Life Insurance Premiums

In the world of personal finance, life insurance is an essential tool for protecting the financial well-being of individuals and their loved ones. One of the key aspects that often raises questions and considerations is the cost, or premiums, associated with life insurance policies. Understanding how these premiums are calculated, the factors that influence them, and the potential variations can empower individuals to make informed decisions about their coverage.

Unraveling the Mystery of Life Insurance Premiums

Life insurance premiums are the regular payments made by policyholders to maintain their coverage. These payments ensure that, in the event of the policyholder’s death, the beneficiaries will receive the agreed-upon death benefit. The calculation of premiums is a complex process, taking into account various factors that contribute to the overall risk profile of the insured individual.

Key Factors Influencing Life Insurance Premiums

The world of life insurance is a nuanced one, with numerous factors coming into play when it comes to determining premiums. Here’s an in-depth look at some of the most significant considerations:

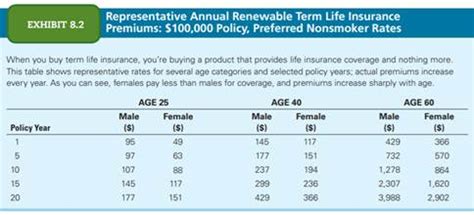

- Age and Life Expectancy: Age is perhaps the most fundamental factor in life insurance premium calculations. Younger individuals typically enjoy lower premiums due to their longer life expectancy. As we age, the risk of mortality increases, leading to higher premiums. For instance, a 30-year-old might pay significantly less than a 60-year-old for the same coverage.

- Health and Lifestyle: The state of one's health and lifestyle habits can greatly impact life insurance premiums. Insurers carefully evaluate an individual's medical history, including any pre-existing conditions or ongoing treatments. Additionally, factors such as smoking, alcohol consumption, and participation in high-risk activities can drive premiums higher. For example, a smoker may pay a premium surcharge compared to a non-smoker.

- Family History and Genetics: Life insurance companies also consider an individual's family history when assessing risk. If there's a history of certain diseases or conditions in the family, it may influence the premiums. For instance, a family with a history of heart disease may face higher premiums due to the increased risk associated with this condition.

- Occupation and Hobbies: The nature of one's occupation and leisure activities can significantly affect life insurance premiums. High-risk occupations, such as those involving heavy machinery or extreme sports, may lead to higher premiums due to the increased likelihood of accidents or injuries. Similarly, hobbies like skydiving or rock climbing can impact premiums, reflecting the elevated risk associated with these pursuits.

- Policy Type and Coverage: The type of life insurance policy chosen, whether it's term life or permanent life insurance, plays a crucial role in determining premiums. Term life insurance, which provides coverage for a specific period, generally has lower premiums compared to permanent life insurance, which offers coverage for the policyholder's entire life.

- Amount of Coverage: The level of coverage desired is another critical factor. Higher death benefit amounts typically correspond to higher premiums. Policyholders can opt for customized coverage amounts based on their financial goals and the needs of their beneficiaries.

It's important to note that life insurance companies use sophisticated actuarial models to assess these factors and calculate premiums. These models take into account statistical data and historical trends to ensure that premiums accurately reflect the risk associated with each policyholder.

Understanding Premium Variations

Life insurance premiums can vary significantly from one individual to another, even among those of similar ages and health profiles. This variation is due to the personalized nature of risk assessment. Insurance companies consider each applicant’s unique circumstances, resulting in tailored premium rates. Additionally, the competitive nature of the insurance industry often leads to variations in pricing strategies among different providers.

To illustrate the impact of these factors, let's consider a hypothetical scenario. Imagine two individuals, John and Sarah, both aged 35, seeking life insurance coverage. John leads a healthy lifestyle, with no significant health issues or risky hobbies. On the other hand, Sarah has a history of high blood pressure and engages in extreme sports. Despite being the same age, John is likely to receive a lower premium quote due to his lower risk profile.

| Factor | John's Profile | Sarah's Profile |

|---|---|---|

| Age | 35 years | 35 years |

| Health | Healthy | High Blood Pressure |

| Lifestyle | Low Risk | Extreme Sports |

| Premium Quote | $50/month | $75/month |

In this scenario, John's lower-risk profile results in a premium quote of $50 per month, while Sarah's higher-risk profile leads to a premium of $75 per month. This example highlights how individual circumstances can significantly influence life insurance premiums.

Strategies for Managing Life Insurance Premiums

While life insurance premiums are primarily determined by risk factors, there are strategies that individuals can employ to manage and potentially reduce their costs. Here are some expert insights to consider:

- Compare Multiple Quotes: Shopping around for life insurance is crucial. Different insurance companies may have varying pricing strategies and risk assessments. By obtaining multiple quotes, individuals can compare premiums and choose the most affordable option that meets their coverage needs.

- Consider Term Life Insurance: Term life insurance offers a cost-effective solution for individuals seeking coverage for a specific period, such as during their working years or while their children are dependent. By opting for term life insurance, policyholders can enjoy lower premiums compared to permanent life insurance, which provides lifelong coverage.

- Maintain a Healthy Lifestyle: Adopting and maintaining a healthy lifestyle can positively impact life insurance premiums. Regular exercise, a balanced diet, and avoiding risky behaviors can lead to a lower risk profile, resulting in more favorable premium rates. Additionally, quitting smoking can significantly reduce premiums over time.

- Bundle Policies: Many insurance companies offer discounts when individuals bundle multiple insurance policies. For instance, combining life insurance with other types of coverage, such as auto or home insurance, can lead to reduced premiums. It's worth exploring these bundling options to maximize savings.

- Review and Adjust Coverage Regularly: Life circumstances can change over time, and it's essential to review and adjust life insurance coverage accordingly. As financial goals and family situations evolve, policyholders may need to increase or decrease their coverage amounts. Regularly reviewing coverage ensures that it remains aligned with current needs and can help manage premiums effectively.

The Future of Life Insurance Premiums

The life insurance industry is continually evolving, driven by advancements in technology and changes in consumer behavior. As we look ahead, several trends and developments are expected to shape the future of life insurance premiums.

- Digital Transformation: The digital revolution is transforming the insurance industry, making it more accessible and efficient. Online platforms and digital tools are simplifying the application process, allowing individuals to obtain quotes and purchase policies with ease. This digital transformation is likely to lead to increased competition and potentially lower premiums as insurance companies strive to attract customers.

- Personalized Risk Assessment: Advances in data analytics and artificial intelligence are enabling insurance companies to conduct more precise risk assessments. By leveraging vast amounts of data, including genetic information and lifestyle patterns, insurers can develop highly personalized premium structures. This level of personalization may result in more accurate pricing and potentially lower premiums for individuals with favorable risk profiles.

- Wellness Programs and Incentives: Insurance companies are increasingly recognizing the value of promoting healthy lifestyles among their policyholders. Many insurers now offer wellness programs and incentives, such as discounted premiums or rewards for maintaining healthy habits. As these programs become more prevalent, they could encourage policyholders to adopt healthier lifestyles, ultimately leading to reduced premiums.

- Collaborative Risk Sharing: The insurance industry is exploring innovative risk-sharing models, such as peer-to-peer insurance and parametric insurance. These models distribute risk across a larger pool of individuals or entities, potentially reducing the financial burden on any single policyholder. While still in their early stages, these collaborative approaches could lead to more affordable life insurance premiums in the future.

Conclusion: Empowering Your Life Insurance Journey

Understanding the intricacies of life insurance premiums is a crucial step in making informed decisions about your financial protection. By grasping the factors that influence premiums and exploring strategies to manage costs, you can take control of your life insurance coverage. Whether you’re a young professional just starting your career or a seasoned individual with a family to protect, life insurance is a powerful tool to secure your loved ones’ future.

Remember, life insurance is not a one-size-fits-all solution. It's a personalized journey that requires careful consideration of your unique circumstances and financial goals. By staying informed, comparing options, and adopting healthy habits, you can navigate the world of life insurance premiums with confidence and ensure that your loved ones are protected.

Can I negotiate life insurance premiums?

+Negotiating life insurance premiums is generally not possible, as insurance companies use standardized actuarial models to calculate rates. However, shopping around and comparing quotes from different insurers can help you find the most competitive rates for your specific circumstances.

Do life insurance premiums increase with age?

+Yes, life insurance premiums typically increase with age. As individuals grow older, their risk of mortality increases, leading to higher premiums. However, the rate of increase can vary depending on the insurance company and other factors like health and lifestyle.

Are there any ways to reduce life insurance premiums for high-risk individuals?

+While high-risk individuals may face higher premiums, there are strategies to potentially reduce costs. These include maintaining a healthy lifestyle, quitting smoking, and regularly reviewing coverage to ensure it aligns with current needs. Additionally, some insurance companies offer discounts for certain health-related achievements.