Long Term Healthcare Insurance Cost

The cost of long-term healthcare insurance is a crucial consideration for individuals and families planning for their future well-being. As the population ages and medical advancements extend lifespans, the demand for long-term care services has grown significantly. This article delves into the various factors influencing the cost of long-term healthcare insurance, offering a comprehensive guide to help readers make informed decisions about this essential aspect of financial planning.

Understanding Long-Term Healthcare Insurance Costs

Long-term healthcare insurance, often referred to as LTC insurance, provides coverage for a range of services that assist individuals with their daily activities as they age or when faced with chronic illnesses or disabilities. These services can include personal care, nursing care, therapy, and assistance with activities of daily living (ADLs) such as bathing, dressing, and eating.

The cost of LTC insurance can vary widely depending on several factors, including the age of the insured, their health status, the benefits chosen, and the location. Let's explore these variables in detail to gain a comprehensive understanding of how they impact the overall cost of long-term healthcare insurance.

Age and Health Factors

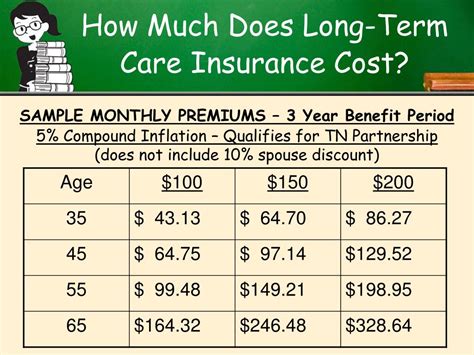

One of the primary drivers of LTC insurance cost is the age at which an individual purchases the policy. Insurance companies consider age when determining premiums, as older individuals are statistically more likely to require long-term care services sooner. Consequently, policies purchased at a younger age often result in lower premiums.

Additionally, the health status of the insured plays a significant role. Those with pre-existing medical conditions or a history of chronic illnesses may face higher premiums or even denial of coverage. It's crucial to disclose all relevant health information when applying for LTC insurance to ensure accurate pricing and appropriate coverage.

| Age Range | Average Annual Premium |

|---|---|

| 40-49 years | $1,500 - $2,500 |

| 50-59 years | $2,000 - $3,500 |

| 60-69 years | $3,000 - $5,000 |

Benefit Selection and Coverage

The benefits chosen within an LTC insurance policy significantly impact the overall cost. Policies can offer a range of coverage options, including the daily benefit amount, the elimination period (the number of days you must pay for care before the policy kicks in), and the maximum benefit period (the total number of days the policy will provide coverage). Each of these factors influences the premium.

For instance, selecting a higher daily benefit amount will result in a higher premium, as it indicates a greater need for coverage. Similarly, a shorter elimination period or a longer maximum benefit period can also increase the cost of the policy. It's essential to strike a balance between the desired coverage and the affordability of the premium.

| Coverage Option | Impact on Premium |

|---|---|

| Daily Benefit Amount | Directly proportional; higher daily benefit = higher premium |

| Elimination Period | Inversely proportional; longer elimination period = lower premium |

| Maximum Benefit Period | Directly proportional; longer benefit period = higher premium |

Location and Provider Factors

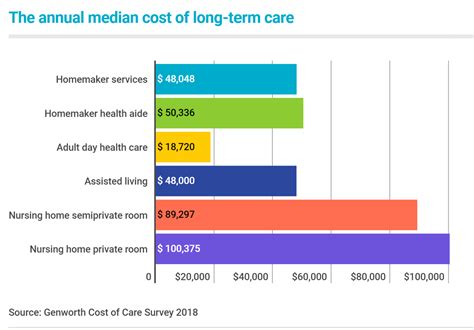

The cost of long-term care services varies significantly depending on the geographic location. Urban areas or regions with a high cost of living often have higher LTC insurance premiums to reflect the increased cost of care. Additionally, the provider network and availability of facilities can influence the pricing. Areas with a larger network of providers and more accessible long-term care facilities may offer more competitive rates.

It's crucial to research and compare providers and their networks to ensure the best value for your LTC insurance investment. Some insurance companies may have preferred provider networks, offering discounted rates at certain facilities, which can further impact the overall cost of care.

Analyzing Real-World Examples

To illustrate the impact of various factors on LTC insurance costs, let’s examine some real-world scenarios. These examples will provide a tangible understanding of how different variables come into play when determining the cost of long-term healthcare insurance.

Case Study: Mr. Johnson

Mr. Johnson, aged 55, resides in a suburban area with a moderate cost of living. He is in good health with no pre-existing conditions. He opts for an LTC insurance policy with a daily benefit of 200, a 90-day elimination period, and a maximum benefit period of 3 years. His annual premium is estimated to be around 2,800.

Case Study: Ms. Smith

Ms. Smith, aged 62, lives in an urban area with a high cost of living. She has a history of chronic heart disease and diabetes. Due to her health status, she faces a higher premium for LTC insurance. She chooses a policy with a daily benefit of 150, a 60-day elimination period, and a maximum benefit period of 2 years. Her annual premium is approximately 4,200.

Case Study: Mr. Lee

Mr. Lee, aged 48, is in excellent health and purchases an LTC insurance policy early in life. He selects a policy with a daily benefit of 250, a 120-day elimination period, and a maximum benefit period of 4 years. Given his younger age and good health, his annual premium is expected to be around 1,800.

Strategies for Managing LTC Insurance Costs

While the cost of long-term healthcare insurance can be significant, there are strategies to help manage these expenses effectively. Here are some tips to consider when planning for your LTC insurance needs.

Purchase Early

As mentioned earlier, purchasing LTC insurance at a younger age can result in substantial savings. The earlier you buy a policy, the lower your premiums are likely to be, as you are less of a risk to the insurer.

Choose Appropriate Coverage

When selecting an LTC insurance policy, it’s essential to balance your needs with your budget. Opt for a daily benefit amount that aligns with your anticipated needs, and consider a longer elimination period if you have savings or other financial resources to cover initial expenses.

Compare Providers

Research and compare different LTC insurance providers to find the best value for your money. Look for companies with a strong financial rating and a good reputation for claim handling. Additionally, explore their provider networks to ensure access to quality care at competitive rates.

Consider Inflation Protection

Long-term care costs tend to increase over time due to inflation. To protect your coverage from losing value, consider adding an inflation protection rider to your LTC insurance policy. This feature adjusts your benefits over time to keep pace with rising costs.

Future Implications and Industry Trends

The landscape of long-term healthcare insurance is continually evolving, influenced by demographic shifts, medical advancements, and regulatory changes. Understanding these trends can provide valuable insights into the future of LTC insurance costs.

Growing Demand for LTC Services

As the baby boomer generation ages, the demand for long-term care services is projected to rise significantly. This increased demand may lead to higher costs for LTC insurance as insurers adjust their rates to manage the growing risk pool.

Advancements in Care Technologies

Medical advancements and technological innovations are transforming the long-term care industry. Telehealth services, remote monitoring, and assistive technologies can reduce the overall cost of care. These advancements may impact LTC insurance costs by offering more efficient and cost-effective care options.

Regulatory Changes and Reforms

Government policies and regulations play a critical role in shaping the LTC insurance market. Reforms aimed at making long-term care more accessible and affordable, such as the Affordable Care Act (ACA) and the Setting Every Community Up for Retirement Enhancement (SECURE) Act, can influence the structure and cost of LTC insurance policies.

Conclusion

Understanding the factors that influence the cost of long-term healthcare insurance is crucial for making informed decisions about your financial future. By considering age, health status, benefit selection, and location, individuals can navigate the complex world of LTC insurance with confidence. Additionally, staying informed about industry trends and regulatory changes can help individuals and families plan effectively for their long-term care needs.

As the demand for long-term care services continues to grow, the importance of LTC insurance cannot be overstated. By taking proactive steps to secure adequate coverage, individuals can ensure they have the necessary support and resources to maintain their quality of life as they age.

What is the average cost of long-term healthcare insurance?

+The average cost of LTC insurance can vary widely depending on factors such as age, health status, coverage options, and location. As a general guideline, premiums can range from a few hundred to several thousand dollars annually. It’s essential to obtain personalized quotes based on your specific circumstances to get an accurate estimate.

How does age impact the cost of LTC insurance?

+Age is a significant factor in determining LTC insurance premiums. Younger individuals tend to pay lower premiums as they are less likely to require long-term care services sooner. Premiums generally increase with age, reflecting the higher risk of needing long-term care as one gets older.

Can I reduce the cost of my LTC insurance policy?

+Yes, there are several strategies to reduce the cost of LTC insurance. Purchasing a policy at a younger age, choosing appropriate coverage options, and comparing providers can all lead to significant savings. Additionally, considering inflation protection and staying informed about industry trends can help manage costs over time.

What are the benefits of purchasing LTC insurance early in life?

+Purchasing LTC insurance early in life offers several advantages. Premiums are typically lower when you’re younger, and you can secure comprehensive coverage at a more affordable rate. Additionally, starting your policy early ensures you have the necessary financial protection in place for your long-term care needs as you age.