Low Cost Medical Insurance Washington State

Accessing affordable healthcare is a pressing concern for many individuals and families, especially in today's economic climate. In the state of Washington, residents are fortunate to have a range of options for low-cost medical insurance, ensuring that quality healthcare is within reach for all. This article delves into the various avenues available to Washingtonians seeking affordable healthcare coverage, offering a comprehensive guide to navigating the complex world of medical insurance.

Understanding the Healthcare Landscape in Washington

Washington state boasts a diverse healthcare system, with a variety of public and private insurance providers offering comprehensive coverage plans. The state’s commitment to healthcare accessibility is evident in its initiatives to provide affordable insurance options, particularly for low-income residents.

The Washington Health Benefit Exchange, commonly known as WAhealthplanfinder, is a key resource for residents seeking insurance. This online platform, established under the Affordable Care Act, enables individuals and families to compare and purchase health insurance plans that best suit their needs and budget.

Public Insurance Programs

Washington offers several public insurance programs to cater to specific demographic groups and income levels. These programs provide vital healthcare coverage to those who might otherwise struggle to afford it.

Apple Health (Medicaid): This program provides free or low-cost healthcare coverage to eligible Washington residents. It serves as the state's Medicaid program, offering comprehensive medical, dental, and vision benefits to those meeting the income and other eligibility criteria.

Basic Health Program: Aimed at individuals and families with incomes between 138% and 200% of the federal poverty level, this program offers affordable premiums and comprehensive coverage. It is an alternative to traditional Medicaid, providing additional benefits such as mental health services and prescription drug coverage.

Washington Apple Health for Kids: As the name suggests, this program is specifically designed for children and teens up to the age of 19. It offers free or low-cost healthcare coverage, ensuring that young Washingtonians receive the medical care they need to grow and thrive.

Private Insurance Options

For those not eligible for public insurance programs, private insurance plans are an alternative. These plans offer a range of benefits and can be tailored to individual needs and preferences.

Washington residents can choose from a variety of private insurance providers, each offering unique plans with different coverage levels and premium costs. These plans typically include essential health benefits such as doctor visits, hospital stays, prescription drugs, and preventive care.

Additionally, private insurance plans in Washington often provide additional benefits such as vision and dental coverage, mental health services, and alternative medicine options. The specific benefits and costs vary depending on the insurance provider and the chosen plan.

Navigating the Insurance Marketplace

When exploring insurance options, it’s crucial to consider various factors to find the best fit for your needs. These factors include cost, coverage, and the insurance provider’s reputation.

Cost Considerations

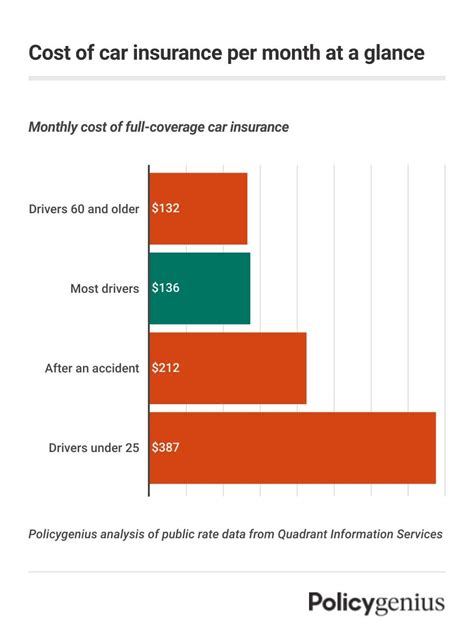

Insurance premiums can vary significantly based on factors such as age, location, and the level of coverage desired. It’s essential to strike a balance between affordable premiums and comprehensive coverage.

Washington residents can access cost-assistance programs to help reduce their insurance premiums. These programs are particularly beneficial for individuals and families with lower incomes, ensuring they can afford the coverage they need.

Additionally, exploring insurance plans with different deductible and copay structures can also impact the overall cost. Higher deductibles and copays may result in lower monthly premiums, while lower deductibles and copays can provide more financial flexibility when utilizing healthcare services.

Coverage Details

Understanding the specific coverage offered by different insurance plans is crucial. This includes knowing what medical services, treatments, and prescriptions are covered, as well as any potential exclusions or limitations.

Reviewing the plan's provider network is also vital. This ensures that your preferred healthcare providers, specialists, and hospitals are included in the network, allowing for more convenient and cost-effective care.

Reputation and Reliability

Choosing a reputable and reliable insurance provider is essential to ensure seamless coverage and prompt claim processing. Researching customer reviews and the provider’s track record can offer valuable insights into their reliability and customer satisfaction.

Additionally, verifying the insurance provider's financial stability is crucial to ensure they can fulfill their obligations and provide continuous coverage. This information can often be found through independent rating agencies or the Washington State Office of the Insurance Commissioner.

Enrolling in a Medical Insurance Plan

Enrolling in a medical insurance plan in Washington is a straightforward process, primarily facilitated through the WAhealthplanfinder platform.

Eligibility and Enrollment Periods

Eligibility for insurance plans is determined by factors such as income, family size, and citizenship status. It’s important to understand your eligibility criteria before beginning the enrollment process.

Washington operates on an open enrollment period, typically occurring annually. During this time, residents can enroll in a new insurance plan or make changes to their existing coverage. However, qualifying life events, such as marriage, divorce, or the birth of a child, allow for special enrollment periods outside of the open enrollment window.

Application Process

The application process for insurance coverage in Washington is primarily done online through the WAhealthplanfinder website. Here, applicants can create an account, input their personal and income information, and compare available plans.

The platform provides a user-friendly interface, guiding applicants through the process step-by-step. It offers tools to estimate premium costs, apply for cost assistance, and choose the most suitable plan based on individual needs and budget.

Cost Assistance and Subsidies

Washington offers cost assistance and subsidies to make insurance more affordable for eligible residents. These programs provide premium tax credits, which lower the monthly cost of insurance plans, and cost-sharing reductions, which reduce out-of-pocket costs for healthcare services.

To qualify for cost assistance, applicants must meet certain income requirements. The specific income thresholds vary based on family size and the chosen insurance plan.

Maximizing Your Insurance Benefits

Once enrolled in a medical insurance plan, it’s important to understand how to make the most of your coverage to ensure you receive the full benefits you’re entitled to.

Understanding Your Plan’s Benefits

Familiarize yourself with the specifics of your insurance plan, including what services and treatments are covered, any applicable deductibles or copays, and the process for filing claims.

Review the plan's provider network to ensure your preferred healthcare providers are included. If they are not, consider changing your plan during the next open enrollment period to better suit your needs.

Utilizing Preventive Care

Most insurance plans in Washington cover a range of preventive care services, such as annual check-ups, screenings, and immunizations, at no additional cost. Taking advantage of these services can help identify potential health issues early on and prevent more serious conditions.

Additionally, many plans offer wellness programs and incentives to encourage healthy behaviors. These programs can provide discounts on gym memberships, healthy food options, or even rewards for meeting certain health goals.

Managing Out-of-Pocket Costs

Understanding your insurance plan’s out-of-pocket costs, such as deductibles, copays, and coinsurance, is crucial to managing your healthcare expenses effectively.

Consider setting aside funds in a dedicated healthcare savings account to cover these out-of-pocket costs. This can provide financial peace of mind and ensure you have the necessary funds when healthcare needs arise.

The Future of Affordable Healthcare in Washington

Washington’s commitment to providing affordable healthcare to its residents is evident in its ongoing initiatives and policy changes. The state continues to explore ways to make insurance more accessible and cost-effective, particularly for low-income individuals and families.

One key area of focus is expanding Medicaid eligibility to cover a broader range of residents. This expansion would provide healthcare coverage to more Washingtonians, ensuring they receive the medical care they need without facing financial hardship.

Additionally, the state is exploring ways to reduce insurance premiums and out-of-pocket costs, making healthcare more affordable for all. This includes negotiating with healthcare providers and insurers to lower costs and improve the overall value of healthcare services.

Washington's dedication to healthcare accessibility is further evidenced by its investments in healthcare infrastructure and support services. This includes funding for community health centers, mental health services, and programs to address social determinants of health, such as housing and food insecurity.

| Public Insurance Programs | Private Insurance Options |

|---|---|

| Apple Health (Medicaid) | Blue Cross Blue Shield of Washington |

| Basic Health Program | Premera Blue Cross |

| Washington Apple Health for Kids | Regence BlueShield |

How do I know if I’m eligible for public insurance programs in Washington?

+Eligibility for public insurance programs in Washington is primarily based on income and family size. You can use the eligibility calculator on the WAhealthplanfinder website to determine if you qualify for programs like Apple Health (Medicaid) or the Basic Health Program.

What if I miss the open enrollment period for insurance coverage?

+If you miss the open enrollment period, you may still be able to enroll in a plan if you experience a qualifying life event, such as marriage, divorce, or the birth of a child. These events trigger a special enrollment period, allowing you to enroll outside of the regular open enrollment window.

How can I find the most affordable insurance plan for my needs?

+To find the most affordable plan, consider your healthcare needs and budget. Compare plans based on premiums, deductibles, and the services you anticipate needing. You can also explore cost assistance programs, which can significantly reduce your monthly premiums.

Are there any resources to help me understand my insurance coverage better?

+Yes, the WAhealthplanfinder website offers a wealth of resources to help you understand your insurance coverage. They provide guides, videos, and customer support to ensure you fully comprehend your plan’s benefits and how to utilize them effectively.