Life Insurance Policy Online

The rise of digital platforms and e-commerce has revolutionized the way we access and manage various services, including financial products like life insurance. With just a few clicks, individuals can now explore, compare, and secure life insurance policies online, offering a convenient and efficient alternative to traditional methods. This article delves into the world of online life insurance, exploring its benefits, the process involved, and the considerations one should make when navigating this digital landscape.

The Evolution of Life Insurance: Embracing Digital Convenience

The life insurance industry has witnessed a significant shift towards digital platforms, enabling individuals to bypass the traditional agent-based model and directly access a plethora of insurance options. This evolution has not only enhanced accessibility but also empowered consumers with a wealth of information, allowing them to make informed decisions about their financial protection.

Benefits of Online Life Insurance Policies

Online life insurance policies offer a range of advantages that cater to the modern consumer’s needs and preferences. Here’s a glimpse into some of the key benefits:

- Convenience and Accessibility: One of the most significant advantages is the ease and convenience of obtaining a life insurance policy online. Consumers can access multiple insurance providers from the comfort of their homes, eliminating the need for in-person meetings or extensive paperwork.

- Transparent Comparison: Digital platforms provide a transparent environment where individuals can easily compare various life insurance policies, their features, and premiums. This comparison empowers consumers to make choices that align with their specific needs and budget constraints.

- Time Efficiency: The online process streamlines the traditionally lengthy application and approval procedures. With digital tools, applicants can often receive near-instantaneous quotes and, in some cases, even immediate policy approvals, saving valuable time.

- Personalized Experience: Advanced algorithms and online tools enable a highly personalized experience. These tools can assess an individual’s unique circumstances, such as health conditions or lifestyle choices, to recommend suitable policies, ensuring a tailored coverage plan.

- Enhanced Customer Service: Many online insurance providers offer robust customer support, including 24⁄7 chat or call services, ensuring prompt assistance with any queries or concerns. This level of service adds a layer of reassurance to the online insurance journey.

The Process of Acquiring an Online Life Insurance Policy

The process of securing an online life insurance policy is designed to be straightforward and user-friendly. Here’s a step-by-step breakdown:

- Research and Comparison: Start by exploring various online insurance platforms or websites. Compare different providers based on their reputation, policy features, and premiums. Read reviews and seek recommendations to make an informed choice.

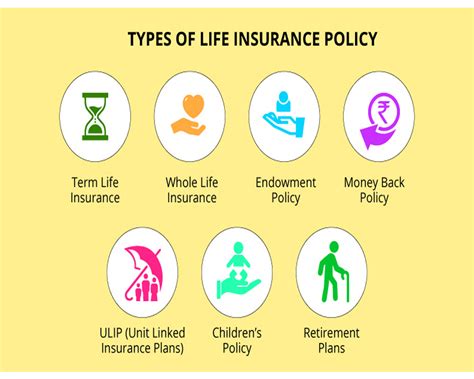

- Choose a Suitable Policy: Select a policy that best fits your needs and budget. Consider factors such as coverage amount, term length, and any additional benefits like critical illness coverage or income protection.

- Provide Personal Information: The next step involves filling out an online application form. This typically requires basic personal details, such as name, date of birth, and contact information, as well as specific questions about your health and lifestyle.

- Medical Assessment (if applicable): Depending on the policy and your health status, you may be required to undergo a medical assessment. This could involve a simple health questionnaire or, in some cases, a more comprehensive medical exam.

- Quote and Review: Once your application is processed, you’ll receive a quote outlining the policy details and premium. Carefully review this information, ensuring it aligns with your expectations and needs.

- Make the Purchase: If satisfied with the quote, you can proceed to purchase the policy online. This typically involves making an initial payment, often via secure online payment gateways.

- Policy Documentation: After purchasing, you’ll receive the policy documentation, which should be thoroughly reviewed and stored securely. This document outlines the policy’s terms, conditions, and coverage details.

- Regular Review and Updates: It’s essential to periodically review your life insurance policy to ensure it continues to meet your changing needs. Life events such as marriage, childbirth, or career changes may necessitate policy adjustments.

Considerations for Online Life Insurance Seekers

While the online life insurance process offers numerous benefits, there are a few considerations to keep in mind to ensure a smooth and successful experience:

- Reputable Providers: Ensure you choose a well-established and reputable insurance provider. Research their track record, financial stability, and customer reviews to make an informed decision.

- Policy Details: Carefully read and understand the policy’s terms and conditions. Pay attention to coverage limits, exclusions, and any specific conditions that may impact your eligibility or claim payouts.

- Transparency: Choose providers that offer transparent pricing and policy information. Avoid any policies or providers that seem vague or hide crucial details.

- Personalized Advice: While online tools can provide valuable insights, consider seeking personalized advice from a financial advisor or insurance expert, especially if you have complex financial needs or health concerns.

- Regular Reviews: As your life circumstances evolve, so should your insurance coverage. Regularly review your policy to ensure it aligns with your current needs and make adjustments as necessary.

| Provider | Premium (Average) | Coverage Features |

|---|---|---|

| InsureTech | $35/month | Term life, critical illness, income protection |

| LifeCover | $40/month | Whole life, accidental death benefit |

| OnlineProtect | $28/month | Term life, flexible term lengths |

How do I know if an online life insurance provider is trustworthy?

+Researching a provider’s reputation, financial stability, and customer reviews is essential. Look for providers with a solid track record and positive feedback. Additionally, check if they are licensed and regulated by relevant authorities.

Can I customize my online life insurance policy?

+Absolutely! Many online providers offer customizable policies, allowing you to choose coverage amounts, term lengths, and additional benefits like critical illness coverage or income protection.

What happens if my health status changes after purchasing an online life insurance policy?

+If your health status changes significantly, it’s important to inform your insurance provider. They may require an updated medical assessment, and depending on the change, your premiums or coverage may be adjusted accordingly.

Are online life insurance policies more affordable than traditional ones?

+Online life insurance policies can often be more cost-effective due to the reduced overhead costs associated with traditional agents. However, premiums can vary based on various factors, including age, health status, and coverage amount, so it’s best to compare multiple providers.