List Of Car Insurance Companies In California

California is known for its diverse insurance market, offering residents a wide range of options when it comes to car insurance. With a population of over 39 million, it is crucial for individuals to understand the various insurance providers and their offerings to make informed decisions about their coverage. In this comprehensive guide, we will explore the top car insurance companies operating in California, delving into their unique features, coverage options, and customer experiences.

The Top Car Insurance Companies in California

California’s insurance landscape is home to both national giants and local, regional providers. Each company brings its own set of strengths and weaknesses, catering to different driver profiles and needs. Let’s dive into the details of some of the most prominent players in the Golden State’s insurance industry.

State Farm

State Farm is a well-established name in the insurance industry, known for its comprehensive coverage options and extensive agent network. In California, State Farm offers a range of car insurance policies, including liability, collision, comprehensive, and personal injury protection (PIP) coverage. They are particularly popular among drivers seeking personalized service and a wide array of discounts.

Key Features:

- Strong financial stability and customer satisfaction ratings.

- Offers discounts for safe driving, multiple policies, and good grades.

- Provides 24⁄7 customer support and a user-friendly digital platform.

Geico

Geico, or the Government Employees Insurance Company, has a strong presence in California, offering competitive rates and a convenient online experience. They cater to a wide range of drivers, including those with a clean driving record and those seeking more affordable options.

Key Features:

- Known for its extensive digital tools and mobile app for policy management.

- Offers discounts for military personnel, good students, and safe driving.

- Provides a wide range of coverage options, including rental car coverage and emergency roadside assistance.

Progressive

Progressive is another major player in California’s insurance market, renowned for its innovative approaches to insurance. They offer a range of coverage options and specialize in providing tailored policies to meet individual needs.

Key Features:

- Provides a Name Your Price® tool, allowing customers to choose their premium and coverage.

- Offers a Snapshot® program, which uses telematics to reward safe driving habits.

- Features a wide range of discounts, including multi-policy, multi-car, and homeowner discounts.

Allstate

Allstate is a trusted name in insurance, providing a range of car insurance policies in California. They focus on delivering personalized coverage and offer a variety of add-on options to cater to different driver profiles.

Key Features:

- Offers customizable coverage with add-ons like rental car reimbursement and rideshare coverage.

- Provides a Safe Driving Bonus Check®, rewarding safe driving habits.

- Features a 24⁄7 customer support team and a user-friendly digital platform.

Esurance

Esurance, a subsidiary of Allstate, is known for its tech-savvy approach to insurance. They offer a fully digital experience, making it convenient for tech-oriented individuals to manage their car insurance policies.

Key Features:

- Provides a range of coverage options, including liability, collision, and comprehensive coverage.

- Offers a mobile app for policy management and claims tracking.

- Features discounts for safe driving, paperless billing, and multi-policy bundling.

USAA

USAA is a highly regarded insurance provider, primarily serving military members, veterans, and their families. They offer a range of car insurance policies with competitive rates and excellent customer service.

Key Features:

- Provides comprehensive coverage options, including liability, collision, and rental car coverage.

- Offers exclusive discounts for military members, including deployment discounts.

- Features a strong focus on customer service and a user-friendly digital platform.

Mercury Insurance

Mercury Insurance is a regional insurance provider with a strong presence in California. They specialize in offering personalized coverage and excellent customer service.

Key Features:

- Provides a range of coverage options, including liability, collision, and comprehensive coverage.

- Offers discounts for good students, safe drivers, and multi-policy bundling.

- Features a 24⁄7 customer support team and a user-friendly website.

Farmers Insurance

Farmers Insurance is a well-known insurance provider, offering a range of car insurance policies with a focus on customer satisfaction.

Key Features:

- Provides a variety of coverage options, including liability, collision, and comprehensive coverage.

- Offers discounts for safe driving, good grades, and multi-policy bundling.

- Features a 24⁄7 claims reporting service and a user-friendly digital platform.

AAA

AAA, or the American Automobile Association, is a trusted name in insurance, providing a range of car insurance policies with a focus on roadside assistance and travel benefits.

Key Features:

- Offers comprehensive coverage options, including liability, collision, and rental car coverage.

- Provides 24⁄7 roadside assistance and travel planning services.

- Features discounts for safe driving, good students, and multi-policy bundling.

Liberty Mutual

Liberty Mutual is a leading insurance provider, offering a range of car insurance policies with a focus on personalized coverage and customer service.

Key Features:

- Provides a variety of coverage options, including liability, collision, and comprehensive coverage.

- Offers discounts for safe driving, multi-policy bundling, and loyalty.

- Features a user-friendly digital platform and a 24⁄7 customer support team.

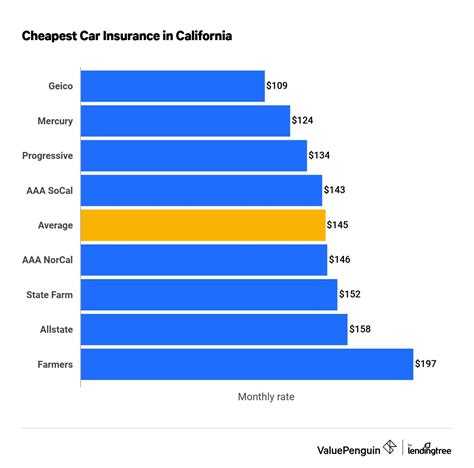

Comparative Analysis: Choosing the Right Insurance Provider

When selecting a car insurance provider in California, it’s essential to consider your specific needs and preferences. Here’s a comparative analysis to help you make an informed decision:

Coverage Options

Each insurance company offers a range of coverage options, including liability, collision, comprehensive, and add-ons like rental car coverage and roadside assistance. Evaluate your driving habits and potential risks to determine the coverage that best suits your needs.

Discounts and Savings

Many insurance companies provide a variety of discounts to help you save on your premiums. Common discounts include safe driving, good student, multi-policy, and loyalty discounts. Compare the discount offerings of different providers to find the best fit for your circumstances.

Customer Service and Digital Experience

Customer service and the digital experience can vary greatly between insurance providers. Consider factors such as 24⁄7 support, user-friendly digital platforms, and the availability of mobile apps for policy management and claims tracking.

Financial Stability and Reputation

It’s important to choose an insurance provider with a strong financial stability rating and a good reputation in the industry. This ensures that the company can provide reliable coverage and support in the event of a claim.

Local Presence and Personalized Service

Some insurance companies, particularly regional providers, offer a more personalized experience with local agents who can provide tailored advice and support. Consider whether a local presence and personalized service are important to you.

The Future of Car Insurance in California

The insurance industry in California is evolving, with a focus on technology, data-driven insights, and personalized coverage. As autonomous vehicles and advanced safety features become more prevalent, insurance providers are adapting their offerings to meet the changing needs of drivers. Here are some key trends to watch for in the future:

Telematics and Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is gaining popularity. This approach uses real-time driving data to calculate premiums, rewarding safe driving habits and providing more accurate pricing.

Connected Car Technology

Connected car technology allows insurance providers to access real-time vehicle data, enabling them to offer more personalized coverage and services. This technology can also improve the claims process by providing accurate information about accidents and vehicle damage.

Autonomous Vehicle Insurance

As autonomous vehicles become more common, insurance providers will need to adapt their policies to cover these new technologies. This includes developing liability frameworks and risk assessment models specific to autonomous vehicles.

Data-Driven Personalization

Insurance providers are increasingly using data analytics to offer personalized coverage and pricing. By analyzing driver behavior, demographics, and other factors, insurers can provide more tailored policies and better serve the needs of individual drivers.

Conclusion

California’s car insurance market offers a diverse range of options, catering to the unique needs of its residents. Whether you’re seeking comprehensive coverage, personalized service, or tech-savvy solutions, there’s an insurance provider that can meet your requirements. By comparing coverage options, discounts, and customer experiences, you can make an informed decision and find the best car insurance provider for your situation.

How can I find the best car insurance rates in California?

+To find the best car insurance rates, compare quotes from multiple providers. Consider your specific needs and preferences, and evaluate the coverage options, discounts, and customer service offered by each insurer. Online comparison tools and insurance broker services can also help you identify the most competitive rates.

What factors influence car insurance rates in California?

+Car insurance rates in California are influenced by various factors, including your driving record, the type of vehicle you drive, your location, and the coverage options you choose. Insurance providers also consider your age, gender, marital status, and credit score when calculating premiums.

Are there any unique coverage options available in California?

+California has a unique requirement for drivers to carry uninsured motorist coverage, which provides protection in case of an accident with an uninsured or underinsured driver. Additionally, some insurance providers offer earthquake coverage as an add-on, given California’s seismic activity.

How can I save money on my car insurance in California?

+To save money on car insurance, consider raising your deductible, bundling multiple policies with the same insurer, maintaining a clean driving record, and taking advantage of available discounts. Shopping around and comparing quotes from different providers can also help you find more affordable rates.