Llc Liability Insurance

In the complex landscape of business ownership, understanding the nuances of liability insurance is crucial, especially when it comes to Limited Liability Companies (LLCs). LLCs, a popular choice for small business owners, offer a distinct legal structure that separates personal and business assets. However, this structure is not a shield against all potential liabilities, and it is here that liability insurance steps in as a vital protective measure.

This comprehensive guide aims to delve into the world of LLC liability insurance, providing an in-depth analysis of its significance, coverage, and implications. By exploring real-world examples and industry insights, we aim to equip business owners with the knowledge needed to make informed decisions about their liability coverage.

Understanding LLC Liability Insurance

LLC liability insurance, often referred to as General Liability Insurance, is a form of coverage designed to protect business owners from various risks and potential lawsuits. It serves as a safety net, ensuring that the personal assets of LLC members remain protected in the event of business-related incidents.

Consider a hypothetical scenario: an LLC operating a small café faces a lawsuit due to a customer slipping and falling on their premises. Without adequate liability insurance, the owners could potentially face financial ruin as their personal assets, such as their homes or savings, might be at risk. However, with the right liability coverage, the financial burden of such incidents can be mitigated, allowing the business to continue operating while ensuring the owners' personal finances remain intact.

Key Coverage Areas

- Property Damage: Covers costs associated with damage to property, whether it’s the business premises or the property of others.

- Bodily Injury: Provides protection in cases of injuries sustained by customers, employees, or visitors on the business premises.

- Personal & Advertising Injury: Covers a range of non-physical injuries, including libel, slander, copyright infringement, or wrongful eviction.

- Medical Payments: Offers immediate medical coverage for minor injuries sustained on the business premises, regardless of fault.

- Legal Defense: Provides financial support for legal fees and court costs if the business is sued.

These coverage areas demonstrate the broad scope of protection that liability insurance can offer, making it an essential consideration for any LLC.

Benefits of LLC Liability Insurance

The advantages of securing liability insurance for an LLC are multifaceted and can have a significant impact on the long-term viability and success of the business.

Financial Protection

The primary benefit of liability insurance is the financial security it provides. By insuring against potential liabilities, business owners can safeguard their personal assets from being seized to cover business-related lawsuits or incidents. This protection is especially crucial for small businesses, where the loss of personal assets could be catastrophic.

Peace of Mind

Knowing that their business is adequately insured can provide business owners with a sense of reassurance. This peace of mind allows them to focus on growing their business without constant worry about unforeseen liabilities. It enables them to make strategic decisions with confidence, knowing that they have taken the necessary steps to protect their interests.

Enhanced Credibility

In certain industries, particularly those with high-risk operations or services, having liability insurance can enhance the credibility of the business. It demonstrates a commitment to safety and responsibility, which can be appealing to potential clients, partners, and investors. For businesses looking to establish themselves or expand their operations, this added credibility can be a significant advantage.

Types of LLC Liability Insurance

While general liability insurance is a common and essential coverage for LLCs, there are other types of liability insurance that may be beneficial depending on the nature of the business.

Product Liability Insurance

For businesses that manufacture, distribute, or sell goods, product liability insurance is crucial. It provides coverage in cases where a product causes injury or damage to a consumer. This type of insurance is particularly important for businesses in the e-commerce space, where the potential for product-related incidents is higher.

Professional Liability Insurance (E&O)

Also known as Errors and Omissions (E&O) insurance, this coverage is designed for businesses that provide professional services. It protects against claims of negligence, errors, or omissions in the services provided. This type of insurance is vital for industries such as consulting, accounting, or legal services, where the risk of professional liability is high.

Cyber Liability Insurance

With the increasing reliance on digital technologies and the ever-growing threat of cyberattacks, cyber liability insurance has become a critical consideration for businesses. This coverage protects against financial losses resulting from cyber incidents, such as data breaches, hacking, or identity theft. For businesses that handle sensitive customer data, this insurance is a necessary safeguard.

Choosing the Right Coverage

Selecting the appropriate liability insurance coverage for an LLC involves careful consideration of various factors, including the nature of the business, the level of risk involved, and the specific needs of the business owners.

Assessing Business Risks

A thorough evaluation of the potential risks and liabilities associated with the business is the first step in choosing the right insurance. This assessment should consider factors such as the industry the business operates in, the products or services offered, the location of the business, and the number of employees.

Customizing Coverage

While general liability insurance provides a broad level of protection, it might not be sufficient for certain businesses. Customizing coverage to address specific risks is often necessary. This could involve adding endorsements or riders to the policy, or even purchasing additional specialized insurance policies to cover unique aspects of the business.

Working with Insurance Professionals

Navigating the complex world of insurance can be challenging, especially for those without prior experience. Working with insurance professionals, such as brokers or agents, can provide valuable guidance. These experts can help assess risks, compare policies, and ensure that the LLC is adequately covered without overspending on unnecessary coverage.

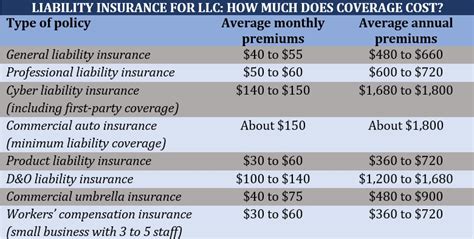

The Cost of LLC Liability Insurance

The cost of liability insurance for an LLC can vary significantly based on several factors, including the size and nature of the business, the level of coverage required, and the claims history of the business or its industry.

Factors Affecting Premiums

- Industry: Some industries are inherently riskier than others. For example, construction businesses face higher risks of accidents or property damage, which can lead to higher insurance premiums.

- Business Size: Larger businesses with more employees, customers, or locations often require higher levels of coverage, resulting in increased premiums.

- Claims History: A business’s past claims history can impact future premiums. Businesses with a history of frequent or large claims may face higher premiums or even difficulty obtaining coverage.

- Location: The geographical location of the business can also affect premiums. Areas with higher rates of crime or natural disasters may have higher insurance costs.

Strategies for Managing Costs

While the cost of liability insurance is an important consideration, it’s crucial to balance cost with adequate coverage. Here are some strategies to help manage insurance costs without compromising protection:

- Compare Quotes: Obtaining multiple quotes from different insurance providers can help identify the most cost-effective options. This competitive analysis can highlight differences in coverage and pricing, allowing business owners to make informed decisions.

- Review Coverage Regularly: Insurance needs can change over time. Regularly reviewing and updating coverage ensures that the LLC remains adequately protected without paying for unnecessary coverage.

- Implement Risk Management Strategies: Taking steps to mitigate risks can reduce the likelihood of claims and, consequently, lower insurance costs. This could involve implementing safety protocols, employee training programs, or investing in security measures.

Real-World Examples and Case Studies

Examining real-world examples and case studies can provide valuable insights into the importance and impact of LLC liability insurance.

Case Study: Small Business Inc.

Small Business Inc., a local café, experienced a significant incident when a customer slipped and fell on a freshly mopped floor. The customer sustained minor injuries but filed a lawsuit against the café, seeking compensation for medical expenses and pain and suffering. Without liability insurance, the café owners faced a potential financial crisis. However, with the help of their insurance coverage, they were able to settle the claim without incurring significant financial loss, and their business remained operational.

Case Study: TechStartups LLC

TechStartups LLC, a software development company, faced a unique challenge when a client accused them of copyright infringement, claiming that their newly launched app violated intellectual property rights. This led to a costly legal battle. TechStartups’ professional liability insurance covered the legal fees and any potential damages, allowing them to focus on resolving the issue without the added financial strain.

The Future of LLC Liability Insurance

As the business landscape continues to evolve, so too does the world of insurance. The future of LLC liability insurance is likely to be shaped by several key trends and developments.

Emerging Risks

With advancements in technology and the increasing complexity of business operations, new risks are emerging. From cybersecurity threats to environmental concerns, businesses face a wider range of potential liabilities. Insurance providers will need to adapt their offerings to address these emerging risks, ensuring that LLCs are adequately protected.

Digitalization of Insurance

The insurance industry is embracing digitalization, with online platforms and apps making it easier for businesses to compare policies, purchase coverage, and manage their insurance needs. This trend is likely to continue, offering increased convenience and accessibility for LLCs looking to secure liability insurance.

Collaborative Risk Management

Insurance providers are recognizing the value of collaborative risk management, where they work closely with businesses to identify and mitigate risks. By offering guidance and resources to help businesses reduce the likelihood of incidents, insurance companies can lower the overall risk profile of their clients, leading to more efficient and effective coverage.

Conclusion

LLC liability insurance is an essential component of any business’s risk management strategy. By understanding the various types of coverage, assessing their specific risks, and choosing the right insurance, LLCs can protect their assets and ensure their long-term viability. While the cost of insurance is an important consideration, the peace of mind and financial protection it provides are invaluable.

As the business world continues to evolve, staying informed about insurance trends and best practices will be crucial for LLCs to navigate potential liabilities effectively. With the right approach to liability insurance, LLCs can focus on their core business operations with confidence and security.

How much does LLC liability insurance typically cost?

+The cost of LLC liability insurance can vary widely depending on several factors. On average, small businesses can expect to pay between 300 and 1,000 per year for general liability insurance. However, this can increase significantly based on the nature of the business, its size, and the level of coverage required. It’s important to obtain multiple quotes to find the most cost-effective option while ensuring adequate coverage.

What happens if an LLC doesn’t have liability insurance and faces a lawsuit?

+If an LLC is sued and does not have liability insurance, the business owners could be held personally liable for any damages awarded in the lawsuit. This means their personal assets, such as their homes, savings, or other investments, could be at risk of being seized to pay for the damages. It’s crucial for LLCs to have adequate liability insurance to protect their personal finances.

Can LLC liability insurance be customized to fit specific business needs?

+Yes, LLC liability insurance can be customized to fit the specific needs of the business. General liability insurance provides a basic level of protection, but businesses can add endorsements or riders to their policy to cover specific risks. Additionally, businesses can purchase separate policies, such as product liability or professional liability insurance, to address unique aspects of their operations.