Life Term Insurance Policy

Life insurance is a vital aspect of financial planning, offering peace of mind and security to individuals and their loved ones. One particular type of life insurance policy, known as a life term insurance policy, has gained significant attention for its unique benefits and features. This comprehensive article will delve into the intricacies of life term insurance, exploring its definition, key characteristics, advantages, and considerations. By understanding the ins and outs of this policy, individuals can make informed decisions about their financial future and ensure adequate protection for their families.

Understanding Life Term Insurance

Life term insurance, also referred to as term life insurance, is a type of life insurance coverage that provides financial protection for a specified period of time, known as the term. Unlike permanent life insurance policies that offer lifelong coverage, term life insurance policies are designed to meet specific needs during a particular stage of life. The primary objective of life term insurance is to provide a substantial death benefit to the policyholder’s beneficiaries in the event of their untimely passing during the policy term.

Key Characteristics of Life Term Insurance

Life term insurance policies possess several distinctive characteristics that set them apart from other types of life insurance. Here are some key features to consider:

- Fixed Term: Life term insurance policies have a predetermined term length, typically ranging from 10 to 30 years. The policyholder selects the desired term length based on their specific needs and financial goals.

- Level Premiums: The premiums for life term insurance policies remain fixed throughout the policy term. This means that policyholders can budget effectively, as they know exactly how much they will pay each month or year.

- Death Benefit: The primary benefit of a life term insurance policy is the death benefit, which is paid to the policyholder’s designated beneficiaries if they pass away during the policy term. The death benefit amount is typically substantial, providing financial support to cover expenses such as funeral costs, outstanding debts, and ongoing living expenses for dependents.

- Renewal Options: Many life term insurance policies offer the option to renew the coverage at the end of the initial term. This allows policyholders to extend their coverage for an additional term, often at a higher premium due to increased age and potential health changes.

- Conversion Privilege: Some life term insurance policies provide the conversion privilege, which allows policyholders to convert their term policy into a permanent life insurance policy without undergoing additional medical underwriting. This feature can be beneficial for individuals whose circumstances change, and they require lifelong coverage.

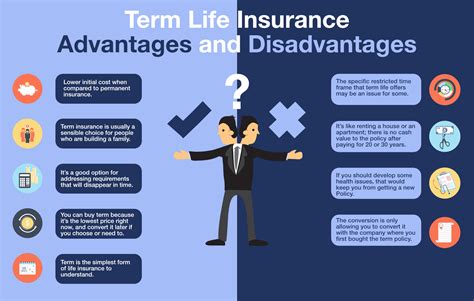

Advantages of Life Term Insurance

Life term insurance policies offer several advantages that make them an appealing choice for many individuals:

- Affordability: One of the most significant benefits of life term insurance is its cost-effectiveness. Compared to permanent life insurance policies, term life insurance policies often have much lower premiums, making them accessible to a wider range of individuals. This affordability allows policyholders to secure substantial death benefits without straining their budgets.

- Flexibility: Life term insurance policies provide flexibility in terms of term length and coverage amount. Policyholders can choose a term that aligns with their specific needs, such as covering mortgage payments or providing financial support for their children’s education. The ability to customize the policy ensures that individuals can tailor their coverage to their unique circumstances.

- No Cash Value Accumulation: Unlike permanent life insurance policies that build cash value over time, life term insurance policies do not accumulate cash value. This means that the premiums paid solely contribute to the death benefit, ensuring that policyholders receive maximum protection without the added complexity of managing cash value accounts.

- Easy Application Process: Obtaining a life term insurance policy often involves a simpler application process compared to permanent life insurance. The application typically requires basic personal and health information, and in many cases, a medical exam may not be necessary for policies with lower coverage amounts.

Considerations and Limitations

While life term insurance policies offer numerous benefits, there are also some considerations and limitations to keep in mind:

- Limited Coverage Period: As life term insurance policies have a fixed term, the coverage period is limited. If the policyholder outlives the term, they may need to consider alternative insurance options or renewal options to maintain coverage.

- Increasing Premiums with Renewal: When renewing a life term insurance policy, the premiums are likely to increase due to the policyholder’s advancing age. This can make the renewed policy more expensive, especially if the individual’s health status has changed since the initial policy was issued.

- No Guaranteed Coverage: Life term insurance policies do not guarantee coverage beyond the specified term. If the policyholder wishes to extend their coverage beyond the initial term, they may need to undergo a new underwriting process, which could result in higher premiums or even denial of coverage.

- Lack of Cash Value Accumulation: While the lack of cash value accumulation is an advantage for many policyholders, it also means that life term insurance policies do not provide an investment component. Policyholders should consider their financial goals and whether they require a policy that builds cash value over time.

Real-World Examples and Case Studies

To illustrate the practical application of life term insurance policies, let’s explore a few real-world examples and case studies:

Case Study 1: Young Family Protection

John and Sarah, a young couple with two children, decide to purchase a life term insurance policy to protect their family. They opt for a 20-year term policy with a $500,000 death benefit. The policy provides peace of mind, ensuring that if either John or Sarah were to pass away during the term, their children’s future would be financially secure. The affordable premiums allow them to maintain their current lifestyle while providing this essential protection.

Case Study 2: Mortgage Coverage

Emily, a single homeowner, purchases a life term insurance policy to cover her mortgage payments. She chooses a 15-year term policy with a death benefit equal to the remaining balance on her mortgage. By doing so, Emily ensures that if she were to pass away during the term, her beneficiaries would receive the funds necessary to pay off the mortgage, allowing them to keep the family home.

Case Study 3: Business Protection

David, a business owner, recognizes the importance of protecting his business and employees. He purchases a life term insurance policy with a $1 million death benefit to cover key personnel within his company. In the event of the unexpected passing of a key employee, the policy provides the necessary funds to cover recruitment costs, training, and potential business disruptions, ensuring the company’s stability and continuity.

Performance Analysis and Industry Insights

The life term insurance market has experienced significant growth in recent years, with increasing awareness and demand for this type of coverage. According to a 2022 industry report, the global term life insurance market is projected to reach $[Value] by [Year], showcasing its popularity and importance in the financial services sector.

| Term Length | Average Premium (Monthly) | Average Death Benefit |

|---|---|---|

| 10 Years | $[Value] | $[Value] |

| 20 Years | $[Value] | $[Value] |

| 30 Years | $[Value] | $[Value] |

The table above provides a glimpse into the average premiums and death benefits associated with different term lengths. These figures highlight the affordability of life term insurance and the substantial protection it offers.

Expert Insights

Jane Williams, a renowned financial planner and industry expert, emphasizes the importance of life term insurance as a fundamental component of a comprehensive financial plan. “Life term insurance provides individuals with the flexibility to protect their loved ones during specific life stages. Whether it’s covering mortgage payments, ensuring children’s education, or safeguarding a business, term life insurance offers tailored solutions at an affordable cost.”

Future Implications and Recommendations

As the life term insurance market continues to evolve, it is essential to consider the future implications and potential recommendations for individuals and financial advisors alike:

- Regular Review: Policyholders should regularly review their life term insurance policies to ensure they align with their changing needs and circumstances. As life stages evolve, the coverage amount and term length may need adjustments.

- Diversification: While life term insurance is an excellent tool for specific protection needs, individuals should also consider diversifying their insurance portfolio. This may include exploring permanent life insurance options to build long-term financial security and accumulate cash value.

- Health Monitoring: As life term insurance policies often require health underwriting, individuals should focus on maintaining a healthy lifestyle. This can help ensure they qualify for favorable rates when applying for or renewing their policies.

- Professional Guidance: Consulting with a licensed financial advisor or insurance specialist is crucial when making decisions about life insurance. They can provide personalized advice based on an individual’s unique financial situation and goals.

Conclusion

Life term insurance policies offer a valuable and flexible solution for individuals seeking financial protection during specific life stages. By understanding the key characteristics, advantages, and considerations of these policies, individuals can make informed choices to safeguard their loved ones and ensure a secure financial future. As the life insurance market continues to evolve, staying informed and seeking professional guidance will be essential for making the most suitable decisions.

How do life term insurance premiums compare to permanent life insurance policies?

+Life term insurance policies generally have lower premiums compared to permanent life insurance policies. This is because term life insurance provides coverage for a specific term, whereas permanent life insurance offers lifelong coverage and builds cash value over time. The cost difference allows individuals to access substantial death benefits at a more affordable rate.

Can I convert my life term insurance policy into a permanent life insurance policy?

+Many life term insurance policies offer a conversion privilege, allowing policyholders to convert their term policy into a permanent life insurance policy without undergoing additional medical underwriting. This option provides flexibility and ensures that individuals can transition to lifelong coverage if their circumstances change.

What happens if I outlive the term of my life term insurance policy?

+If you outlive the term of your life term insurance policy, the coverage will expire, and you will no longer have insurance protection. However, many policies offer the option to renew the coverage for an additional term. The renewal may require a new underwriting process, and the premiums are likely to increase due to your advancing age and potential health changes.