Low Cost Private Health Insurance

In the pursuit of quality healthcare, finding an affordable and comprehensive private health insurance plan is a top priority for many individuals and families. With the rising costs of medical care, navigating the complex world of private health insurance can be daunting. This comprehensive guide aims to shed light on the intricacies of low-cost private health insurance, offering expert insights and practical tips to help you make informed decisions.

Understanding the Landscape: Low-Cost Private Health Insurance

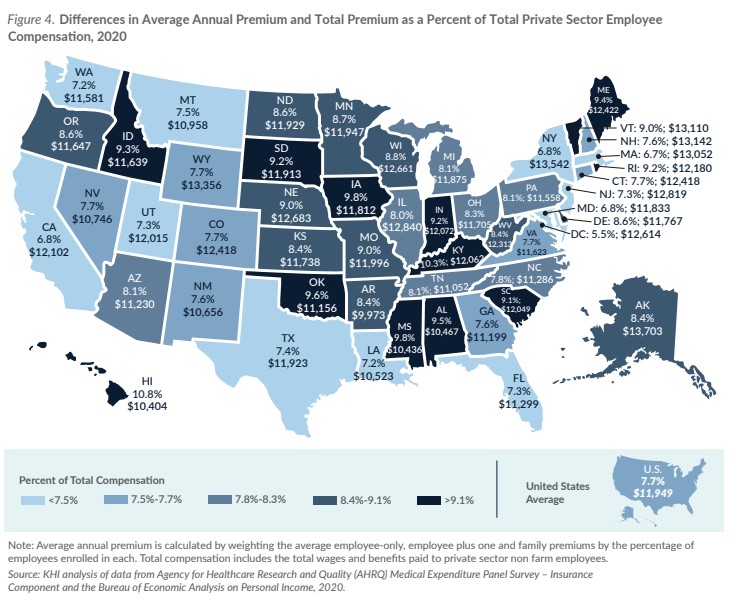

Low-cost private health insurance plans have emerged as a popular alternative for those seeking affordable coverage. These plans are designed to provide essential healthcare benefits at a more accessible price point, catering to individuals and families with varying needs and budgets.

Key Considerations for Choosing Low-Cost Private Health Insurance

When evaluating low-cost private health insurance options, it’s crucial to consider several factors to ensure you’re getting the best value and coverage for your money. Here are some key aspects to keep in mind:

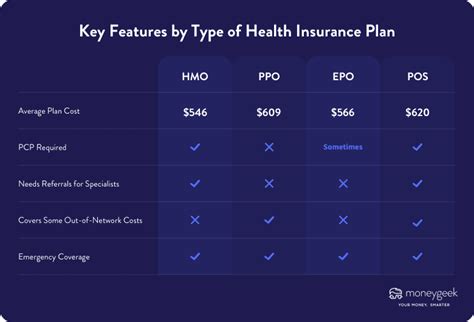

- Coverage and Benefits: Evaluate the scope of coverage offered by the plan. Look for essential benefits such as doctor visits, hospitalization, prescription medications, and preventive care. Ensure that the plan aligns with your healthcare needs and priorities.

- Network of Providers: Check the network of healthcare providers associated with the insurance plan. A robust network can provide greater flexibility and convenience, allowing you to choose from a wide range of medical professionals and facilities.

- Deductibles and Out-of-Pocket Costs: Understand the deductibles and out-of-pocket expenses associated with the plan. While low-cost plans may have higher deductibles, it's important to assess your financial situation and determine whether you can afford these costs in the event of a medical emergency.

- Additional Services and Benefits: Some low-cost private health insurance plans offer additional services and benefits, such as telemedicine options, wellness programs, or discounts on certain healthcare services. These extras can enhance the value of the plan and provide added peace of mind.

- Renewability and Longevity: Consider the renewability and long-term viability of the insurance plan. Ensure that the plan offers continuous coverage and that you understand any potential limitations or exclusions as you age or your healthcare needs change.

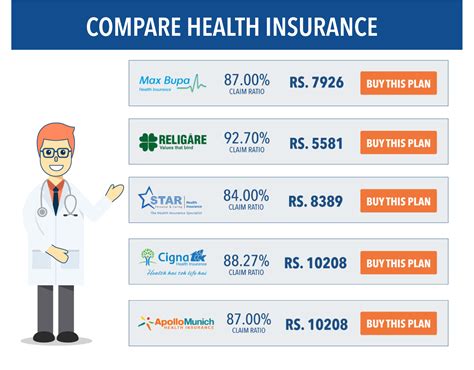

Comparing Low-Cost Private Health Insurance Plans

To make an informed decision, it’s essential to compare multiple low-cost private health insurance plans. Here’s a breakdown of some key aspects to consider during your comparison:

| Plan Name | Monthly Premium | Deductible | Out-of-Pocket Limit | Network Size |

|---|---|---|---|---|

| Blue Cross Basic | $120 | $2,000 | $5,000 | 1,500+ Providers |

| HealthSmart Value Plan | $135 | $1,800 | $4,500 | 2,000+ Providers |

| WellnessCare Essential | $110 | $2,500 | $6,000 | 1,200+ Providers |

These plans offer a range of options, each with its own unique features and benefits. It's important to carefully review the specifics of each plan and assess how they align with your healthcare needs and budget.

Navigating the Enrollment Process

Enrolling in a low-cost private health insurance plan can be a straightforward process with the right guidance. Here’s a step-by-step guide to help you navigate the enrollment journey:

Step 1: Research and Compare Plans

Start by researching and comparing various low-cost private health insurance plans. Utilize online resources, insurance marketplaces, or seek advice from insurance brokers or financial advisors. Consider your healthcare needs, budget, and the coverage options available to find the plan that best suits your requirements.

Step 2: Understand the Application Process

Each insurance provider may have slightly different application processes. Familiarize yourself with the required documentation, such as proof of identity, income verification, and any necessary medical records. Ensure you understand the timeline for application submission and any potential waiting periods for coverage to begin.

Step 3: Complete the Application

Carefully review and complete the application form provided by your chosen insurance provider. Double-check all the information for accuracy and ensure you understand the terms and conditions of the plan. If you have any questions or concerns, reach out to the insurance provider’s customer support for clarification.

Step 4: Submit Supporting Documents

Along with the completed application, you may need to submit additional supporting documents. This could include proof of income, copies of medical records (if applicable), and any other requested verification. Ensure you meet all the requirements to avoid delays in processing your application.

Step 5: Wait for Approval

Once you’ve submitted your application and supporting documents, the insurance provider will review your information. This process can take a few days to a few weeks, depending on the provider and the complexity of your application. During this time, you may receive updates or requests for additional information.

Step 6: Review and Accept the Offer

If your application is approved, the insurance provider will send you an offer letter or policy document outlining the terms of your coverage. Carefully review the details, including the coverage benefits, exclusions, and any potential limitations. Ensure that the offered plan aligns with your expectations and meets your healthcare needs.

Step 7: Pay the Initial Premium

Upon accepting the offer, you’ll be required to pay the initial premium to activate your coverage. The insurance provider will provide instructions on how to make the payment, typically via online banking, credit card, or direct deposit. Ensure you make the payment within the specified timeframe to avoid any gaps in coverage.

Maximizing the Benefits of Low-Cost Private Health Insurance

Once you’ve secured your low-cost private health insurance plan, it’s important to understand how to maximize the benefits and make the most of your coverage. Here are some tips to help you navigate your new plan effectively:

Familiarize Yourself with the Plan Details

Take the time to thoroughly read and understand the terms and conditions of your insurance plan. Pay attention to the coverage limits, deductibles, co-pays, and any exclusions. This knowledge will help you make informed decisions about your healthcare choices and avoid unexpected expenses.

Utilize In-Network Providers

Low-cost private health insurance plans often come with a network of preferred providers. To maximize your savings, it’s advisable to use these in-network healthcare professionals and facilities. In-network providers have negotiated rates with the insurance company, which can result in lower out-of-pocket costs for you.

Understand Cost-Sharing

Most low-cost private health insurance plans operate on a cost-sharing basis, where you and the insurance company share the financial responsibility for your healthcare expenses. Familiarize yourself with the cost-sharing arrangement, including deductibles, co-pays, and co-insurance. Understanding these costs will help you budget effectively and make informed decisions about your healthcare.

Take Advantage of Preventive Care

Many low-cost private health insurance plans offer preventive care services at little to no cost. These services, such as annual check-ups, immunizations, and screenings, are essential for maintaining good health and catching potential issues early on. Take advantage of these benefits to stay proactive about your well-being and potentially save on future medical costs.

Review Your Plan Annually

Insurance plans and healthcare needs can change over time. It’s a good practice to review your low-cost private health insurance plan annually to ensure it still meets your requirements. Assess whether the coverage, network of providers, and cost-sharing arrangement are still suitable for your needs. If necessary, consider switching plans during open enrollment periods to find a better fit.

Addressing Common Concerns and Misconceptions

When exploring low-cost private health insurance options, it’s natural to have questions and concerns. Here, we address some common misconceptions and provide clarity on important aspects:

Is low-cost private health insurance comprehensive enough for my needs?

+Low-cost private health insurance plans are designed to offer essential coverage at an affordable price. While they may have higher deductibles and out-of-pocket costs, they still provide valuable benefits such as doctor visits, hospitalization, and prescription medication coverage. It's important to carefully review the plan details and ensure it aligns with your specific healthcare needs.

Can I switch to a low-cost plan if I currently have a more expensive plan?

+Yes, you can switch to a low-cost private health insurance plan if your current plan is too expensive or no longer meets your needs. However, it's important to time your switch carefully. Open enrollment periods, typically occurring once a year, are the best time to make changes to your insurance coverage. Outside of these periods, you may need a qualifying life event, such as a job loss or marriage, to make a change.

Are there any hidden costs or fees associated with low-cost plans?

+Low-cost private health insurance plans aim to be transparent with their pricing. However, it's always a good idea to carefully review the plan details and any additional fees or charges that may apply. Some plans may have administration fees or charges for specific services, so it's essential to understand these potential costs before enrolling.

How do I choose between a low-cost plan and a government-sponsored healthcare program?

+The decision between a low-cost private health insurance plan and a government-sponsored program depends on your individual circumstances. Government-sponsored programs often have more comprehensive coverage and lower out-of-pocket costs, but they may have stricter eligibility criteria and limited provider networks. Low-cost private plans offer more flexibility and choice but may have higher costs. It's crucial to assess your healthcare needs, budget, and preferences to make an informed decision.

In conclusion, navigating the world of low-cost private health insurance requires careful consideration and an understanding of your healthcare needs and budget. By comparing plans, understanding the enrollment process, and maximizing the benefits of your chosen plan, you can make informed decisions and access quality healthcare at an affordable price. Remember, staying informed and proactive about your healthcare choices is key to maintaining your well-being and financial stability.