Low Car Insurance Rates

Finding low car insurance rates is a common goal for many drivers, as it can significantly impact your monthly expenses and overall financial planning. In this comprehensive guide, we will delve into the factors that influence car insurance rates and provide expert insights on how to secure the best possible deals. By understanding the intricate world of automotive insurance, you'll be equipped to make informed decisions and potentially save a substantial amount on your policy.

Understanding Car Insurance Rates

Car insurance rates are a reflection of the risk an insurance company assumes when providing coverage for your vehicle. These rates are determined by a multitude of factors, each playing a unique role in assessing the likelihood of accidents, claims, and overall financial exposure for the insurer. Let’s explore some of the key elements that influence these rates.

Risk Factors

Insurance companies meticulously evaluate various risk factors to calculate premiums. These factors can be broadly categorized into three main groups: personal, vehicle, and geographic.

Personal Risk Factors: These are attributes related to the driver and their driving history. Age, gender, marital status, and driving record (including accidents and traffic violations) are significant determinants. For instance, younger drivers, especially males, are often considered higher-risk due to their propensity for more aggressive driving and higher accident rates.

Vehicle Risk Factors: The type of car you drive, its age, make, and model, and even the purpose for which it's used (personal, commercial, or recreational) can influence insurance rates. High-performance vehicles or those with a history of frequent claims may attract higher premiums. Additionally, safety features like airbags, anti-lock brakes, and theft-deterrent systems can potentially lower your rates.

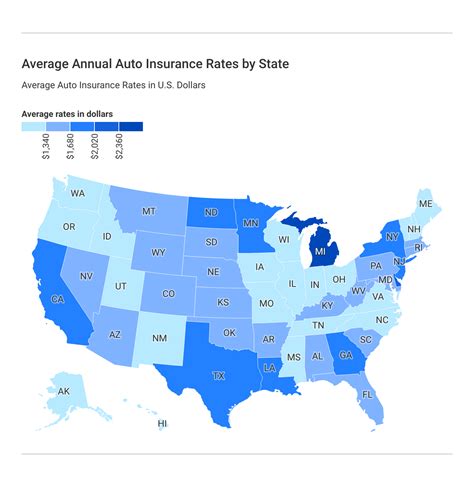

Geographic Risk Factors: The location where you reside and drive plays a crucial role. Urban areas, for example, often have higher rates due to increased traffic congestion and the higher likelihood of accidents and theft. Similarly, regions with harsh weather conditions or a higher incidence of natural disasters may also see elevated insurance costs.

| Risk Factor | Impact on Rates |

|---|---|

| Age | Younger drivers typically pay more |

| Gender | Male drivers often face higher rates |

| Marital Status | Married individuals may benefit from lower rates |

| Vehicle Type | High-performance cars usually attract higher premiums |

| Location | Urban areas and regions with severe weather may have higher rates |

Insurance Coverage Options

Car insurance policies come in various forms, offering different levels of coverage. Understanding these options is crucial as it allows you to tailor your policy to your specific needs while also impacting the overall cost.

Liability Coverage: This is the most basic form of car insurance, covering the costs associated with injuries or property damage you cause to others. It's mandatory in most states and forms the foundation of your policy. However, liability coverage alone may not be sufficient, especially if you have significant assets to protect.

Collision Coverage: This type of insurance covers the damage to your vehicle resulting from an accident, regardless of fault. It's an essential addition to your policy if you want comprehensive protection, but it does come at a cost.

Comprehensive Coverage: Comprehensive insurance provides protection against damage to your vehicle that's not caused by a collision. This can include events like theft, vandalism, natural disasters, or collisions with animals. While it offers a high level of protection, it also tends to be more expensive.

Uninsured/Underinsured Motorist Coverage: This coverage protects you in the event of an accident with a driver who doesn't have insurance or doesn't have sufficient coverage to cover the damages. It's a wise choice, given the potential financial risks associated with uninsured drivers.

Personal Injury Protection (PIP): PIP coverage, also known as no-fault insurance, covers medical expenses and lost wages for you and your passengers, regardless of who's at fault in an accident. It's mandatory in some states and can be a valuable addition to your policy.

Strategies to Lower Car Insurance Rates

Now that we’ve established the key factors influencing car insurance rates, let’s explore some effective strategies to lower your premiums and make your insurance more affordable.

Shop Around and Compare

One of the simplest yet most effective ways to find low car insurance rates is to compare quotes from multiple providers. Each insurance company uses its own formula to calculate premiums, and rates can vary significantly between them. By shopping around, you can identify the companies offering the most competitive rates for your specific circumstances.

Online quote comparison tools can be particularly useful, allowing you to quickly and easily gather quotes from a wide range of insurers. However, it's important to note that these tools provide only a snapshot of the market. To get the most accurate and up-to-date quotes, consider reaching out directly to insurance companies or working with an independent insurance agent who can provide quotes from multiple carriers.

Bundle Policies

Many insurance companies offer discounts when you bundle multiple policies with them. For instance, if you have homeowners or renters insurance, consider getting your car insurance from the same provider. Bundling policies can result in significant savings, as insurers often reward loyalty and the convenience of managing multiple policies in one place.

Increase Your Deductible

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you can lower your monthly premiums. This strategy works best if you have a good financial cushion to cover the higher deductible in the event of an accident. It’s a trade-off between immediate savings and potential future costs.

Improve Your Credit Score

Believe it or not, your credit score can impact your car insurance rates. Many insurance companies use credit-based insurance scores to assess the risk of insuring a driver. A higher credit score often correlates with lower insurance rates, as it’s seen as an indicator of financial responsibility. Improving your credit score can therefore lead to significant savings on your car insurance.

Take Advantage of Discounts

Insurance companies offer a variety of discounts to attract customers and reward safe driving behavior. Some common discounts include:

- Safe Driver Discount: This discount is often given to drivers with a clean driving record, free of accidents and traffic violations.

- Multi-Car Discount: If you insure more than one vehicle with the same insurer, you may be eligible for a discount.

- Good Student Discount: Many insurers offer discounts to students who maintain a certain GPA or are on the honor roll.

- Loyalty Discount: Staying with the same insurer for an extended period can lead to loyalty discounts.

- Safety Features Discount: Having certain safety features in your vehicle, such as anti-theft devices or advanced driver assistance systems, can qualify you for a discount.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, uses real-time data from your driving habits to calculate premiums. This type of insurance can be a great option for safe, low-mileage drivers, as it rewards responsible driving behavior. With usage-based insurance, your premium is often based on factors like how many miles you drive, when you drive, and how safely you drive.

The Future of Car Insurance Rates

The world of car insurance is constantly evolving, with technological advancements and changing consumer behaviors shaping the industry. Here’s a glimpse into some of the trends that may impact car insurance rates in the future.

Autonomous Vehicles

The rise of autonomous vehicles has the potential to significantly reduce accidents, leading to lower insurance rates. With fewer accidents, insurers may be able to offer more affordable coverage. However, the transition period as autonomous vehicles become more prevalent could lead to initial increases in rates as insurers adjust their models and understand the risks associated with this new technology.

Telematics and Usage-Based Insurance

Telematics technology, which collects data on driving behavior, is becoming increasingly common. As more insurers adopt usage-based insurance models, they’ll be able to more accurately assess risk and offer rates that reflect an individual’s actual driving habits. This could lead to more personalized insurance rates, rewarding safe drivers with lower premiums.

Environmental Considerations

As environmental concerns continue to grow, insurers may start to factor in the environmental impact of vehicles when calculating rates. Electric and hybrid vehicles, for example, could become more affordable to insure due to their lower environmental footprint and reduced risk of certain types of accidents.

Data-Driven Risk Assessment

Advancements in data analytics and machine learning are allowing insurers to more accurately assess risk. By analyzing vast amounts of data, insurers can identify patterns and correlations that traditional methods might miss. This could lead to more precise risk assessment and, potentially, more tailored and affordable insurance rates for specific groups of drivers.

Can I get car insurance if I have a poor driving record?

+Yes, it’s possible to obtain car insurance even with a poor driving record. However, you may face higher premiums due to the increased risk associated with your record. It’s important to shop around and compare quotes to find an insurer willing to provide coverage at a competitive rate.

How often should I review my car insurance policy and rates?

+It’s a good practice to review your car insurance policy and rates annually, or whenever you experience a significant life event such as a move, marriage, or purchase of a new vehicle. Regular reviews ensure you’re always getting the best possible coverage and rate for your circumstances.

Are there any government programs or subsidies available to help with car insurance costs?

+Some states offer subsidies or programs to help low-income individuals or certain demographic groups with car insurance costs. It’s worth researching what’s available in your state and applying if you meet the eligibility criteria. Additionally, some insurers may offer payment plans or financial assistance programs to make insurance more accessible.