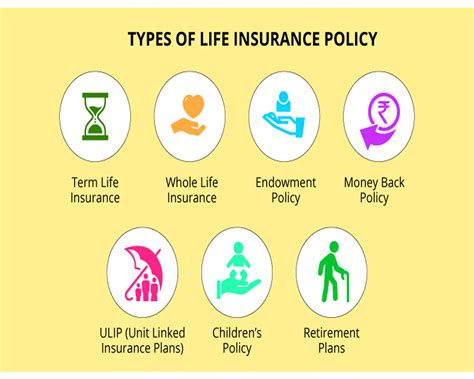

Life Insurance Type

Life insurance is an essential financial tool that provides security and peace of mind to individuals and their loved ones. With various types of life insurance policies available, understanding the differences and benefits is crucial when making an informed decision. This article aims to delve into the world of life insurance, exploring the different types, their key features, and how they can cater to diverse needs and life stages.

Term Life Insurance: A Temporal Solution

Term life insurance is a popular and cost-effective option, offering coverage for a specified period, typically ranging from 10 to 30 years. This type of insurance is designed to provide financial protection during specific life stages, such as when you have young children or significant financial obligations. Here’s a breakdown of its key characteristics:

- Affordable Premiums: Term life insurance is known for its budget-friendly premiums, making it an accessible choice for many. The cost remains stable throughout the policy term, ensuring predictable expenses.

- Specific Coverage Period: As the name suggests, term life insurance covers you for a defined “term.” Once the term expires, the coverage ends, and you may choose to renew or opt for a different policy.

- No Cash Value: Unlike permanent life insurance, term policies do not build cash value. They are purely for protection, ensuring your beneficiaries receive a death benefit if you pass away during the policy term.

- Flexible Options: You can customize term life insurance to suit your needs. Some policies offer the option to convert to permanent insurance, providing flexibility as your circumstances change.

- Suitable for Specific Goals: Term life insurance is ideal for covering temporary needs, such as providing for your family’s living expenses or paying off a mortgage in the event of your untimely demise.

Advantages of Term Life Insurance

Term life insurance shines when you have a clear idea of your financial goals and the duration for which you require coverage. For instance, if you’re a young professional with growing financial responsibilities, term insurance can provide a safety net for your family during your peak earning years. It’s a straightforward solution that offers comprehensive protection without the added complexities of permanent insurance.

| Pros of Term Life Insurance |

|---|

| Affordable and accessible for most budgets. |

| Focuses on providing a death benefit, ensuring financial security for beneficiaries. |

| Offers flexibility with the option to convert to permanent insurance. |

| Suitable for covering short-term financial obligations. |

Permanent Life Insurance: A Lasting Legacy

Unlike term life insurance, permanent life insurance offers lifelong coverage, making it an attractive option for those seeking long-term financial protection and planning. Here’s an overview of the two primary types of permanent life insurance:

Whole Life Insurance: The Comprehensive Package

Whole life insurance is a comprehensive and guaranteed permanent life insurance option. It provides coverage for your entire life and includes a cash value component, which grows over time and can be accessed during your lifetime. Key features include:

- Guaranteed Coverage: Whole life insurance ensures that as long as you pay your premiums, your policy remains active, providing a death benefit to your beneficiaries.

- Cash Value Accumulation: A unique aspect of whole life insurance is the cash value account. This account grows tax-deferred, allowing you to borrow against it or withdraw funds in the future.

- Consistent Premiums: Whole life insurance offers fixed and predictable premiums throughout your life, providing stability in your financial planning.

- Investment Potential: The cash value component can be invested, offering the potential for growth and additional financial benefits.

- Estate Planning Tool: Whole life insurance can be an effective tool for estate planning, providing a tax-efficient way to transfer wealth to your heirs.

Universal Life Insurance: Flexibility and Customization

Universal life insurance is another form of permanent life insurance that offers flexibility and customization. It combines the traditional death benefit of life insurance with a savings component, allowing policyholders to adjust their premiums and death benefit amounts as their needs change.

- Flexible Premiums: Universal life insurance allows you to vary your premium payments within certain limits, providing flexibility to adjust your coverage based on your financial situation.

- Cash Value Accumulation: Similar to whole life insurance, universal life policies have a cash value component that grows tax-deferred. You can access this cash value through loans or withdrawals.

- Customizable Death Benefit: The death benefit amount can be adjusted, ensuring it aligns with your changing needs and financial goals.

- Investment Opportunities: The cash value account can be invested, offering the potential for higher returns compared to whole life insurance.

- Long-Term Planning: Universal life insurance is ideal for those seeking lifelong coverage with the ability to adapt their policy as their circumstances evolve.

Choosing the Right Life Insurance: A Personalized Decision

Selecting the appropriate life insurance policy involves considering various factors, including your financial goals, family situation, and life stage. Here’s a simplified guide to help you make an informed choice:

- Term Life Insurance: Opt for term insurance if you have specific financial obligations or goals that will expire within a defined period. It’s an excellent choice for covering short-term needs without the added cost of permanent insurance.

- Whole Life Insurance: Consider whole life insurance if you’re seeking guaranteed coverage for your entire life and value the stability of fixed premiums. The cash value component also offers long-term savings and investment opportunities.

- Universal Life Insurance: Universal life insurance is a flexible option for those who want lifelong coverage but may have changing financial needs. It allows you to adjust your premiums and death benefit, making it adaptable to your circumstances.

Frequently Asked Questions

Can I switch from term life insurance to permanent life insurance?

+Yes, many term life insurance policies offer the option to convert to permanent life insurance. This allows you to transition from a temporary coverage solution to a lifelong protection plan. It’s important to review the terms and conditions of your policy to understand the conversion process and any potential limitations.

How does the cash value component of permanent life insurance work?

+The cash value component of permanent life insurance, such as whole life or universal life, acts as a savings account. It grows tax-deferred over time, and you can access this cash value through loans or withdrawals. However, it’s important to note that borrowing against the cash value may reduce the death benefit and impact the overall policy.

What happens if I miss a premium payment for my permanent life insurance policy?

+Missing a premium payment can have different consequences depending on the type of permanent life insurance you have. With whole life insurance, missing a payment may result in policy lapse if the cash value is insufficient to cover the premium. In contrast, universal life insurance offers more flexibility, allowing you to adjust premiums within certain limits.

Is life insurance tax-deductible?

+Life insurance premiums are generally not tax-deductible for individuals. However, certain types of life insurance policies, such as those owned by businesses or used for specific investment strategies, may offer tax benefits. It’s advisable to consult with a tax professional to understand the tax implications specific to your situation.

Can I have multiple life insurance policies simultaneously?

+Yes, it is possible to have multiple life insurance policies at the same time. This may be beneficial if you have specific financial goals or if your circumstances require different types of coverage. However, it’s essential to carefully review the terms and conditions of each policy to avoid duplication of benefits or other potential conflicts.