Lowest Car Insurance Prices

When it comes to car insurance, finding the lowest prices can be a daunting task. With numerous insurance providers and varying factors that influence premiums, it's essential to understand the key elements that contribute to affordable coverage. This comprehensive guide will delve into the strategies and considerations that can help you secure the most competitive car insurance rates, ensuring you get the best value for your money.

Understanding the Factors that Affect Car Insurance Prices

The cost of car insurance is influenced by a multitude of factors, each playing a unique role in determining your premium. By familiarizing yourself with these elements, you can make informed decisions to minimize your insurance expenses.

Vehicle Make and Model

The type of car you drive is a significant factor in insurance pricing. Different vehicles have varying safety ratings, repair costs, and theft rates, all of which impact the insurance premium. For instance, sports cars or luxury vehicles often attract higher insurance costs due to their higher repair costs and greater risk of theft.

Age and Experience

Your age and driving experience are crucial considerations for insurance providers. Younger drivers, particularly those under 25, are generally viewed as higher risk due to their lack of experience on the road. As a result, they often face higher insurance premiums. However, as you gain more years of driving experience, your insurance costs may decrease.

Location and Usage

The area where you live and the purpose of your vehicle’s usage can significantly affect your insurance rates. Insurance providers consider factors such as the crime rate, traffic density, and accident rates in your region. If you live in an area with a high incidence of car theft or frequent accidents, your insurance premiums may be higher. Additionally, if you use your vehicle for business purposes or frequently drive long distances, your insurance costs may increase.

Driving Record

Your driving history is a critical factor in insurance pricing. A clean driving record with no accidents or traffic violations typically leads to lower insurance premiums. On the other hand, a history of accidents, DUI convictions, or traffic violations can result in significantly higher insurance costs or even difficulty in obtaining coverage.

Coverage Options

The type and extent of coverage you choose can also impact your insurance costs. Comprehensive and collision coverage, which protect against damage to your vehicle, generally cost more than liability-only coverage, which covers injuries and property damage caused to others in an accident for which you are at fault. Understanding your coverage needs and selecting the appropriate level of coverage can help you strike a balance between cost and protection.

Insurance Provider and Policy Features

Different insurance providers offer varying policy features and pricing structures. Some providers may specialize in certain types of coverage or cater to specific demographics, while others may have a broader customer base. Shopping around and comparing quotes from multiple providers can help you identify the most affordable options that suit your needs.

Strategies to Secure the Lowest Car Insurance Prices

With a solid understanding of the factors that influence car insurance prices, you can employ several strategies to secure the lowest premiums.

Shop Around and Compare Quotes

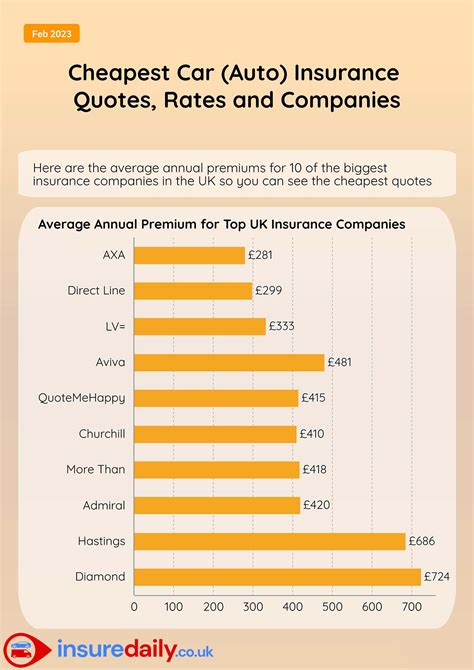

Obtaining multiple quotes from different insurance providers is a crucial step in finding the best deal. Each provider uses its own formula to calculate premiums, and rates can vary significantly between companies. By comparing quotes, you can identify the most competitive options and choose the provider that offers the best value for your specific circumstances.

Bundle Policies

Many insurance providers offer discounts when you bundle multiple policies with them. For example, if you have both car and home insurance, you may be eligible for a discount by having both policies with the same provider. Bundling can lead to significant savings, so it’s worth exploring this option with your current or prospective insurance provider.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach that bases your premium on your actual driving behavior. This type of insurance uses telematics devices or smartphone apps to track your driving habits, such as miles driven, time of day, and driving style. If you are a safe and cautious driver, usage-based insurance can result in lower premiums. However, it’s essential to understand the privacy implications and potential drawbacks before opting for this type of coverage.

Improve Your Credit Score

Believe it or not, your credit score can influence your insurance premiums. Many insurance providers use credit-based insurance scoring, which considers your credit history as an indicator of your overall financial responsibility. Maintaining a good credit score can lead to lower insurance costs, so it’s essential to manage your credit wisely.

Maintain a Clean Driving Record

A clean driving record is one of the most effective ways to keep your insurance premiums low. Avoid traffic violations and accidents, and if you have a history of accidents or violations, consider taking defensive driving courses to improve your driving skills and potentially reduce your insurance costs.

Explore Discounts

Insurance providers offer a range of discounts to attract and retain customers. These discounts can significantly reduce your insurance premiums. Some common discounts include:

- Safe Driver Discount: For maintaining a clean driving record

- Multi-Car Discount: For insuring multiple vehicles with the same provider

- Good Student Discount: For young drivers with good academic performance

- Loyalty Discount: For staying with the same provider for an extended period

- Anti-Theft Discount: For vehicles equipped with anti-theft devices

Understand Your Coverage Needs

Before purchasing car insurance, it’s crucial to understand your coverage needs. Consider your vehicle’s value, your financial situation, and the risks you’re willing to take. If your car is older and has low market value, you may opt for liability-only coverage to keep costs down. On the other hand, if you have a newer, more expensive vehicle, you may want to consider comprehensive coverage to protect your investment.

Choose a Higher Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your insurance premiums, as you’re assuming more financial responsibility in the event of a claim. However, it’s essential to select a deductible that you can comfortably afford in the event of an accident or other covered loss.

The Future of Affordable Car Insurance

As technology advances and consumer preferences evolve, the car insurance industry is undergoing significant changes. Here’s a glimpse into the future of affordable car insurance:

Telematics and Connected Cars

Telematics and connected car technologies are revolutionizing the insurance industry. These technologies allow insurance providers to gather real-time data on driving behavior, vehicle performance, and even road conditions. By leveraging this data, insurance providers can offer more personalized and accurate insurance pricing, rewarding safe drivers with lower premiums. Additionally, connected cars can provide early warnings and automated responses to accidents, potentially reducing the severity of injuries and the cost of claims.

Pay-How-You-Drive Insurance

Building on the concept of usage-based insurance, pay-how-you-drive insurance takes into account not only the miles driven but also the driving style and habits. This approach considers factors such as acceleration, braking, and cornering, providing an even more precise assessment of driving risk. By encouraging safer driving behaviors, pay-how-you-drive insurance has the potential to lower insurance costs for responsible drivers.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are transforming the way insurance providers assess risk and price policies. These technologies can analyze vast amounts of data, including historical claims data, driver behavior, and even social media activity, to predict future risks more accurately. By leveraging AI, insurance providers can offer more tailored and competitive pricing, ensuring that responsible drivers are rewarded with lower premiums.

Autonomous Vehicles and Safety Innovations

The rise of autonomous vehicles and advanced safety features is expected to significantly reduce the number of accidents and insurance claims. With features like collision avoidance systems, lane departure warnings, and automatic emergency braking, vehicles are becoming safer than ever. As these technologies become more prevalent, insurance costs are likely to decrease, as the risk of accidents and injuries declines.

Peer-to-Peer Insurance

Peer-to-peer insurance, also known as collaborative insurance, is an emerging model that allows groups of individuals to pool their resources and share the risk of car insurance. This model is particularly appealing to younger drivers who may struggle to find affordable insurance. By forming a community of trusted peers, these drivers can collectively reduce their insurance costs while still enjoying comprehensive coverage.

Blockchain and Smart Contracts

Blockchain technology has the potential to revolutionize the insurance industry by providing a secure and transparent platform for policy management and claims processing. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, can automate many insurance processes, reducing administrative costs and potential fraud. This technology could lead to more efficient and cost-effective insurance models, benefiting consumers with lower premiums.

Conclusion

Securing the lowest car insurance prices requires a combination of understanding the factors that influence premiums and employing strategic approaches to minimize costs. By shopping around, comparing quotes, and exploring discounts, you can find the most competitive rates. Additionally, as the car insurance industry evolves with technological advancements and changing consumer needs, the future of affordable car insurance looks promising, with potential cost savings arising from connected cars, autonomous vehicles, and innovative insurance models.

How can I quickly compare insurance quotes from multiple providers?

+Online insurance marketplaces and comparison websites provide a convenient way to compare quotes from multiple providers in one place. These platforms allow you to input your information once and receive multiple quotes, making it easier to identify the most competitive options.

What are some common mistakes to avoid when purchasing car insurance?

+Common mistakes include assuming your current provider offers the best rates, not shopping around regularly, and not understanding your coverage needs. It’s essential to compare quotes, explore different coverage options, and regularly review your policy to ensure it meets your changing needs and offers the best value.

Can I get car insurance without a driver’s license?

+Obtaining car insurance without a valid driver’s license can be challenging but not impossible. Some providers offer coverage for non-drivers, such as owners of vehicles used solely for business purposes or those who rely on hired drivers. However, the availability of such coverage may vary by state and provider.

What should I do if I’m denied car insurance coverage due to my driving record?

+If you’re denied coverage due to your driving record, consider shopping around for providers that specialize in high-risk drivers or those that offer second-chance programs. Additionally, focus on improving your driving habits and maintaining a clean record to increase your chances of obtaining coverage in the future.

How often should I review and adjust my car insurance coverage?

+It’s a good practice to review your car insurance coverage annually or whenever your circumstances change significantly. This includes changes in your vehicle, driving habits, marital status, or the addition of a new driver to your policy. Regular reviews ensure that your coverage remains adequate and cost-effective.