Life Insurance Whole Vs Term

Unveiling the Differences: Whole Life Insurance vs Term Life Insurance

When it comes to safeguarding your loved ones' future, life insurance is a crucial financial decision. Two primary types of life insurance policies dominate the market: Whole Life and Term Life. Understanding the distinctions between these policies is essential to making an informed choice tailored to your unique circumstances. This comprehensive guide delves into the nuances of both, offering an in-depth analysis to assist you in navigating this critical decision.

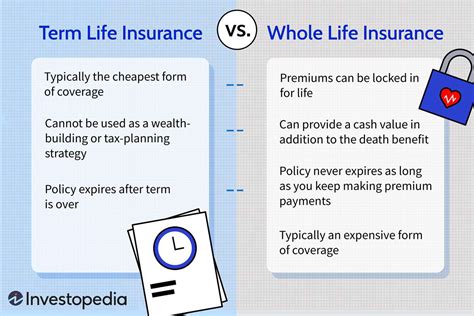

Whole Life Insurance: The Comprehensive Coverage

Whole Life Insurance, often referred to as permanent life insurance, is designed to provide lifelong coverage. This type of policy offers more than just a death benefit; it's an all-encompassing financial tool. Let's explore its key features and benefits.

Guaranteed Protection for Life

The most distinctive feature of Whole Life Insurance is its lifelong coverage. Unlike Term Life, which has a fixed term, Whole Life policies remain active until the insured passes away, provided premiums are paid.

| Key Feature | Description |

|---|---|

| Lifetime Coverage | Whole Life policies offer guaranteed protection for the insured's entire life, ensuring peace of mind. |

Cash Value Accumulation

Whole Life policies come with a cash value component, which grows over time. This cash value can be borrowed against or withdrawn, providing a financial safety net. The growth of cash value is tax-deferred, making it an attractive feature.

Fixed Premiums

Whole Life Insurance policies offer the stability of fixed premiums. This means the insured pays the same premium amount throughout the policy's lifetime, making financial planning more predictable.

Policy Loans and Dividends

Policyholders can take out loans against the cash value of their Whole Life policy. Additionally, some policies may pay dividends, further enhancing the policy's value.

Real-Life Example

Consider Mr. Johnson, a 40-year-old professional. He opts for a Whole Life policy with a $500,000 death benefit. Over time, his policy accumulates cash value, which he can access if needed. This provides him with financial flexibility and a sense of security.

Term Life Insurance: The Affordable Option

Term Life Insurance, as the name suggests, is a policy with a defined term, typically ranging from 10 to 30 years. It offers a straightforward and cost-effective solution for those seeking temporary coverage.

Affordable Premiums

The standout feature of Term Life Insurance is its affordability. Premiums are significantly lower compared to Whole Life policies, making it an attractive option for those on a budget.

| Key Feature | Description |

|---|---|

| Low Premiums | Term Life policies offer the most affordable option for life insurance, making it accessible to a wide range of individuals. |

Coverage Flexibility

Term Life policies allow for customization based on your needs. You can choose the term length and the death benefit amount, ensuring you get the coverage you require.

No Cash Value

Unlike Whole Life, Term Life policies do not accumulate cash value. This means there is no financial benefit beyond the death benefit, which is paid out upon the insured's passing.

Renewal Options

Many Term Life policies offer the option to renew at the end of the term. However, it's important to note that premiums may increase with age, making it more costly over time.

Real-Life Example

Ms. Smith, a 35-year-old mother, chooses a 20-year Term Life policy with a $1 million death benefit. This ensures her family's financial security during her children's formative years. Once the term ends, she can reassess her needs and choose a new policy if necessary.

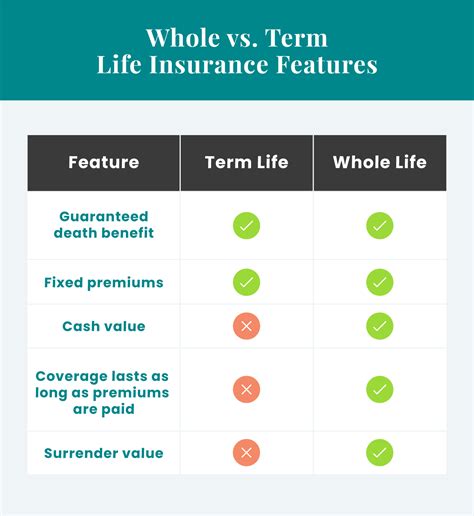

Comparative Analysis: Whole Life vs Term Life

Let's delve into a side-by-side comparison to better understand the differences.

| Whole Life | Term Life | |

|---|---|---|

| Coverage Duration | Lifetime | Fixed Term (10-30 years) |

| Premiums | Fixed, Higher | Lower, Can Increase Over Time |

| Cash Value | Accumulates Over Time | None |

| Renewal Options | None Needed | Can Renew, Premiums May Increase |

| Suitability | Long-term Financial Planning | Temporary Coverage Needs |

Conclusion: Finding the Right Fit

The choice between Whole Life and Term Life insurance depends on your individual needs and financial goals. Whole Life offers comprehensive, lifelong coverage with the added benefit of cash value accumulation. Term Life, on the other hand, provides a cost-effective solution for temporary coverage needs.

Consider your financial situation, your family's needs, and the duration of coverage you require. Consulting with a financial advisor or insurance professional can further guide you in making an informed decision.

Can I switch from Term Life to Whole Life Insurance later in life?

+

Yes, it’s possible to make this switch. However, it’s essential to consider the increased cost of Whole Life premiums and the potential health-related restrictions that may apply as you age.

Are Whole Life policies a good investment option?

+

While Whole Life policies offer the benefit of cash value accumulation, they may not be the most efficient investment option compared to other financial instruments. It’s advisable to consult a financial advisor for a comprehensive evaluation.

What happens if I outlive my Term Life policy’s term?

+

If you outlive your Term Life policy, the coverage ends, and you may need to consider alternative options or renew the policy if it allows for renewal.

Are there any tax implications with Whole Life Insurance’s cash value?

+

The tax treatment of cash value withdrawals or loans depends on various factors, including the policy’s design and the amount withdrawn. It’s best to consult a tax professional for accurate guidance.

Can I add riders to my Term Life policy to enhance coverage?

+

Yes, many Term Life policies allow for the addition of riders, which can provide extra benefits like waiver of premium or accidental death benefits.