Long Term Insurance Policy

Long-term insurance policies are a vital component of financial planning, offering individuals and businesses protection against potential risks and uncertainties that may arise over an extended period. These policies provide a safety net, ensuring individuals and their families can maintain their standard of living and meet their financial obligations even in the face of unforeseen events such as critical illnesses, accidents, or death. In today's complex and ever-changing world, long-term insurance has become increasingly important, offering peace of mind and financial security for the future.

Understanding Long-Term Insurance Policies

Long-term insurance policies are designed to cover a range of potential risks and provide financial protection over an extended period, typically spanning several years or even decades. Unlike short-term insurance policies, which offer temporary coverage for specific events or periods, long-term insurance is a more comprehensive and enduring form of protection.

These policies are tailored to meet the unique needs of individuals and businesses, offering a wide range of benefits and features. Common types of long-term insurance include life insurance, health insurance, disability insurance, and long-term care insurance. Each type serves a specific purpose, ensuring individuals and their loved ones are protected against the financial impact of various life events.

Life Insurance

Life insurance is a cornerstone of long-term financial planning, providing a lump-sum payment to beneficiaries upon the policyholder’s death. This payment, known as the death benefit, can help cover a range of expenses, including funeral costs, outstanding debts, and ongoing living expenses for the policyholder’s family. Life insurance policies come in various forms, including term life insurance, which offers coverage for a specified period, and permanent life insurance, which provides lifelong coverage.

| Life Insurance Type | Description |

|---|---|

| Term Life Insurance | Offers coverage for a specified term, typically 10-30 years. It is affordable and suitable for those seeking coverage for a specific period, such as during their working years. |

| Permanent Life Insurance | Provides lifelong coverage and includes a cash value component that grows over time. It is more expensive but offers long-term financial protection and potential tax benefits. |

Health Insurance

Health insurance is an essential component of long-term financial planning, providing coverage for medical expenses. It ensures individuals have access to necessary healthcare services without incurring substantial out-of-pocket costs. Health insurance policies can cover a range of medical services, including hospital stays, doctor visits, prescription medications, and preventive care.

There are several types of health insurance plans, including fee-for-service plans, health maintenance organizations (HMOs), and preferred provider organizations (PPOs). Each type has its own network of providers, coverage options, and cost structure, allowing individuals to choose a plan that best suits their healthcare needs and budget.

| Health Insurance Type | Description |

|---|---|

| Fee-for-Service Plans | Offer the most flexibility, allowing individuals to choose any doctor or hospital. However, they may have higher out-of-pocket costs and less predictable expenses. |

| Health Maintenance Organizations (HMOs) | Require individuals to choose a primary care physician and use a network of providers. They typically have lower out-of-pocket costs but may limit choice. |

| Preferred Provider Organizations (PPOs) | Offer a balance between HMOs and fee-for-service plans, allowing individuals to choose any doctor or hospital but providing discounts when using in-network providers. |

Disability Insurance

Disability insurance is a critical component of long-term financial planning, providing income replacement in the event of a disability that prevents an individual from working. This type of insurance ensures individuals can maintain their standard of living and meet their financial obligations even if they are unable to earn an income due to illness or injury.

Disability insurance policies can be short-term or long-term, with the latter providing coverage for an extended period, typically up to age 65 or retirement. These policies offer a monthly benefit, typically a percentage of the individual's pre-disability income, to help cover living expenses and maintain financial stability during a disability.

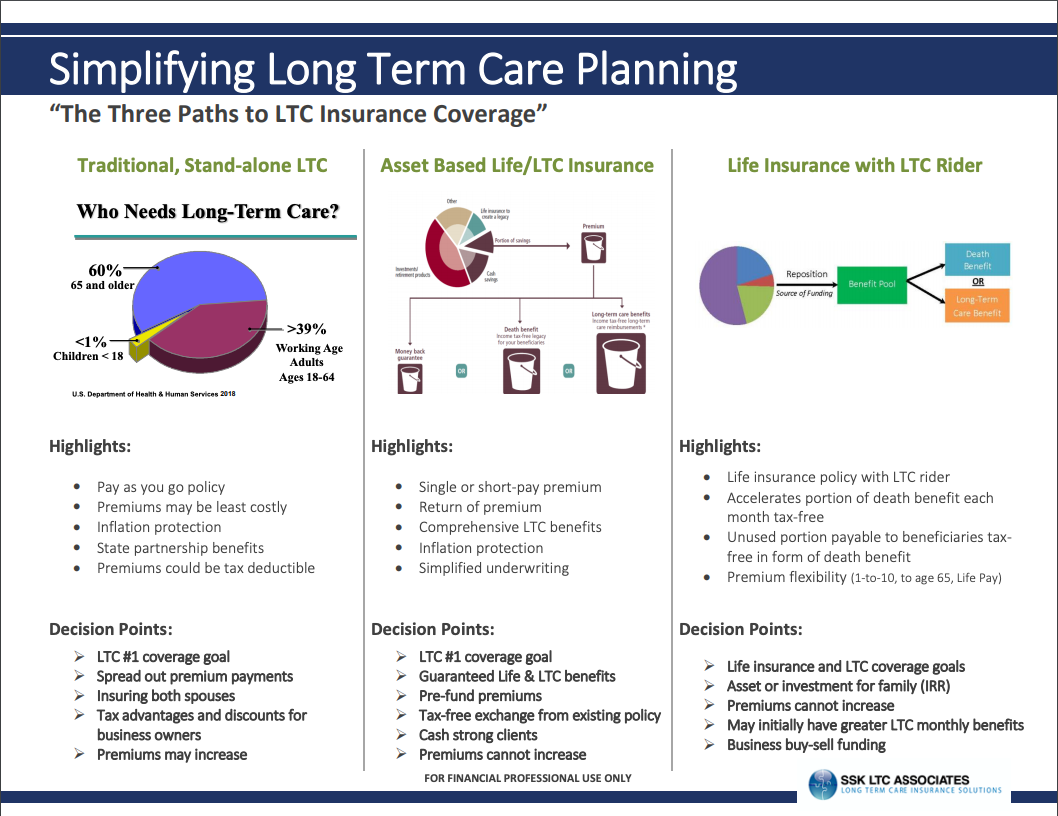

Long-Term Care Insurance

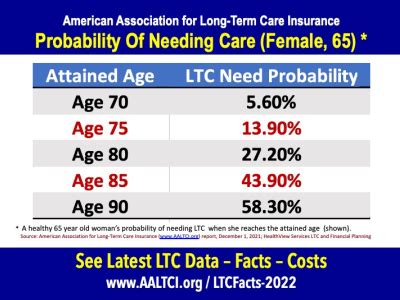

Long-term care insurance is designed to cover the costs associated with extended care needs, such as those arising from chronic illnesses, disabilities, or aging. This type of insurance provides coverage for a range of services, including home healthcare, assisted living facilities, and nursing home care. It ensures individuals have access to the necessary care and support they need as they age or face health challenges.

Long-term care insurance policies can be customized to meet individual needs, offering a range of benefits and coverage options. These policies typically have a daily or monthly benefit limit, which can be used to cover the costs of long-term care services. By having long-term care insurance, individuals can plan for their future care needs and ensure they have the financial resources to access the care they require.

Benefits and Considerations of Long-Term Insurance

Long-term insurance policies offer a range of benefits and considerations that make them an essential part of financial planning. These policies provide peace of mind, knowing that individuals and their loved ones are protected against potential risks and uncertainties.

One of the key benefits of long-term insurance is the financial security it provides. By having insurance coverage in place, individuals can ensure they have the necessary funds to cover unexpected expenses, such as medical bills, funeral costs, or long-term care needs. This financial security allows individuals to focus on their health and well-being without the added stress of financial burdens.

Long-term insurance also offers flexibility in terms of policy options and customization. Individuals can choose policies that align with their specific needs and circumstances, whether it's life insurance to protect their family's financial future, health insurance to cover medical expenses, or disability insurance to provide income replacement in case of illness or injury. This flexibility ensures individuals can tailor their insurance coverage to their unique situation and goals.

Another advantage of long-term insurance is the tax benefits it can offer. Certain types of insurance policies, such as permanent life insurance, can provide tax-advantaged savings and investment opportunities. These policies often include a cash value component that grows over time, providing individuals with a tax-efficient way to save for the future and potentially supplement their retirement income.

However, it's important to consider the cost of long-term insurance policies. These policies can be expensive, especially for comprehensive coverage. Factors such as age, health status, and lifestyle choices can impact the premium amounts. It's crucial to carefully assess one's financial situation and budget when selecting long-term insurance to ensure the policy is affordable and provides adequate coverage.

Additionally, policy terms and conditions should be thoroughly understood. Each insurance policy comes with its own set of terms, exclusions, and limitations. It's essential to read and comprehend these details to ensure the policy meets one's expectations and provides the desired level of protection. Consulting with an insurance professional can help individuals navigate the complexities of long-term insurance and choose the most suitable policies for their needs.

Choosing the Right Long-Term Insurance Policy

Selecting the right long-term insurance policy is a crucial decision that requires careful consideration of one’s individual needs, financial situation, and future goals. It’s important to understand the various types of insurance available and how they can provide protection and financial security over the long term.

When choosing a long-term insurance policy, it's essential to assess your specific needs. Consider the potential risks and uncertainties you want to protect against. For example, if you have a family to support, life insurance is a crucial component to ensure their financial well-being in the event of your untimely death. Similarly, if you have a history of health issues or are concerned about the rising costs of healthcare, health insurance is vital to cover medical expenses and access necessary treatments.

Your financial situation is another key factor in choosing the right long-term insurance policy. Evaluate your income, savings, and existing insurance coverage to determine how much additional protection you can afford. Long-term insurance policies can be expensive, so it's important to strike a balance between comprehensive coverage and your budget constraints.

It's also beneficial to seek professional advice from an insurance expert or financial advisor. They can provide guidance tailored to your unique circumstances and help you navigate the complex world of insurance. An expert can assess your needs, explain the various policy options, and recommend the most suitable long-term insurance policies to meet your goals.

When comparing insurance policies, pay attention to the fine print. Understand the policy's coverage limits, exclusions, and any waiting periods or restrictions. Ensure the policy aligns with your expectations and provides the level of protection you require. Don't hesitate to ask questions and seek clarification to make an informed decision.

Additionally, consider the reputation and financial stability of the insurance company. Choose a reputable insurer with a strong track record of paying claims promptly and fairly. A stable insurer is more likely to honor your policy and provide long-term protection, even in the face of changing economic conditions or market fluctuations.

The Future of Long-Term Insurance

The landscape of long-term insurance is continually evolving, driven by advancements in technology, changing demographics, and evolving consumer needs. As we move into the future, several trends and developments are shaping the industry and influencing the way long-term insurance is perceived and utilized.

Digital Transformation

The insurance industry is undergoing a digital transformation, leveraging technology to enhance the customer experience and streamline processes. Insurers are investing in digital platforms and mobile apps, making it easier for policyholders to manage their policies, file claims, and access information. This digital shift is not only improving convenience but also reducing costs and enhancing efficiency.

With the rise of digital insurance, individuals can now compare policies, obtain quotes, and purchase coverage online. This accessibility and convenience are attracting a new generation of insurance consumers who value the ability to research and purchase insurance at their own pace and on their own terms.

Personalized Insurance Products

The future of long-term insurance lies in personalized products that cater to the unique needs and circumstances of individuals. Insurers are using data analytics and machine learning to develop policies that are tailored to specific customer segments. These personalized products offer more flexibility and customization, allowing individuals to select coverage options that align with their lifestyle, health status, and financial goals.

For example, health insurance policies may offer customizable benefit packages, allowing individuals to choose the level of coverage they need for different medical services. This approach ensures that policyholders are not paying for coverage they don't require, making insurance more affordable and accessible.

Focus on Wellness and Prevention

The future of long-term insurance is also marked by a growing emphasis on wellness and prevention. Insurers are recognizing the importance of promoting healthy lifestyles and preventing costly health issues before they arise. Many insurance companies are now offering incentives and rewards for policyholders who engage in healthy behaviors, such as regular exercise, healthy eating, and preventive screenings.

By encouraging wellness and prevention, insurers can reduce the overall cost of healthcare and improve the long-term health outcomes of their policyholders. This shift towards a proactive approach to healthcare aligns with the changing expectations of consumers who value their health and well-being.

Integration of Telehealth Services

The COVID-19 pandemic has accelerated the adoption of telehealth services, and this trend is expected to continue shaping the future of long-term insurance. Telehealth offers convenient and accessible healthcare options, allowing individuals to consult with healthcare professionals remotely. Insurers are increasingly integrating telehealth services into their policies, making it easier for policyholders to access medical advice and treatment without the need for in-person visits.

The integration of telehealth services not only improves access to healthcare but also reduces costs and wait times. It empowers individuals to take a more active role in managing their health and makes insurance coverage more efficient and responsive to changing healthcare needs.

Conclusion

Long-term insurance policies are an essential tool for financial planning and risk management. By understanding the various types of insurance, their benefits, and how to choose the right policies, individuals can secure their financial future and protect their loved ones. The evolving landscape of long-term insurance, driven by digital transformation, personalized products, wellness initiatives, and telehealth integration, is making insurance more accessible, efficient, and aligned with the needs of modern consumers.

As we navigate an increasingly uncertain world, long-term insurance remains a vital component of financial security. By staying informed and making well-informed choices, individuals can ensure they have the protection they need to face life's challenges with confidence and peace of mind.

What is the difference between term life insurance and permanent life insurance?

+

Term life insurance offers coverage for a specified term, typically 10-30 years, and is affordable. Permanent life insurance provides lifelong coverage with a cash value component and is more expensive but offers long-term financial protection and potential tax benefits.

How do I choose the right health insurance plan for my needs?

+

When choosing a health insurance plan, consider your healthcare needs, budget, and preferences. Fee-for-service plans offer flexibility but may have higher costs. HMOs have lower out-of-pocket costs but limit provider choice. PPOs provide a balance between flexibility and cost.

What factors should I consider when selecting long-term care insurance?

+

When selecting long-term care insurance, consider your age, health status, and the level of care you may require. Assess the policy’s daily or monthly benefit limits, inflation protection, and any additional riders or benefits that align with your specific needs.