Lower Car Insurance Rates

When it comes to car insurance, one of the most pressing concerns for drivers is finding ways to reduce their insurance rates. While insurance companies use various factors to determine premiums, there are several strategies and considerations that can help individuals secure lower rates and save money on their auto insurance policies. This comprehensive guide will delve into the world of car insurance, offering expert insights and practical tips to navigate the process effectively.

Understanding the Factors That Impact Car Insurance Rates

Before we explore strategies to lower insurance costs, it’s crucial to grasp the key factors that influence car insurance rates. Insurance providers assess a multitude of elements to determine the level of risk associated with insuring a particular driver and vehicle. These factors can vary significantly between insurance companies, but some common considerations include:

- Driving History: A clean driving record with no recent accidents or traffic violations is often rewarded with lower insurance rates. Insurance companies view drivers with a history of safe driving as less risky.

- Vehicle Type: The make, model, and age of your vehicle play a role in insurance rates. Certain vehicle types, especially those known for their safety features or lower repair costs, may qualify for discounts.

- Location: Where you live and where your vehicle is primarily garaged can impact rates. Urban areas with higher populations and accident rates often result in increased insurance costs.

- Age and Gender: Insurance companies may consider age and gender when assessing risk. Younger drivers, especially males, are often associated with higher accident rates, leading to increased premiums.

- Credit Score: Surprisingly, your credit score can influence your insurance rates. Many insurers believe that individuals with higher credit scores are more responsible and less likely to file claims, resulting in lower premiums.

- Coverage and Deductibles: The type and level of coverage you choose, as well as your selected deductibles, directly impact your insurance costs. Higher deductibles can lead to lower premiums, but it's essential to find a balance that suits your financial situation.

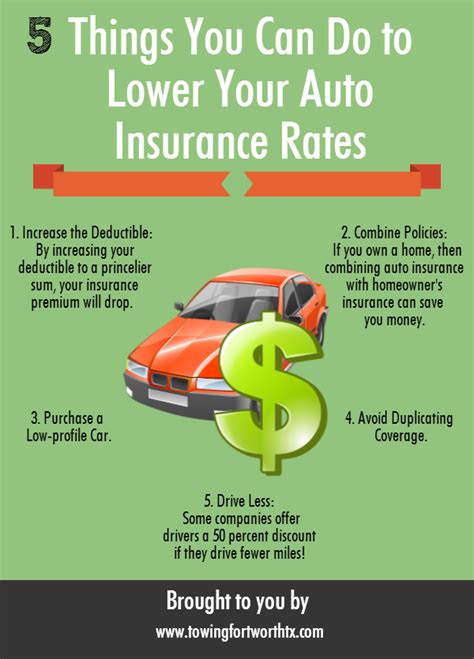

Strategies to Secure Lower Car Insurance Rates

Now that we have a better understanding of the factors at play, let’s explore some effective strategies to reduce your car insurance rates:

Shop Around and Compare Quotes

One of the simplest yet most effective ways to lower your insurance rates is to shop around and compare quotes from multiple insurance providers. Each insurer uses its own unique formula to calculate rates, and you might be surprised by the variations in quotes for the same coverage. Utilize online quote comparison tools and contact insurance agents to obtain a range of quotes. This approach allows you to identify the most competitive rates and choose the provider that offers the best value for your needs.

Bundle Your Insurance Policies

If you have multiple insurance needs, such as auto, home, or renters’ insurance, consider bundling your policies with a single insurance provider. Many insurers offer significant discounts when you combine multiple policies under their umbrella. This strategy not only simplifies your insurance management but also leads to substantial savings on your overall insurance costs.

Explore Discounts and Rewards Programs

Insurance companies often provide a variety of discounts and rewards programs to attract and retain customers. These discounts can be based on factors such as:

- Safe Driving: Many insurers offer discounts for maintaining a clean driving record over a specified period, often one to three years.

- Defensive Driving Courses: Completing a defensive driving course can lead to reduced rates, as it demonstrates a commitment to safe driving practices.

- Student Discounts: Full-time students with good grades may qualify for discounts, as insurers view education as a positive indicator of responsibility.

- Loyalty Rewards: Staying with the same insurance provider for an extended period can result in loyalty discounts, rewarding your long-term commitment.

- Group or Association Membership: Belonging to certain professional organizations, alumni associations, or other groups may unlock exclusive insurance discounts.

Research the discounts and rewards programs offered by different insurers to ensure you're taking advantage of all the savings opportunities available to you.

Adjust Your Coverage and Deductibles

Reviewing your insurance coverage and deductibles regularly is essential to ensure you’re not overpaying. Consider the following:

- Comprehensive and Collision Coverage: If your vehicle is older or has a lower value, it might be more cost-effective to remove comprehensive and collision coverage. These coverages protect against damage to your vehicle, but they may not be necessary if the potential payout is less than the cost of the premiums.

- Liability Coverage: Ensure you have adequate liability coverage to protect yourself financially in the event of an accident. However, be mindful that excessive liability coverage can drive up your premiums.

- Higher Deductibles: Increasing your deductible can significantly reduce your insurance premiums. While this means you'll pay more out of pocket if you need to file a claim, it's a strategy that can lead to substantial savings if you have a clean driving record and are unlikely to file frequent claims.

Consider Usage-Based Insurance Programs

Usage-based insurance (UBI) programs, also known as pay-as-you-drive or pay-how-you-drive programs, are becoming increasingly popular. These programs use telematics devices or smartphone apps to monitor your driving behavior, such as miles driven, driving speed, and braking habits. Insurance companies then use this data to offer personalized insurance rates. Drivers who exhibit safe driving behaviors may qualify for lower premiums under these programs.

Maintain a Clean Driving Record

Perhaps the most straightforward way to lower your insurance rates is to maintain a clean driving record. Avoid traffic violations and accidents, as these can significantly increase your insurance premiums. Even a single speeding ticket or minor accident can lead to higher rates for an extended period. Additionally, focus on improving your driving skills and practicing defensive driving techniques to minimize the risk of accidents.

Explore Alternative Ownership Models

If you’re in the market for a new vehicle, consider exploring alternative ownership models, such as leasing or subscription services. These options often include insurance coverage as part of the package, providing convenience and potential cost savings. Additionally, when purchasing a new vehicle, research the insurance costs associated with different makes and models to make an informed decision.

The Future of Car Insurance: Technology and Data-Driven Insights

The insurance industry is evolving rapidly, driven by advancements in technology and data analytics. Insurers are increasingly leveraging data-driven insights and innovative technologies to enhance risk assessment and provide personalized insurance offerings. Here’s a glimpse into the future of car insurance and how it may impact rates:

Telematics and Connected Car Technology

Telematics devices and connected car technology are revolutionizing the way insurance companies assess risk. These technologies provide real-time data on driving behavior, vehicle performance, and even environmental conditions. By analyzing this data, insurers can offer more accurate and personalized insurance rates, rewarding safe drivers with lower premiums.

| Telematics Benefits | Impact on Rates |

|---|---|

| Accurate Risk Assessment | Lower premiums for safe drivers |

| Real-time Monitoring | Quick response to accidents or claims |

| Driver Feedback and Coaching | Improved driving habits and reduced accidents |

AI and Machine Learning in Insurance

Artificial Intelligence (AI) and machine learning algorithms are being utilized by insurance companies to analyze vast amounts of data and identify patterns that influence risk. These technologies can predict accident probabilities, assess vehicle damage, and even streamline the claims process. By leveraging AI, insurers can make more accurate decisions, leading to more precise insurance rates and improved customer experiences.

Blockchain and Smart Contracts

Blockchain technology is poised to revolutionize the insurance industry by enhancing transparency, security, and efficiency. Smart contracts, which are self-executing contracts with predefined rules, can automate various insurance processes, including claims handling and policy management. This technology has the potential to reduce administrative costs, minimize fraud, and streamline the insurance experience for both insurers and policyholders.

Predictive Analytics for Risk Assessment

Insurance companies are leveraging predictive analytics to forecast potential risks and identify trends that may impact insurance rates. By analyzing historical data, demographic information, and external factors, insurers can make more informed decisions about policy pricing and risk management strategies. This approach allows for a more dynamic and responsive insurance market, benefiting both insurers and policyholders.

Conclusion: Empowering Drivers to Take Control of Their Insurance Costs

Lowering car insurance rates is within your reach when you understand the factors that influence premiums and employ effective strategies. By shopping around, exploring discounts, adjusting your coverage, and maintaining a clean driving record, you can significantly reduce your insurance costs. Additionally, embracing the future of insurance, with its focus on technology and data-driven insights, offers new opportunities for personalized and affordable insurance coverage.

As the insurance landscape continues to evolve, drivers can take an active role in managing their insurance costs. By staying informed, utilizing technology, and making smart choices, you can secure the best possible insurance rates while enjoying the peace of mind that comes with comprehensive coverage.

How often should I review my car insurance policy and rates?

+It’s recommended to review your car insurance policy and rates at least once a year, or whenever your circumstances change significantly. This ensures you’re getting the best value and coverage for your needs.

Can I negotiate my car insurance rates with the provider?

+While car insurance rates are largely determined by factors beyond your control, it doesn’t hurt to ask your insurance provider about potential discounts or rate adjustments. They may be able to offer suggestions or apply discounts you weren’t aware of.

Are usage-based insurance programs suitable for all drivers?

+Usage-based insurance programs can be beneficial for drivers who exhibit safe driving behaviors and drive fewer miles. However, it’s essential to carefully review the terms and conditions of these programs to ensure they align with your driving habits and preferences.