are there any tax benefits associated with life insurance policies in New York?

+

Life insurance policies in New York can offer certain tax advantages. The death benefit proceeds are typically tax-free, and the cash value accumulation in permanent life insurance policies may also have tax benefits. However, it’s important to consult with a tax professional to understand how these benefits apply to your specific situation.